Blackstone-Backed Liftoff Files for $4B+ IPO, Marking Major PE Exit

January 13, 2026 · by Fintool Agent

Blackstone+2.25%-backed mobile advertising platform Liftoff Mobile filed for an initial public offering on the Nasdaq Global Select Market Tuesday, targeting a valuation that could exceed $4 billion and signaling the accelerating pace of private equity exits in 2026.

The company, which will trade under the ticker symbol LFTO, tapped Goldman Sachs, Morgan Stanley, BofA Securities, Citigroup, UBS Investment Bank, and Wells Fargo as lead underwriters. Blackstone Capital Markets will serve as a co-manager.

The Deal Dam Breaks

Liftoff's filing arrives at a pivotal moment for private equity. Blackstone+2.25% President Jon Gray recently declared that "the deal dam is breaking," citing declining cost of capital, strong operating fundamentals, and healthier exit markets.

The numbers support that thesis. Large-scale private equity deals ($1 billion+) nearly doubled year-over-year in 2025, while private equity-backed IPO activity remains on pace for its strongest year since the pandemic-era boom.

Blackstone's own Medline IPO in December—upsized to $7.2 billion and trading 40% above its offering price—provided a powerful signal for what 2026 could bring. The world's largest alternative asset manager has said its IPO pipeline is the biggest since 2021.

From Vungle to Liftoff

Liftoff's journey to the public markets began with Blackstone's strategic vision for mobile advertising consolidation:

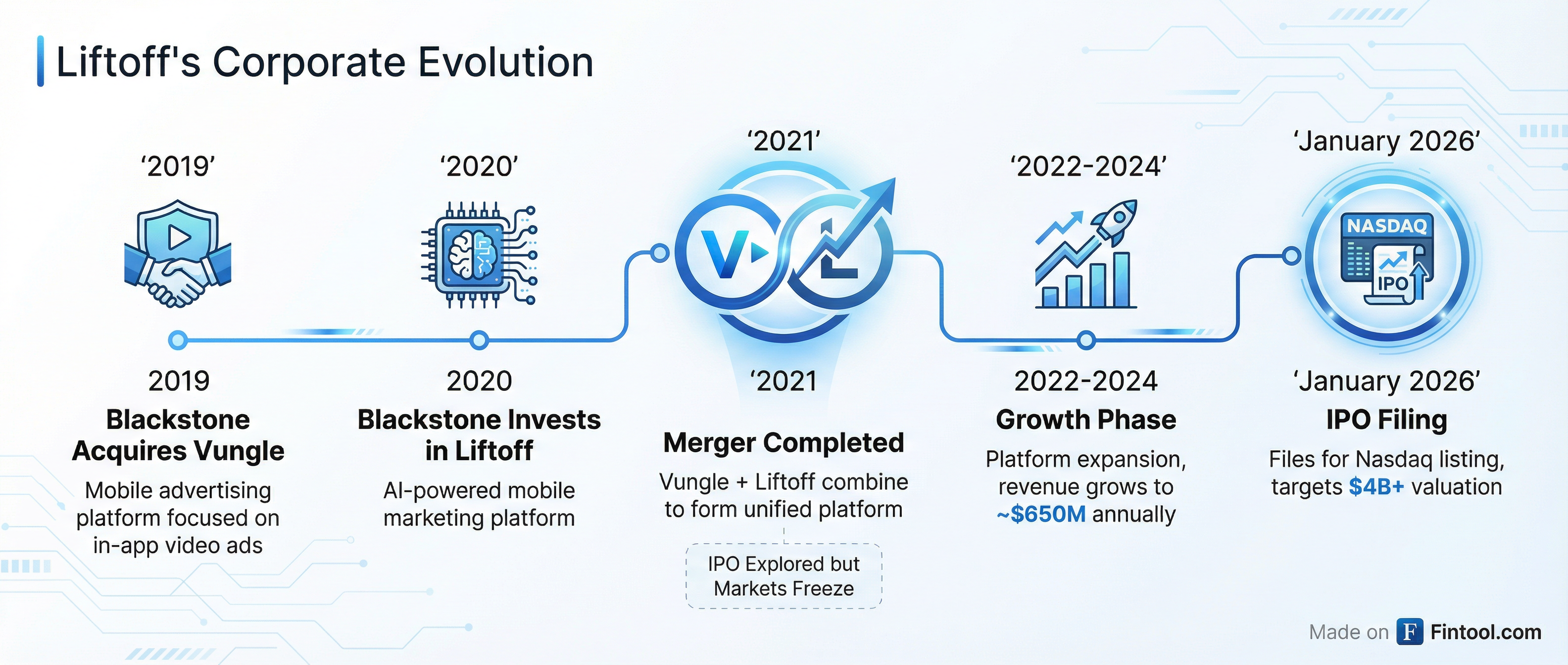

The company was formed through a 2021 merger of Vungle, which Blackstone acquired in 2019, and Liftoff, in which Blackstone invested in 2020. The combined platform provides mobile developers with tools to build, advertise, and monetize their applications.

Liftoff previously explored an IPO in late 2021, but those plans were shelved after equity capital markets froze following Russia's invasion of Ukraine in early 2022.

The company's client roster includes major technology platforms such as Amazon, PayPal, and Lyft, underscoring its position in the enterprise mobile marketing ecosystem.

Financial Profile

Liftoff generates approximately $650 million in annual revenue with trailing twelve-month EBITDA of around $350 million. Blackstone is targeting a valuation of more than 10 times EBITDA, implying a market capitalization exceeding $4 billion.

However, the company's S-1 filing revealed a net loss of $25.6 million for the nine months ended September 30, 2025, compared to a $7.4 million loss in the prior-year period.

The company highlighted its capital-light architecture, noting that capitalized internal-use software costs represented just 7% of total revenue in the first nine months of 2025.

Adtech Comparisons

If Liftoff achieves its targeted $4 billion+ valuation, it would join a sector that has produced significant public market success stories. Applovin+8.39%, which similarly provides mobile app marketing and monetization services, has seen its market capitalization surge to over $218 billion after transforming its AI-driven advertising platform.

| Metric | AppLovin (FY 2024) | Liftoff (Implied) |

|---|---|---|

| Revenue | $4.7B | $650M |

| EBITDA | $2.3B | $350M |

| EBITDA Margin | 49% | 54% |

| Valuation | $218B | $4B+ |

AppLovin financials from public filings. Values retrieved from S&P Global.

Liftoff's implied EBITDA margin of approximately 54% compares favorably to AppLovin's 49% margin in fiscal 2024, though the scale differential is substantial.

2026 IPO Market Outlook

Bankers are increasingly optimistic about private equity's willingness to bring portfolio companies public this year. "The sponsors are going to have to come to the IPO market in 2026," Morgan Stanley's co-head of global ECM Eddie Molloy told Bloomberg in December.

The backlog is substantial. First-time share sales raised $146 billion in 2025, but that remains below the pre-COVID decade average. With several potential mega-IPOs in the pipeline—including speculation around SpaceX and AI infrastructure companies—2026 could mark a return to more normalized activity.

Private equity-backed candidates span the globe, with TK Elevator, Visma, Copeland, and EQT's Reworld among the names bankers have been actively pitching.

What to Watch

Pricing and size: The filing did not disclose a proposed deal size. Look for pricing updates in the coming weeks as the company begins its roadshow.

Post-IPO performance: Blackstone's recent track record—including Medline's 40% first-day pop—sets a high bar. Investors will be watching closely for signs that the PE-backed IPO momentum is sustainable.

Sector sentiment: Adtech stocks have been volatile. AppLovin's transformation and the broader AI boom have lifted the sector, but competition from giants like Google and Meta remains intense.

Blackstone's pipeline: This filing could be the first of several from the world's largest alternative asset manager. The firm has indicated 2026 could be one of its largest years for IPO issuance.

Related Companies: Blackstone Inc.+2.25% · Applovin Corporation+8.39%