Eli Lilly Bets $3.5 Billion on Pennsylvania to Build Retatrutide Arsenal

January 30, 2026 · by Fintool Agent

Eli Lilly is placing its biggest bet yet on the obesity drug arms race. The Indianapolis-based pharma giant announced today it will invest more than $3.5 billion to build a new injectable medicine and device manufacturing facility in Pennsylvania's Lehigh Valley—a facility specifically designed to produce retatrutide, the company's triple-agonist obesity drug that has shown the highest weight loss of any treatment in clinical trials.

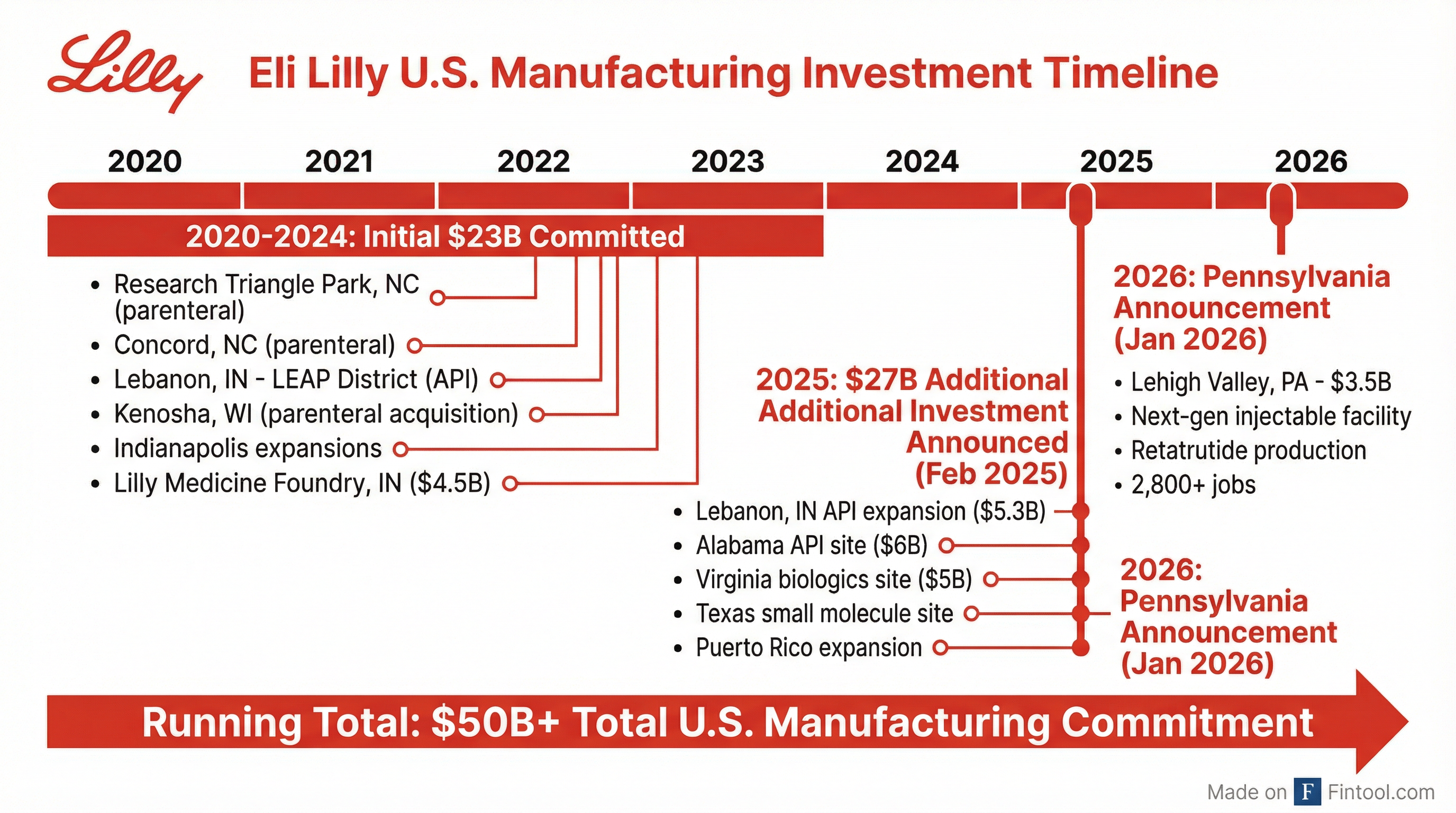

The announcement marks Lilly's tenth new U.S. manufacturing site since 2020 and pushes the company's total domestic capital commitments past $50 billion—the largest pharmaceutical manufacturing investment in American history.

The Retatrutide Gamble

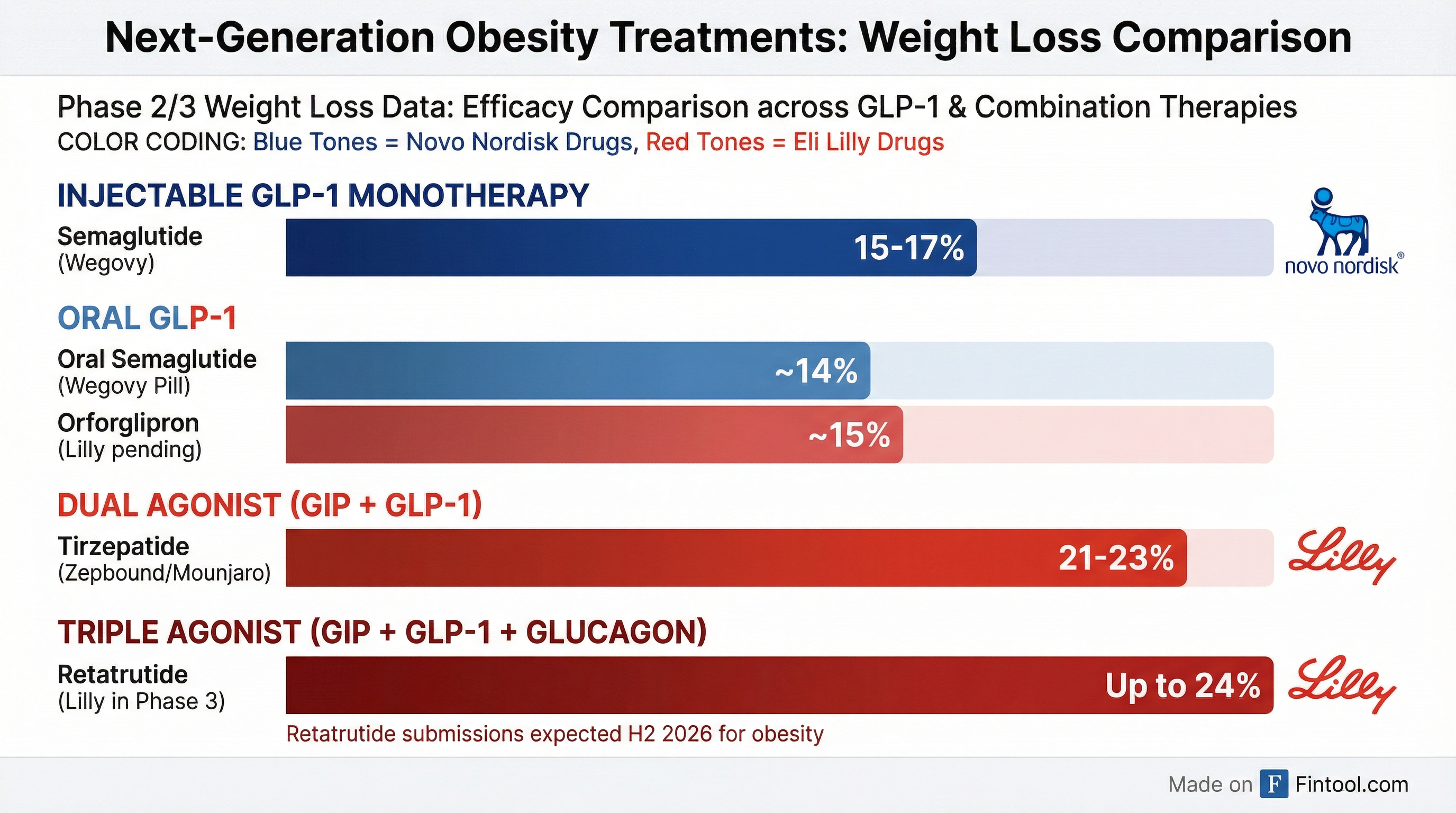

The Pennsylvania facility isn't just another manufacturing expansion—it's Lilly's infrastructure play for what could be the most potent obesity treatment ever developed. Retatrutide is a once-weekly injectable that activates three hormone receptors simultaneously: GIP, GLP-1, and glucagon. In Phase 2 trials, participants on the highest dose lost an average of 24.2% of their body weight—roughly 60 pounds from a 250-pound starting weight.

That efficacy significantly exceeds Lilly's own tirzepatide (marketed as Zepbound for obesity and Mounjaro for diabetes), which delivers 21-23% weight loss, and Novo Nordisk's semaglutide (Wegovy), which achieves 15-17% in trials.

"Lilly Lehigh Valley—our newest injectable medicine and device manufacturing facility—will increase access to next-generation weight-loss treatments and improve the domestic supply of essential medicines," said Edgardo Hernandez, executive vice president of Lilly Manufacturing Operations.

A Race Against Time

The timing of today's announcement is not coincidental. Novo Nordisk launched its oral Wegovy pill in the United States on January 5, offering cash-paying patients a needle-free alternative starting at $149 per month. The pill was prescribed more than 18,000 times in its first full week—an aggressive start that signals strong consumer demand for more accessible obesity treatments.

Lilly's own oral GLP-1, orforglipron, is awaiting FDA approval with a decision expected by April. But the company's long-term competitive advantage lies in retatrutide's superior efficacy profile—and that requires injectable manufacturing capacity at massive scale.

The Clinical Pipeline

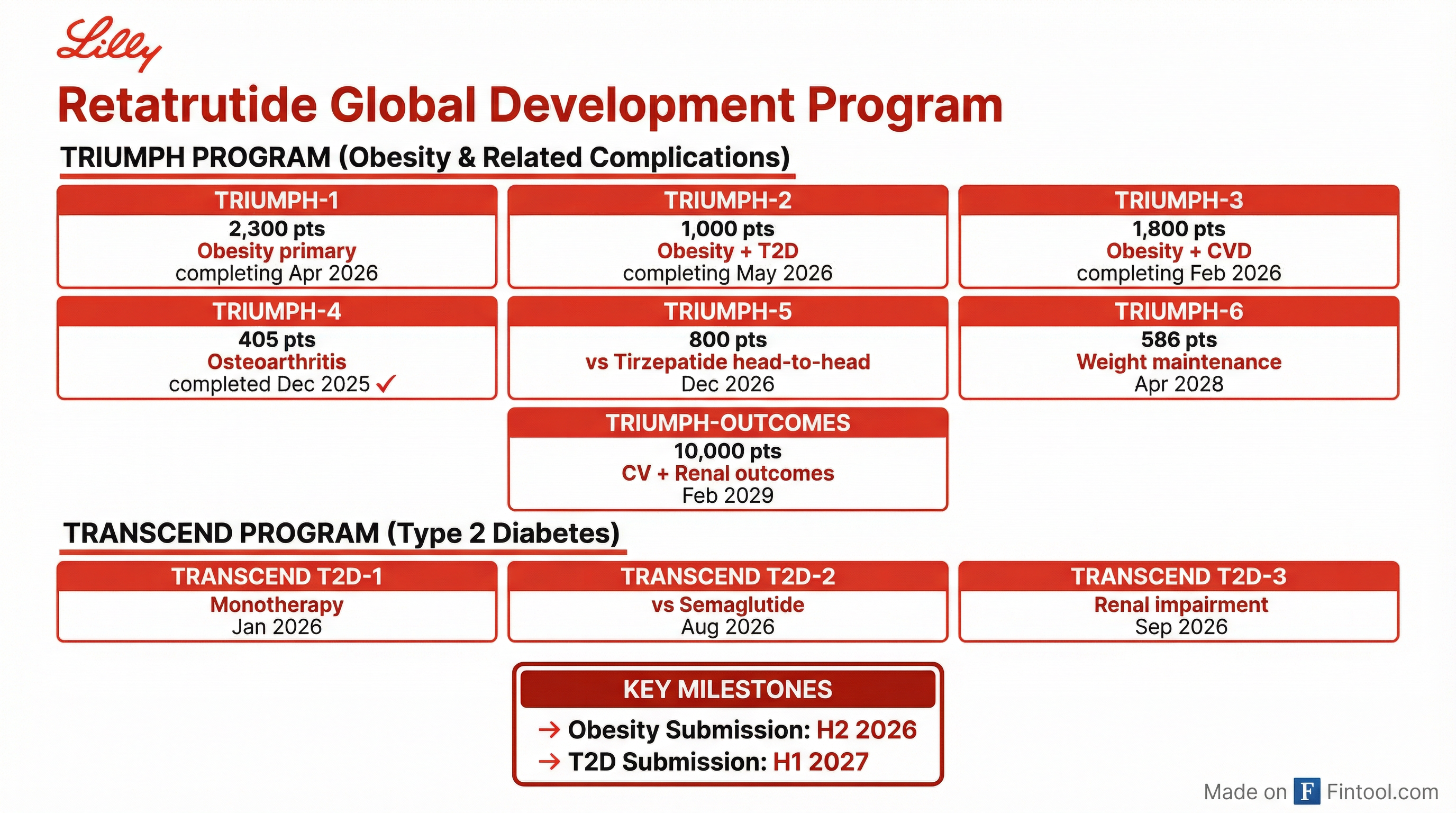

Lilly is running one of the largest obesity clinical development programs in history. The TRIUMPH program for retatrutide in obesity and related complications includes seven Phase 3 trials with more than 17,000 patients enrolled across indications including cardiovascular disease, osteoarthritis, and obstructive sleep apnea.

The first data readout—TRIUMPH-4 in osteoarthritis patients—already showed impressive results in December 2025:

- 9 mg dose: 20.0% weight loss and 67% reduction in knee pain

- 12 mg dose: 23.7% weight loss and 63% reduction in knee pain

Lilly expects to submit retatrutide for obesity approval in the second half of 2026, with diabetes submissions following in the first half of 2027.

The $50 Billion Manufacturing Buildout

The Pennsylvania announcement is the latest chapter in Lilly's unprecedented manufacturing expansion. Since 2020, the company has committed to:

| Site | Investment | Focus | Status |

|---|---|---|---|

| Research Triangle Park, NC | — | Parenteral | Operational |

| Concord, NC | — | Parenteral | Commercial production started late 2024 |

| Lebanon, IN (LEAP) | $9B+ | API | Expanding |

| Kenosha, WI | $3B | Parenteral | Expanding |

| Medicine Foundry, IN | $4.5B | Clinical trials | Opening late 2027 |

| Alabama | $6B | API | Announced |

| Virginia | $5B | Biologics | Announced |

| Texas | — | Small molecule | Announced |

| Puerto Rico | — | Small molecule | Expansion |

| Pennsylvania (Lehigh Valley) | $3.5B | Injectable | Announced today |

"To deliver on our big bets on next-generation modalities like small molecules, biologics and nucleic acid therapies, Lilly is investing in the state-of-the-art manufacturing infrastructure needed to deliver tomorrow's safe and reliable medicines," said Hernandez in February 2025.

Financial Trajectory

Lilly's manufacturing investments are backed by a financial profile that continues to accelerate:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $13.5B | $12.7B | $15.6B | $17.6B |

| Gross Margin | 82.2% | 82.5% | 84.3% | 82.9% |

| CapEx | $1.5B | $1.5B | $1.7B | $2.1B |

| Net Income | $4.4B | $2.8B | $5.7B | $5.6B |

Analysts expect revenue to grow from $45 billion in 2024 to approximately $64 billion in 2025 and $78 billion in 2026, with EPS projected to nearly triple from $13 in 2024 to $33 in 2026.*

The company's incretin franchise—Mounjaro and Zepbound—now accounts for roughly 6 out of 10 prescriptions in the U.S. incretin analog market.

What to Watch

Near-term catalysts:

- TRIUMPH Phase 3 readouts throughout 2026

- Orforglipron FDA decision (expected April 2026)

- Q4 2025 earnings (February 4, 2026)

Medium-term milestones:

- Retatrutide obesity submission (H2 2026)

- Pennsylvania facility groundbreaking

- TRIUMPH cardiovascular outcomes data (2029)

Key risks:

- Phase 3 trial execution across 10,000+ patient outcomes study

- Manufacturing scale-up complexity for triple-agonist production

- Competitive pressure from Novo Nordisk's oral Wegovy launch

- Potential IRA pricing negotiations for Medicare Part D

The obesity drug market is projected to exceed $100 billion annually by 2030. With retatrutide's superior efficacy profile and a $50 billion manufacturing infrastructure commitment, Lilly is positioning itself to capture a disproportionate share of that market—but only if it can deliver the molecules at scale.

Today's Pennsylvania announcement shows the company is betting it can.

Related:

*Values retrieved from S&P Global consensus estimates.