Lululemon Pulls 'Get Low' Leggings Days After Launch as See-Through Complaints Pile Up—Echoing 2013's Luon Disaster

January 20, 2026 · by Fintool Agent

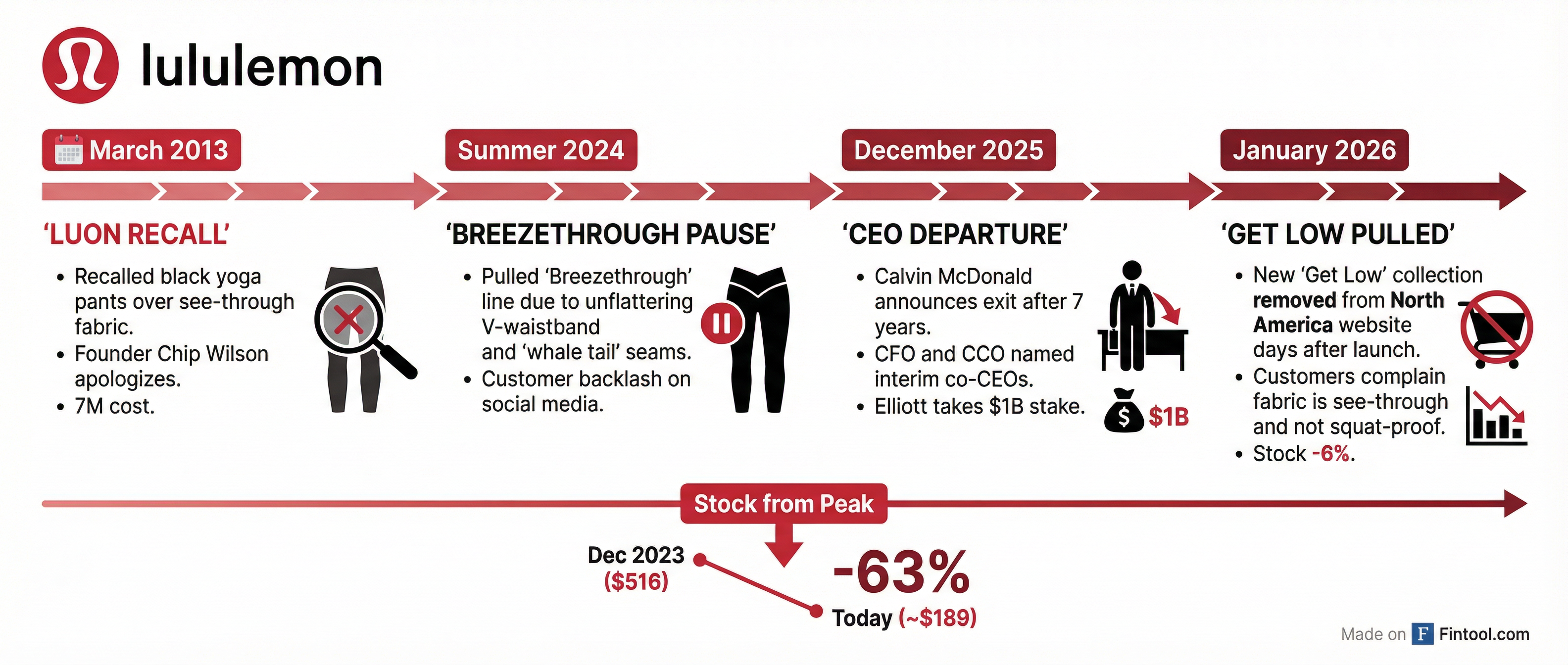

Lululemon yanked its new "Get Low" training collection from its North American e-commerce site on Tuesday—mere days after launch—after customers flooded social media with complaints that the leggings are see-through and fail the most basic athletic wear test: staying opaque during squats.

The stock cratered 6.5% on the news, closing at $188.76—its lowest level since October 2024 and 63% below its December 2023 peak of $516.39.

For long-suffering shareholders, the déjà vu is painful. This is the same company that recalled its Luon yoga pants in 2013 over identical transparency issues—a scandal that cost $67 million and triggered founder Chip Wilson's infamous "some women's bodies just actually don't work" apology that led to his resignation from the board.

Now, thirteen years later, Lululemon faces the same embarrassment at the worst possible moment: days before CEO Calvin McDonald departs, while two separate activist investors wage campaigns against the board.

"We Have Temporarily Paused Sales"

A Lululemon spokesperson confirmed the company pulled the Get Low collection from its online store in North America to "better understand some initial guest feedback and support with product education."

The products remain available in physical North American stores and online in other markets—Europe's website still shows the full collection—while the company determines its next steps.

On Reddit and TikTok, customers documented the problems: leggings so sheer that underwear and thigh tattoos were clearly visible through the fabric, and sizing that ran so large customers reported needing to size down multiple times.

"Customers are also complaining that the product is see-through," BNP Paribas analyst Laurent Vasilescu wrote in a note Tuesday, adding that "since the Get Low launch, customers have been complaining on social media that sizing runs big as knitwear stretches."

The Get Low line was designed for training and featured seamless construction meant to deliver "a sculpted look and feel in a weightless, fast-drying fabric." The premium positioning made the quality failure particularly jarring.

A Pattern of Product Stumbles

This isn't an isolated incident—it's the latest in a pattern of execution failures that have eroded confidence in Lululemon's product development machine.

| Incident | Date | Issue | Outcome |

|---|---|---|---|

| Luon Recall | March 2013 | Black yoga pants too sheer | $67M cost, Wilson controversy, board exit |

| Breezethrough Pause | Summer 2024 | Unflattering V-waistband, "whale tail" seams | Line pulled from market |

| Get Low Pulled | January 2026 | See-through fabric, sizing issues | Online sales paused in North America |

BNP Paribas highlighted "a string of prior product and execution issues at Lululemon," including problems with its Wundermost, Seersucker, and now Get Low collections.

The timing compounds the damage. CEO Calvin McDonald acknowledged product staleness on the Q2 earnings call, admitting the company "relied too heavily on some of our core franchises across lounge and social for too long" and had become "too predictable."

Leadership Vacuum Meets Activist Pressure

The product stumble arrives at a moment of maximum vulnerability:

CEO Exit in 11 Days: Calvin McDonald will leave on January 31 after nearly seven years. CFO Meghan Frank and Chief Commercial Officer André Maestrini are serving as interim co-CEOs—a stopgap that has done little to stabilize sentiment.

Elliott's $1 Billion Campaign: Activist investor Elliott Management built a stake exceeding $1 billion and is pushing for former Ralph Lauren executive Jane Nielsen to take the CEO role, arguing she has the turnaround credentials to fix the business.

Wilson's Proxy Fight: Founder Chip Wilson is waging a parallel campaign demanding the board remove Advent International chair David Mussafer. Wilson has nominated three independent directors—including former On Holding Co-CEO Marc Maurer—and refuses to settle unless both Advent directors resign.

Just yesterday, Wilson escalated by calling for Advent's complete ouster from the board, citing the PE firm's disastrous track record at Olaplex—another company where Mussafer sits on the board—whose stock has collapsed 92% from its IPO price.

Financial Trajectory: Margins Under Pressure

Lululemon's financials tell the story of a company facing headwinds from multiple directions: tariffs, competitive pressure, and now product execution.

| Metric | Q4 FY25 | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|---|

| Revenue ($M) | $3,611 | $2,371 | $2,525 | $2,566 |

| Gross Margin | 60.4% | 58.3% | 58.5% | 55.6% |

| Net Income ($M) | $748 | $315 | $371 | $307 |

Gross margins have declined nearly 500 basis points from the Q4 peak, squeezed by tariff costs, increased markdowns on stale inventory, and supply chain pressures. The Q3 FY26 gross margin of 55.6% is the lowest in years—down 110 basis points year-over-year with "40 basis points driven by higher markdowns."

At $188.76, the stock trades at roughly 16x forward earnings—cheap by historical standards for a company that once commanded 30x+ multiples. But the compression reflects fundamental questions about whether Lululemon can recapture its innovation edge.

The Competitive Threat Has Intensified

McDonald warned on the Q2 call that "competition is different today" with "more players across all of specialty" offering at-leisure and performance solutions.

The threat isn't from a single rival—it's from many:

- Alo Yoga: The "new Lululemon" positioning has attracted customers seeking fresher aesthetics

- Vuori: Men's-first approach has captured market share in a segment Lululemon has struggled to scale

- On Holding: Premium positioning and performance credibility from running has expanded into training

- Nike: The incumbent has intensified focus on women's athletic wear

The combined effect has been especially damaging in the U.S., where "low to mid-value consumers, the newer guest cohorts" have reduced spend. Lululemon's Americas comparable sales were down 3% in Q2, even as international markets—particularly China at +25%—continued to grow.

What Happens Next

The immediate question is whether Get Low can be salvaged through "product education" or must be redesigned entirely. The longer-term question is whether Lululemon's product development machine is fundamentally broken.

Near-Term Catalysts to Watch:

| Event | Timing | Why It Matters |

|---|---|---|

| CEO McDonald Departure | January 31, 2026 | Leadership vacuum formalizes |

| Q3 Earnings Call | Likely early March | First post-incident commentary |

| Annual Meeting | Spring 2026 | Wilson/Elliott proxy showdown |

| Get Low Return | TBD | Execution test for product team |

The risk factors in Lululemon's own 10-Q lay out the stakes with prescient clarity: "If the unacceptability of our products is not discovered until after such products are sold, our guests could lose confidence in our products or we could face a product recall and our results of operations could suffer and our business, reputation, and brand could be harmed."

That's exactly what's playing out today.

For the incoming CEO—whoever that turns out to be—the Get Low debacle is both a warning and an opportunity. It validates Wilson's critique that the board has lost touch with product excellence. It strengthens Elliott's case that the company needs fresh leadership. And it demonstrates why the next leader's first priority must be restoring quality control to a brand built on technical performance.

The company that once defined premium athletic wear can't afford to have customers learn, mid-squat, that its products don't pass the most basic test.

Related Companies