Lumen Completes $5.75 Billion Fiber Sale to AT&T, Pivots to AI Infrastructure

February 2, 2026 · by Fintool Agent

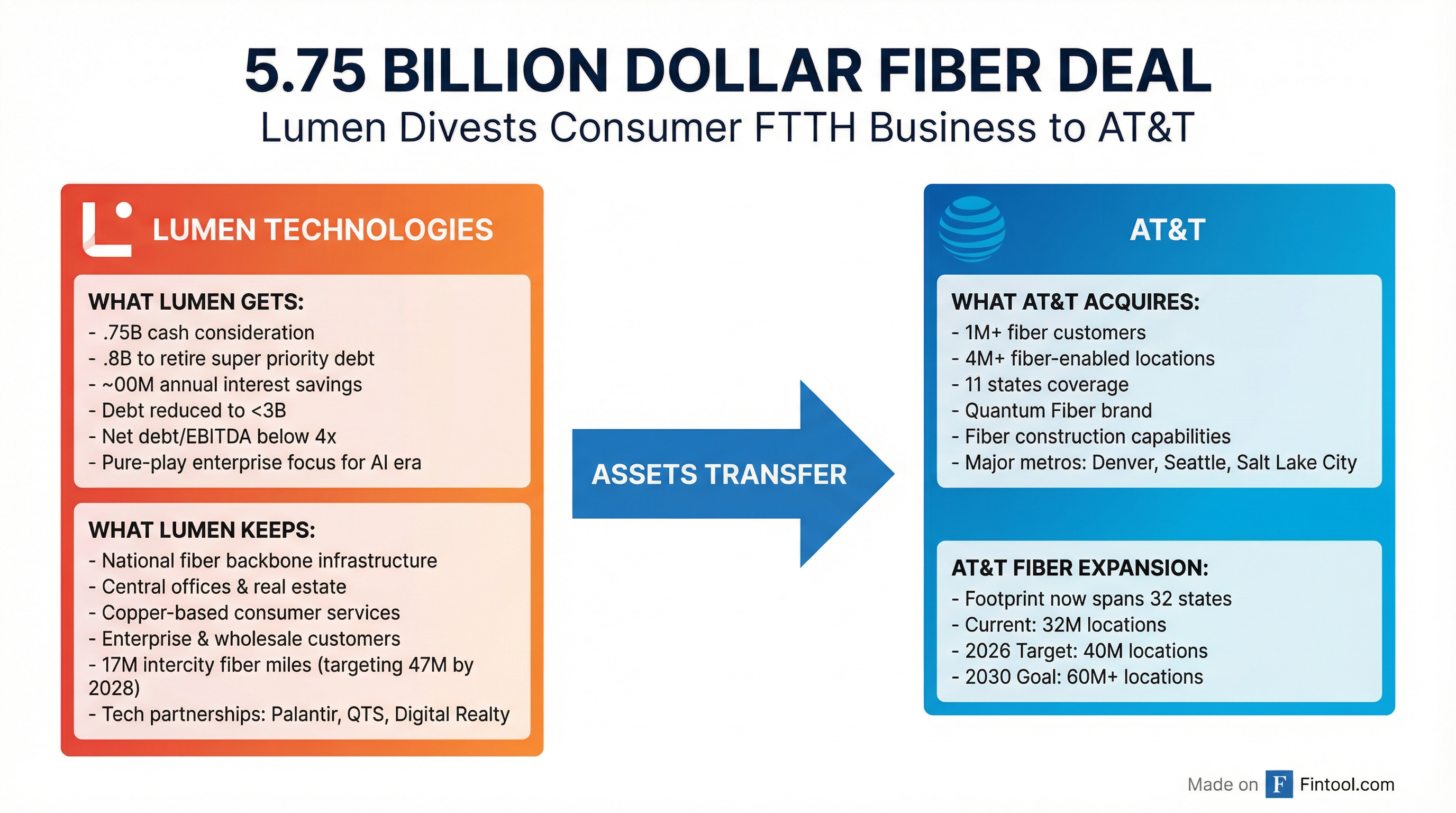

Lumen Technologies has closed its $5.75 billion sale of consumer fiber operations to AT&T, a deal that transforms both telecom giants—slashing Lumen's debt burden while making AT&T the dominant fiber provider across 32 states.

The transaction, first announced in May 2025, transfers over 1 million fiber subscribers and more than 4 million fiber-enabled locations across 11 western and midwestern states to AT&T. Lumen stock jumped 7.5% on the news as markets cheered the company's transformation into a pure-play enterprise networking company focused on AI infrastructure.

The Deal Structure

AT&T acquires Lumen's Mass Markets fiber-to-the-home business in Arizona, Colorado, Florida, Idaho, Iowa, Minnesota, Nebraska, Nevada, Oregon, Utah, and Washington—including the Quantum Fiber brand. The deal delivers AT&T immediate scale in major metros including Denver, Seattle, and Salt Lake City.

For Lumen, the math is transformational. The company will deploy approximately $4.8 billion of proceeds to retire all super priority debt, reducing annual interest expense by roughly $300 million. Post-transaction, Lumen's total debt drops below $13 billion with a net debt to adjusted EBITDA ratio under 4x.

"The divestiture of our consumer fiber-to-the-home business marks a pivotal moment for Lumen," said CEO Kate Johnson. "We are doubling down on where we are strongest and where the opportunity is greatest for us—powering the digital infrastructure that enterprises and public sector organizations need to win in the AI era."

What Lumen Keeps: The AI Pivot

While Lumen divests its consumer-facing operations, the company retains substantial infrastructure that positions it for the enterprise AI opportunity.

| Asset Category | Details |

|---|---|

| Fiber Backbone | All national, regional, state, and metro level fiber network infrastructure |

| Real Estate | Central offices and associated properties |

| Legacy Consumer | Copper-based consumer services (ongoing financial contribution) |

| Enterprise Customers | All enterprise and wholesale fiber customers in all geographies |

| Intercity Fiber | 17 million miles deployed at close of 2025; targeting 47 million by end of 2028 |

Lumen's growth strategy centers on three pillars:

- Physical Network: Building high-capacity, low-latency fiber designed for AI, cloud, and edge workloads

- Digital Platform: Cloudifying network services to deliver automated, consumption-based connectivity

- Connected Ecosystem: Technology partnerships with Palantir, Meter, Commvault, QTS, and Digital Realty

"Time-to-first-token has become the new measurement of success in the AI economy," Johnson noted, highlighting why network performance matters for AI inference workloads.

AT&T's Fiber Expansion Accelerates

For AT&T, the acquisition represents a major step toward its ambitious fiber buildout targets. The carrier added over 1 million fiber subscribers to its customer base, with the opportunity to grow penetration from roughly 25% in the acquired footprint to levels consistent with its existing fiber markets.

| Metric | Current | 2026 Target | 2030 Target |

|---|---|---|---|

| Fiber Locations | 32M | 40M | 60M+ |

| States with Fiber | 32 | — | — |

| Annual Fiber Net Adds (2025) | 1M+ | — | — |

"AT&T Fiber—America's best and top-rated technology for getting on the internet—will be available to millions more people as we expand the service in 32 states," said AT&T CEO John Stankey. "This investment will create good-paying jobs, boost U.S. connectivity and bring the benefits of high-speed connections to more communities across the country."

AT&T plans to hold the acquired fiber network assets in a wholly owned subsidiary and intends to sell partial ownership to an equity partner for co-investment in the ongoing business. The carrier expects the Lumen acquisition to contribute approximately 100 basis points of growth to Advanced Connectivity service revenue in 2026.

Financial Impact

Lumen

The debt restructuring fundamentally alters Lumen's financial profile:

| Metric | Before Sale | After Sale |

|---|---|---|

| Super Priority Debt | $4.8B | $0 |

| Total Debt | $17B+ | <$13B |

| Net Debt/EBITDA | >4x | <4x |

| Annual Interest Savings | — | $300M |

Lumen management will discuss the transaction's impact on forward guidance during the company's Q4/FY2025 earnings call tomorrow, February 3.

AT&T

AT&T reported strong Q4 2025 results last week, with the Lumen deal factored into its long-term outlook:

| Outlook Metric | 2026 | 2027 | 2028 |

|---|---|---|---|

| Adjusted EBITDA Growth | 3-4% | — | 5%+ |

| Adjusted EPS | $2.25-$2.35 | — | Double-digit CAGR |

| Free Cash Flow | $18B+ | $19B+ | $21B+ |

| Capital Investment | $23-24B | $23-24B | $23-24B |

AT&T expects the acquisition to be modestly dilutive to adjusted EPS in 2026-2027 and accretive beginning in 2028. The company's net debt-to-adjusted EBITDA ratio will increase to approximately 3.2x following the Lumen and EchoStar spectrum transactions, declining to roughly 3x by year-end 2026.

Market Context: The Fiber Wars

The deal reshapes competitive dynamics in U.S. broadband. AT&T's expanded fiber footprint positions it more directly against Verizon Fios and cable incumbents in markets where fiber previously had limited presence.

AT&T achieved its best year for consumer broadband subscriber growth in a decade in 2025, with 42% of AT&T Fiber households also subscribing to wireless—a convergence play the carrier views as its key competitive advantage.

Meanwhile, Lumen's pivot to enterprise AI networking places it in competition with hyperscalers' private networks and other backbone providers. The company's partnerships with Palantir and cloud infrastructure companies suggest a strategy of embedding Lumen's network into the AI data pipeline rather than competing on consumer connectivity.

What to Watch

For Lumen (LUMN):

- Tomorrow's Q4/FY2025 earnings call for updated guidance reflecting the sale

- Progress on 47 million intercity fiber mile target by 2028

- New enterprise AI contract announcements

- Further debt reduction and deleveraging

For AT&T (T):

- Fiber subscriber growth in acquired territories

- Integration execution and synergy realization

- Equity partner announcement for acquired fiber subsidiary

- Progress toward 40 million fiber locations by year-end 2026