Meta Commits $6 Billion to Corning for AI Data Center Fiber

January 27, 2026 · by Fintool Agent

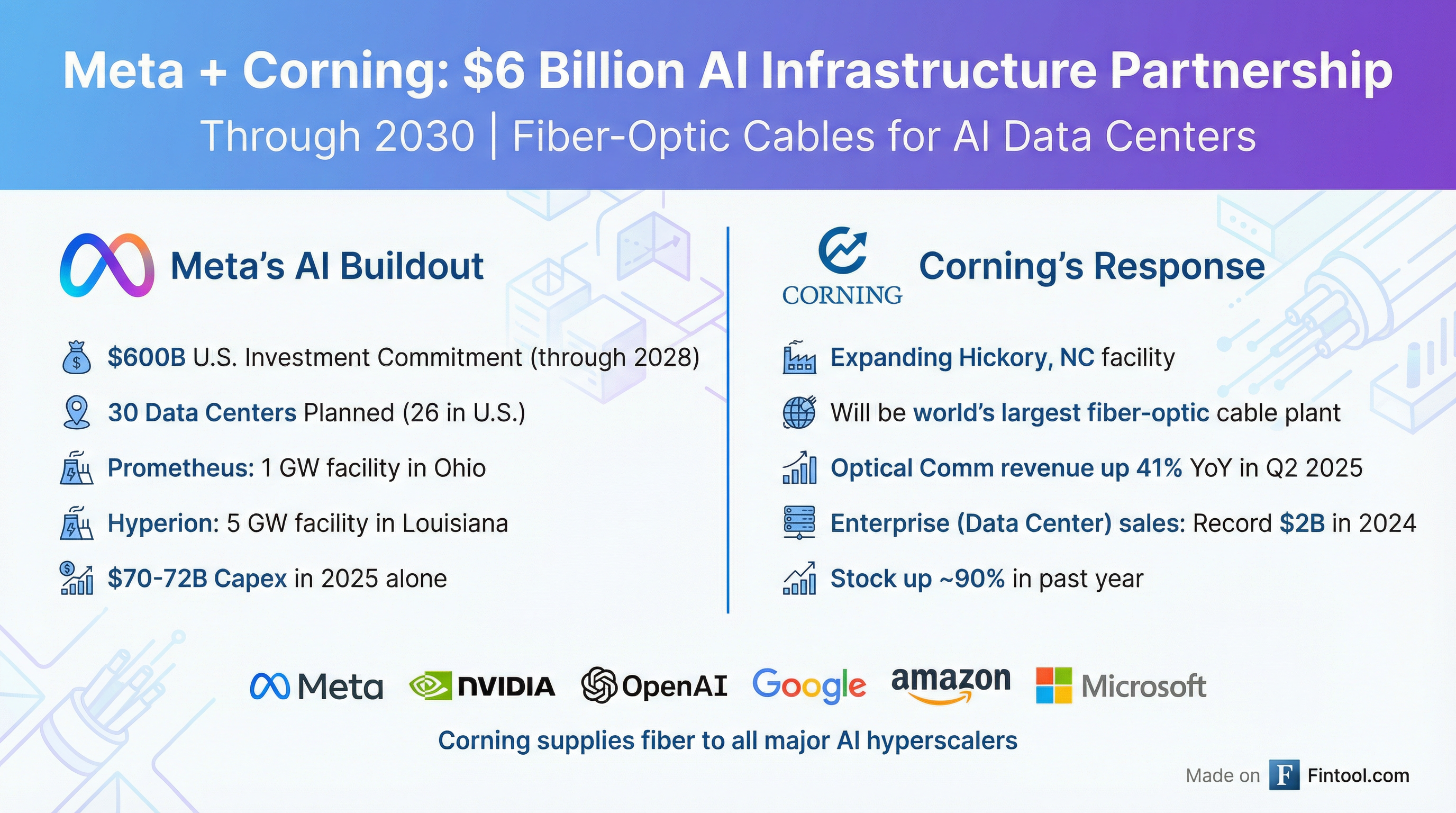

Meta Platforms will pay Corning Incorporated up to $6 billion through 2030 for fiber-optic cables to power its sprawling AI data center buildout, the companies announced Tuesday. The deal, first reported by CNBC, underscores how the AI arms race is reshaping supply chains and reviving a 175-year-old glassmaker once left for dead after the dot-com bust.

Corning shares jumped on the news, trading up to $100.99 in aftermarket trading—near all-time highs and roughly double where they traded a year ago.

The Deal

The agreement makes Meta one of Corning's largest customers and locks in a multi-year supply commitment at a time when fiber demand is outstripping capacity. Corning CEO Wendell Weeks told CNBC the company is expanding its Hickory, North Carolina facility to accommodate the surge, and when complete, it will be the largest fiber-optic cable plant in the world.

"Almost every phone call I get from my customers is trying to see, how do we get them more?" Weeks said. "I think next year the hyperscalers will be our biggest customers."

The fiber will be deployed across Meta's growing data center portfolio, including:

- Prometheus — A 1-gigawatt AI supercluster under construction in New Albany, Ohio

- Hyperion — A 5-gigawatt facility in Richland Parish, Louisiana, one of the largest ever planned

Both projects are part of Meta's commitment to spend $600 billion in the U.S. by 2028 on data centers and supporting infrastructure.

Why AI Needs So Much Fiber

Traditional data centers require connectivity, but AI workloads demand something different entirely. Corning has identified two key growth drivers: scale-out and scale-up.

Scale-out refers to hyperscalers connecting more and more GPU nodes together into larger neural networks. Because each AI node is connected to others by fiber, larger clusters mean more demand for Corning's products.

Scale-up is the shift from single-rack AI nodes to multi-rack configurations. As nodes stretch across multiple server racks, the distance between GPUs increases—and once that distance exceeds what's called the "electrical-to-optical frontier," fiber becomes more economical than copper.

"A single Blackwell-like node has more than 70 GPUs with more than 1,200 links using more than two miles of copper," Weeks said on a recent earnings call. "As that node scales up, those two miles will eventually be replaced by fiber connections."

If Corning's technology succeeds, the scale-up opportunity alone could be 2-3x the size of its existing $2 billion enterprise business.

Corning's AI-Driven Resurgence

The deal caps a remarkable turnaround for Corning. Once a dot-com darling that crashed over 90% in the early 2000s telecom bust, the company has reinvented itself as a critical AI infrastructure supplier.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $3.50 | $3.45 | $3.86 | $4.10 |

| Optical Communications Growth (YoY) | — | +46% | +41% | — |

| Enterprise (Data Center) Growth (YoY) | — | +106% | +81% | — |

| Gross Margin | 35.4% | 35.2% | 36.0% | 37.1% |

*Values retrieved from S&P Global

Optical Communications revenue surged 41% year-over-year in Q2 2025, driven by AI demand both inside data centers and for data center interconnect products. The segment's net income jumped 73% on the higher volume.

The company has set a "Springboard" target of adding $4 billion in annualized sales by the end of 2026, with AI as the primary driver. Management has upgraded its enterprise sales CAGR target from 25% to 30% based on customer demand.

Meta's AI Spending Spree

For Meta, the Corning deal is one piece of a massive AI investment campaign that has both dazzled and worried investors.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $48.4 | $42.3 | $47.5 | $51.2 |

| Capital Expenditure ($B) | $14.4 | $12.9 | $16.5 | $18.8 |

| Cash from Operations ($B) | $28.0 | $24.0 | $25.6 | $30.0 |

Meta guided for $70-72 billion in capital expenditures for 2025 to support AI and expects "significant capital expenditure growth in 2026." The company's property and equipment (net) has ballooned to $160.3 billion, up from $121.3 billion at year-end 2024.

The spending has drawn skepticism from some investors who question whether the AI buildout will generate returns. Meta had its worst trading day in three years last October after announcing ambitious AI capex without a clear monetization plan.

But Joel Kaplan, Meta's chief global affairs officer, framed the investment in geopolitical terms: "We want to have a domestic supply chain that's available to support that... If we as a country don't make the right policy choices and the right investments, that's a real risk" of China winning the AI race.

Echoes of the Dot-Com Era?

Corning's CEO acknowledged the parallels to the late 1990s, when fiber demand exploded only to collapse when the telecom bubble burst. The company's stock multiplied roughly eightfold from 1997 to 2000 before losing over 90% of its value.

"What we learned then was that it wasn't enough to do great innovations," Weeks said. But he expressed confidence that today's AI demand is different—and that even if spending slows, fiber demand will find a home. "Fiber-optic demand has grown at about 7% annually on average, so we'll find a good use for it."

As for betting on Meta specifically, Weeks offered a vote of confidence: "In the end, really technical excellence, willingness to commit to the infrastructure, compute matters."

What to Watch

- Meta's earnings (expected early February) — Will management provide more detail on AI infrastructure ROI?

- Corning's next quarter — How much of the Meta deal flows through immediately?

- Hyperscaler capex guidance — Microsoft, Google, and Amazon all report soon. Will they match Meta's spending pace?

- Co-packaged optics — Corning's scale-up opportunity depends on this technology. Technical progress will matter.