Microsoft and Bristol Myers Squibb Partner to Deploy AI for Early Lung Cancer Detection

January 20, 2026 · by Fintool Agent

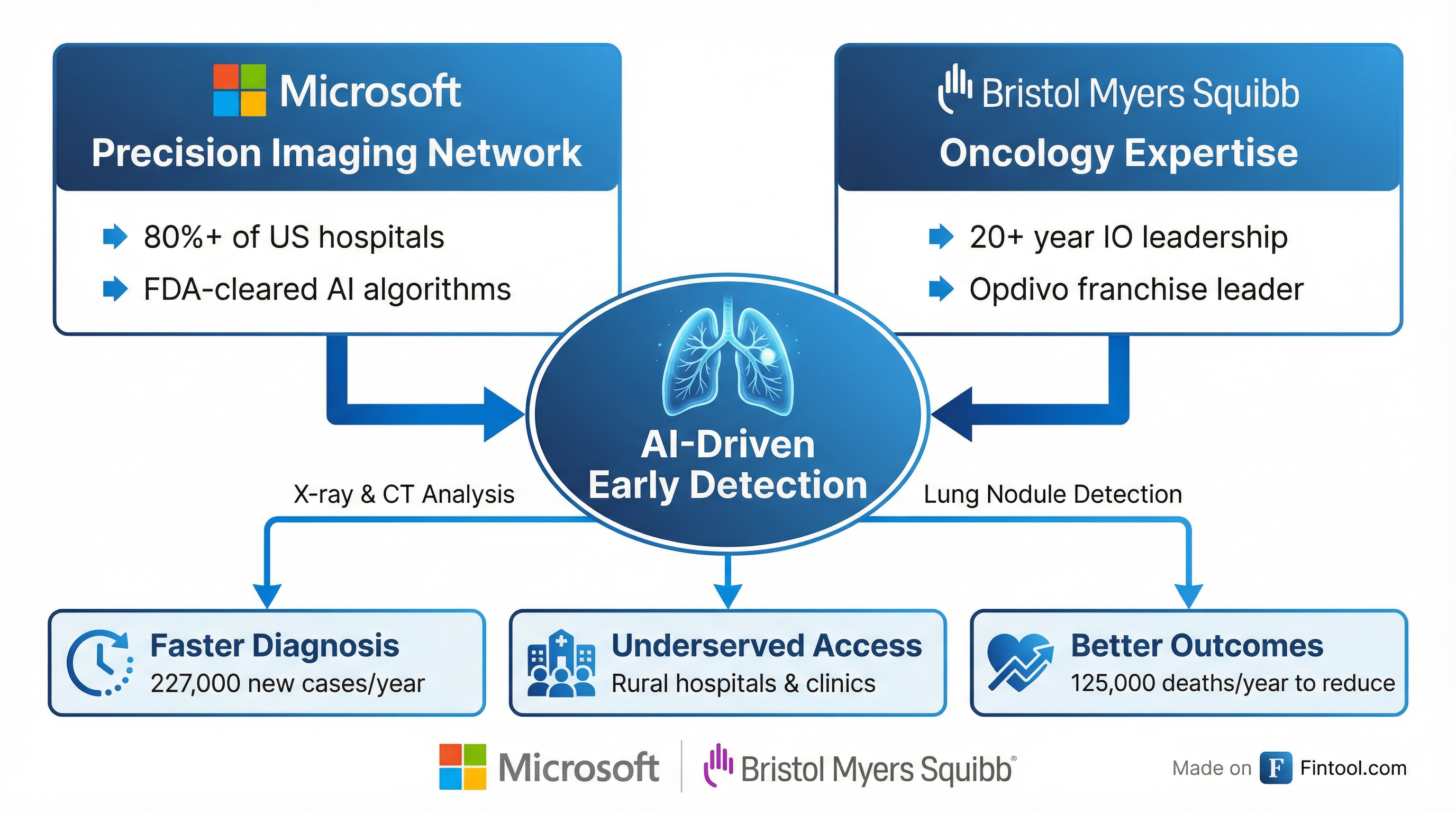

Microsoft+1.90% and Bristol Myers Squibb+4.15% announced a strategic partnership today to accelerate early detection of lung cancer using FDA-cleared AI algorithms deployed across Microsoft's Precision Imaging Network—a platform already used by more than 80% of US hospitals.

The collaboration pairs Microsoft's $3.4 trillion technology infrastructure with Bristol Myers Squibb's oncology expertise, targeting a disease that kills approximately 125,000 Americans and produces 227,000 new diagnoses annually.

The Deal

Under the agreement, Bristol Myers Squibb's FDA-cleared radiology AI algorithms will be integrated into Microsoft's Precision Imaging Network, which is part of Microsoft for Healthcare's radiology solutions suite.

The AI capabilities can automatically analyze X-ray and CT images to:

- Detect lung nodules that are difficult for radiologists to spot visually

- Identify patients earlier in the disease cycle when treatment is most effective

- Reduce clinical workload by streamlining radiologist workflows

- Triage patients to appropriate care pathways

"By combining Microsoft's highly scalable radiology solutions with BMS' deep expertise in oncology and drug delivery, we've envisioned a unique AI-enabled workflow that helps clinicians quickly and accurately identify patients with Non-Small Cell Lung Cancer (NSCLC) and guide them to optimal care pathways and precision therapies," said Dr. Alexandra Goncalves, VP and Head of Digital Health at Bristol Myers Squibb.

Why It Matters

Scale and Reach

The partnership's immediate advantage is distribution. Microsoft's Precision Imaging Network already connects to more than 80% of US hospitals, providing an established channel for deploying advanced diagnostics without requiring new infrastructure investments.

This is critical because lung cancer remains the leading cause of cancer-related deaths in the United States. Underserved populations face particularly high mortality rates—rural communities have both lower screening rates and higher death rates, and more than half of patients with incidental findings on imaging are lost to follow-up.

Strategic Fit for Both Companies

For Microsoft, the partnership extends its healthcare AI footprint. The company acquired Nuance Communications for $19.7 billion in 2022, and Nuance Healthcare cloud services now contribute to its Intelligent Cloud segment. In Q4 2025, CEO Satya Nadella highlighted that Dragon Copilot documented over 13 million physician-patient encounters—up nearly 7x year-over-year.

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| MSFT Revenue ($B) | $69.6 | $70.1 | $76.4 | $77.7 |

| MSFT Net Income ($B) | $24.1 | $25.8 | $27.2 | $27.7 |

For Bristol Myers Squibb, earlier detection feeds directly into its commercial engine. Opdivo, the company's blockbuster PD-1 inhibitor, is approved for multiple NSCLC indications and generated U.S. revenue growth of 6% in Q3 2025. The company's Growth Portfolio overall increased 17% year-over-year in Q2 2025.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| BMY Revenue ($B) | $12.3 | $11.2 | $12.3 | $12.2 |

| BMY Net Income ($B) | $0.07 | $2.5 | $1.3 | $2.2 |

| BMY EBITDA Margin (%) | 37.6%* | 40.6%* | 41.7%* | 40.2%* |

*Values retrieved from S&P Global

Market Context

Both stocks traded lower on Tuesday, though the declines reflected broader market weakness from President Trump's tariff threats against European nations rather than the partnership announcement. Microsoft shares were down 1.2% to $454.52, while Bristol Myers Squibb fell 1.9% to $54.20.

The partnership announcement comes as Microsoft continues to build out its healthcare AI capabilities. Azure AI offerings are positioned as a competitive advantage, with the company offering supercomputing power for AI at scale and a rapidly expanding portfolio of AI cloud services.

Bristol Myers Squibb, meanwhile, has been active in strategic partnerships. In June 2025, the company entered a global collaboration with BioNTech for a PD-L1/VEGF bispecific antibody (pumitamig) that's being evaluated in Phase III trials for small cell lung cancer and NSCLC, making an upfront payment of $1.5 billion.

What to Watch

Deployment timeline: Neither company disclosed specific rollout dates or financial terms. Watch for updates on how quickly the AI tools reach rural and underserved markets—the stated priority of the partnership.

Clinical validation: The algorithms are FDA-cleared, but real-world performance data across diverse hospital settings will be important for assessing impact on detection rates and patient outcomes.

Competitive response: Other pharma-tech partnerships in oncology diagnostics could emerge. Companies like Roche (through Foundation Medicine), AstraZeneca, and Merck all have interests in early cancer detection.

Regulatory evolution: AI in healthcare continues to draw FDA scrutiny. Any changes to approval pathways for diagnostic AI could affect deployment speed.