Mobileye Lands 9 Million Chip Deal With Major U.S. Automaker

January 5, 2026 · by Fintool Agent

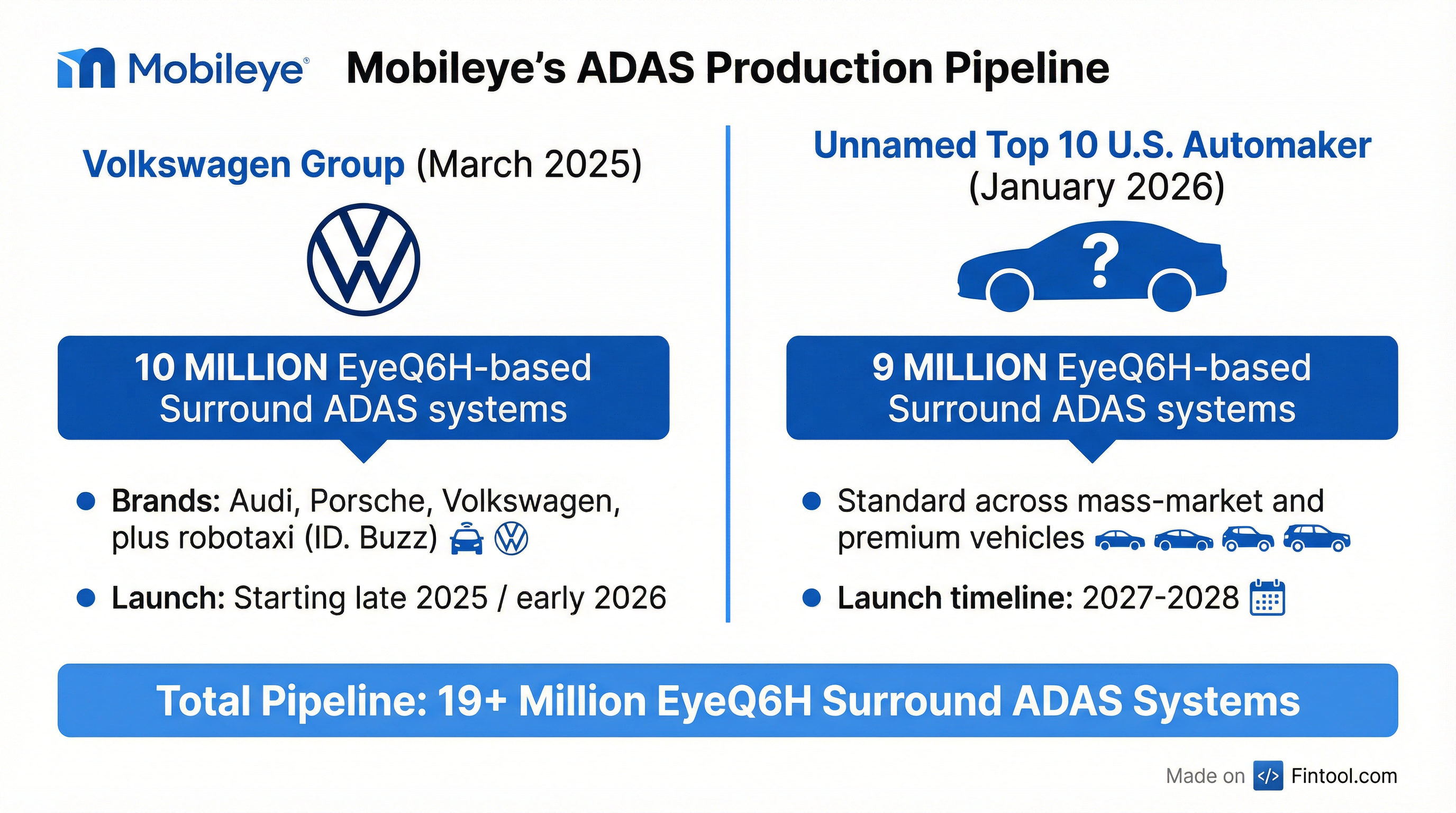

Mobileye announced at CES 2026 that it has secured a major U.S. automaker as a customer for its EyeQ6H-based Surround ADAS system, with the deal covering approximately 9 million units across mass-market and premium vehicle lines. The agreement brings Mobileye's total pipeline for its next-generation hands-free highway driving system to more than 19 million units—potentially the largest committed ADAS backlog in the industry.

The stock surged as much as 8% in premarket trading before settling up roughly 2.5% to $11.50 by midday, a modest relief for shareholders who watched the company lose nearly half its market value in 2025.

The Unnamed Customer

Mobileye disclosed only that the customer is a "top-10 U.S.-based automaker," but analysts who cover the company have previously suggested the most likely candidate is General Motors. GM has been notably absent from Mobileye's disclosed customer list despite the two companies' previous relationship, and GM's Super Cruise hands-free system has faced growing competitive pressure from Tesla's and others' offerings.

The deal positions Mobileye's Surround ADAS as standard equipment—not an option—across multiple vehicle segments, which is significant because it guarantees volume regardless of consumer take rates.

What is Surround ADAS?

Mobileye's Surround ADAS represents the company's push to democratize hands-free highway driving—capabilities previously reserved for premium vehicles costing $80,000+—for mainstream models.

The system uses:

- One forward-facing high-resolution camera

- Four corner parking cameras (repurposed for 360° perception)

- Multiple radar units (up to 11 total sensors)

- Single EyeQ6H chip processing everything from one ECU

This consolidation is the key value proposition: where competitors might require multiple chips and control units, Mobileye integrates all perception, mapping, and driving functions onto a single system-on-chip. For automakers pursuing "software-defined vehicle" architectures, this simplification is compelling.

The system enables:

- Hands-free, eyes-on highway driving up to 81 mph

- Automated lane changes

- Highway traffic jam assist

- Cut-in protection

- Over-the-air software updates for future features

"This selection of Mobileye Surround ADAS by one of the world's great automakers reflects the power of our approach to democratizing safety and technology," said Mobileye CEO Prof. Amnon Shashua.

Building a Massive Pipeline

The 9 million unit deal comes on top of the Volkswagen Group partnership announced in March 2025, which covers approximately 10 million EyeQ6H-based systems across Audi, Porsche, Volkswagen, and VW's robotaxi subsidiary MOIA.

| Customer | Units | Products | Start of Production |

|---|---|---|---|

| Volkswagen Group | 10 million | Surround ADAS, SuperVision, Chauffeur, Robotaxi | Late 2025 - 2027 |

| New U.S. Automaker | 9 million | Surround ADAS | 2027-2028 |

| Total Pipeline | 19+ million |

At an average selling price in the $150-200 range for Surround ADAS systems (compared to roughly $40-50 for basic ADAS), this pipeline represents substantial revenue potential over the next 5-7 years.

Why Now? The Regulatory Tailwind

The timing of automaker commitments to advanced ADAS isn't coincidental. New European and North American safety regulations coming into effect in 2028-2029 will require more sophisticated vehicle sensing capabilities that basic single-camera ADAS systems cannot satisfy.

"You're getting to the point where you can't really score highly on European and North American safety tests without having multiple cameras around the vehicle," Mobileye's Chief Communications Officer Dan Galves explained at a recent conference. "That makes the software much more sophisticated, much more complex. It requires more processing power."

This regulatory push is creating urgency among automakers who previously delayed decisions on advanced ADAS. With 2028 vehicle launches requiring design freezes soon, the window for making supplier decisions is narrowing rapidly.

A Battered Stock Finds a Lifeline

Mobileye shareholders desperately needed good news. The stock collapsed 48% in 2025, falling from $20 at the start of the year to $10.44 by year-end—touching a 52-week low of $10.04 in mid-December.

The decline reflected several headwinds:

- Slower-than-expected SuperVision/Chauffeur decisions: Major automakers kept delaying commitments to Mobileye's premium hands-free systems

- China competitive pressure: Local suppliers undercut on price, even as Mobileye maintained technology leadership

- Robotaxi timeline uncertainty: While the ID. Buzz robotaxi partnership with Uber and Lyft generated headlines, commercial deployments remain in early stages

Despite the stock weakness, Mobileye's fundamentals have stabilized. Revenue grew 12-14% year-over-year in 2025 to approximately $1.85-1.88 billion, and the company generated $489 million in operating cash flow through the first nine months.

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $239 | $439 | $486 | $490 | $438 | $506 | $504 |

| Gross Margin % | 22.6% | 47.6% | 48.8% | 49.2% | 47.3% | 49.8% | 48.2% |

The Q1 2024 weakness was driven by excess inventory burn at Tier 1 customers—an issue that has since normalized.

Analyst View: Substantial Upside

Wall Street remains cautiously bullish. The consensus price target of $18.90 implies 64% upside from current levels, with 19 analysts covering the stock for Q4 2025 estimates.*

| Estimate | Q4 2025 | Q1 2026 | Q2 2026 | Q3 2026 |

|---|---|---|---|---|

| Revenue ($M) | $431 | $456 | $496 | $517 |

| EPS | $0.06 | $0.07 | $0.10 | $0.10 |

*Values retrieved from S&P Global

The estimates imply continued modest growth, but don't yet fully reflect the potential revenue acceleration from Surround ADAS production ramps expected to begin in late 2026 and 2027.

The Intel Factor

Mobileye remains majority-owned by Intel, which acquired the company for $15.3 billion in 2017 and re-listed it in October 2022. Intel currently owns approximately 88% of Mobileye's outstanding shares.

This ownership creates both opportunities and overhang:

- Opportunity: Intel's semiconductor manufacturing expertise and balance sheet provide resources

- Overhang: Any Intel decision to monetize its stake could pressure the stock

Intel itself has faced significant challenges, and the company's shares have been volatile. Some analysts have speculated Intel might eventually divest its Mobileye stake to raise capital, though no such plans have been announced.

What to Watch

Near-term catalysts:

- CES 2026 presentations (January 6-7): Additional product announcements and demos expected

- Q4 2025 earnings (late January): Full-year 2025 results and 2026 guidance

- SuperVision/Chauffeur decision progress: More automaker commitments would validate the premium ADAS strategy

Longer-term:

- Robotaxi commercialization: Driverless ID. Buzz deployments with Uber in LA and Lyft in Dallas targeted for 2026

- European regulatory certification: First Level 4 autonomous vehicle certifications expected late 2026

- China trajectory: Stabilizing but structurally challenged, representing about 6 million of roughly 35 million annual EyeQ shipments

Today's announcement won't immediately solve Mobileye's challenges—automaker decision-making remains frustratingly slow, China remains competitive, and the stock trades at a significant discount to its post-IPO highs. But securing a second top-10 global automaker for Surround ADAS demonstrates that the company's technology-first strategy is gaining traction where it matters most: in the design studios and boardrooms of the world's largest vehicle manufacturers.

Related: