Mobileye Bets $900 Million on Humanoid Robots, Acquiring Startup Founded by Its Own CEO

January 7, 2026 · by Fintool Agent

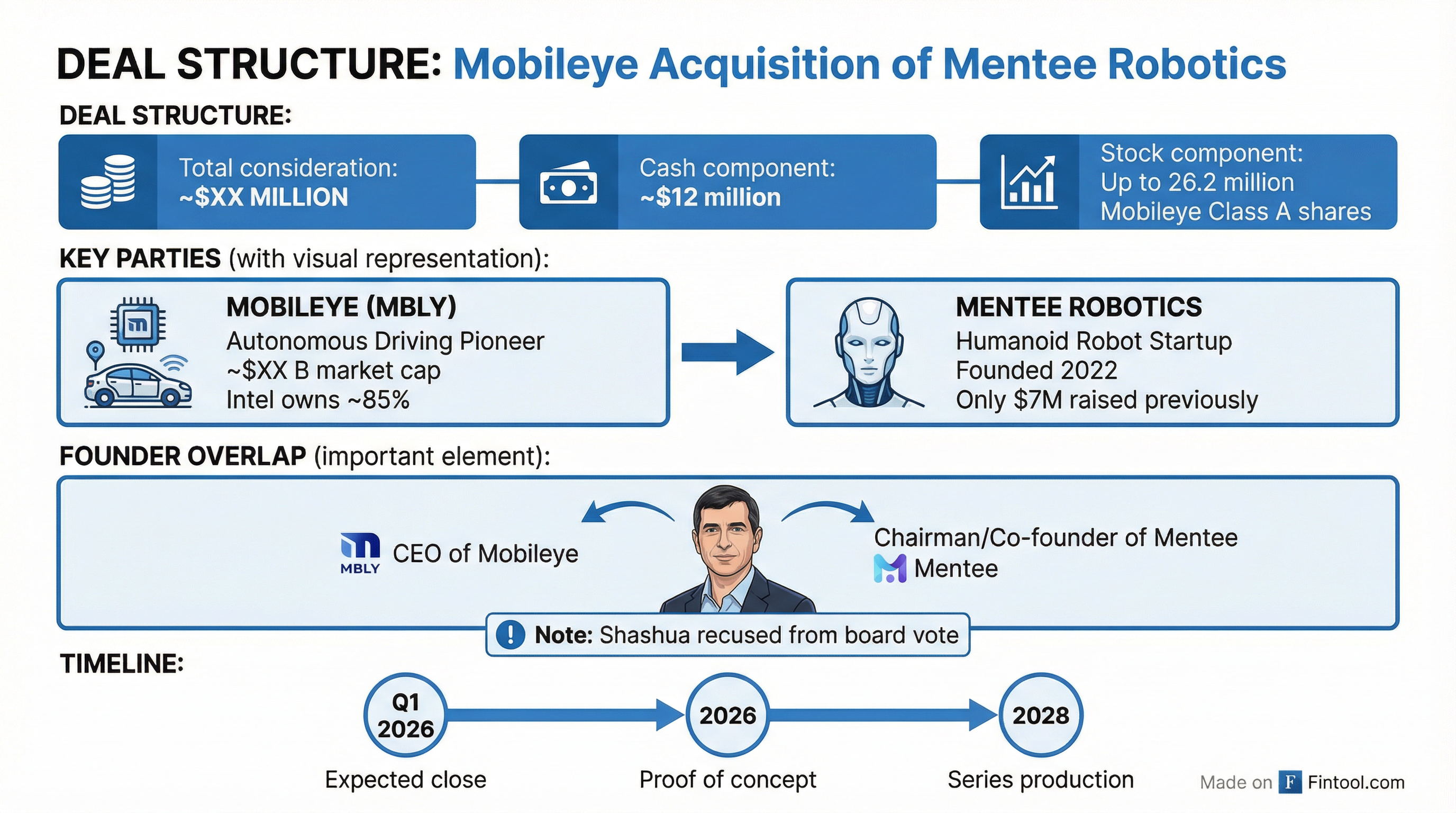

Mobileye announced at CES 2026 it will acquire Mentee Robotics, a humanoid robot startup co-founded by Mobileye's own CEO Amnon Shashua, for approximately $900 million in cash and stock—the largest-ever acquisition combining an automotive technology company with humanoid robotics.

The deal raises immediate governance questions given Shashua's roles at both companies. It also signals a dramatic strategic pivot for Mobileye, which has built its business supplying computer vision chips to automakers and is now betting that autonomous driving and humanoid robots represent two sides of the same "physical AI" opportunity.

The Deal

Mobileye will pay approximately $612 million in cash and up to 26.2 million shares of Class A common stock (subject to adjustment based on Mentee option vesting). At Mobileye's recent share price of approximately $12-13, the stock component values at roughly $315-340 million.

The transaction was approved by Mobileye's board of directors following recommendation from a Strategic Transactions Committee of independent directors. Intel, which owns approximately 85% of Mobileye through Class B shares, also approved the deal. Shashua recused himself from all consideration and approval proceedings at the Mobileye board level.

The acquisition is expected to close in Q1 2026 and will modestly increase Mobileye's operating expenses by "a low-single-digit percentage" in 2026.

The Founder Overlap Problem

The deal's most unusual aspect is the founder relationship. Amnon Shashua, a renowned Israeli computer scientist:

- Is CEO of Mobileye (the acquirer)

- Is Chairman, co-founder, and significant shareholder of Mentee Robotics (the target)

Two other key figures also span both companies:

- Shai Shalev-Shwartz is Mobileye's Chief Technology Officer and a Mentee co-founder

- Prof. Lior Wolf, formerly a senior scientist at Facebook AI Research, is Mentee's CEO and co-founder

This creates an extraordinary situation where Mobileye's most senior technical executives have direct financial interests in the acquisition target. While Shashua recused himself from the vote, critics may question whether independent directors had adequate information and leverage to negotiate arm's-length terms.

For Mentee's shareholders, the acquisition represents an exceptional return. The startup raised just $17 million in a single funding round led by Ahren Innovation Capital before being acquired for 53x that amount—despite having no reported revenue.

Strategic Rationale: "Mobileye 3.0"

Shashua called the acquisition "the beginning of Mobileye 3.0," describing a vision where autonomous driving and humanoid robotics represent two expressions of the same underlying technology challenge—enabling machines to navigate and interact with the physical world.

"By combining Mentee's breakthroughs in humanoid robotics with Mobileye's expertise in automotive autonomy, and its proven ability to productize advanced AI, we have a unique opportunity to lead the evolution of physical AI across robotics and autonomous vehicles on a global scale," Shashua said.

The thesis rests on several technical overlaps:

- Sensing and perception: Both autonomous vehicles and humanoid robots need to understand their physical environment through cameras, lidar, and other sensors

- Real-time decision-making: Both require split-second choices about movement and interaction

- Safety systems: Both must operate safely around humans without causing harm

- Simulation and training: Both can leverage similar approaches to generate training data through simulation

Mentee's approach bypasses traditional data collection by transforming a single human demonstration into millions of virtual repetitions—a technique that could accelerate Mobileye's development of edge cases for autonomous driving as well.

Mobileye's Financial Position

The $900 million acquisition is significant relative to Mobileye's current scale:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $490M | $438M | $506M | $504M |

| Net Income | ($71M) | ($102M) | ($67M) | ($96M) |

| Cash | $1,426M | $1,512M | $1,709M | $1,749M |

The company has been consistently unprofitable, losing $336 million over the last four quarters on approximately $1.9 billion in revenue. However, Mobileye maintains a strong balance sheet with nearly $1.75 billion in cash and only $61 million in debt .

The $612 million cash component will consume roughly 35% of Mobileye's cash reserves. The company justified the expenditure by pointing to its automotive revenue pipeline of $24.5 billion over the next eight years—up more than 40% since January 2023.

The Humanoid Robot Gold Rush

Mobileye joins an increasingly crowded field chasing the humanoid robot opportunity. Nvidia CEO Jensen Huang and Tesla CEO Elon Musk have both identified humanoid robots as transformative technology. At CES 2026, Huang unveiled Nvidia's "Groot" humanoid robot platform alongside new autonomous driving models.

Recent valuations in the space have been extraordinary:

- Figure AI (U.S.): Valued at $39 billion after raising $1.5 billion in May 2025

- Neura Robotics (Germany): Raised $1.16 billion two months ago at a valuation exceeding $10 billion

- Tesla Optimus: Musk has stated humanoid robots could become Tesla's largest business long-term

By this measure, Mobileye is acquiring Mentee relatively cheaply at $900 million—though Mentee's robots remain in development with proof-of-concept deployments not expected until 2026 and commercialization targeted for 2028.

The deal dwarfs the last major automotive-to-robotics acquisition: Hyundai's $880 million purchase of Boston Dynamics in 2021. That transaction has yet to generate meaningful commercial returns.

Intel's Role

Intel's approval was required given its ~85% controlling stake in Mobileye through Class B shares. The chipmaker acquired Mobileye for $15.3 billion in 2017, later taking the company public again in 2022 at a valuation exceeding $20 billion.

Today, Mobileye trades at approximately $10 billion market cap—a significant decline from post-IPO highs. Intel itself has struggled, with its stock down substantially as it lost ground to Nvidia in AI chips.

The Mentee acquisition adds another dimension to Intel's exposure: the chip giant now indirectly owns stakes in both autonomous vehicles (through Mobileye) and humanoid robotics (through Mentee via Mobileye). Whether this diversification creates value or spreads focus too thin remains to be seen.

Timeline and Risks

Near-term milestones:

- Q1 2026: Transaction expected to close

- 2026: First on-site proof-of-concept deployments with customers (without teleoperation)

- 2028: Series production and commercialization target

Key risks:

- Technology execution: Humanoid robotics remains extraordinarily challenging; many well-funded competitors have struggled to achieve commercial deployment

- Integration: Combining an automotive software company with a robotics startup requires cultural and technical integration

- Governance: The founder overlap may create ongoing conflicts or perception issues

- Competition: Deep-pocketed rivals including Tesla, Nvidia-backed startups, and Chinese competitors are all pursuing similar technology

- Cash consumption: The acquisition consumes significant resources while Mobileye's core business remains unprofitable

What to Watch

Proof of concept details: The 2026 deployments will be the first real-world test of whether Mentee's simulation-based training approach works outside the lab.

Intel's position: Whether Intel continues to support Mobileye's expansion or seeks to monetize its stake will influence Mobileye's strategic flexibility.

Competitive response: Tesla's Optimus and Nvidia-powered humanoid platforms represent formidable competition. Watch for announcements at upcoming tech events.

Shashua's empire: Beyond Mobileye and Mentee, Shashua recently co-founded AAI, an AI startup that has already reached unicorn status. Reports suggest he is also in advanced talks to sell AI21 Labs to Nvidia for $2-3 billion. His expanding portfolio raises questions about bandwidth and potential conflicts.