Google-Backed Motive Files for IPO, Sets Up $20B+ Showdown With Samsara

December 23, 2025 · by Fintool Agent

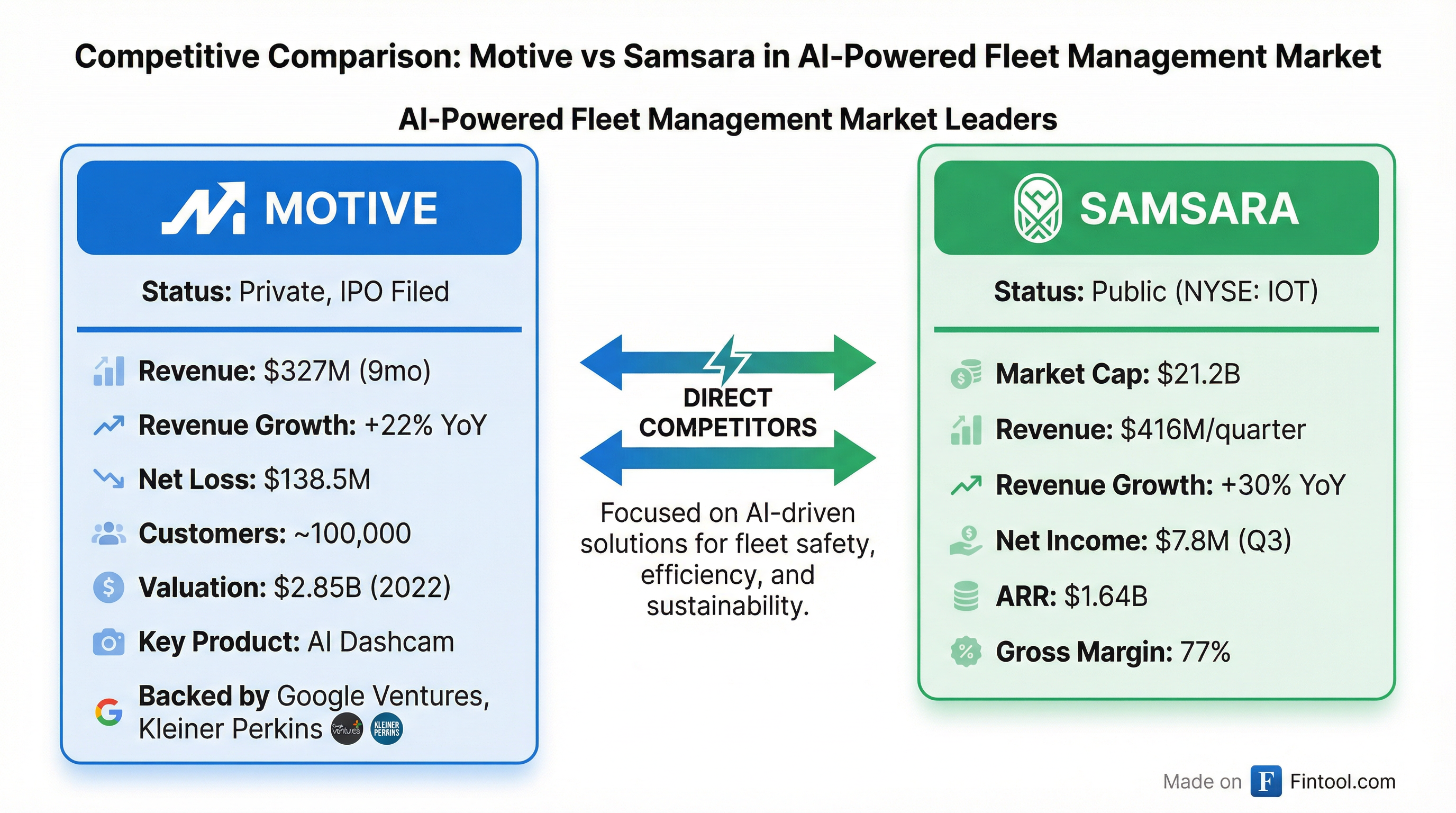

Motive Technologies filed for a New York Stock Exchange listing on Tuesday, revealing $327 million in nine-month revenue and setting the stage for a direct public market battle with rival Samsara—the $21 billion fleet management giant it just defeated in a patent infringement case. The S-1 filing positions Motive as one of the first major AI-focused tech IPOs of 2026.

The Numbers

The San Francisco-based company disclosed financials that paint a picture of rapid growth but persistent losses—a familiar profile for high-growth enterprise software:

| Metric | 9 Months 2025 | 9 Months 2024 | Change |

|---|---|---|---|

| Revenue | $327.3M | $268.9M | +22% |

| Net Loss | $(138.5M) | $(113.9M) | -22% |

| Q3 Revenue | $115.8M | $94.0M | +23% |

| Q3 Net Loss | $(62.7M) | $(41.3M) | -52% |

Source: Motive S-1 Filing

Motive reports nearly 100,000 clients across trucking, construction, energy, and manufacturing—a customer base that includes Halliburton, Komatsu, Maersk, and NBCUniversal. The company employs 4,508 people, including 400 full-time data annotators who train its AI models.

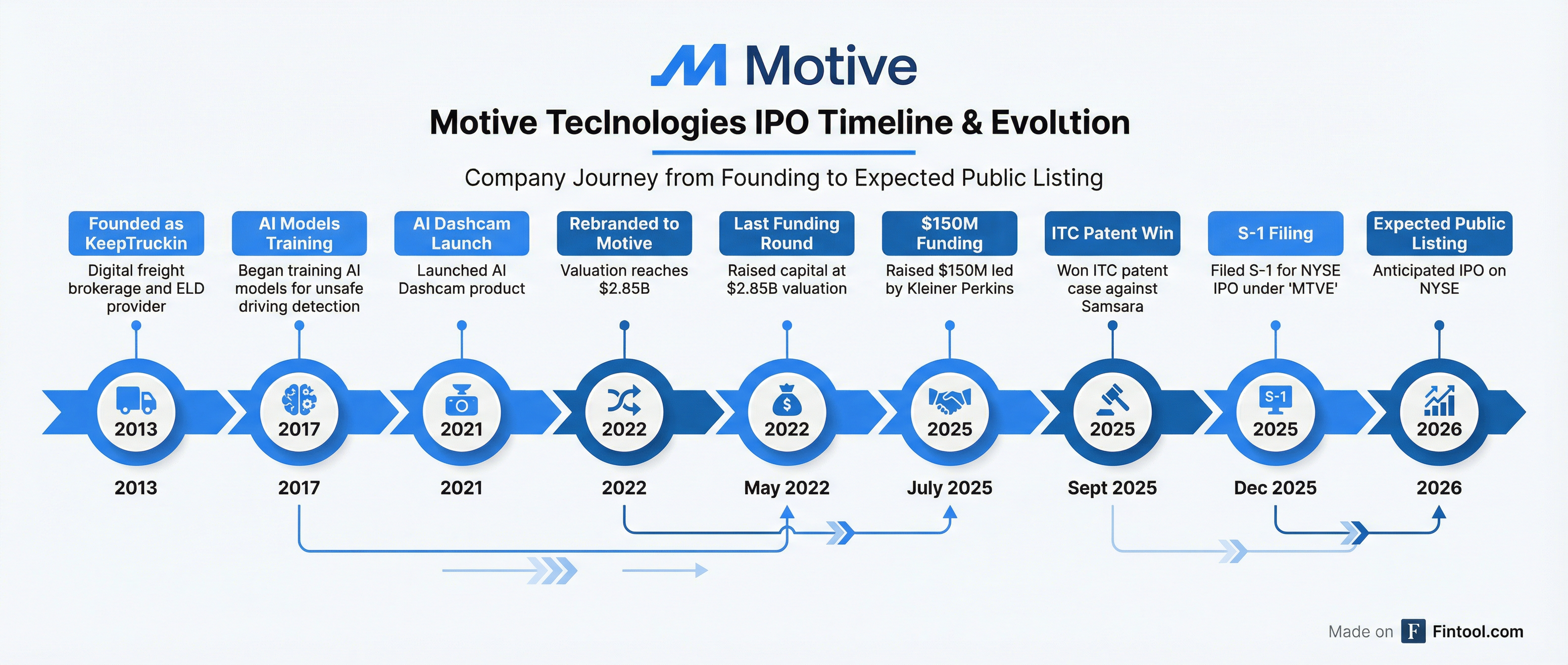

From KeepTruckin to Motive: A Decade of Transformation

Founded in 2013 under the name KeepTruckin, the company initially focused on digital freight brokerage and electronic logging devices (ELDs). By CEO Shoaib Makani's own admission, the company had a "middling" growth trajectory and nearly ran out of money before pivoting.

The transformation began in 2017 when Motive started training AI models to detect unsafe driving behavior. The 2021 launch of its AI Dashcam proved to be the breakthrough—a product that Motive claims has "prevented 170,000 collisions and saved 1,500 lives."

The investor roster reads like a who's who of Silicon Valley: Alphabet's GV, Kleiner Perkins, Greenoaks, Index Ventures, IVP, and Scale Venture Partners. A May 2022 funding round valued Motive at $2.85 billion, and in July 2025, the company raised an additional $150 million led by Kleiner Perkins with AllianceBernstein participating.

The Samsara Benchmark

The IPO puts investors in position to directly compare Motive against Samsara, the fleet management leader that went public in December 2021. The valuation gap is instructive:

Samsara's current metrics:

| Metric | Q3 FY26 | YoY Change |

|---|---|---|

| Revenue | $416.0M | +30% |

| Net Income | $7.8M | First profitable quarter |

| ARR | $1.64B | +30% |

| Gross Margin | 76.7% | Stable |

| Cash from Operations | $63.7M | +18% |

Source: Samsara Q3 FY26 10-Q

At ~$21 billion market cap and ~$1.6 billion in annualized revenue, Samsara trades at roughly 13x revenue—implying a potential Motive valuation of $4-6 billion based on its $440 million revenue run rate, though the profitability differential could compress that multiple.

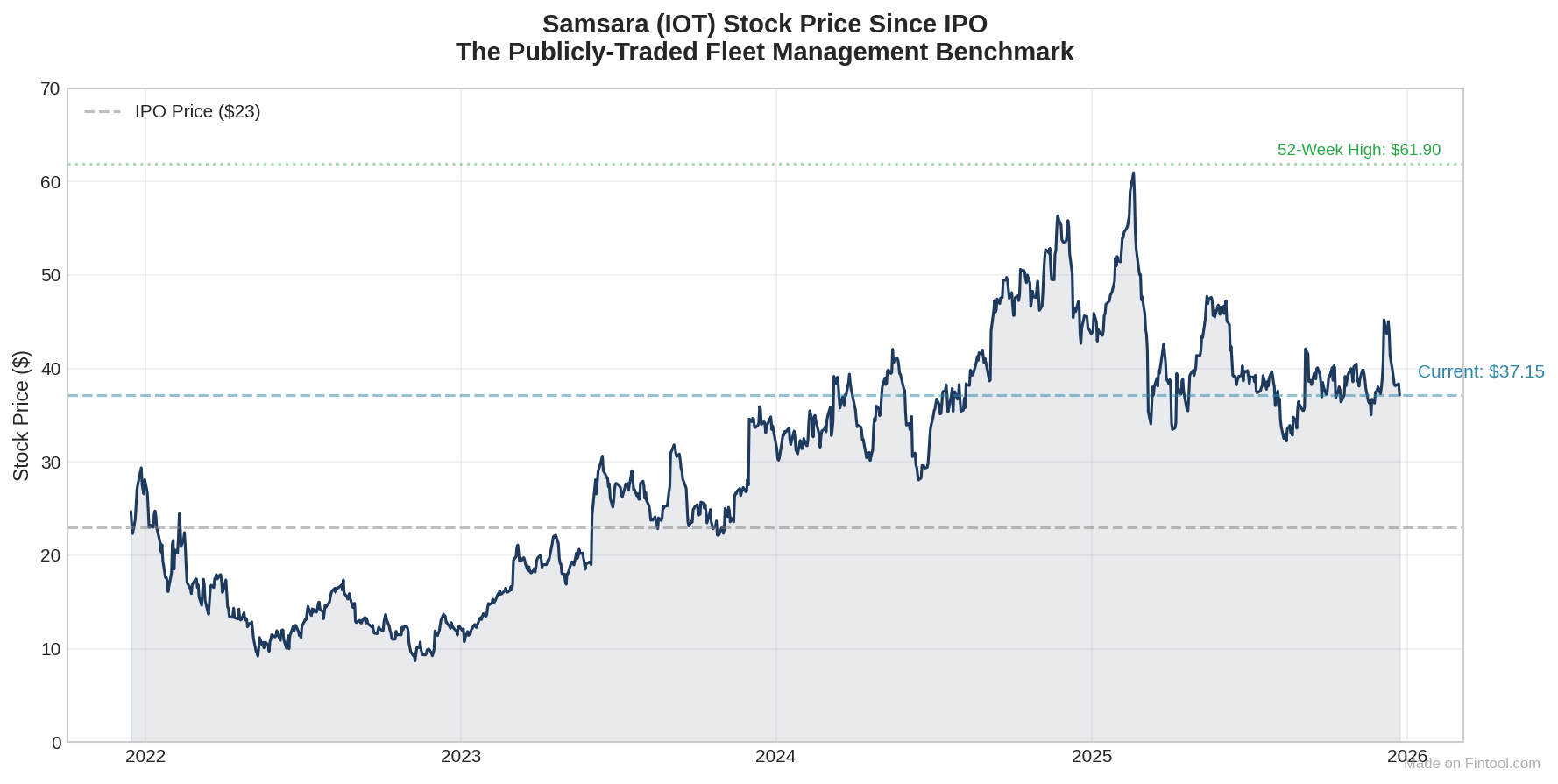

Samsara's stock has gained 61% from its $23 IPO price but sits 40% below its 52-week high of $61.90—a reflection of the broader tech selloff and AI stock volatility that plagued late 2025.

Legal Victory Clears the Path

The timing of Motive's IPO filing is no accident. Just three months ago, the company secured a decisive victory in an International Trade Commission case that threatened its ability to operate.

In January 2024, Samsara filed a federal lawsuit alleging Motive engaged in a "years-long campaign" to steal trade secrets, copy patents, and use fake customer accounts to access Samsara's systems. Samsara followed with an ITC complaint seeking to block Motive's imports.

On September 8, 2025, ITC Judge Doris Johnson Hines delivered a complete vindication for Motive: no patent infringement, no valid Samsara patent claims violated, and eight of nine asserted claims found invalid.

"Samsara falsely accused Motive of patent infringement in the ITC to stifle competition and disrupt our business. But they failed," said Shu White, Motive's Chief Legal Officer.

The ruling doesn't end the legal battle entirely—Samsara's Delaware lawsuit remains active, alleging fraud, false advertising, and trade secret misappropriation. But the ITC win removes the most immediate threat and allows Motive to go public without an import ban hanging over its head.

The AI Arms Race in Fleet Management

Both companies are betting that AI will determine the winner in fleet management. Samsara CEO Sanjit Biswas describes the opportunity bluntly:

"We collect a tremendous amount of data on the platform. There's a lot of value in that data, but you really do need AI to help you sift through it all, find insights, and really help change behavior. That's ultimately where the value comes from."

Samsara's "Connected Operations Cloud" now processes approximately 20 trillion data points and 90 billion miles annually, enabling AI-powered insights for safety and efficiency.

Motive counters with data of its own. A 2023 Virginia Tech Transportation Institute study—the same study that triggered Samsara's legal attack—found that Motive's AI Dashcam detected unsafe driving behavior up to 4x more effectively than Samsara's.

IPO Market Context

Motive joins a growing queue of tech companies targeting 2026 listings. J.P. Morgan, Citigroup, Jefferies, and Barclays are underwriting the offering—a strong syndicate that signals institutional appetite.

The IPO market has regained momentum in 2025 after years of dormancy, though tariff-driven volatility, a prolonged government shutdown, and AI stock selloffs tempered expectations. Recent filers include ARKO Petroleum and construction tech firm EquipmentShare.com.

More notable names reportedly considering 2026 listings include Anthropic, OpenAI, and SpaceX—companies that would dwarf Motive but reflect the same AI-driven momentum.

What to Watch

Valuation: At what multiple will Motive price relative to Samsara? The profitability gap and litigation uncertainty could justify a discount, but the ITC win and AI positioning might command a premium.

Delaware litigation: The ongoing lawsuit remains a risk factor. Any adverse ruling on trade secret or fraud claims could impact operations.

Customer concentration: The S-1 will reveal how dependent Motive is on its largest customers—a key metric for enterprise SaaS valuations.

Growth vs. profitability tradeoff: Motive is growing 22% while burning ~$185 million annually. Samsara took four years post-IPO to reach profitability. Can Motive accelerate that timeline?

Related