Netflix and Sony Strike $7 Billion Global Streaming Deal in Industry First

January 15, 2026 · by Fintool Agent

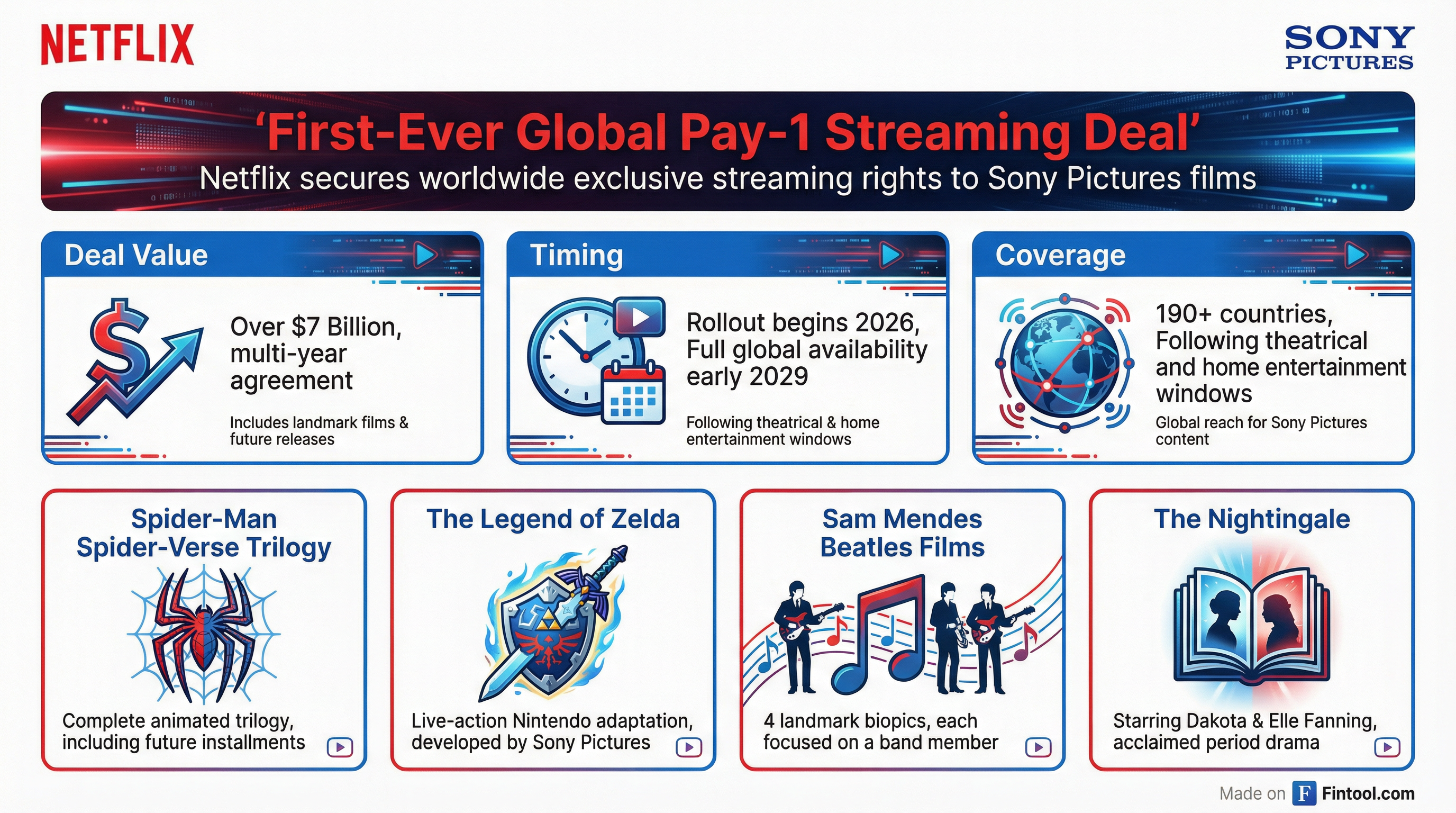

Netflix+1.64% and Sony Pictures Entertainment have closed a landmark $7 billion-plus global Pay-1 licensing deal—an industry first that gives the streaming giant exclusive worldwide rights to Sony's theatrical releases following their cinema runs.

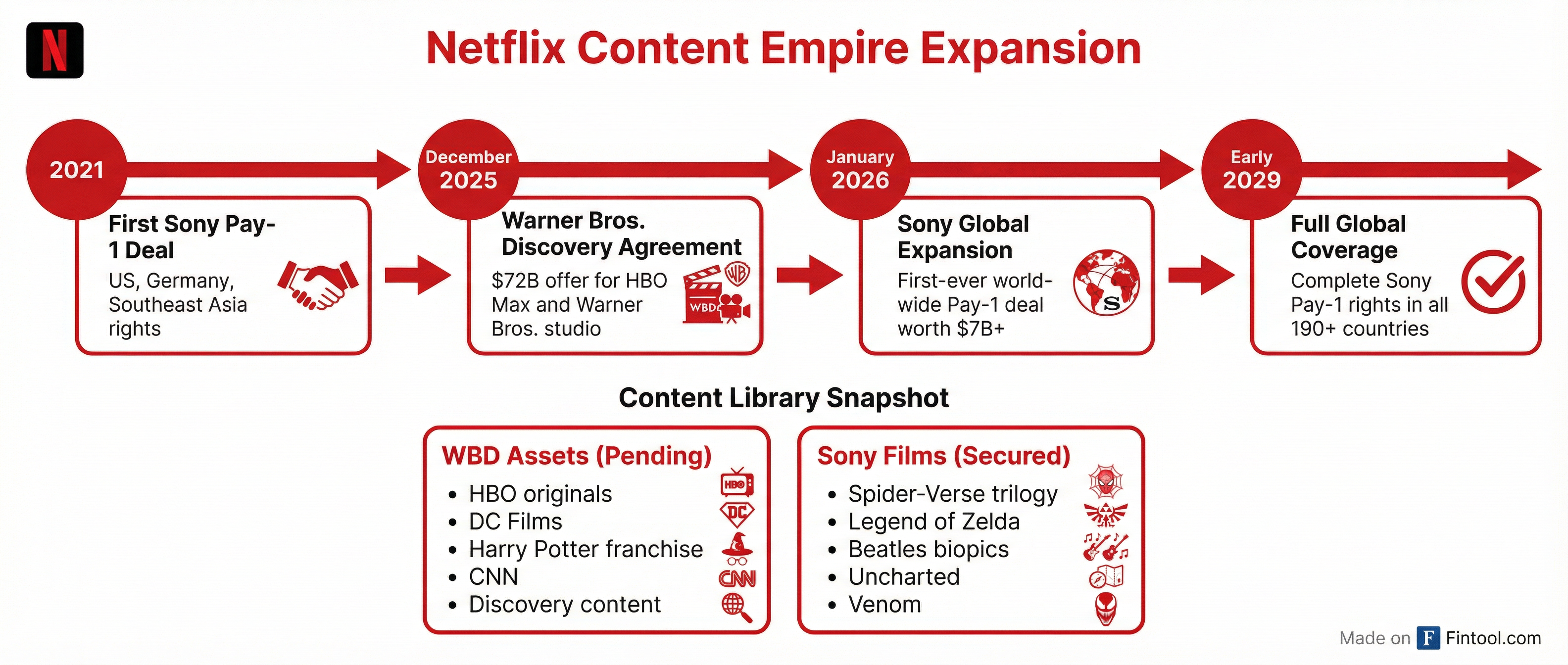

The multi-year agreement expands a 2021 partnership that previously covered only the U.S., Germany, and Southeast Asia, delivering Sony's film slate to Netflix's 300+ million subscribers across all 190+ markets.

A Streaming Industry First

This represents the first time a Pay-1 window—the exclusive streaming period following theatrical and home entertainment releases—has been licensed globally to a single platform. Historically, studios negotiated these rights territory by territory, creating a fragmented content landscape that Netflix has now unified under one roof.

"Our members all over the world love movies and giving them exclusive access to Sony's much loved films adds incredible value to their subscriptions," said Lauren Smith, Vice President of Licensing and Programming Strategy at Netflix.

Blockbuster Pipeline Secured

The deal locks in some of Hollywood's most anticipated releases for Netflix's global audience:

| Title | Genre | Details |

|---|---|---|

| Spider-Man: Beyond the Spider-Verse | Animation | Conclusion to the groundbreaking animated trilogy |

| The Legend of Zelda | Live-Action | Nintendo's first major live-action film adaptation |

| Beatles Films (4 total) | Drama | Sam Mendes' audacious quartet of biopics |

| The Nightingale | Drama | Kristin Hannah adaptation starring Dakota and Elle Fanning |

| Buds | Animation | Sony Pictures Animation's talking plants film |

Sony's proven track record under the existing regional deal—hits like Spider-Man: Across the Spider-Verse, Uncharted, Anyone But You, It Ends With Us, and Venom: The Last Dance—made the global expansion a natural progression.

Strategic Context: Netflix's Content Empire Push

The Sony agreement arrives as Netflix pursues an even larger prize: the $72 billion acquisition of Warner Bros. Discovery's+2.24% streaming and studio assets. That deal, announced in December, would bring HBO Max, Warner Bros. studio, and franchises like Harry Potter, DC Films, and Game of Thrones under Netflix's control.

Netflix is reportedly preparing to amend its WBD offer to all-cash to accelerate shareholder approval and fend off Paramount Skydance's-6.04% hostile $30-per-share counter-bid.

Paul Littmann, EVP of Global Distribution at Sony Pictures Television, emphasized the strategic fit: "This new Pay-1 deal takes that partnership to the next level and reinforces the enduring appeal of our theatrical releases to Netflix's global audience. It also further underscores the strength of our independence and unique ability to create meaningful opportunities that benefit our creative stakeholders, consumers, and world-class partners."

Financial Firepower

Netflix's financial position supports its aggressive content acquisition strategy:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $10.2* | $10.5 | $11.1 | $11.5 |

| Net Income ($B) | $1.9 | $2.9 | $3.1 | $2.5 |

| EBITDA Margin | 23.0%* | 32.5%* | 34.8%* | 29.0%* |

| Free Cash Flow ($B) | $4.9* | $5.7* | $6.0* | $6.7* |

*Values retrieved from S&P Global

As of Q3 2025, Netflix carried $20.9 billion in content obligations, with $11.3 billion due within 12 months. The company's licensed content portfolio stood at $12.2 billion on its balance sheet.

Rollout Timeline

The global expansion will be phased:

- 2026 (Later This Year): Rollout begins as individual territory rights become available

- Early 2029: Full global availability across all Netflix markets

This gradual approach reflects the complexity of unwinding existing licensing agreements in various territories. Netflix currently holds Pay-1 rights in select regions including the U.S., Germany, and across Southeast Asia.

Market Implications

For Sony, the deal ensures a reliable home for its theatrical slate as studios recalibrate distribution strategies in the streaming era. Sony remains one of the few major studios without its own streaming platform, positioning it as a content supplier rather than a platform competitor.

For Netflix, combining the Sony pipeline with a potential WBD acquisition would create an unprecedented content moat—controlling first-window streaming rights to two major Hollywood studios while operating its own production apparatus.

What to Watch

- WBD Shareholder Vote: If Netflix's all-cash amendment proceeds, the vote could move from spring/summer to late February or early March

- Paramount Counter-Moves: Paramount Skydance's $30-per-share hostile bid remains active with a January 21 tender deadline

- Regulatory Scrutiny: A combined Netflix-WBD entity controlling nearly half the streaming market has drawn political attention

The Sony deal demonstrates Netflix's willingness to deploy billions securing content pipelines while simultaneously pursuing transformational M&A—a dual-track strategy that could reshape Hollywood's power structure.