Novo Nordisk Warns of Sales Decline in 2026—Stock Plunges 12%

February 3, 2026 · by Fintool Agent

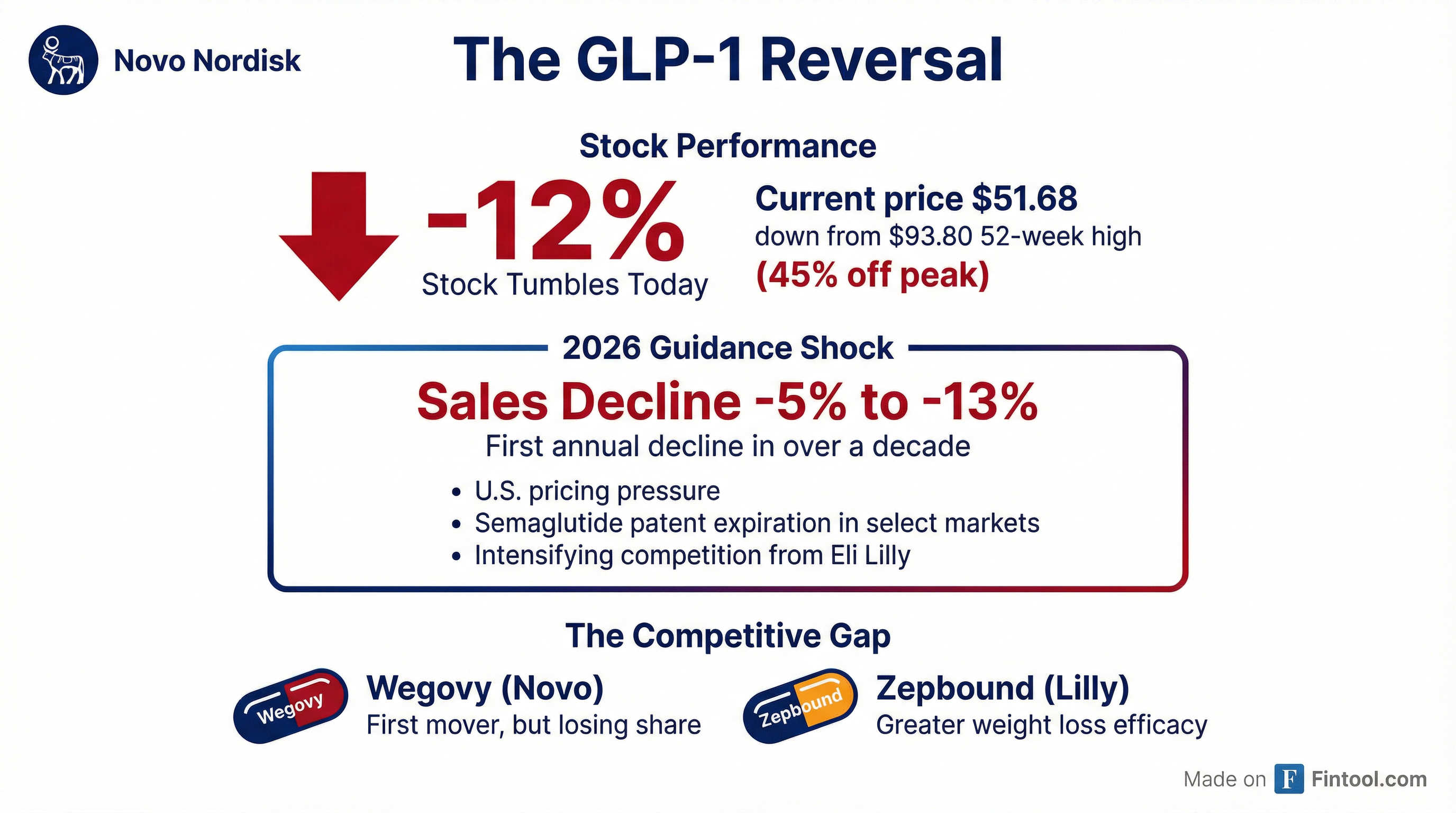

Novo Nordisk just issued its starkest warning yet: sales will decline in 2026. The Danish drugmaker, whose Ozempic and Wegovy franchises made it the world's most valuable pharmaceutical company, now expects revenue to fall 5-13% at constant exchange rates this year—the first annual decline in over a decade.

The stock cratered 12% on the news, falling to $51.68 and erasing approximately $30 billion in market value in a single session.

What Happened

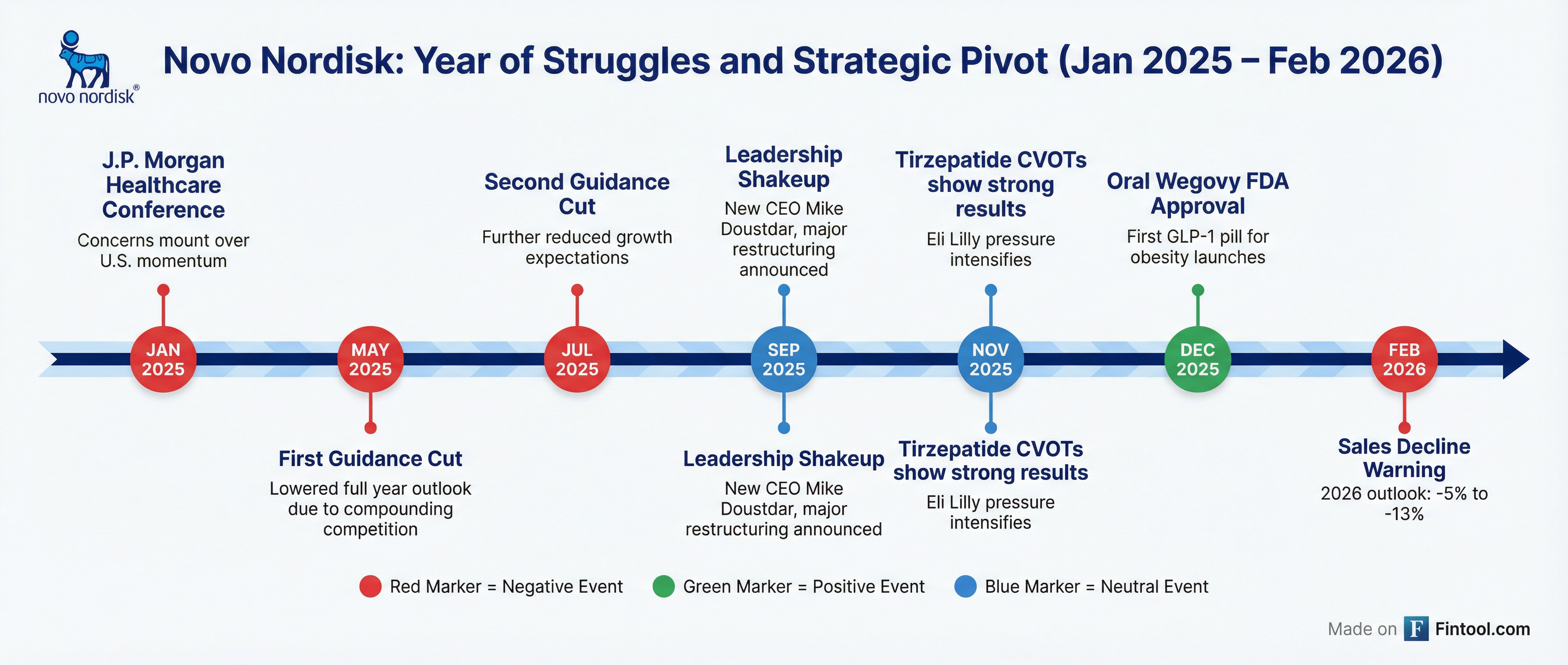

Novo released its 2026 outlook ahead of Wednesday's full earnings report, and the numbers were worse than feared. For 2025, the company delivered 10% sales growth and 6% operating profit growth—in line with reduced guidance from multiple cuts throughout the year.

But it's the forward guidance that shocked investors:

| Metric | 2025 Actual | 2026 Guidance |

|---|---|---|

| Sales Growth (CER) | +10% | -5% to -13% |

| Operating Profit | +6% | Decline expected |

"The outlook reflects expectations for sales growth within International Operations and expectations for a sales decline within US Operations," Novo said in its statement.

The U.S. Problem

The U.S. market—Novo's largest and most profitable—is where the trouble lies. Three forces are converging:

1. Eli Lilly's Competitive Assault

Eli Lilly's tirzepatide drugs (Mounjaro for diabetes, Zepbound for obesity) have proven more effective for weight loss than Novo's semaglutide-based products. Clinical data consistently shows tirzepatide delivers ~25% weight loss versus ~15-17% for semaglutide. As Novo's U.S. operations chief acknowledged last year: "12% is not 26%."

Lilly has also demonstrated strong cardiovascular outcomes, and its sales force has found it "easier to walk in and say, switch to my product."

2. Pricing Pressure

Medicare negotiations have forced significant price cuts. Novo's self-pay pricing program launched Wegovy at $499/month through NovoCare Pharmacy, and broader price concessions across channels have compressed margins.

3. Patent Expirations

Semaglutide is losing exclusivity in Canada, Brazil, and China in 2026, opening the door to generic competition in major international markets.

The Revenue Reversal

The divergence between Novo and Lilly has been dramatic. While Novo's revenue is expected to decline in 2026, analysts project Lilly's revenue to surge 42% year-over-year to $63.9 billion.*

| Company | FY 2024 Revenue | FY 2025E Revenue | FY 2026E Revenue | FY25-26 Growth |

|---|---|---|---|---|

| Novo Nordisk | $40.3B | $48.3B | $47.5B | -2% |

| Eli Lilly | $45.0B | $63.9B | $77.6B | +21% |

*Values retrieved from S&P Global

A Year of Turbulence

Today's guidance caps a brutal 18 months for Novo Nordisk:

The company cut guidance twice in 2025, underwent a major leadership shakeup—replacing its CEO with Mike Doustdar in September—and launched a company-wide restructuring program.

The stock has fallen 45% from its 52-week high of $93.80, though it had rebounded modestly after securing FDA approval for the oral Wegovy pill in December. That gain was wiped out today.

Historical Financial Trajectory

Until this year, Novo had been on a remarkable growth trajectory:

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|

| Revenue ($B) | $21.5 | $25.4 | $34.4 | $40.3 |

| Net Income ($B) | $7.3 | $8.0 | $12.4 | $14.0 |

| EBITDA Margin % | 45.3% | 45.8% | 47.6% | 50.5% |

*Values retrieved from S&P Global

The company nearly doubled revenue in four years. Now it faces its first annual decline since the pre-GLP-1 era.

The Counteroffensive

Novo isn't surrendering. The company is banking on two strategic pillars:

Oral Wegovy — Launched in January 2026, this is the first GLP-1 pill approved for obesity. It offers significant convenience over weekly injections and gives Novo first-mover advantage in oral obesity treatment.

CagriSema — Novo's next-generation injectable combines semaglutide with cagrilintide for enhanced weight loss. The drug is in Phase III trials and could recapture the efficacy advantage.

Management has also signaled more aggressive commercial execution, including shifting marketing back to weight-loss messaging after a failed "beyond weight" campaign.

Market Reaction

Novo's 12.3% drop was the worst single-day decline in months. Volume exploded to 24.6 million shares—nearly double the recent average.

Lilly also fell 2.8% in sympathy, though the company's fundamentals remain intact. Analysts continue to project 40%+ earnings growth for Lilly in 2026.*

*Values retrieved from S&P Global

Barclays analyst James Gordon noted before the print that while guidance cuts were expected, they "could act as a clearing event" allowing investors to buy into the oral Wegovy launch and potential volume inflection.

What to Watch

- Wednesday's full earnings report — The detailed Q4 numbers and management commentary will be scrutinized for signs of stabilization

- Oral Wegovy prescription data — Early uptake will signal whether the pill can reverse U.S. share losses

- CagriSema Phase III readouts — Success could restore Novo's efficacy leadership

- Lilly's orforglipron timeline — Lilly's oral GLP-1 is under FDA review; approval would intensify competition

The GLP-1 market remains one of the largest pharmaceutical opportunities in history—analysts still project it reaching $100B+ annually. But Novo's days of unchallenged dominance are over. The question now is whether it can fight back.

Related Companies