Novo Nordisk Cuts Wegovy Prices 50% in China as Patent Cliff Looms

December 29, 2025 · by Fintool Agent

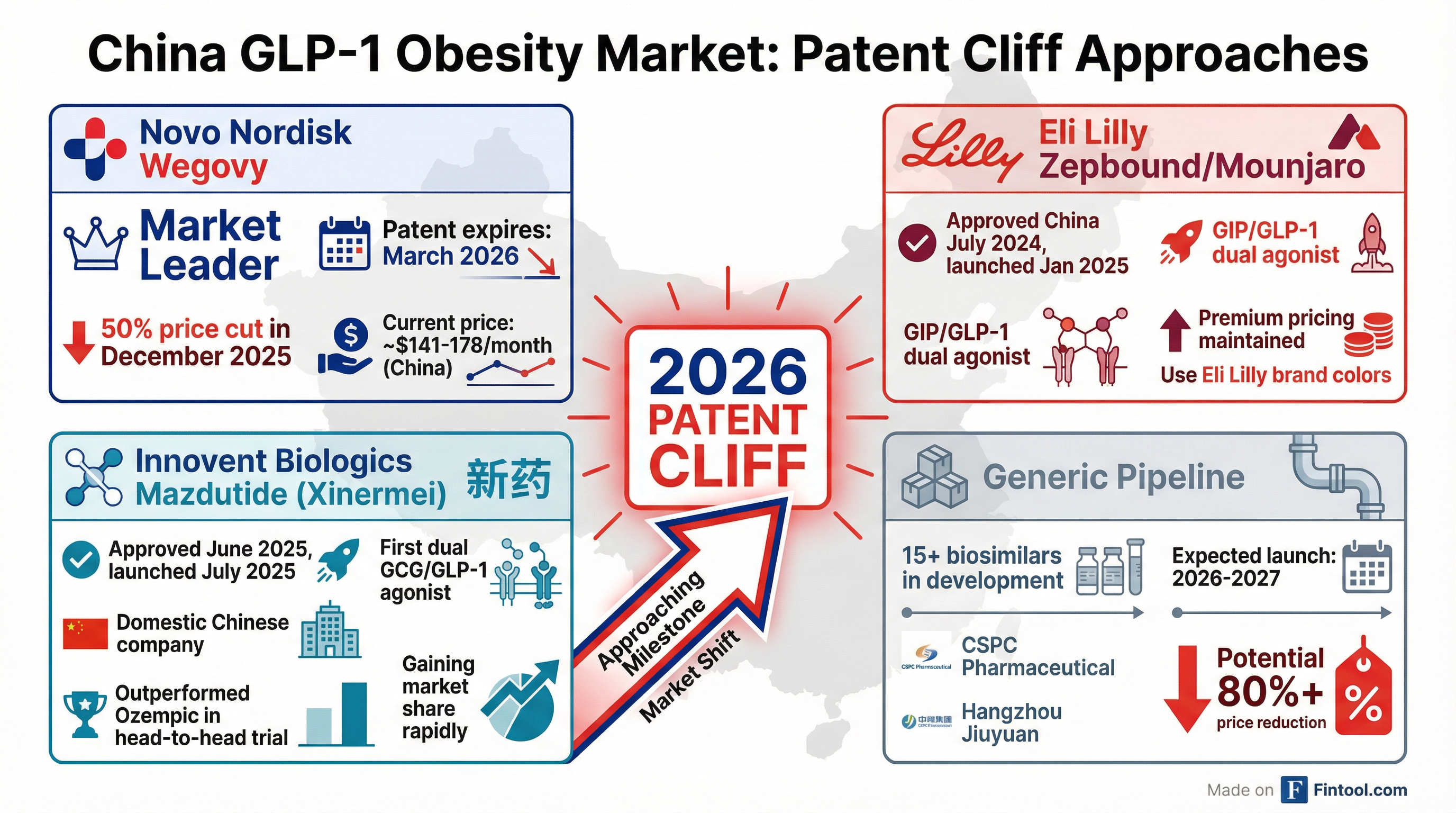

Novo Nordisk has slashed the prices of its obesity blockbuster Wegovy by roughly 50% in parts of China, a defensive move that signals the end of the semaglutide pricing supercycle in the world's second-largest pharmaceutical market.

The Danish drugmaker cut list prices for the two highest dosages of Wegovy to 987.48 yuan ($141) and 1,284.36 yuan per month respectively in the southwestern provinces of Yunnan and Sichuan, according to local media outlet Yicai. Prices on JD.com's online pharmacy platform have also been lowered.

Novo said the price reduction would "further reduce the burden for patients and improve treatment adherence."

But make no mistake: this is about survival in a market that's about to be flooded with copycats.

Why Now: The March 2026 Patent Cliff

The timing is not coincidental. Novo Nordisk's patent on semaglutide—the active ingredient in both Wegovy and Ozempic—expires in China in March 2026, just three months away.

At least 15 generic versions of semaglutide are currently in development by Chinese manufacturers, including CSPC Pharmaceutical Group and Hangzhou Jiuyuan Genetic Biopharmaceutical. Several are in late-stage clinical trials and could launch as soon as patent protection lapses.

Industry analysts estimate generic competition could drive prices down by 80% or more in China. By cutting prices proactively, Novo aims to retain market share and customer relationships before the generic flood arrives.

China: The First Domino to Fall

China represents a crucial test case for Novo Nordisk's global franchise. The semaglutide patent expires in China years ahead of its expiration in other key markets:

| Market | Semaglutide Patent Expiry |

|---|---|

| China | March 2026 |

| Japan | 2031 |

| Europe | 2032 |

| United States | 2032 |

The company's China patent situation is further complicated by legal challenges. A Chinese patent office invalidation ruling was overturned by the Beijing IP Court in November 2023, but that decision has been appealed to the Supreme People's Court where the case remains pending. An adverse ruling could accelerate generic entry.

Wegovy sales in China are estimated at roughly 2.2 billion Danish crowns ($346 million) in 2025, expected to grow 30% in 2026 before declining due to generic competition.

The Domestic Challenger: Innovent's Mazdutide

Beyond generics, Novo faces an immediate threat from domestic competition that doesn't require waiting for patent expiry.

Innovent Biologics launched mazdutide (branded as Xinermei) in China in July 2025 after securing approval the prior month. It's the world's first dual GCG/GLP-1 receptor agonist approved for obesity—a differentiated mechanism that targets an additional hormone called glucagon.

In a head-to-head Phase 3 trial announced in October, mazdutide showed superior efficacy to Novo's semaglutide:

| Metric | Mazdutide (6mg) | Semaglutide (1mg) |

|---|---|---|

| Weight Loss | -10.29% | -6.00% |

| HbA1C Reduction | -2.03 | -1.84 |

Innovent's shares have surged 155% since the start of the year, while Novo's have fallen 38%. The domestic company is aggressively expanding partnerships with online platforms, retail pharmacies, and private hospitals. A former Eli Lilly executive expects mazdutide to become "a major blockbuster product in China."

A Year to Forget for Novo

The China price cut is the latest challenge in what has become a brutal year for Novo Nordisk shareholders.

The stock is trading at $52.40—down 40% year-to-date—while rival Eli Lilly is up 39% over the same period. The divergence reflects:

- Competitive pressure: Lilly's Zepbound and Mounjaro have captured significant market share globally

- Margin erosion: Gross margins declined from 85.9% in Q4 2024 to 80.7% in Q3 2025

- Execution concerns: Management turnover, including the CEO transition to Maziar Doustdar

- China weakness: China sales growth has lagged other regions due to market dynamics

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $11.9 | $11.3 | $12.1 | $11.8 |

| Net Income ($B) | $3.9 | $4.2 | $4.2 | $3.1 |

| Gross Margin | 85.9% | 83.5% | 83.3% | 80.7% |

Values retrieved from S&P Global

The company trades at a consensus analyst price target of $62—implying ~18% upside—but skepticism remains high given the competitive dynamics.

The Bigger Picture: GLP-1 Pricing Pressure Goes Global

Novo's China price cut may foreshadow broader pricing pressure across global markets.

The company has already made significant pricing concessions elsewhere:

- United States: In November 2025, Novo announced a $149/month introductory price for the oral Wegovy pill as part of an agreement with the Trump administration—far below the ~$1,350 monthly list price for injectable Wegovy

- Trump administration deals: Both Novo and Eli Lilly struck agreements to lower obesity drug prices for Medicare, Medicaid, and self-paying patients

The oral pill approval—which came just last week—gives Novo a temporary lifeline in the U.S. market. But the broader trajectory is clear: premium GLP-1 pricing is under attack from generics, biosimilars, domestic competitors, and government pressure.

For the 600 million Chinese adults projected to be overweight by 2050, cheaper semaglutide is good news. For Novo Nordisk shareholders, it's another signal that the fat margins of the GLP-1 golden era are thinning.

What to Watch

Near-term catalysts:

- March 2026: China semaglutide patent expiry—watch for generic launches

- Q1 2026: China Wegovy sales trajectory post-price cut

- Ongoing: Supreme People's Court ruling on patent validity

Competitive dynamics:

- Innovent mazdutide market share gains

- Additional domestic Chinese GLP-1 approvals

- Eli Lilly pricing strategy in China

Global signals:

- Whether China price cuts presage action in other markets

- U.S. compounding pharmacy litigation outcomes

- European regulatory decisions on generic semaglutide

The Bottom Line

Novo Nordisk's 50% Wegovy price cut in China is a tacit admission that the competitive moat around semaglutide is crumbling. With patent expiry just months away, 15+ generics in development, and a domestic challenger already stealing share, the company is choosing to sacrifice margins in hopes of retaining volume.

For investors, China is a preview of what awaits globally. The GLP-1 market is set to exceed $150 billion by the 2030s—but the question is increasingly whether Novo Nordisk can maintain its share as first-mover advantages fade and competition intensifies.

The era of GLP-1 scarcity pricing is ending. The era of GLP-1 commoditization has begun.