Nvidia Eyes $3 Billion AI21 Labs Deal as Israel Becomes Its AI Talent Factory

December 30, 2025 · by Fintool Agent

Nvidia+7.87% is in advanced talks to acquire Israeli AI startup AI21 Labs for $2–3 billion, according to Israeli financial publication Calcalist—a deal that would mark the chipmaker's fourth major Israeli acquisition and signal its aggressive pursuit of scarce AI talent as it cements the country as a critical pillar of its global R&D empire.

The transaction, if completed, would value AI21 at roughly double its $1.4 billion valuation from a 2023 funding round, representing a significant premium for a company whose primary appeal appears to be its workforce rather than its technology.

The Real Prize: 200 AI Researchers

Nvidia's interest in AI21 centers squarely on talent acquisition. The startup employs approximately 200 workers, most holding advanced academic degrees with rare expertise in artificial intelligence development. At the reported deal range, that implies a cost of roughly $10–15 million per employee—a steep but increasingly common premium in the AI talent wars.

"Nvidia's primary interest in AI21 appears to be its workforce," Calcalist reported. "Such a transaction would effectively provide Nvidia with a fast-track expansion of its AI talent base in Israel."

AI21 Labs was founded in 2017 by Professor Amnon Shashua, Professor Yoav Shoham, and Ori Goshen. Shashua is best known as the founder and CEO of Mobileye+3.69%, the autonomous driving pioneer that Intel+4.87% acquired for $15.3 billion in 2017—then the largest-ever Israeli tech exit.

The company has raised $636 million across seven funding rounds, including a $300 million Series D in May 2025 led by Nvidia and Alphabet-2.53%'s Google.

Building an Israeli AI Empire

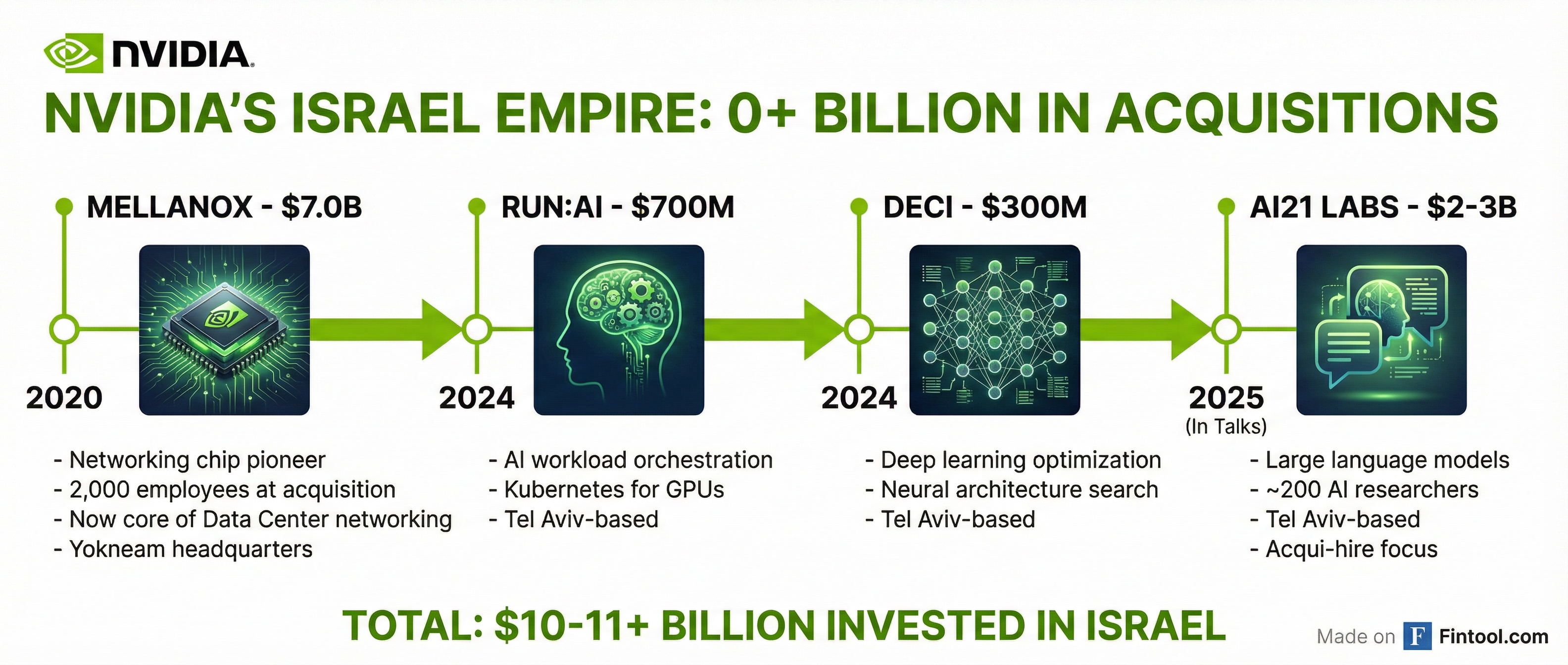

The AI21 deal would extend Nvidia's aggressive Israeli acquisition strategy, which has already delivered transformative results:

| Acquisition | Year | Deal Value | Strategic Rationale |

|---|---|---|---|

| Mellanox Technologies | 2020 | $7.0B | Networking chips, InfiniBand |

| Run:ai | 2024 | $700M | AI workload orchestration |

| Deci | 2024 | $300M | Deep learning optimization |

| AI21 Labs (in talks) | 2025 | $2–3B | LLM expertise, AI talent |

The Mellanox acquisition, completed for $6.9 billion in April 2020, has proven spectacularly successful. Nvidia's networking segment—born from that deal and headquartered in Yokneam—delivered $8.2 billion in Q3 FY2026, up 162% year-over-year. The division now accounts for over 16% of total revenue and is on track for a $25–30 billion annual run rate.

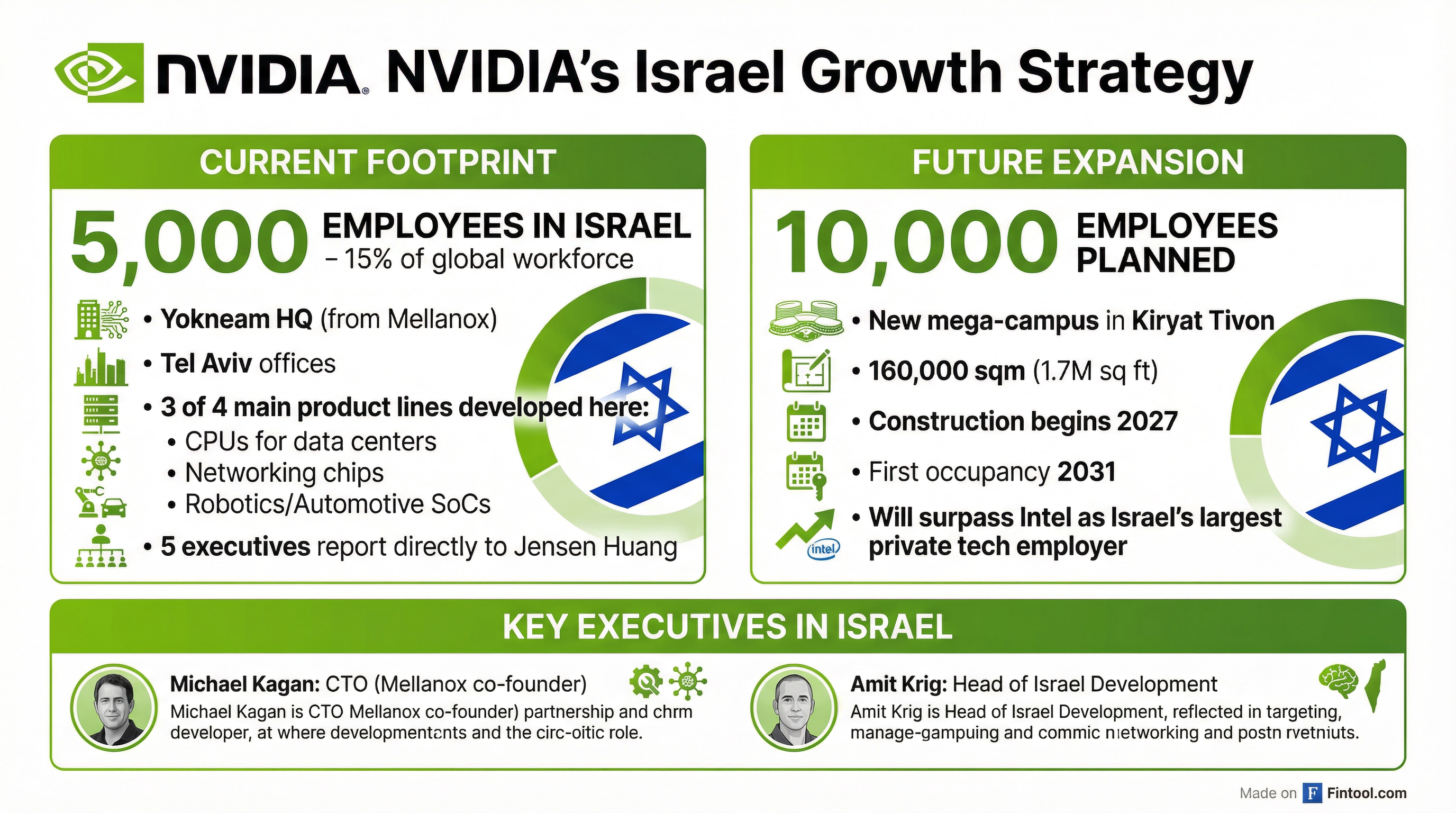

Five Israeli executives now report directly to CEO Jensen Huang, including CTO Michael Kagan (Mellanox co-founder) and Amit Krig, who oversees development in Israel.

Israel: Nvidia's "Second Home"

Jensen Huang has called Israel Nvidia's "second home," and the numbers support that designation. Nearly 15% of Nvidia's 36,000-person global workforce—approximately 5,000 employees—is based in Israel.

More importantly, development of three of Nvidia's four main product lines is led or substantially conducted in Israel:

- CPUs for data centers

- Networking chips (InfiniBand, Spectrum-X)

- Systems-on-chip for robotics and automotive

The company is planning a massive expansion with a new R&D campus in Kiryat Tivon, south of Haifa. The facility will house up to 10,000 employees across 160,000 square meters (1.7 million square feet), with construction beginning in 2027 and initial occupancy planned for 2031.

When complete, Nvidia is expected to surpass Intel as Israel's largest private-sector tech employer.

The LLM Pivot That Wasn't

For AI21 Labs, the deal represents a strategic retreat from its original ambitions. The company was founded to develop large language models and compete directly with OpenAI and Anthropic. It built the Jamba model family using a hybrid mixture-of-experts architecture combining state-space models and transformers.

But as AI21 co-founder Yoav Shoham acknowledged, the funding gap proved insurmountable. While AI21 raised $300 million in its latest round, Anthropic raised $3.5 billion and OpenAI secured $40 billion.

"Money is important, but it's not everything. We're not terribly interested in creating a model that can draw a donkey on the moon," Shoham said.

Financial Context

For Nvidia, the $2–3 billion price tag is modest relative to its scale:

| Metric | Q3 FY2026 | Q2 FY2026 | Q1 FY2026 | Q4 FY2025 |

|---|---|---|---|---|

| Revenue | $57.0B | $46.7B | $44.1B | $39.3B |

| Net Income | $31.9B | $26.4B | $18.8B | $22.1B |

| Cash | $11.5B | $11.6B | $15.2B | $8.6B |

The company's $4.6 trillion market cap makes it the world's most valuable, and it has approximately $60 billion in cash and investments available for strategic moves.

What to Watch

Both Nvidia and AI21 have declined to confirm the talks. Several factors could still derail the deal:

Regulatory scrutiny: Nvidia faces ongoing antitrust attention globally. The company disclosed in its Q3 10-Q that it has received "broad requests for information from competition regulators in the European Union, the United States, the United Kingdom, China, and South Korea" regarding GPU sales, partnerships with AI companies, and market competition.

China complications: Chinese regulators published preliminary findings in September 2025 that Nvidia violated the terms of its Mellanox acquisition approval by offering "degraded products" due to U.S. export controls. Additional regulatory friction could complicate future Israeli deals.

Strategic investments: Nvidia has committed to significant capital deployments elsewhere, including up to $10 billion in Anthropic, a potential investment in OpenAI, and an equity stake in Intel.

If completed, AI21 would join a rapidly expanding list of Israeli AI assets under Nvidia's umbrella—cementing Israel's role as a critical node in the AI supply chain and Nvidia's dominance of the talent pipeline that powers it.

Related: