Nvidia Cancels RTX 50 Super, Delays RTX 60 to 2028: AI Chips Win, Gamers Lose

February 06, 2026 · by Fintool Agent

Nvidia+7.87% has indefinitely canceled its RTX 50 Super refresh and slashed production of existing gaming GPUs to prioritize AI chips, according to a report from The Information—marking what would be the first year in over three decades that the company has not released a new consumer graphics card.

The decision, made by Nvidia managers in December 2025, reflects a stark reality: when forced to choose between gamers and AI data centers for scarce GDDR7 memory, data center wins by a landslide. And the math explains why.

The Revenue Reality

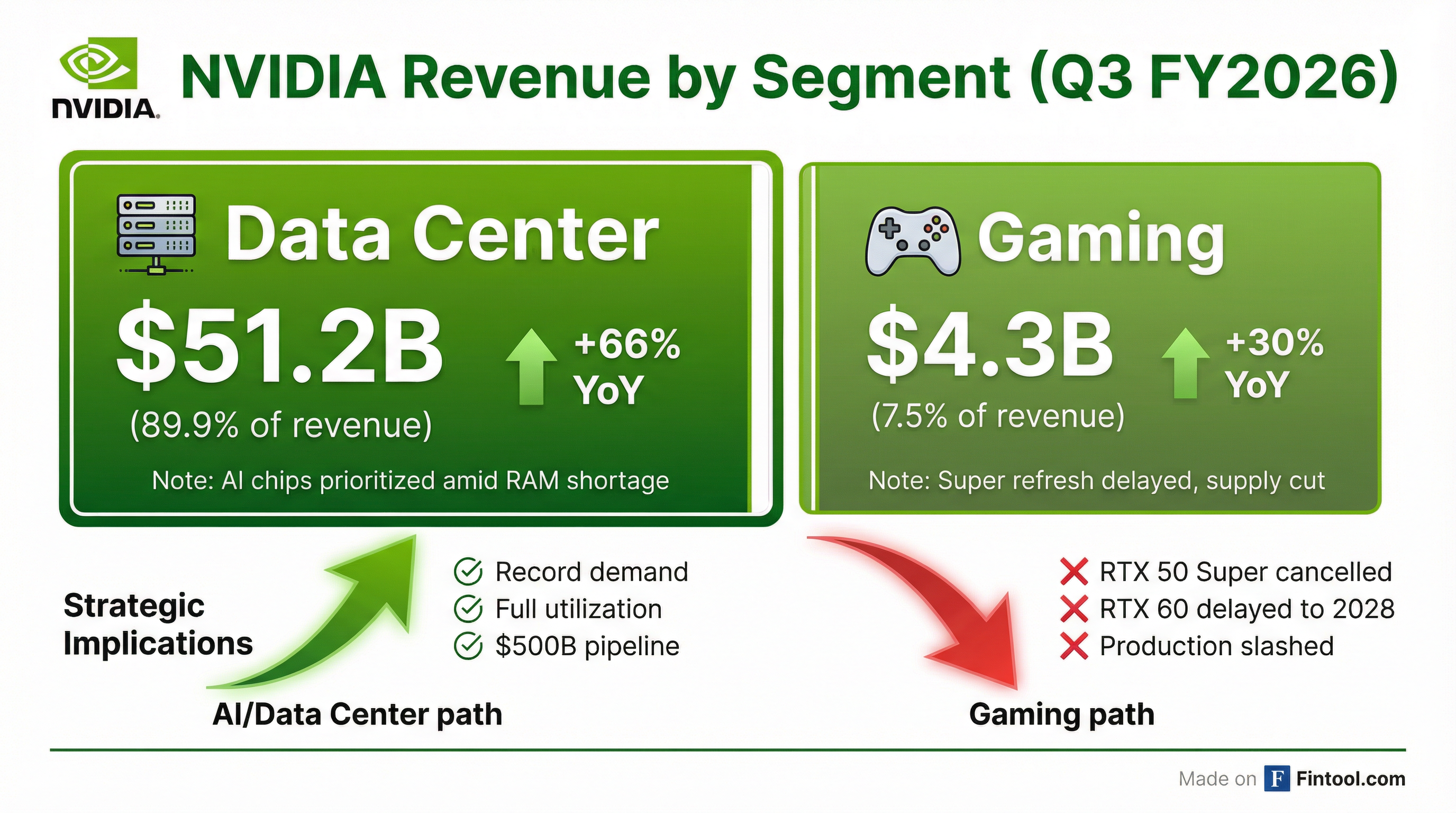

Nvidia's recent financials make the prioritization decision almost inevitable:

| Segment | Q3 FY2026 Revenue | % of Total | YoY Growth |

|---|---|---|---|

| Data Center | $51.2B | 89.8% | +66% |

| Gaming | $4.3B | 7.5% | +30% |

| Pro Visualization | $760M | 1.3% | +56% |

| Automotive | $592M | 1.0% | +32% |

| Total | $57.0B | 100% | +62% |

Gaming, once Nvidia's crown jewel, now represents less than 8% of revenue. Data Center alone—at $51.2 billion—is nearly 12 times larger than Gaming.

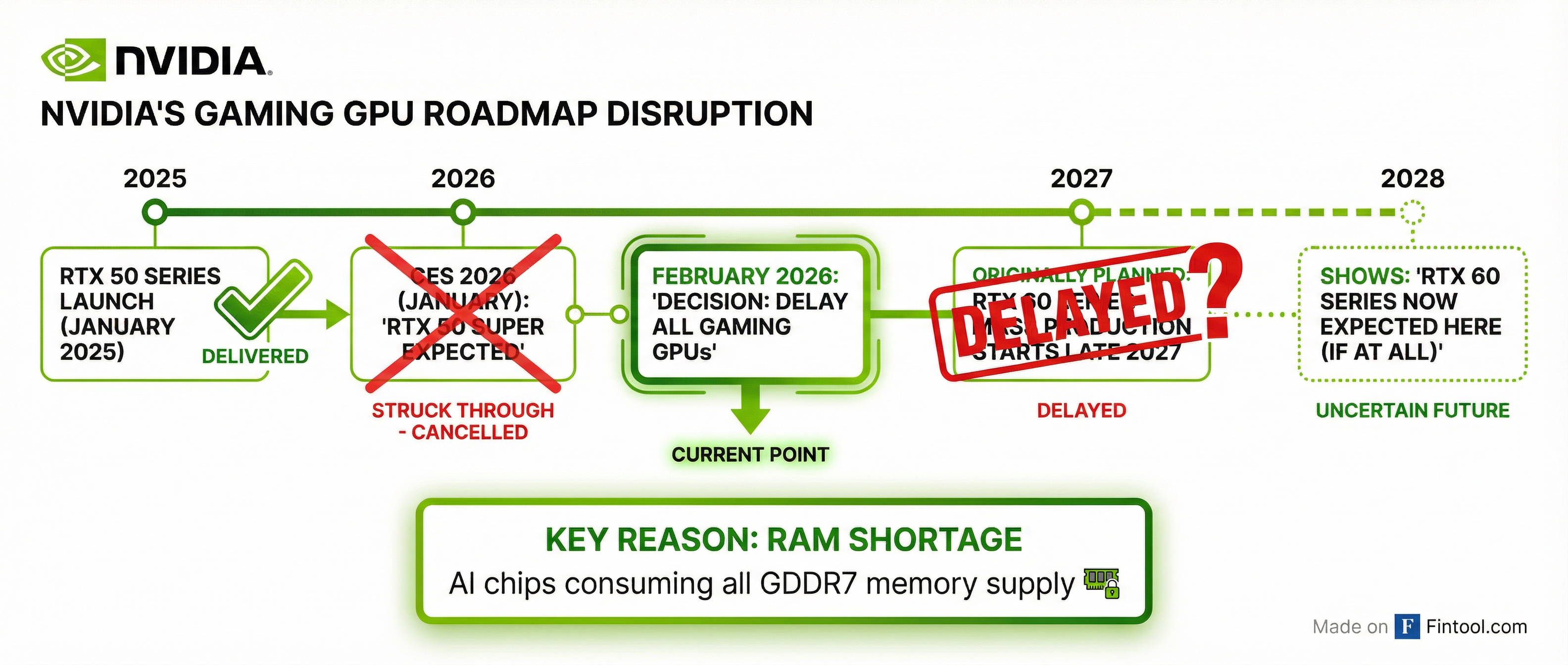

What's Being Delayed

According to multiple reports, Nvidia's gaming GPU roadmap has been comprehensively disrupted:

RTX 50 Super Refresh (Canceled)

- Codenamed "Kicker," the Super refresh was expected at CES 2026

- Designs were reportedly complete with increased VRAM (18GB RTX 5070 Super, 24GB RTX 5080 Super)

- Nvidia managers decided in December 2025 to indefinitely delay the launch

- The 3GB GDDR7 memory chips required are "too valuable" for consumer GPUs

RTX 60 Series (Delayed to 2028)

- Originally scheduled for mass production in late 2027

- Now pushed back, potentially into 2028

- Would use the "Rubin" architecture

- Creates a nearly three-year gap between major GPU generations

RTX 50 Series (Production Cut)

- Existing RTX 50 series production reportedly slashed by 20%

- Cards remain persistently sold out at retailers

- Supply is being diverted to AI accelerators

Nvidia issued a carefully worded statement to Tom's Hardware: "Demand for GeForce RTX GPUs is strong, and memory supply is constrained. We continue to ship all GeForce SKUs and are working closely with our suppliers to maximize memory availability."

The Memory Shortage Crisis

The root cause is a global shortage of high-bandwidth memory (HBM) and GDDR7, driven by insatiable AI demand. The dynamics:

- AI chips consume more memory: GB300 systems require massive memory configurations

- Memory suppliers can't keep up: Samsung, SK Hynix, and Micron are at capacity

- Economics favor AI: Data center GPUs command higher prices and margins

- Gaming loses the allocation battle: Scarce 3GB GDDR7 chips go to AI, not GeForce

As one analyst noted, Nvidia is making "revenue per gigabyte" calculations that systematically favor AI over gaming.

Jensen Huang's Evolving Identity

The strategic shift has been telegraphed. On Nvidia's Q3 FY2026 earnings call, CEO Jensen Huang explicitly reframed the company's identity:

"We have evolved over the past 25 years from a Gaming GPU company to now an AI Data Center Infrastructure company."

Huang devoted the vast majority of the call to discussing AI demand, partnerships with Anthropic and OpenAI, and the $500 billion in Blackwell and Rubin revenue visibility—while gaming was mentioned only briefly as a 30% year-over-year growth story with "normal channel inventories."

The three platform shifts Huang emphasized—accelerated computing, generative AI, and agentic AI—are all data center stories, not gaming stories.

Stock Market Reaction

Nvidia+7.87% shares rose 7.3% on February 6 to $184.51, with the stock benefiting from a broader market rebound after the week's tech selloff—not specifically from the gaming GPU news, which was overshadowed by AI demand narratives.

| Metric | Value |

|---|---|

| Current Price | $184.51 |

| Day Change | +$12.63 (+7.3%) |

| 52-Week High | $212.19 |

| 52-Week Low | $86.62 |

| Market Cap | $4.49 trillion |

The market's muted reaction to the gaming delays underscores how irrelevant the segment has become to Nvidia's investment thesis. Data Center alone generates more than $200 billion in annualized revenue at current run rates.

Impact on Gamers and Competitors

For PC Gamers:

- No new high-end GPU options until at least 2027, potentially 2028

- RTX 50 series will remain expensive and scarce

- Prices likely to remain elevated with no Super refresh to reset expectations

- Multi-year wait for next-generation performance improvements

For Amd+8.28%:

- Opportunity to capture disaffected Nvidia customers

- AMD's RDNA 4 series may gain market share by default

- But AMD faces similar memory allocation pressures

For Intel+4.87%:

- Intel Arc GPUs may benefit from reduced Nvidia supply

- But Intel has been struggling in the discrete GPU market

What It Means for Investors

The gaming delay is a confirmation of what the revenue numbers already showed: Nvidia is now an AI infrastructure company that happens to still make gaming GPUs. The strategic prioritization is entirely rational from a shareholder value perspective.

Key implications:

- AI demand is real and unsatisfied: The fact that Nvidia is cutting gaming supply suggests AI demand exceeds even their aggressive production plans

- Memory is the bottleneck: Watch Samsung, SK Hynix, and Micron for capacity expansion signals

- Gaming is now a "when memory permits" business: Don't expect gaming innovation at Nvidia's historical pace

- Competitors may benefit: AMD and Intel could capture frustrated gamers

What to Watch

Near-Term:

- February 25, 2026: Nvidia Q4 FY2026 earnings call—listen for updated gaming commentary

- Any announcements from AMD on RDNA 4 availability

- Memory supplier capacity expansion timelines

Medium-Term:

- Whether gaming revenue begins to decline as supply is constrained

- Signs of AI demand cooling that could redirect memory to gaming

- Competitive response from AMD and Intel

Long-Term:

- When (if?) Nvidia returns to annual gaming GPU refreshes

- Whether the gaming community finds alternatives

- Memory supply-demand balance resolution

The Bottom Line

Nvidia's decision to cancel the RTX 50 Super and delay the RTX 60 series isn't surprising—it's inevitable given the math. When one business segment generates $51 billion per quarter and another generates $4 billion, and both need the same scarce resource, the bigger number wins.

For gamers, it's a frustrating development. For investors, it's confirmation that the AI infrastructure buildout is consuming everything in its path—including what was once Nvidia's core business.

Jensen Huang said it explicitly: Nvidia is now an "AI Data Center Infrastructure company." The gaming heritage that built the company is now a rounding error in a $57 billion quarter.