Nvidia Taps Intel for 2028 Feynman GPUs in Historic Supply Chain Shift

January 28, 2026 · by Fintool Agent

Nvidia-2.89% will shift part of its 2028 "Feynman" AI GPU production to Intel+5.04% foundries—the first time the AI chip leader has committed to manufacturing silicon at Intel—in a strategic move to diversify away from near-total reliance on Taiwan Semiconductor+3.27%.

Intel stock surged 11% to $48.78 on the news, its largest single-day gain in months, while Nvidia added 1.6% to $191.52.

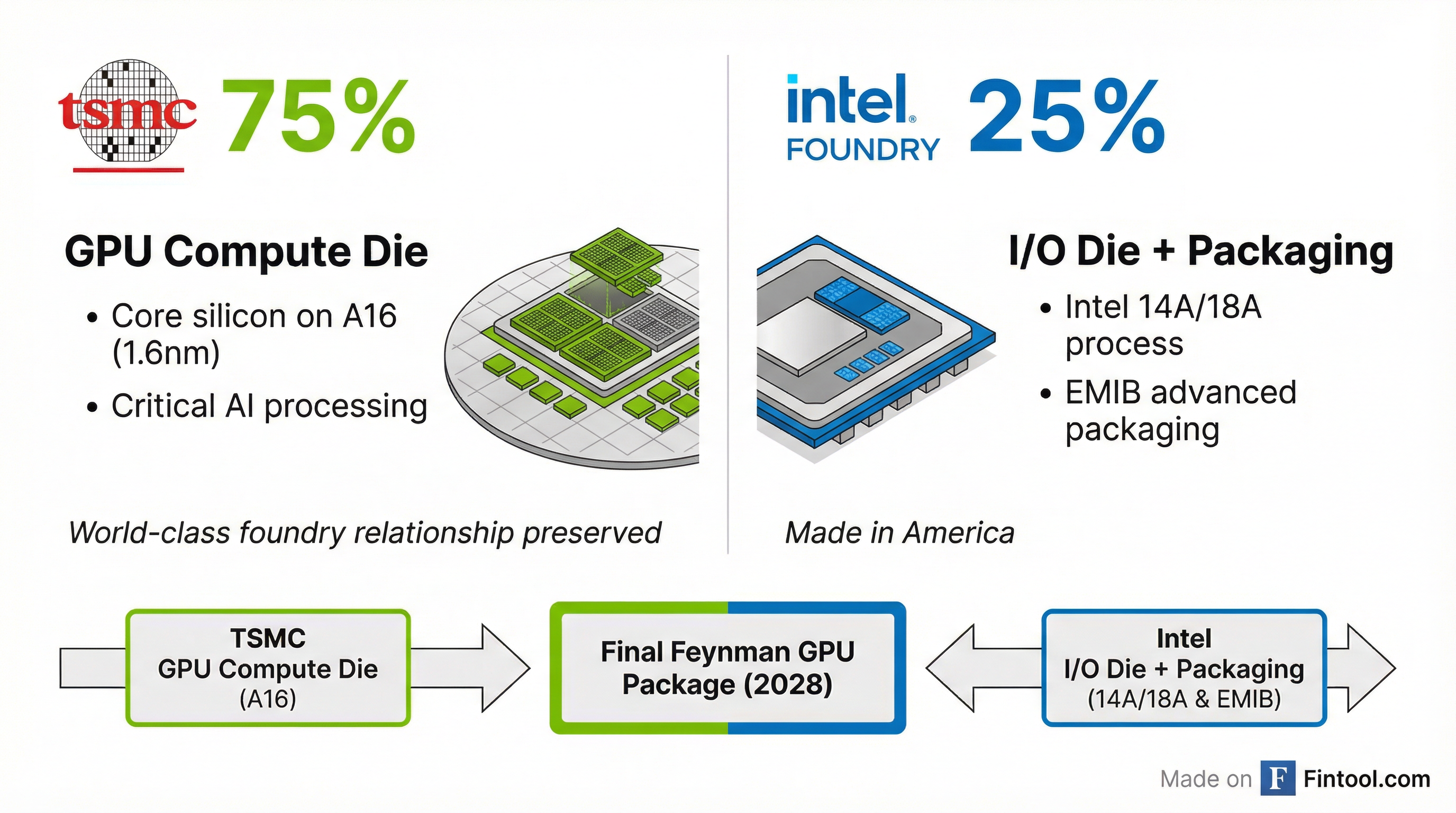

The arrangement reflects a carefully calibrated "low risk" approach: Nvidia will outsource only the I/O die and up to 25% of final advanced packaging to Intel, while keeping the critical GPU compute die at TSMC on its leading-edge A16 (1.6nm) process. Intel will use either its 18A or 14A process nodes and its proprietary EMIB (Embedded Multi-die Interconnect Bridge) packaging technology.

The Production Split

The deal structure minimizes execution risk while establishing Intel as a legitimate secondary supplier for the world's most valuable chipmaker:

| Component | Manufacturer | Process Node | Share |

|---|---|---|---|

| GPU Compute Die | TSMC | A16 (1.6nm) | Core silicon |

| I/O Die | Intel Foundry | 14A or 18A | Non-core |

| Advanced Packaging | Intel + TSMC | EMIB / CoWoS | 25% Intel / 75% TSMC |

Source: DigiTimes supply chain reports

By assigning the I/O die—rather than the performance-critical GPU cores—to Intel, Nvidia ensures the production ramp won't be compromised if Intel struggles with yield or capacity. Supply chain insiders note that this mirrors strategies other fabless chipmakers are pursuing: a "low volume, low-tier, non-core" approach that satisfies U.S. government pressure while preserving critical TSMC relationships.

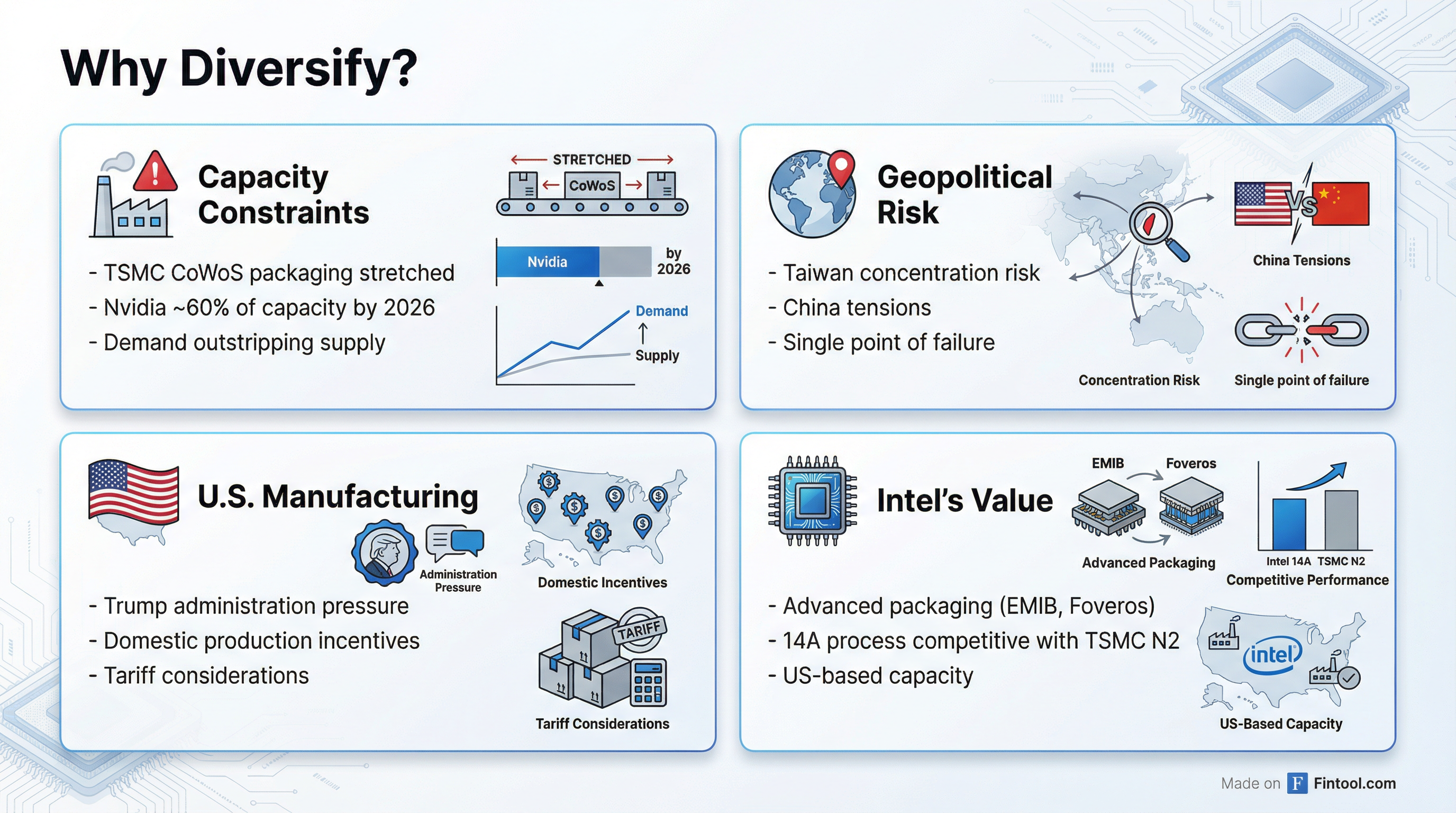

Why Now? Four Converging Pressures

The decision to diversify to Intel reflects pressures that have been building for years:

1. TSMC Capacity Bottleneck

Morgan Stanley warned that Nvidia could consume roughly 60% of TSMC's CoWoS (Chip-on-Wafer-on-Substrate) advanced packaging capacity by 2026—a concentration that creates supply risk for Nvidia and squeezes out other customers. The AI infrastructure buildout has stretched TSMC's advanced packaging to its limits, and even deep-pocketed customers are scrambling to secure slots.

2. Geopolitical Risk

TSMC's concentration in Taiwan represents a "single point of failure" for the entire AI industry. Rising tensions between China and Taiwan have pushed U.S. chipmakers toward dual-foundry strategies that reduce exposure to a potential disruption.

3. U.S. Manufacturing Mandates

The Trump administration has pressured American tech companies to increase domestic production. Moving some Feynman packaging to Intel's U.S. facilities allows Nvidia to demonstrate supply chain diversification while positioning for potential tariffs on chips manufactured abroad.

4. Intel's Improved Technology

Intel's CEO Lip-Bu Tan has made foundry execution a top priority since taking over in early 2025. The 18A process has shown yield improvements under the Panther Lake CPU ramp, and the upcoming 14A node is viewed by some analysts as competitive with TSMC's N2. Critically, Intel's EMIB packaging technology has been praised by Jensen Huang himself as "really enabling" for multi-chiplet designs.

Intel's Stock Surges on Validation

For Intel, this represents a major validation of its foundry strategy after years of skepticism. The stock has more than doubled from its 2025 lows following a series of developments:

| Event | Date | Impact |

|---|---|---|

| Nvidia $5B investment announced | Sept 2025 | +25% stock pop |

| Panther Lake 18A yield improvements | Q4 2025 | Analyst upgrades |

| Feynman foundry deal reported | Jan 28, 2026 | +11% to $48.78 |

Stock price and market data

In September 2025, when Nvidia invested $5 billion in Intel as part of their CPU partnership, Jensen Huang stopped short of committing to Intel's foundry for GPUs, stating: "We've always evaluated Intel's foundry technology, and we're going to continue to do that. Today, this announcement is squarely focused on these custom CPUs."

Lip-Bu Tan responded at the time by noting Intel would "win the customer's confidence and trust, one step at a time." The Feynman deal suggests that process has advanced significantly.

Apple Also in Discussions

The same DigiTimes report indicates Apple+4.06% is holding discussions with Intel about producing entry-level M-series processors on the 18A-P or 14A process—a notable development given Apple's high-profile departure from Intel CPUs in 2020.

Apple's potential return to Intel, even for non-flagship products, would represent another significant customer win for Intel Foundry. Like Nvidia, Apple is reportedly motivated less by technology and more by geopolitical hedging, tariff concerns, and the strategic value of domestic manufacturing options.

What This Means for TSMC

The news doesn't spell trouble for TSMC, which will retain the most valuable portion of Nvidia's business—the GPU compute die built on cutting-edge A16. But it does signal that even TSMC's most important customer is hedging its bets:

For TSMC bulls:

- 75% of Feynman packaging retained

- All critical GPU silicon stays at TSMC

- A16 process remains the performance leader

- Nvidia explicitly praised TSMC as "world-class" in September comments

For TSMC bears:

- Precedent set for Nvidia diversification

- Intel gaining credibility with major customers

- U.S. manufacturing momentum building

- Other fabless companies likely to follow

The Feynman Architecture

Feynman represents Nvidia's 2028 GPU generation, succeeding the Rubin architecture currently in development. While details remain limited, supply chain reports indicate Feynman will:

- Implement next-generation memory (HBM4e or HBM5)

- Enable trillion-parameter scale AI model processing

- Use advanced chiplet designs requiring sophisticated packaging

- Target both data center AI and potentially gaming/workstation markets

The I/O die that Intel will fabricate handles communication between the GPU compute chiplets and external components—a critical but less performance-sensitive function than the GPU cores themselves.

What to Watch

Q2-Q3 2026: Intel's 14A customer tape-outs and yield data will determine whether Nvidia proceeds with the reported plan or adjusts the manufacturing split.

GTC 2026 (March): Nvidia may provide additional roadmap details on Feynman and its manufacturing strategy.

H2 2026: Intel CEO Lip-Bu Tan has indicated meaningful foundry customer commitments are expected by the second half of 2026, potentially including formal announcements with Nvidia and Apple.

2028: Feynman launch and the first tangible evidence of Intel's role in Nvidia's supply chain.

Related Companies

Sources: DigiTimes, supply chain reports, company transcripts. Neither Nvidia nor Intel has officially commented on the reported arrangement.