The Canadian Warren Buffett Just Bet $204 Million on Under Armour's Comeback

January 30, 2026 · by Fintool Agent

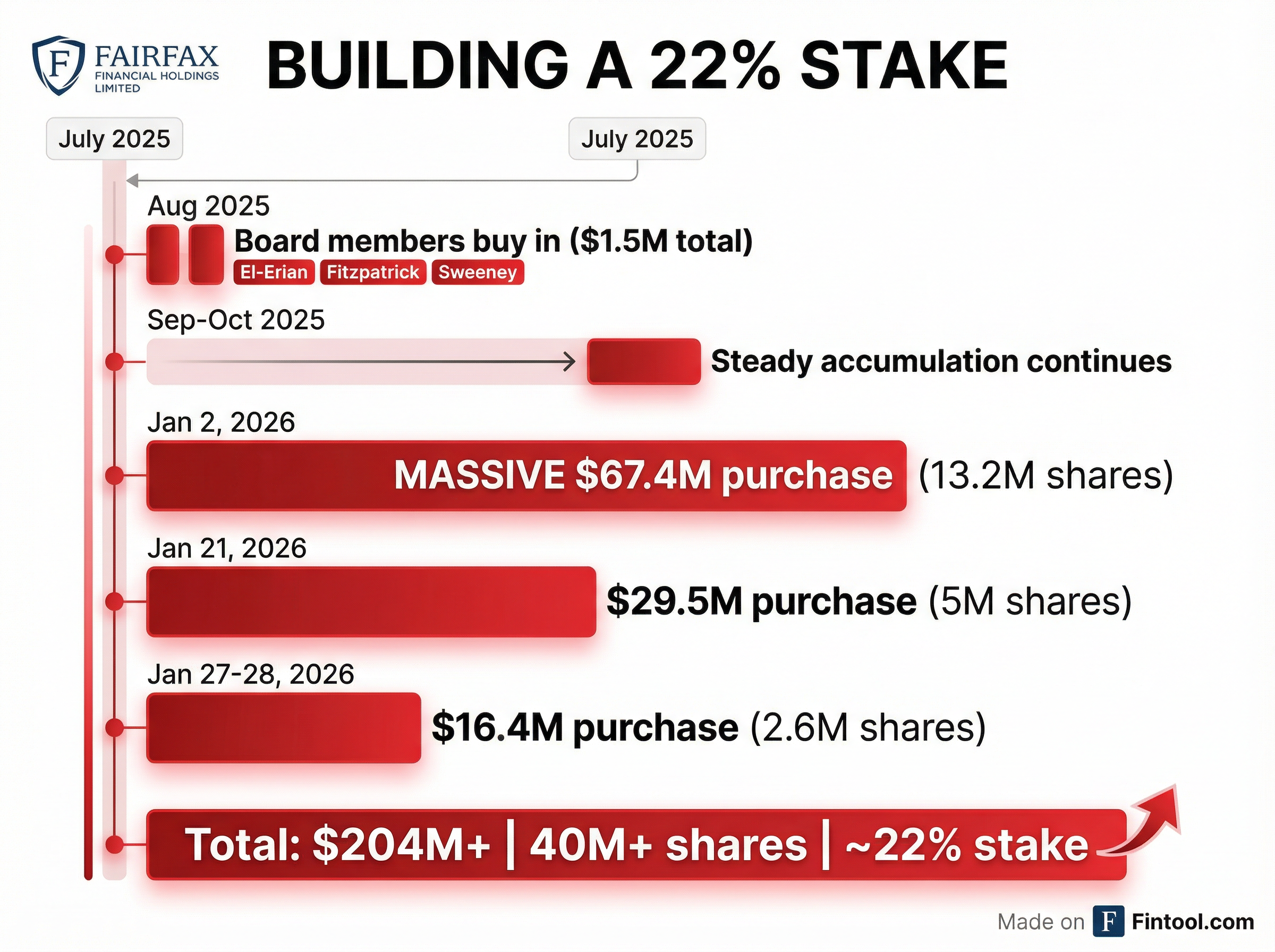

Prem Watsa isn't known for subtlety. The Fairfax Financial chairman—often called the "Canadian Warren Buffett" for his patient value investing style—has spent the past six months quietly accumulating an enormous position in Under Armour. The latest SEC filings reveal the full scope: $204 million invested across more than 40 million shares, giving Fairfax a 22% stake in the struggling athletic apparel brand.

The most recent purchases, disclosed Wednesday, show Watsa's entities buying another $16.4 million worth of shares on January 27-28 at prices between $6.20 and $6.30. The stock closed Thursday at $6.17, up 2% on the day.

The Numbers Behind the Bet

The buying has been relentless. Starting in August 2025 with board-level purchases and accelerating through January 2026, Watsa's entities have executed 19 separate transactions:

| Date | Amount | Shares | Avg Price |

|---|---|---|---|

| Aug 2025 | $1.5M | 300K | $5.00 |

| Jan 2, 2026 | $67.4M | 13.2M | $5.12 |

| Jan 21, 2026 | $29.5M | 5.0M | $5.89 |

| Jan 27-28, 2026 | $16.4M | 2.6M | $6.25 |

| Total | $204M+ | 40M+ | ~$5.10 |

Watsa isn't alone. Three Under Armour board members bought shares in August 2025: renowned economist Mohamed El-Erian ($520K), Dawn Fitzpatrick ($493K), and Robert John Sweeney ($488K). When multiple insiders buy simultaneously at depressed prices, it typically signals conviction that shares are undervalued.

Why Under Armour? Why Now?

The thesis is textbook value investing. Under Armour once commanded a $24 billion market cap when shares peaked above $50 in 2015. Today, after a decade of missteps, brand erosion, and leadership turmoil, the company is valued at just $2.65 billion—a 90% decline from its highs.

But there are early signs the turnaround under founder Kevin Plank—who returned as CEO in April 2024—is gaining traction:

The Good:

- "Signs of brand momentum in North America—an important milestone in our turnaround" — Kevin Plank, Q2 2026 earnings call

- EMEA revenue up 12% year-over-year, demonstrating the brand still resonates internationally

- Adjusted operating income guidance raised to $95-110 million for FY2026

- Inventory down 6% to $1.0 billion, suggesting improved discipline

- New CFO Reza Taleghani (from Samsonite) joining February 2026—delivered record margins at his prior company

The Challenges:

- Revenue still declining: -5% overall, -8% in North America

- Footwear segment down 16%

- Gross margin compressed 250 basis points due to tariffs

- Curry Brand separation—losing Stephen Curry as brand ambassador

The Restructuring Playbook

Under Armour is executing an expanded $255 million restructuring plan, up from the original $160 million announced in May 2024. The plan includes:

- $107 million in cash charges: severance, facility consolidation, contract exits

- $148 million in non-cash charges: asset impairments, including the Curry Brand separation

- Executive leadership changes: New CMO, new Americas President, Chief Product Officer departure

The Curry Brand separation is notable—rather than trying to outspend Nike for athlete endorsements, Plank is focusing resources on the core UA brand. The basketball business represented only $100-120 million in revenue anyway.

The Value Investor's Math

Watsa's average cost basis of ~$5.10 per share implies he's paying roughly 0.4x trailing revenue for an iconic American sports brand. For comparison:

| Company | Price/Sales | Market Cap |

|---|---|---|

| Nike | 2.5x | $115B |

| Lululemon | 5.0x | $45B |

| Under Armour | 0.5x | $2.6B |

Even accounting for Under Armour's challenges, the valuation gap is extraordinary. If Plank can stabilize revenues and restore margins to mid-single digits, the upside could be substantial.

Watsa's focus on Class A shares (with voting rights) over non-voting Class C shares suggests potential activist intentions. With 22% of the company, Fairfax has meaningful influence over strategic decisions.

What to Watch

Near-term catalysts:

- Q3 FY2026 earnings (expected early February)—will North America momentum continue?

- New CFO arrival (February 2026)—Taleghani's operational playbook from Samsonite

- Curry 13 launch (February 2026)—the final Curry Brand x UA shoe

Key risks:

- Tariff headwinds persisting on gross margins

- Nike and Lululemon continuing to win market share

- Brand relevance failing to recover with younger consumers

Watsa has been wrong before—his infamous Blackberry investment taught painful lessons. But his track record includes prescient calls on insurance companies and consumer brands during distressed periods. At $6 per share with a legendary value investor backing the turnaround, Under Armour offers asymmetric risk/reward for those willing to bet on Kevin Plank's second act.

Related: