Pyxis Oncology CEO Sullivan Steps Down After 88% Stock Plunge, Board Member Takes Reins

February 6, 2026 · by Fintool Agent

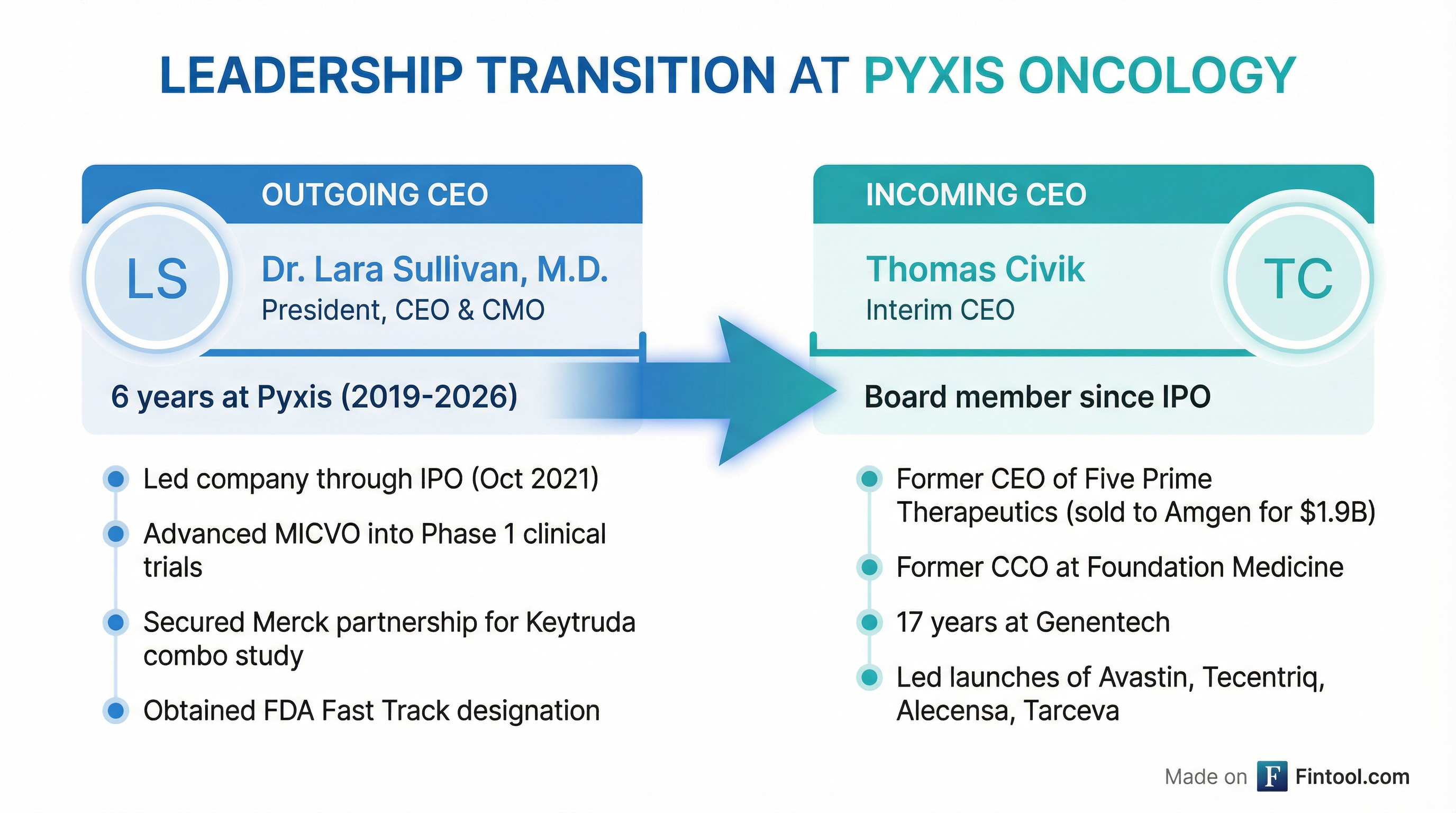

Dr. Lara Sullivan has stepped down as President, CEO, and Chief Medical Officer of Pyxis Oncology-1.95% after six years at the helm, the company disclosed in an 8-K filing today . The departure comes with the stock down 88% from its October 2021 IPO and just seven weeks after the company reported promising Phase 1 data for its lead cancer drug.

Thomas Civik, a board member since the company went public, takes over as Interim CEO while the board searches for permanent leadership . The transition raises questions about the future direction of the $95 million market cap biotech at a pivotal moment in its clinical development.

The Departure

Sullivan's exit was announced in terse regulatory language with no explanation beyond standard transition framing. The 8-K states she "ceased serving" as CEO effective February 2, 2026, with no mention of health issues, strategic disagreements, or future plans .

"On behalf of the Board, I would like to thank Lara for her commitment and contributions to Pyxis Oncology throughout a formative period for the Company, including advancing MICVO into the clinic and guiding the Company through a critical period of growth," said Chairman John Flavin .

Sullivan's own statement was equally measured: "Serving as President, Chief Executive Officer, and Chief Medical Officer of Pyxis Oncology has been a privilege. I have had the honor to lead Pyxis Oncology over the last six years and am proud of the progress the team has made in advancing MICVO" .

The lack of specificity is notable. In biotech, CEO departures typically come with clear narratives—whether pursuing new opportunities, health reasons, or board disagreements over strategy. The silence here invites speculation.

The New Leader

Civik brings substantial oncology experience to the role. He previously served as President and CEO of Five Prime Therapeutics, leading the company through its $1.9 billion acquisition by Amgen+4.49% in April 2021 . Before that, he was Chief Commercial Officer at Foundation Medicine and spent 17 years at Genentech, where he led commercialization of major oncology franchises including Avastin, Tecentriq, Alecensa, and Tarceva .

His compensation package reflects the interim nature of the role: $710,000 annualized base salary with a 60% target bonus, plus stock options representing 1.1% of outstanding shares that vest monthly during his tenure . An additional 0.4% option grant vests upon completion of "a successful financing transaction or strategic transaction" .

That language is telling. Civik isn't being paid to run a long-term development program—he's being incentivized to find a partner or acquirer.

A Turbulent Tenure

Sullivan joined Pyxis Oncology in 2019, helping to build the company from its founding through a $152 million Series B and the October 2021 IPO . But the post-IPO era has been brutal.

| Metric | Value |

|---|---|

| IPO Price (Oct 2021) | $13.20 |

| Current Price | $1.53 |

| Decline from IPO | -88.4% |

| 52-Week High | $5.55 |

| 52-Week Low | $0.83 |

| Market Cap | $95M |

| Analyst Price Target | $6.93* |

*Values retrieved from S&P Global

The company has undergone wrenching restructuring:

- November 2023: 40% workforce reduction following the Apexigen acquisition

- December 2024: Shelved the Siglec-15 antibody PYX-106 to focus entirely on MICVO

- March 2025: Another 20% layoff, reducing headcount to approximately 44 employees

Sullivan also absorbed the CMO role in March 2025 after Ken Kobayashi stepped down, adding to an already heavy workload .

The Puzzling Timing

What makes this departure unusual is the timing. Just seven weeks ago, Pyxis announced Phase 1 data that appeared genuinely promising :

| Study | Response Rate | Disease Control | Status |

|---|---|---|---|

| MICVO Monotherapy (2L+ HNSCC) | 46% confirmed ORR | 92% DCR | n=13 at 5.4 mg/kg |

| MICVO + Keytruda Combo (1L/2L+ HNSCC) | 71% confirmed ORR | 100% DCR | n=7 at 3.6/4.4 mg/kg |

The company has FDA alignment on a pivotal trial design for monotherapy in second-line head and neck cancer . MICVO holds Fast Track designation . Updated data from both studies is expected in mid-2026 and second half 2026, respectively .

CEOs typically don't leave after delivering good data and securing regulatory pathway clarity—that's when they're best positioned to raise capital or attract partners. The December data disclosure would have been the natural setup for a financing or BD deal announcement.

The company's financial position isn't dire by clinical-stage biotech standards. Cash runway extends into Q4 2026 , and in December the company raised $11 million through a non-dilutive royalty sale .

What Happens Next?

The board has initiated a "structured search" for a permanent CEO . But Civik's compensation structure—with its emphasis on "strategic transactions"—suggests the real play may be finding a buyer or partner.

Pyxis's entire value proposition now rests on MICVO, a first-in-concept antibody-drug conjugate targeting the tumor extracellular matrix rather than tumor cells directly . The mechanism is novel, the early data is encouraging, and head and neck cancer represents a significant unmet need with limited competition in later lines of therapy .

For potential acquirers, the math could be attractive. At $95 million market cap with Phase 1 data showing 46-71% response rates, plus FDA pathway clarity and a Merck collaboration in hand, Pyxis might look like a bargain to larger oncology players building ADC portfolios.

The company's clinical team remains in place, and trials continue without interruption . Key 2026 milestones include:

- Mid-2026: Updated monotherapy data with durability

- 2H 2026: Updated combination data across tumor types

- TBD: Decision on pivotal trial initiation

The Bottom Line

Sullivan's departure leaves more questions than answers. The standard "pursuing other opportunities" framing is absent. The timing—after good data, before expected catalysts—doesn't fit typical founder fatigue or performance-related exits.

What's clear is that Pyxis now enters 2026 with an interim leader explicitly incentivized to pursue transactions, a single-asset pipeline with promising but early data, and a cash runway measured in quarters rather than years.

The stock barely reacted, dropping 2.6% on the announcement day before recovering. At $1.53, shares trade at a 78% discount to the $6.93 analyst consensus target. Investors appear to be betting that MICVO's clinical potential will ultimately determine the company's fate—regardless of who's in the corner office.

Related Companies: Pyxis Oncology-1.95% · Amgen+4.49% · Merck+1.82%