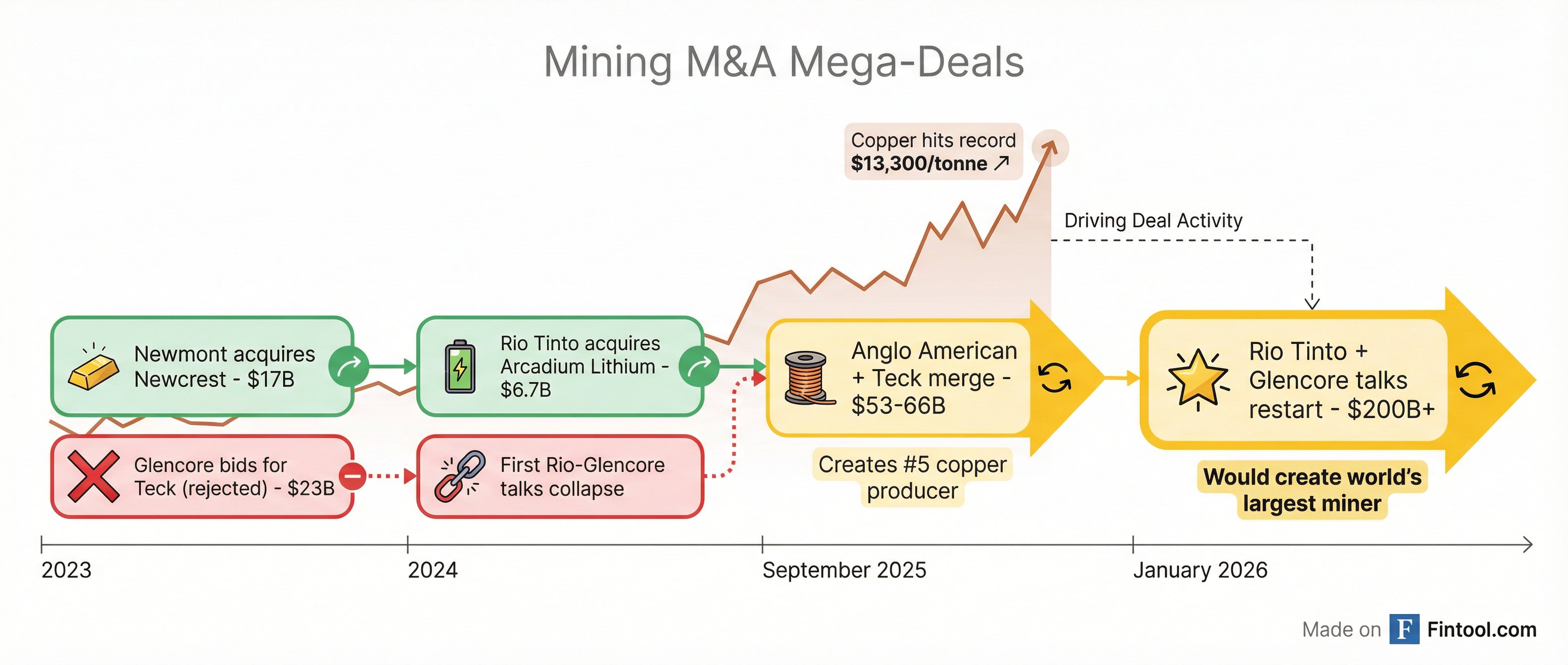

Rio Tinto and Glencore Restart Merger Talks to Create $207 Billion Mining Giant

January 9, 2026 · by Fintool Agent

Rio Tinto+2.51% and Glencore have confirmed they are in preliminary discussions about a combination that would create the world's largest mining company, with a combined market value exceeding $200 billion. The talks come roughly a year after previous negotiations collapsed over valuation disagreements, leadership questions, and the future of Glencore's coal business.

Glencore+4.71% shares surged nearly 10% in London trading on Friday, while Rio Tinto's Australian-listed shares fell 6.3% — a classic acquirer-target spread that reflects investor skepticism about whether Rio Tinto might overpay.

The Deal Structure

Both companies confirmed late Thursday that the current expectation is for an all-share buyout of "some or all" of Glencore by Rio Tinto. Under UK takeover rules, Rio Tinto has until February 5 to either make a formal offer or walk away.

The combined entity would top BHP Group+0.78%'s $163 billion market capitalization to become the world's largest diversified miner — and the largest mining deal in history, surpassing even the Anglo American-Teck merger completed in September 2025.

| Company | Market Cap | FY 2024 Revenue | FY 2024 EBITDA | EBITDA Margin |

|---|---|---|---|---|

| Rio Tinto | $142B* | $53.7B* | $19.1B* | 35.5%* |

| Glencore | $65B | $218B | $17B | 8% |

| Combined | ~$207B | ~$272B | ~$36B | — |

| BHP (for comparison) | $163B* | $51.3B* | $23.4B* | 45.7%* |

*Values retrieved from S&P Global

Why Now? The Copper Supercycle

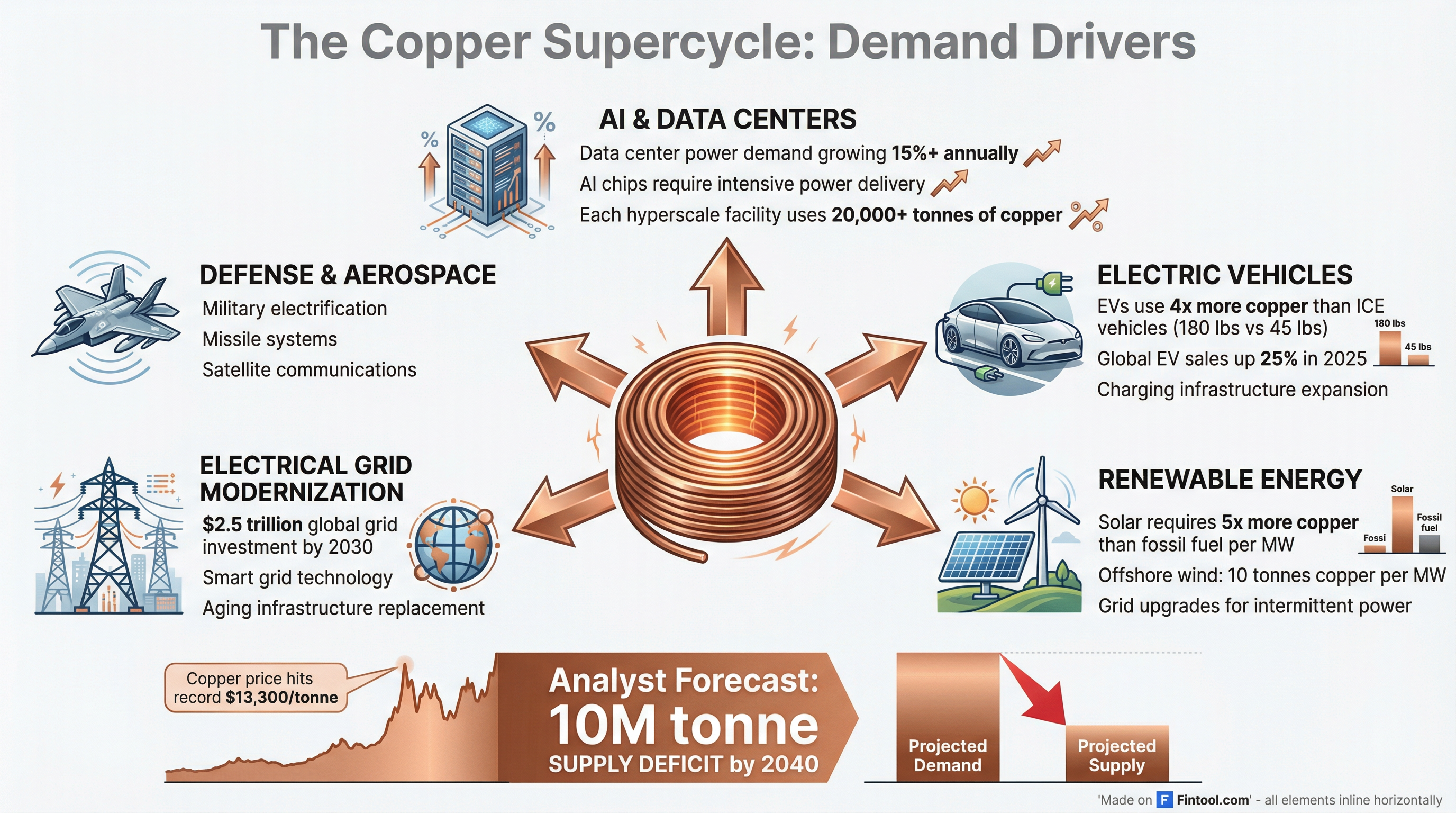

The resumption of talks comes as copper prices hit an all-time high above $13,300 per tonne this week, driven by a confluence of structural demand drivers that mining executives believe will persist for decades.

"We believe fundamentals for copper are favorable with growing demand supported by copper's critical role in the global transition to renewable power, electric vehicles and other carbon-reduction initiatives, continued urbanization in developing countries, data centers and artificial intelligence developments and growing connectivity globally," Freeport-McMoRan noted in its latest annual report.

Analysts project a supply shortfall of up to 10 million tonnes by 2040 — creating a strategic imperative for major miners to bulk up their copper exposure.

Strategic Rationale

A combined Rio-Glencore would create a powerhouse with exposure across the metals complex:

Copper: Both companies have significant copper assets. Rio Tinto's Oyu Tolgoi mine in Mongolia is ramping strongly — production was up 54% year-over-year in H1 2025. Glencore operates major copper mines in the DRC, Zambia, and South America.

Trading Operations: Glencore's commodity trading arm — one of the world's largest — would bring marketing capabilities that pure miners like Rio Tinto have historically lacked.

Diversification: The combined entity would have significant positions in iron ore, aluminum, lithium, zinc, nickel, and cobalt, reducing dependence on any single commodity.

"The diverse asset base and likely synergies have the potential to provide further protection against commodity price fluctuations," analysts noted.

The Coal Question

The elephant in the room remains Glencore's coal business. Rio Tinto exited coal entirely in 2018, and ESG-conscious investors may resist a re-entry into thermal coal.

In May 2025, Glencore confirmed a restructure to move its coal operations into a separate Australian-based entity — a potential solution that could allow Rio Tinto to acquire Glencore's base metals and trading operations while spinning off coal to Glencore shareholders.

"The dirty, dirty business nobody wants to own is coal. So I wouldn't be surprised to see Glencore do a tax-free spin on the coal business," one analyst noted.

Market Reaction

The divergent stock reactions — Glencore up, Rio Tinto down — reflect the market's historical wariness of mega-deals in the mining sector.

"The share market tells you what you want to know. Investors are not happy with this," said Hugh Dive, chief investment officer of Atlas Funds Management, a Rio Tinto shareholder. "I like the concept of going to copper, but the record is dreadful for the big majors making acquisitions or even mergers. We've seen a lot of these big mergers occur at the top of the market."

Rio Tinto's New Leadership

The talks mark an early test for Rio Tinto's new CEO Simon Trott, who took over in August 2025 after the board signaled a preference for a leader more open to large-scale deals than his predecessor Jakob Stausholm.

Stausholm, in his final earnings presentation in July 2025, deflected questions about the previous Glencore approach: "I can't comment on rumors... I would be surprised that we are actively looking at going into coal at this point in time."

Under Trott, Rio Tinto has focused on becoming leaner with fewer non-core assets — a strategy that may actually create space for a transformational deal if Glencore's coal can be cleanly separated.

Financial Comparison

| Metric | Rio Tinto (FY 2024) | BHP (FY 2025) | Freeport-McMoRan (FY 2024) |

|---|---|---|---|

| Revenue | $53.7B* | $51.3B* | $25.5B |

| EBITDA | $19.1B* | $23.4B* | $9.5B* |

| Net Income | $11.6B* | $9.0B* | $1.9B |

| EBITDA Margin | 35.5%* | 45.7%* | 37.5%* |

| Total Debt | $14.2B* | $25.6B* | — |

*Values retrieved from S&P Global

Regulatory Hurdles Ahead

A deal of this magnitude would face intense regulatory scrutiny across multiple jurisdictions:

- China: As the dominant buyer of industrial metals, Beijing would likely raise antitrust concerns about combining two major iron ore and copper suppliers

- Australia: Both companies have significant Australian operations; FIRB approval would be required

- EU: Competition concerns around base metals and trading operations

- South Africa: Glencore has substantial mining interests requiring approval

What to Watch

February 5: UK takeover rules deadline for Rio Tinto to make a formal offer or walk away

Deal structure: Whether Glencore's coal business is carved out or included

Premium: Any acquisition premium would signal how aggressive Rio Tinto is willing to be

Chinese response: Beijing's antitrust stance will be critical to deal certainty

Related

- Rio Tinto+2.51% — Company Profile

- BHP Group+0.78% — Company Profile

- Freeport-mcmoran+2.41% — Company Profile

- Southern Copper+5.58% — Company Profile