Saks Global Shuts 82% of OFF 5TH Stores as Luxury Giant Abandons Off-Price Business

January 30, 2026 · by Fintool Agent

Saks Global is closing 57 of its 69 Saks OFF 5TH stores and all five remaining Last Call locations in a sweeping retreat from off-price retail, the company announced Thursday. The closures, which begin with closing sales on January 31, represent the most significant operational restructuring in the company's Chapter 11 bankruptcy proceedings—and a stark acknowledgment that discount luxury failed to deliver.

The off-price division projected a roughly $139 million loss for 2025, according to industry reports, making it an obvious target for cuts as Saks Global CEO Geoffroy van Raemdonck pivots the company toward full-price selling across its core luxury banners.

"As we advance on Saks Global's transformation, we are taking decisive steps to realign our business to better serve our luxury customers and drive full-price selling across our core luxury businesses," van Raemdonck said in a statement. "With these actions, we will be well positioned to seize the greatest opportunities for long-term growth and value creation."

The Closures at a Glance

| Metric | Count |

|---|---|

| OFF 5TH stores closing | 57 |

| OFF 5TH stores remaining | 12 |

| Last Call stores closing | 5 |

| Stores beginning closing sales Jan 31 | 34 + 5 Last Call |

| Stores closing Feb 2 | 23 |

| Projected 2025 off-price loss | $139M |

The remaining 12 OFF 5TH locations will no longer operate as traditional off-price retail stores. Instead, they "will serve primarily as a selling channel for residual inventory from Saks Fifth Avenue, Neiman Marcus and Bergdorf Goodman," the company said, effectively converting them to clearance outlets for full-price merchandise.

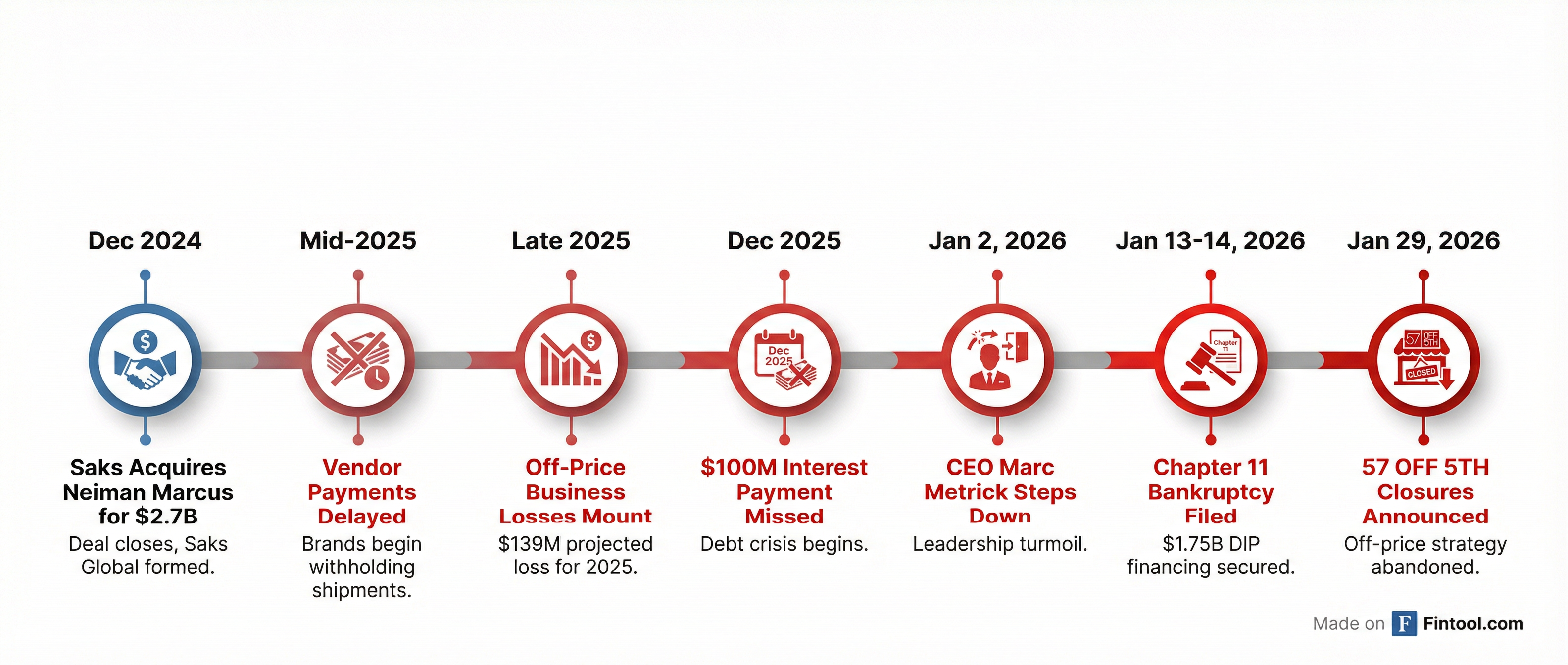

From $2.7 Billion Deal to Chapter 11 in 13 Months

The OFF 5TH closures cap a stunning reversal of fortune for Saks Global, which just 13 months ago completed its $2.7 billion acquisition of Neiman Marcus with ambitions of creating a luxury retail powerhouse. The deal closed in December 2024, combining Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman under one corporate umbrella—along with approximately $3.4 billion in funded debt obligations.

The debt load proved crushing. By late 2025, Saks had fallen behind on vendor payments, prompting luxury brands to withhold shipments. In December, the company missed a $100 million interest payment to bondholders, triggering the crisis that led to Richard Baker's abrupt departure as CEO on January 13 and the Chapter 11 filing the following day.

The bankruptcy filing revealed the extent of Saks Global's creditor exposure:

| Top Unsecured Creditors | Amount Owed |

|---|---|

| Chanel | $136 million |

| Kering (Gucci parent) | $60 million |

| LVMH | $26 million |

| Top 30 creditors total | $712 million |

The company estimates it has between 10,001 and 25,000 total creditors and employs approximately 16,830 workers, with 87% in full-time positions.

Which Stores Are Closing—and Which Survive

Saks Global disclosed the complete store footprint in a filing with the bankruptcy court.

The 12 OFF 5TH Locations Remaining Open:

| Location | City | State |

|---|---|---|

| Gallery @ Westbury Plaza | Garden City | NY |

| Woodbury Common Premium Outlets | Central Valley | NY |

| Bergen Town Center | Paramus | NJ |

| Sawgrass Mills | Sunrise | FL |

| Town Center Aventura | Aventura | FL |

| Dolphin Mall | Miami | FL |

| Palm Beach Outlets | West Palm Beach | FL |

| Somerset Shoppes | Boca Raton | FL |

| Miromar Outlets | Estero | FL |

| Buckhead Station | Atlanta | GA |

| The Outlets at Orange | Orange | CA |

| Grapevine Mills | Grapevine | TX |

Notable closures include locations in Boston, Chicago, Los Angeles, Phoenix, Las Vegas (both stores), San Diego, and both Hawaii stores. The geographic concentration of survivors in Florida and New York outlet destinations signals a focus on tourist-heavy retail centers with proven traffic.

The SaksOff5th.com Website Is Also Shutting Down

Adding to the off-price retreat, the company's e-commerce operation—saksoff5th.com—has separately "determined that it will commence a wind-down of its operations," with an online closing sale beginning January 30.

The website is legally separate from Saks Global. When Saks split its e-commerce and physical store businesses in 2021, the off-price digital arm—called SO5 Digital—was spun off, with Saks Global retaining an 80% stake. The digital unit had been evaluating strategic alternatives following persistent revenue declines before deciding to liquidate.

What It Means for Competitors

The mass closures come as Saks Global's primary off-price competitors pursue opposite strategies. Nordstrom Rack has continued expanding, recently adding multiple new locations to its 2026 lineup.

TJX Companies, which operates TJ Maxx, Marshalls, and HomeGoods, remains the dominant force in off-price retail with a market capitalization exceeding $160 billion and consistent same-store sales growth. Ross Stores, another off-price stalwart, has similarly maintained strong performance with disciplined expansion.

The contrast underscores a key distinction: TJX and Ross built dedicated off-price supply chains and buyer networks over decades, while Saks OFF 5TH operated primarily as a clearance channel dependent on unsold merchandise from full-price Saks stores. That model proved unsustainable as luxury brands grew increasingly protective of their products appearing at discount.

| Company | Ticker | Market Cap | Strategy |

|---|---|---|---|

| TJX Companies | TJX | $164B | Dedicated off-price buyer network |

| Ross Stores | ROST | $60B | Pure-play off-price model |

| Dillard's | DDS | $9.4B | Department store with clearance centers |

| Macy's | M | $5.3B | Multi-format including Backstage |

The Path Forward for Saks Global

With off-price behind it, Saks Global's restructuring will focus on its approximately 70 full-line luxury locations across Saks Fifth Avenue, Neiman Marcus, and Bergdorf Goodman. The company secured $1.75 billion in committed financing—comprising $1.5 billion from senior secured bondholders and $240 million from asset-based lenders—to fund operations during Chapter 11.

Van Raemdonck, who previously ran Neiman Marcus before its acquisition, has assembled a leadership team of former Neiman executives:

- Darcy Penick: President, Chief Commercial Officer (overseeing stores, marketing, buying, digital)

- Lana Todorovich: Chief of Global Brand Partnerships

- Brandy Richardson: CFO (formerly CFO at Neiman Marcus)

The company expects to emerge from bankruptcy "later this year" with the bondholders committed to providing an additional $500 million in exit financing.

What to Watch

Gift Card Window Closing: Customers holding Saks OFF 5TH gift cards have a limited window to use them—in-store through mid-February and online through early March 2026. Approximately $320 million in gift cards remain unredeemed across all Saks Global brands.

Job Impact Unknown: Saks Global has not disclosed how many workers will be affected by the 62 store closures. With approximately 16,830 total employees, the off-price business likely employed several thousand.

Creditor Committee Dynamics: Luxury brands owed hundreds of millions may push for favorable treatment in the Chapter 11 proceedings. The meeting of creditors is scheduled for February 23, 2026.

Emergence Timeline: Management expects to exit bankruptcy later in 2026, but the path forward depends on stabilizing vendor relationships and demonstrating the full-price luxury model can generate sufficient cash flow to service remaining debt.