Santander to Acquire Webster Financial for $12.3 Billion, Creating Top-10 U.S. Bank

February 3, 2026 · by Fintool Agent

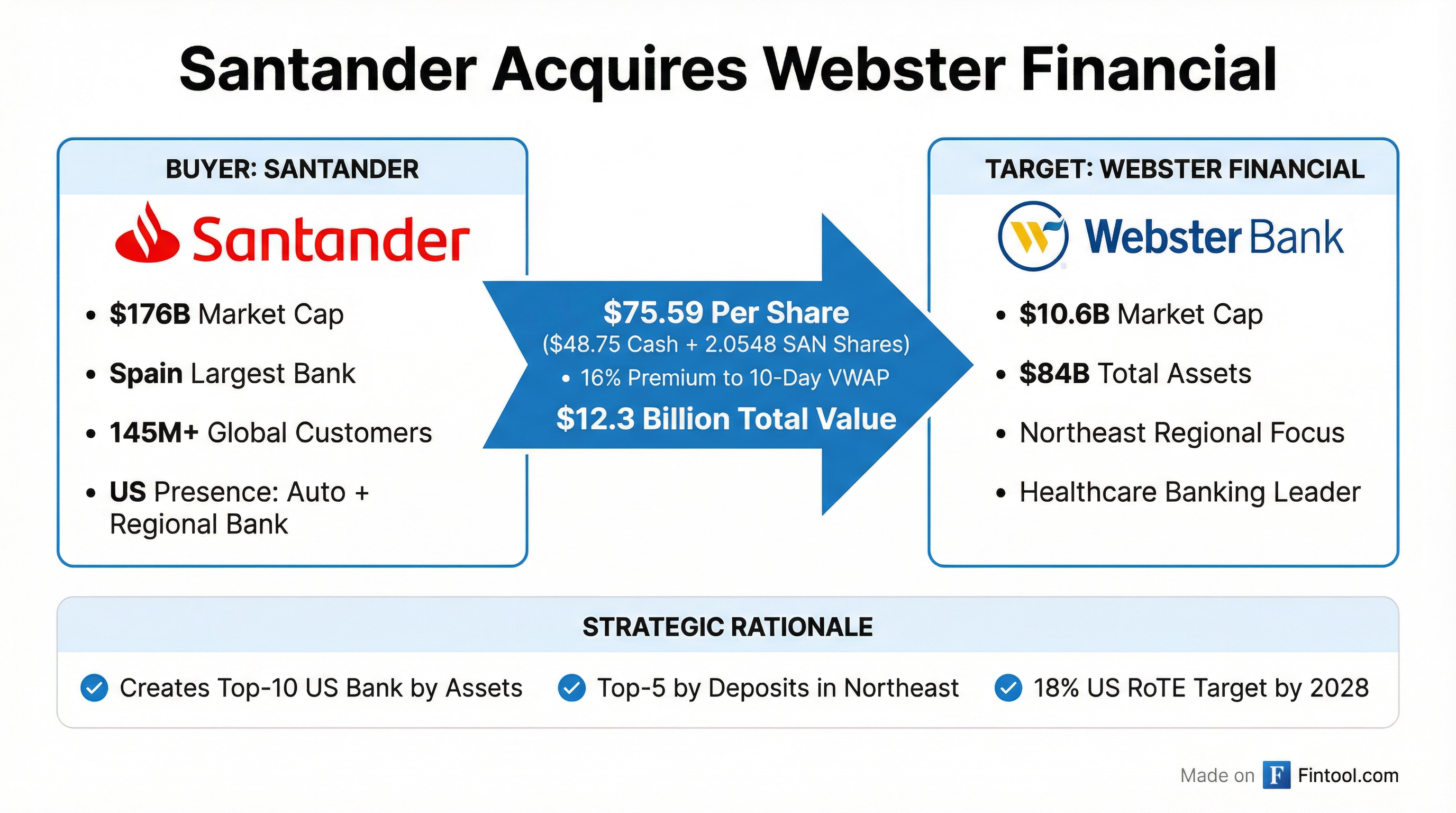

Spain's Banco Santander is acquiring Webster Financial Corporation in a $12.3 billion cash-and-stock deal that will create a top-10 U.S. bank by assets and dramatically expand Santander's presence in the lucrative Northeastern banking market. Webster shares surged 8% on the news while Santander ADRs dropped 8%, reflecting investor skepticism about the premium paid and integration challenges ahead.

Deal Terms

Under the agreement announced this morning, Webster shareholders will receive $48.75 in cash and 2.0548 Santander American Depository Shares for each Webster common share—a total consideration of $75.59 per share based on Santander's February 2 closing price.

| Metric | Value |

|---|---|

| Total Deal Value | $12.3 billion |

| Per Share Price | $75.59 |

| Cash Component | $48.75 per share |

| Stock Component | 2.0548 SAN ADRs per share |

| Premium (10-Day VWAP) | 16% |

| Premium (All-Time High) | 9% |

| Price-to-TBV | >2.0x |

| Expected Close | H2 2026 |

The transaction is expected to close in the second half of 2026, subject to regulatory approvals and shareholder votes from both companies. Centerview Partners, Goldman Sachs, and Bank of America advised Santander on the deal.

Strategic Rationale

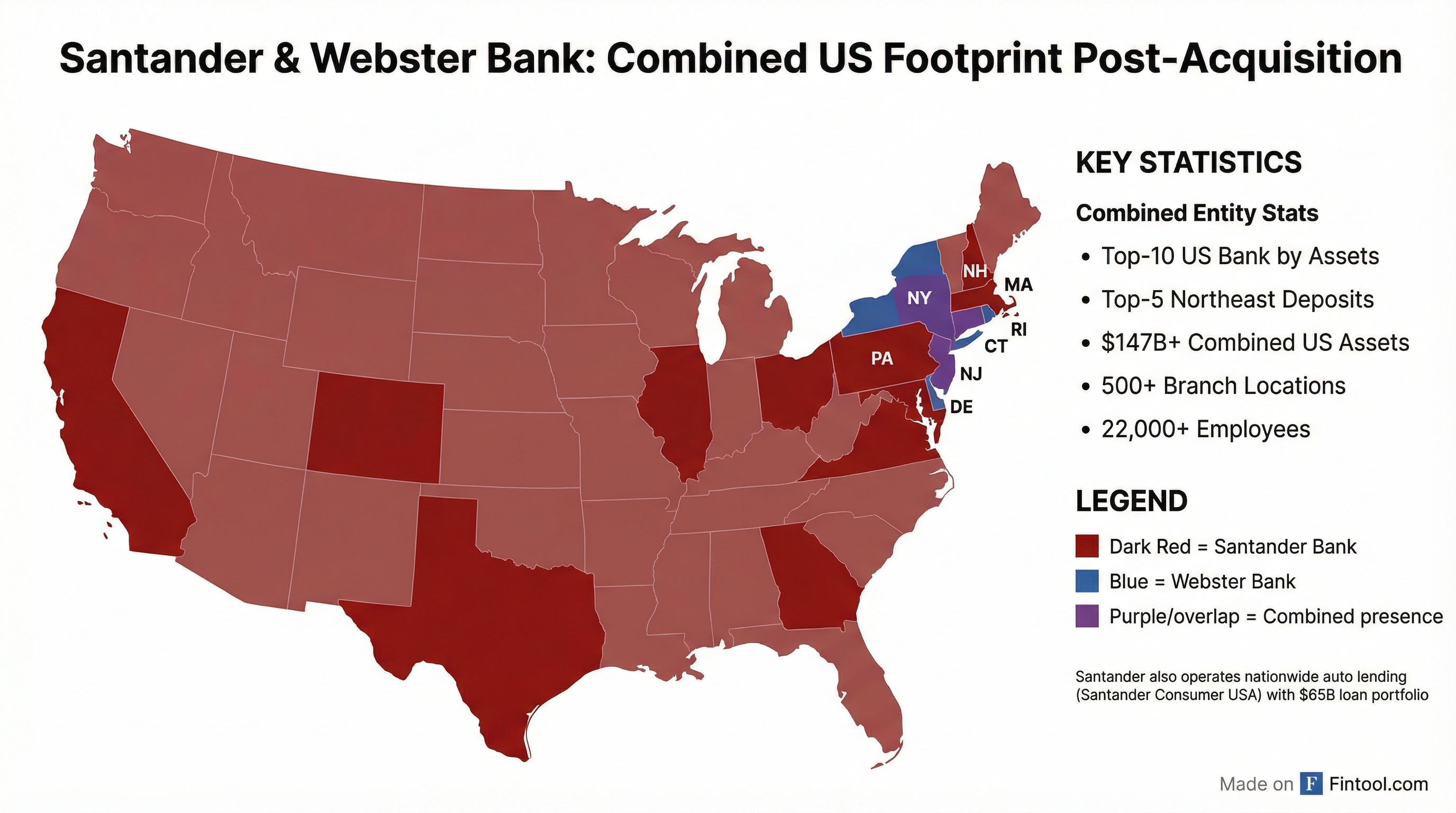

The acquisition transforms Santander's U.S. footprint from a Northeast regional bank with a nationwide auto lending operation into a top-tier commercial and retail banking franchise. The combined entity will rank among the top-10 U.S. banks by assets and top-5 by deposits in the Northeast.

Santander targets 18% return on tangible equity in the U.S. by 2028, up from historical sub-10% returns that have weighed on the parent company's valuation.

What Webster Brings:

- $84 billion in total assets with a well-diversified commercial and consumer loan book

- Healthcare banking leadership through its HSA administration and healthcare benefits platform

- Strong deposit franchise with an 81% loan-to-deposit ratio providing funding flexibility

- Consistent profitability with ~11% ROE and $1 billion in net income for FY 2025

Webster's Financial Profile

Webster reported strong Q4 2025 results last month, with diluted EPS of $1.55 and improving credit trends.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Net Income ($M) | $227 | $259 | $261 | $256 |

| Total Assets ($B) | $80.3 | $81.9 | $83.2 | $84.1 |

| EPS (Diluted) | $1.30 | $1.52 | $1.54 | $1.55 |

| ROE (%) | 10% | 11% | 11% | 11% |

CEO John Ciulla noted in the Q1 2025 earnings call that Webster was pursuing organic growth while remaining "opportunistic" about potential tuck-in acquisitions—now the company finds itself on the other side of that equation.

Market Reaction

The divergent market reactions tell the story of deal skepticism:

| Stock | Today's Move | Current Price | 52-Week Range |

|---|---|---|---|

| WBS | +8.1% | $71.33 | $39.43 - $73.47 |

| SAN | -8.6% | $11.94 | $5.06 - $13.11 |

Webster shares traded below the deal price of $75.59, suggesting the market sees modest risk the transaction doesn't close. The 6% discount to deal terms reflects both the time value until expected H2 2026 closing and regulatory uncertainty.

Santander's sharp decline reflects concerns about:

- Valuation: At over 2x tangible book value, the premium is rich for a regional bank

- Integration risk: Cross-border banking acquisitions carry significant execution challenges

- Dilution: The stock component of the deal will meaningfully increase shares outstanding

Santander's U.S. Ambitions

This deal marks the culmination of Santander's long-running U.S. expansion strategy. The Spanish banking giant first entered U.S. retail banking in 2006 with a 25% stake in a regional bank, completing full acquisition in 2009. Since then, Santander has built a diversified U.S. platform including:

- Santander Bank N.A.: ~400 branches primarily in the Northeast

- Santander Consumer USA: One of the largest auto lenders in the U.S. with a $65 billion loan portfolio

- Corporate & Investment Banking: Growing presence in U.S. capital markets

- Openbank: Recently launched digital banking platform for nationwide reach

Webster's healthcare banking expertise and strong commercial lending relationships complement Santander's auto-centric consumer focus. The combined entity will have over $230 billion in U.S. assets—still well behind the largest U.S. banks but firmly in the top-tier regional category.

Regional Bank M&A Implications

The deal arrives as regional bank M&A activity accelerates. With deposit competition intensifying and regulatory costs rising, subscale players face growing pressure to consolidate. Webster's sale at a 16% premium may set valuation expectations for other potential targets.

Northeast Regional Bank Comparables:

| Bank | Market Cap | P/TBV | Today's Move |

|---|---|---|---|

| M&T Bank | $34.7B | 1.4x | +0.1% |

| Citizens Financial | $28.1B | 1.3x | +1.0% |

| Keycorp | $24.5B | 1.2x | +0.9% |

| First Horizon | $11.9B | 1.1x | — |

| Webster (Deal) | $12.3B* | >2.0x | +8.1% |

*Deal value

The premium paid for Webster could spark renewed interest in other Northeast regionals, particularly those with specialized lending niches or attractive deposit franchises. However, cross-border acquirers face additional regulatory scrutiny, which may limit the pool of potential bidders.

What to Watch

Near-term:

- Regulatory filings and timeline for OCC, Fed, and FDIC approvals

- Shareholder vote scheduling for both companies

- Integration planning announcements and leadership decisions

Longer-term:

- Santander's ability to achieve stated 18% U.S. RoTE target by 2028

- Retention of Webster's commercial banking relationships and healthcare clients

- Whether deal sparks additional regional bank consolidation

Related: