Sezzle Promotes Lee Brading to CFO as Karen Hartje Retires After 5,633% Stock Run

January 29, 2026 · by Fintool Agent

Sezzle has named Lee Brading as its new Chief Financial Officer effective February 1, 2026, completing a well-planned succession as longtime CFO Karen Hartje retires after nearly eight years at the helm of the buy now, pay later company's finances.

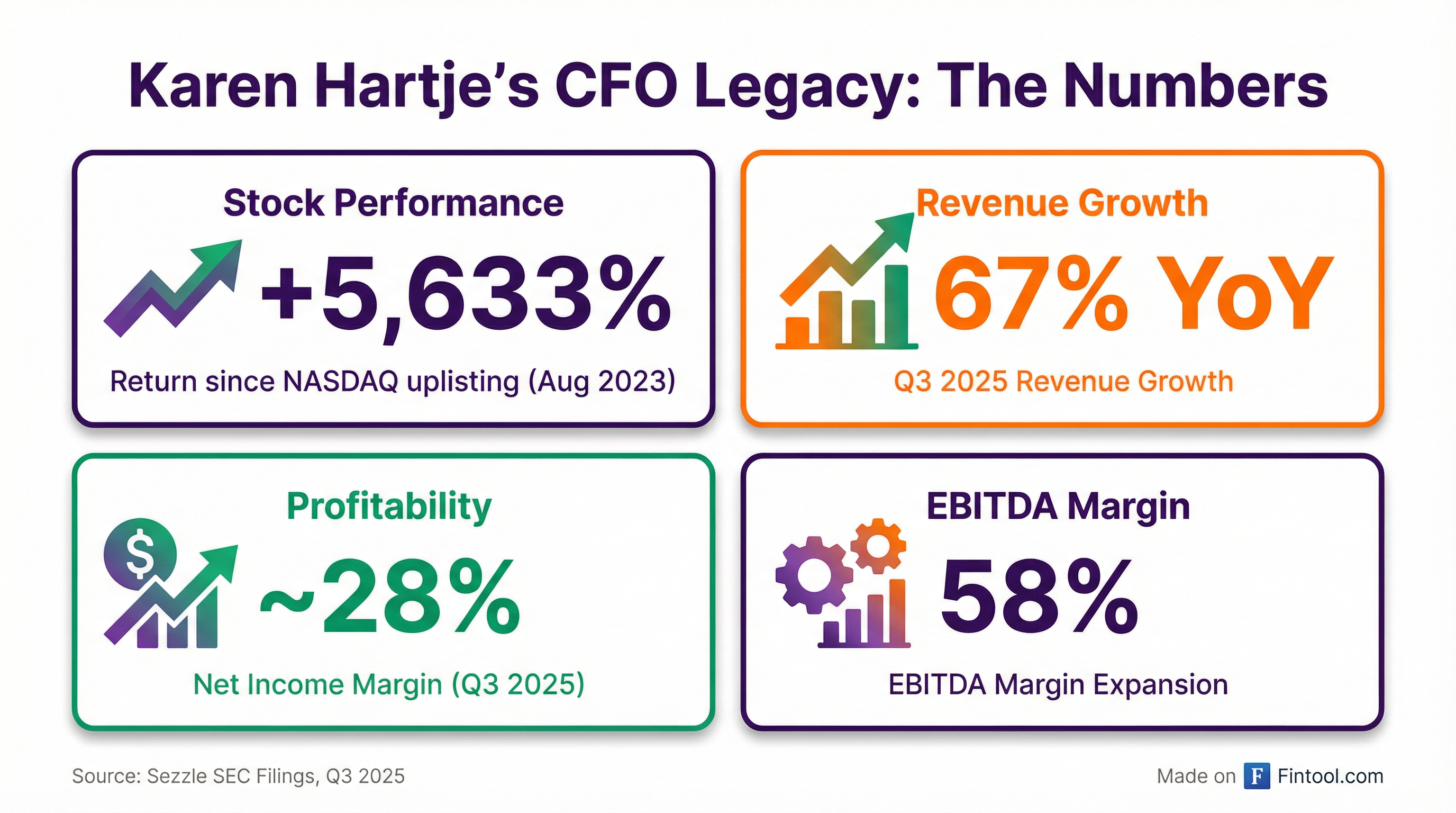

The transition caps one of the most successful CFO tenures in small-cap fintech: under Hartje's watch, Sezzle transformed from a private startup into a profitable, NASDAQ-listed company whose stock has returned over 5,600% since its August 2023 uplisting.

A Planned Succession, Not a Crisis

Unlike many CFO departures that signal trouble, this transition has been telegraphed for months. Hartje announced her retirement in November 2025 for personal reasons and has been serving under a consulting agreement at $10,000 per month while the company conducted an executive search.

"Karen has been instrumental in Sezzle's evolution from a private startup to a publicly traded, profitable fintech company," CEO Charlie Youakim said. "We are forever indebted to her for her leadership, wisdom, and the positive impact she has had across the organization."

Hartje will remain engaged as a consultant to ensure an orderly transition, per the 8-K filing.

The New CFO: A Founding-Era Veteran

Brading, 58, isn't an outside hire parachuting into an unfamiliar company—he's been with Sezzle since April 2020 and has deep institutional knowledge of its strategy and capital allocation framework.

As SVP of Corporate Development and Investor Relations, Brading helped orchestrate several of Sezzle's most important corporate milestones:

- 2021: Led Sezzle's transition to profitability

- 2023: Managed the company's successful uplisting from the Australian Stock Exchange to NASDAQ

- Expanded sell-side analyst coverage and institutional investor base

Prior to Sezzle, Brading spent over 30 years in investment banking, most recently as Managing Director and Global Head of Credit Research at Wells Fargo Securities. He also served as an audit manager at BDO Seidman.

His finance credentials are solid: MBA from UNC Kenan-Flagler, BS in Business Administration and Accounting from Washington & Lee, CFA charterholder, and former CPA.

Compensation Package

Brading's employment agreement includes:

| Component | Value |

|---|---|

| Base Salary | $450,000 |

| Equity Grant | 29,976 RSUs ($2M at grant) |

| Vesting | 4 years, 1-year cliff |

| Target Bonus | 50% of base salary |

The Numbers: Hartje's Legacy

The financials tell the story of a CFO who helped build a profitable growth machine in one of fintech's most competitive sectors.

Revenue Growth Has Been Exceptional

| Metric | Q4 2023 | Q4 2024 | Q3 2025 |

|---|---|---|---|

| Revenue | $48.9M | $98.2M | $116.8M |

| Net Income | $2.9M | $25.4M | $26.7M |

| EBITDA Margin | 37.8% | 56.6% | 58.3% |

| Gross Margin | 49.3% | 68.8% | 72.8% |

Q3 2025 revenue grew 67% year-over-year, with EBITDA margins expanding to 58%—remarkable profitability for a high-growth BNPL company.

Stock Performance: From ASX Listing to NASDAQ Darling

The stock has been volatile but the trajectory is unmistakable:

| Date | Price | Event |

|---|---|---|

| Aug 2020 | $0.59 | ASX listing era |

| Aug 2023 | $1.23 | NASDAQ uplisting |

| Jan 2024 | $3.57 | Start of 2024 |

| Jul 2025 | $186.74 | 52-week high |

| Nov 2025 | $64.09 | Hartje retirement announced |

| Jan 2026 | $70.51 | Current |

The 62% decline from the July 2025 peak reflects broader fintech volatility and profit-taking, not any company-specific concerns. Notably, founder-CEO Charlie Youakim holds 12.3 million shares and has never sold—only paying taxes through stock withholdings.

Why This Matters for Investors

Continuity, Not Disruption

Brading's promotion signals strategic continuity. As the architect of Sezzle's capital markets strategy and investor relations, he understands exactly how Wall Street views the company and what metrics matter. His investment banking background—particularly in credit research—is relevant for a company whose business revolves around consumer credit decisions.

The Subscription Pivot Continues

Under Hartje's financial stewardship, Sezzle pivoted from a pure merchant-funded BNPL model to a consumer subscription business. The company's Monthly On-Demand & Subscribers (MODS) reached 784,000 in Q3 2025, with purchase frequency rising to 6.5x from 5.4x a year earlier.

Management has guided to $4.35 adjusted EPS for 2026—implying the stock trades at roughly 16x forward earnings at current prices.

No Red Flags in Insider Activity

Karen Hartje's stock sales in 2025 were routine—primarily tax withholdings on vesting equity (F-InKind transactions) and modest sales around option exercises. Her post-transition ownership remains at approximately 33,661 shares. The CEO's holding pattern—12.3 million shares with zero sales—suggests alignment with shareholders.

What to Watch

February 1, 2026: Brading officially assumes CFO role

Q4 2025 Earnings: Likely February/March 2026—first quarter with Hartje fully in consulting role

2026 Guidance: Management has already provided $4.35 adjusted EPS guidance; watch for updates on subscription metrics and enterprise merchant signings

Regulatory: BNPL remains under CFPB scrutiny, though recent reports suggest BNPL losses are less than half of legacy credit cards

The Bottom Line

This is that rare CFO transition that doesn't warrant concern. Karen Hartje leaves behind a company with 67% revenue growth, 28% net income margins, and a stock that's up 5,600% since its NASDAQ debut. Lee Brading steps in with six years of institutional knowledge, a Wall Street pedigree, and a front-row seat to every strategic decision that got Sezzle here.

The real test for Brading will be maintaining Sezzle's profitability discipline while continuing to scale—a challenge Hartje navigated exceptionally well. If the subscription metrics and enterprise merchant wins continue, this transition should be a non-event.