Shell Eyes Exit from Argentina's Vaca Muerta—Just as the Permian Peaks

January 22, 2026 · by Fintool Agent

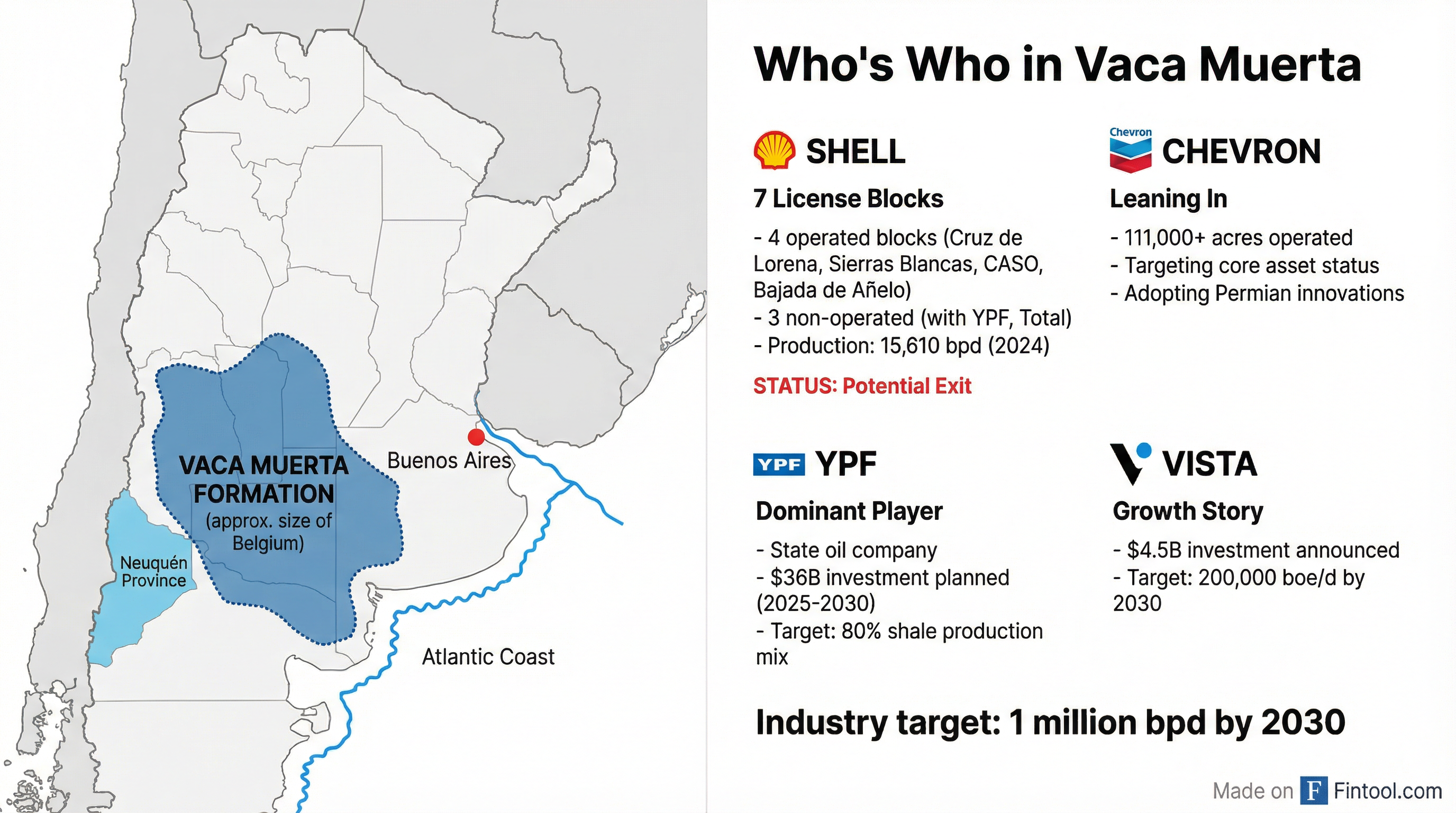

Shell is considering a sale of its assets in Argentina's Vaca Muerta shale play and has approached potential buyers in recent weeks, according to three sources familiar with the matter—a surprising potential exit by one of the formation's earliest backers, just as the U.S. Permian Basin appears to have peaked and interest in the South American frontier is surging.

The oil major is open to selling some or all of its interests in the highly sought shale oil and gas play, with assets likely valued in the billions of dollars. Shell has not responded publicly to the report.

Shares of Shell fell 1.8% to $72.50 on the news, while YPF—Argentina's state oil company and the dominant Vaca Muerta player—dipped 1.3% to $35.62.

The Sawan Strategy: Performance Over Geography

The potential Vaca Muerta exit fits squarely within CEO Wael Sawan's playbook since taking the helm in January 2023. Sawan has systematically divested assets that don't fit Shell's core strengths—deepwater oil, integrated gas, and premium downstream—while driving $3.9 billion in structural cost reductions since 2022.

Recent exits under Sawan's leadership include:

- Singapore Energy and Chemicals Park (2025): Loss-making refinery and chemicals complex

- Nigeria onshore (SPDC) (2024): Decades-long operation sold to local consortium

- Pakistan retail (2024): 500+ service stations divested

- Argentina LNG (2025): Exited after YPF halved project capacity

- Syria's al-Omar oilfield (2026): Currently seeking buyers

- LNG Canada stake (2026): Exploring sale options

"We have been working for the past two years to get well ahead of this," Sawan told analysts on the Q1 2025 earnings call. "While others today are looking to dispose to be able to make their financial framework work, our focus now can be very much on actually delivering what we have promised."

Shell's Argentina Footprint

Shell entered Vaca Muerta in 2012 and has since grown its presence to seven license blocks in the Neuquén Basin:

Operated blocks (majority interest):

- Cruz de Lorena (90%)

- Sierras Blancas (90%)

- Coiron Amargo Sur Oeste (80%)

- Bajada de Añelo (50%)

Non-operated blocks:

- Rincon La Ceniza (45%) – operated by TotalEnergies

- La Escalonada (45%) – operated by TotalEnergies

- Bandurria Sur (30%) – operated by YPF

Shell's production from Argentina averaged 15,610 barrels per day in 2024, according to the company's annual report. The assets are estimated to break even at Brent crude prices below $50 per barrel—economics that "screen favorably versus other global shale assets," according to analyst commentary.

Why Now? The Permian Peak Paradox

The timing is notable. The U.S. Energy Information Administration reported that the Permian Basin hit a record 6.76 million barrels per day in December 2025—a figure that may stand as the basin's all-time high. After 15 years of hypergrowth, America's most prolific oil patch is entering what analysts call a "manufacturing phase" of mature, technology-driven production rather than the aggressive expansion that defined the shale revolution.

This has intensified interest in Vaca Muerta, which sits atop 308 trillion cubic feet of technically recoverable gas (second globally) and 16 billion barrels of oil (fourth globally). The formation is often compared to the Eagle Ford shale for its geological characteristics and resource potential.

"The secondary zones in the Permian have 15% to 20% less reserves by our observation," one Texas operator told the Federal Reserve Bank of Dallas in its December 2025 survey. "Make no mistake, these are economic locations, but we view secondary zones as unable to keep up with global crude oil demand in the next five years. Hence, why we are seeing larger independents make forays into Turkey, Argentina, and the like."

Potential Buyers: Chevron Leans In While Others Exit

Several operators are expanding aggressively in Vaca Muerta, even as Shell considers an exit:

Chevron has explicitly stated it expects Vaca Muerta to play a larger role in its portfolio. "We remain focused on Argentina and Vaca Muerta, where today we have an enviable unconventional resource position that can be scaled into a core asset within a relatively short time frame," Javier La Rosa, now president of Base Assets and Emerging Countries, told Energy Intelligence.

However, Chevron has also acknowledged challenges. Vice Chairman Mark Nelson noted in November that drilling costs in Vaca Muerta run about 35% higher than the Permian, though the gap is narrowing as operators adopt innovations from North American shale.

Vista Energy, the Mexico City-listed producer, announced a $4.5 billion investment plan in November 2025, targeting 200,000 barrels of oil equivalent per day by 2030—up from 114,000 boe/d today.

YPF is undergoing a transformation under CEO Horacio Marín, planning to invest $36 billion between 2025 and 2030 to shift from conventional mature fields to predominantly shale production. The company targets 80% of output from Vaca Muerta, up from about 50% currently. YPF's Vaca Muerta lifting costs average just $4.60 per barrel—so low that Marín has said the company can sustain profitable operations even at $40-45 oil.

Pluspetrol recently acquired ExxonMobil Exploration Argentina, absorbing the supermajor's Vaca Muerta assets including Bajo del Choique-La Invernada, Los Toldos I Sur, and Los Toldos II Oeste.

Infrastructure: The $3 Billion Pipeline Shell Helped Finance

One complicating factor: Shell is a shareholder in the Vaca Muerta Oleoducto Sur SA (VMOS), the joint venture developing the $3 billion Vaca Muerta Sur pipeline. The 437-km pipeline will transport 180,000 barrels per day when it enters service at the end of 2026, with capacity rising to 550,000 bpd in 2027 and potentially 700,000 bpd after 2028.

Other VMOS shareholders include YPF, Vista Energy, Pampa Energía, Pan American Sur, Chevron, and Pluspetrol. Any exit would likely need to address Shell's pipeline stake.

What to Watch

A sale is not guaranteed—Shell could still choose to hold the assets. Sources cautioned that the oil major has approached potential buyers to gauge interest, but no formal process has been announced.

Key catalysts to monitor:

- Shell's Q4 2025 earnings (February): Any commentary on portfolio optimization and Argentina specifically

- Commodity prices: EIA forecasts Brent averaging $56/barrel in 2026 and $54 in 2027—levels that would test operators' cost discipline but remain above Vaca Muerta breakevens

- Argentina's Rigi incentive regime: The Milei administration has signaled potential extension of investment incentives to upstream hydrocarbons

- Buyer announcements: Any indication from Chevron, Vista, or private equity on appetite for additional Vaca Muerta acreage

For Shell, an exit would complete the company's retreat from Argentina—a country where it once bet on both shale and LNG but now appears ready to leave to hungrier operators.

Related Companies