Snap Spins Out Spectacles Into Specs Inc., Betting on AR Glasses to Challenge Meta

January 28, 2026 · by Fintool Agent

Snap Inc. is making its boldest move yet in the battle for your face: the company announced Tuesday it's spinning out its augmented reality glasses business into a standalone subsidiary called Specs Inc., signaling it's ready to go toe-to-toe with Meta Platforms in the nascent but rapidly growing smart glasses market.

The new subsidiary will operate independently within Snap while preparing for the consumer launch of its AR glasses later this year—a product CEO Evan Spiegel has been building toward for a decade.

Why Spin Out Now?

The timing is strategic. Snap is creating operational distance between its profitable core Snapchat business and the cash-intensive hardware venture, while simultaneously opening the door for outside investment.

"Establishing Specs Inc. as a wholly-owned subsidiary provides greater operational focus and alignment, enables new partnerships and capital flexibility including the potential for minority investment, allows us to grow a distinct brand, and supports clearer valuation of the business," Snap said in its announcement.

The structure mirrors how Alphabet operates Waymo—a wholly-owned subsidiary that can attract strategic partners without directly diluting the parent company's shareholders. A Snap spokesperson confirmed the company will launch consumer Specs regardless of whether it secures external funding, but the subsidiary structure makes it easier to bring in minority investors if needed.

Specs Inc. is already hiring for over 100 roles worldwide, a significant buildout ahead of the consumer launch.

A Decade in the Making

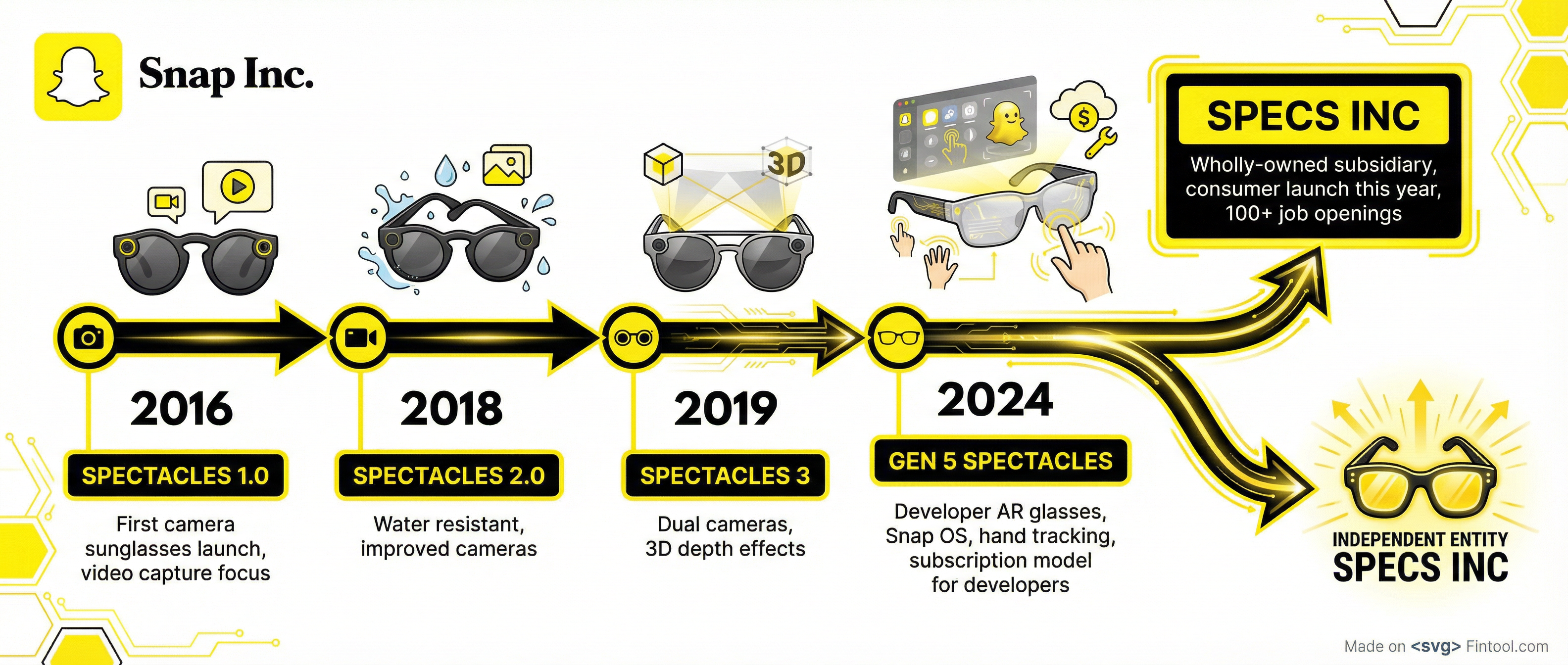

Snap isn't a newcomer to smart eyewear—it's been iterating on the concept longer than any major tech company:

The journey began in 2016 with camera-equipped sunglasses that captured first-person video, and has evolved into a fully immersive AR computing platform. The fifth-generation Spectacles, released to developers in September 2024, run Snap OS—a purpose-built operating system with hand and voice controls, no physical controllers required.

"Since the launch of our fifth generation Spectacle Smart Glasses six months ago, we have expanded our AR platform with new features for developers, introduced innovative Lens experiences, and created new opportunities for AR developers to be rewarded for their creations," Spiegel said on the Q1 2025 earnings call.

Key developer features added include GPS integration, advanced hand tracking, improved keyboard input, and in-game leaderboards. Over 400,000 AR creators have built more than 4 million Lenses for Snap's ecosystem—an asset Meta can't easily replicate.

The Meta Problem

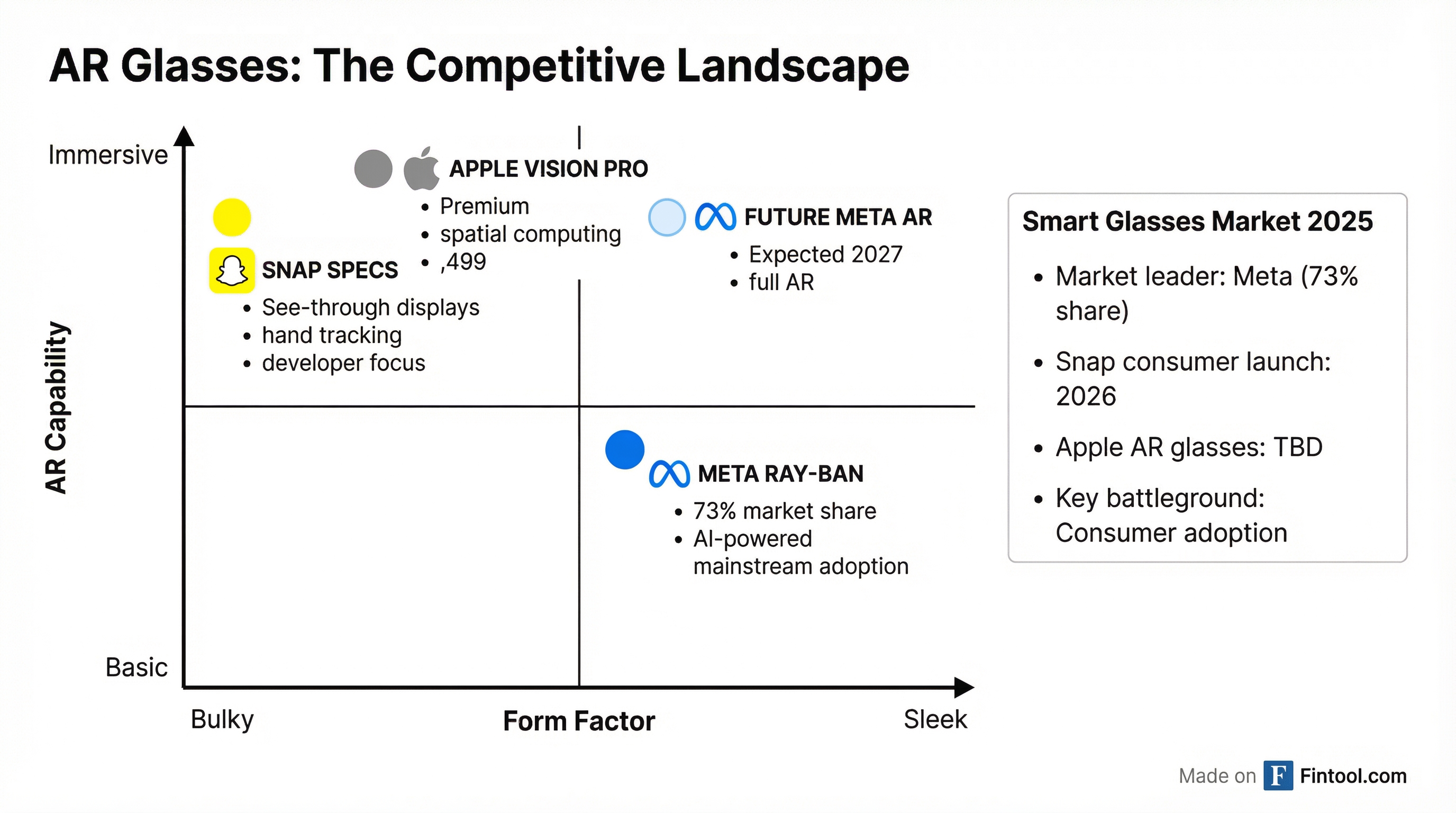

The elephant in the room is Meta Platforms, which commands 73% of the smart glasses market through its partnership with EssilorLuxottica's Ray-Ban brand. Meta's AI-powered Ray-Ban glasses have achieved something rare in wearables: actual consumer adoption at scale.

But here's Snap's opening: Meta's current glasses are essentially AI-powered cameras, not true AR devices. They don't overlay digital objects on the real world—they just capture video and respond to voice commands. Meta's full AR glasses aren't expected until 2027.

"Specs are launching at an important time, as artificial intelligence transforms the way that we use our computers," Snap said. "The glasses' operating system can help you get things done faster based on what they see and what they know about your behaviors."

Snap's differentiation: see-through lenses that "add digital objects to the world in three dimensions, enabling natural controls with your hands and voice."

The Financial Reality

The spinout comes as Snap shows improved, though still challenged, financial performance:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $1,557 | $1,363 | $1,345 | $1,507 |

| Net Income ($M) | $9 | -$140 | -$263 | -$104 |

| Cash from Ops ($M) | $231 | $152 | $88 | $146 |

| Cash & Equivalents ($M) | $1,047 | $911 | $926 | $953 |

Snap has about $1 billion in cash against $4.2 billion in debt. The company is generating positive operating cash flow, but hardware development is expensive—which is partly why the subsidiary structure and potential for outside investment makes sense.

"Given the progress we have made with our advertising platform and the pace of execution against our 2025 strategic priorities, we believe we are well positioned to deliver improved business performance and meaningful positive free cash flow as we make further progress towards GAAP profitability," Spiegel noted.

David vs Goliath

The market cap disparity tells the competitive story: Snap trades at roughly $13 billion versus Meta's $1.7 trillion. That's a 130x difference.

Yet Snap has advantages Meta doesn't:

- AR-native platform: Snap's entire developer ecosystem is built around augmented reality Lenses, with 8 billion daily AR Lens uses on Snapchat

- Vertical integration: Snap claims to be "the only company in the world with a fully integrated AR computing stack"

- First-mover in immersive: True see-through AR glasses launching before Meta's 2027 target

- Developer loyalty: 375,000+ AR creators already building for Snap's platform

Analyst Ben Wood of CCS Insight called it "a smart move" given the heat in the AR space, adding: "I suspect we are going to see quite a few products emerging in this segment in 2026."

What to Watch

The consumer launch later this year will be the ultimate test. Key questions:

- Pricing: Developer Spectacles cost $99/month via subscription. Consumer pricing hasn't been announced, but it will need to compete with Meta Ray-Bans at $299-379.

- Form factor: Spiegel has promised the consumer version will be "significantly smaller, lighter, and more capable" than the developer model

- Battery life: A perennial challenge for AR glasses with displays

- Killer apps: What use cases will drive mainstream adoption beyond tech enthusiasts?

Snap is betting that true AR—digital objects overlaid on reality—will eventually beat Meta's current AI-camera approach. "Instead of staring at an opaque screen that separates you from your surroundings, Specs smart glasses have see-through lenses that add digital objects to the world in three dimensions," the company argues.

The race is on. Meta has the money and market share. Snap has the AR DNA and a decade head start in see-through displays. Whoever wins will shape how the next generation interacts with computing.

Snap shares closed up 2.8% at $7.67 on the news.

Related: Snap Inc. Company Profile | Meta Platforms Company Profile