Southwest Airlines Ends 53-Year Open Seating Era Tomorrow

January 26, 2026 · by Fintool Agent

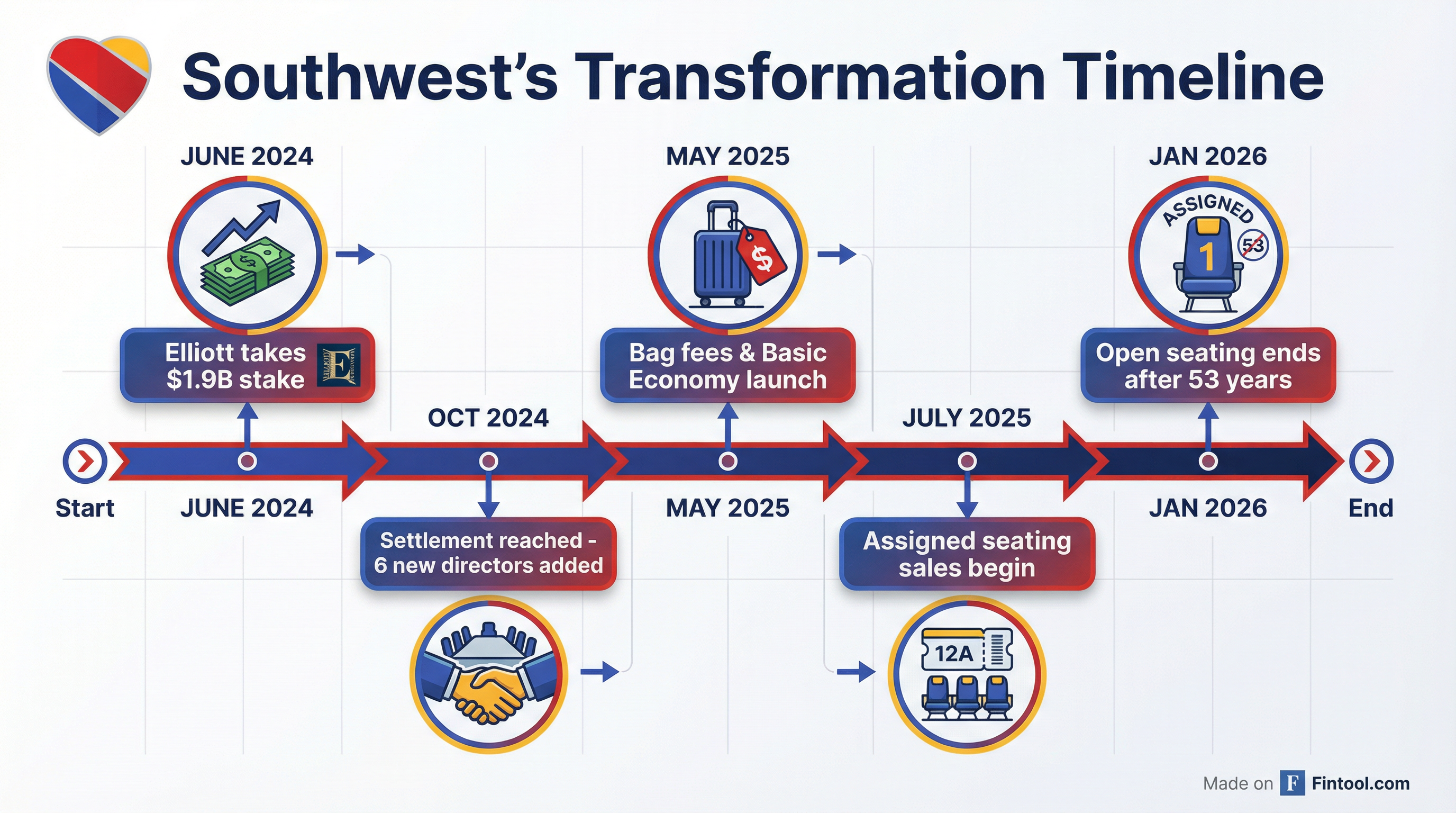

Southwest Airlines will fundamentally transform its passenger experience tomorrow, ending 53 years of open seating as flights departing January 27, 2026 shift to assigned seats and a new eight-group boarding process. The change marks the most visible milestone in the carrier's Elliott Investment Management-driven transformation—and removes the single biggest barrier to customer acquisition that has defined the Southwest brand since 1971.

LUV shares closed at $41.91 Monday, up 51% from the $27.69 level when Elliott first disclosed its $1.9 billion stake in June 2024. The stock has found support near $38 and trades above both its 50-day ($38.89) and 200-day ($33.47) moving averages.

The End of "Cattle Call" Boarding

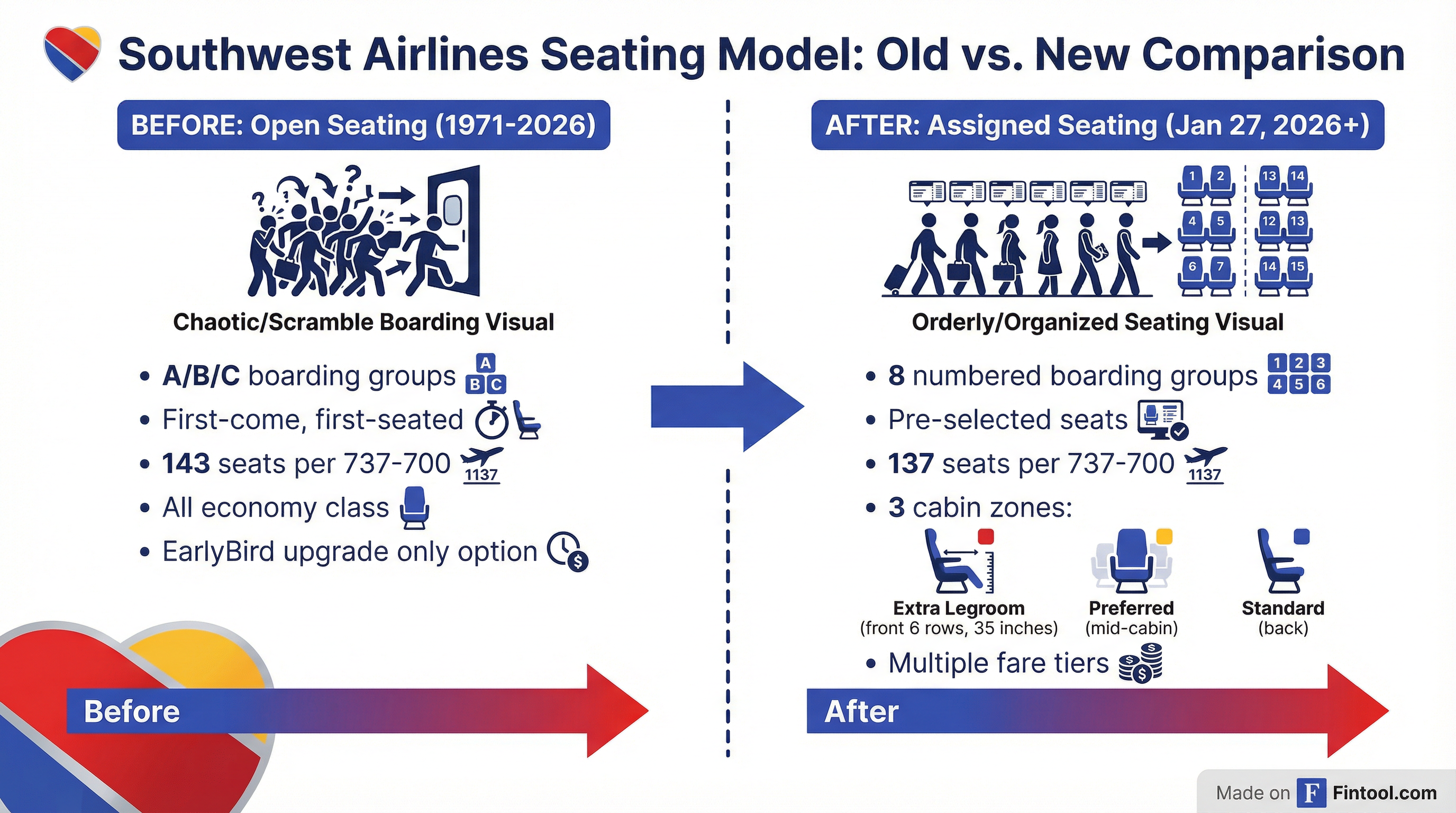

Beginning tomorrow, passengers will no longer scramble for seats in Southwest's famous boarding process. Instead, they'll receive:

- Assigned seats selected at booking or check-in

- Eight numbered boarding groups (replacing A/B/C with position numbers)

- Three seat categories: Extra Legroom (front 6 rows, 35" pitch), Preferred (mid-cabin), and Standard (rear)

The airline completed its fleet-wide retrofit of Boeing 737-700s one week ahead of schedule on January 20, 2026, removing one row of seats to create the Extra Legroom section. The 737-700s now seat 137 passengers versus 143 previously, while the larger 737-800s and MAX 8s maintain 175 seats.

Why 53 Years Wasn't Enough

CEO Bob Jordan put it bluntly in the Q2 2025 earnings call: "More than 80% of our customers want assigned seating. 85% of those who don't fly us want assigned seating. Open seating is the number one reason people leave us and the number one reason customers who won't fly Southwest won't fly Southwest."

The math was stark: removing the barrier that kept Southwest out of millions of travelers' consideration sets offered upside that management hadn't even quantified in their initiative projections.

"Our initiative value for assigned seating extra legroom did not include a share shift from people all of a sudden being willing to fly Southwest since we have assigned seating," noted COO Andrew Watterson. "So that's an unquantified upside... lots of opportunity here to get incremental EBIT from some of those seats."

Elliott's Victory Lap

The open seating elimination is the capstone of a transformation that accelerated dramatically after Elliott Investment Management disclosed its stake in June 2024 and demanded sweeping changes.

Elliott trimmed its stake to 13.1% in December 2025—down from a peak of 16%—but remains a significant shareholder. The hedge fund said it would stay invested based on "confidence that execution of ongoing strategic initiatives will translate into greater profitability, accretive capital-allocation opportunities, and shareholder value creation."

The settlement in October 2024 brought six new directors to the board (five Elliott nominees plus former Chevron CFO Pierre Breber), forced Executive Chairman Gary Kelly into early retirement, and protected CEO Bob Jordan's position—with the implicit understanding that transformation must deliver results.

Financial Trajectory: Initiatives Taking Hold

Southwest's initiative-driven EBIT target of $1.8 billion for 2025 remained on track through Q3, despite industry headwinds. The company achieved record Q3 revenue of $6.9 billion, up 1.1% year-over-year.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $6.35* | $5.85* | $6.67* | $6.36* |

| Operating Income ($M) | $261 | -$161* | $225 | $35 |

| Net Income ($M) | $261 | -$149 | $213 | $54 |

*Values retrieved from S&P Global

Key revenue initiatives launched in 2025:

- Bag fees (May 2025): Exceeding expectations with take rates at the "higher end" of peer bag revenue per passenger

- Basic economy (May 2025): Foundation for product differentiation

- Flight credit expiration (Q2 2025): Revenue recapture

- Assigned seating sales (July 2025 for Jan 2026 travel): Bookings "in line with expectations"

Stock Performance Since Elliott

Southwest shares have climbed 51% since Elliott's June 2024 investment disclosure:

| Metric | Value |

|---|---|

| Current Price | $41.91 |

| Price at Elliott Disclosure (June 2024) | $27.69 |

| 52-Week High | $45.02 |

| 52-Week Low | $23.82 |

| Market Cap | $21.7B |

| 50-Day Moving Average | $38.89 |

| 200-Day Moving Average | $33.47 |

The stock traded above its 52-week high of $45.02 in late 2025 before pulling back slightly. Current levels suggest investors are pricing in continued execution of the transformation plan.

What's Lost, What's Gained

Not everyone is celebrating. Southwest's cult-like brand loyalty was built on differentiation—open seating, free bags, no change fees—that made it feel fundamentally different from legacy carriers.

The changes that drove profitability also stripped away distinctiveness:

What Southwest Lost:

- Open seating (53 years)

- Free checked bags (ended May 2025)

- No-fee culture identity

- "Unique" positioning vs. legacy carriers

What Southwest Gained:

- Multiple revenue streams per passenger

- Premium cabin monetization

- Removal of customer acquisition barriers

- Closer alignment with industry economics

As one observer noted: "Southwest no longer feels like the 'budget-friendly' airline it has been for a long time... Now, the carrier has to compete largely on price and schedule, which is a far more difficult game."

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected all-time record revenue quarter)

- Initial assigned seating revenue contribution visibility

- Customer satisfaction data post-transition

Longer-term questions:

- Will the "unquantified upside" from share shift materialize?

- Can Southwest maintain operational efficiency advantages?

- Will Elliott continue trimming its stake?

The January 27 transition will be closely watched—not just for operational smoothness, but for early signals on whether removing the open seating barrier actually brings new customers into the Southwest consideration set.