S&P Global Stock Crashes 18% After Guidance Miss Drags Down Financial Data Sector

February 10, 2026 · by Fintool Agent

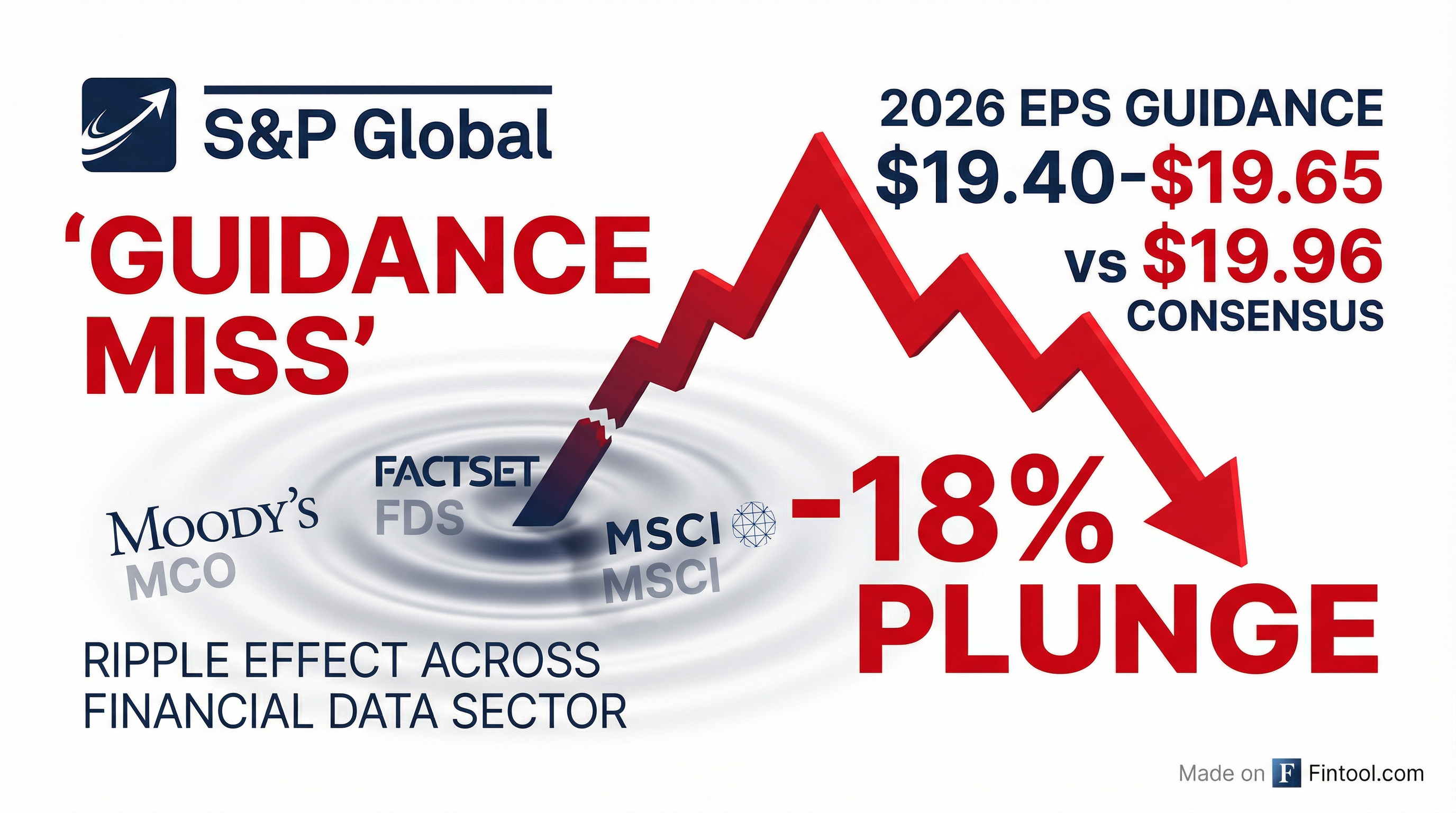

S&P Global shares plunged 18% in after-hours trading Tuesday after the financial data giant issued 2026 profit guidance that missed Wall Street expectations, sending shockwaves through the entire financial information sector.

The company behind the S&P 500 index projected full-year 2026 adjusted earnings per share of $19.40 to $19.65, falling short of the $19.96 consensus estimate. The miss triggered a brutal selloff that dragged down peers Moody's, Msci, and Factset in sympathy, erasing billions in combined market value.

The Numbers Behind the Crash

S&P Global's Q4 2025 results were actually solid—revenue of $3.916 billion beat expectations, up 9% year-over-year, with all five business segments posting growth. The Ratings division led with 12% revenue growth on strong debt issuance, while Indices surged 14% on higher asset-linked fees.

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $3.916B | $3.592B | +9% |

| Adj. EPS | $4.30 | $3.77 | +14% |

| Operating Margin | 42.7% | 36.7% | +600 bps |

| Net Income | $1.134B | $880M | +29% |

Full-year 2025 results were equally robust: revenue hit $15.336 billion (+8%), adjusted EPS reached $17.83 (+14%), and the company returned $6.2 billion to shareholders—113% of adjusted free cash flow.

But it was the 2026 guidance that spooked investors.

The Guidance Gap

Management guided for organic constant currency revenue growth of just 6.0% to 8.0% in 2026, with reported revenue growth of 6.6% to 8.6%. The adjusted EPS range of $19.40 to $19.65 implies growth of roughly 9-10%—a material deceleration from 2025's 14% adjusted EPS growth.

| 2026 Guidance | Company | Consensus | Gap |

|---|---|---|---|

| Adjusted EPS | $19.40-$19.65 | $19.96 | -2.5% to -4% |

| Revenue Growth | 6.6%-8.6% | 7.6% | In-line |

| Op. Margin Expansion | 10-35 bps | - |

The company also flagged uncertainty around the planned spin-off of its Mobility division, expected mid-2026, noting it could not provide GAAP guidance "without unreasonable effort."

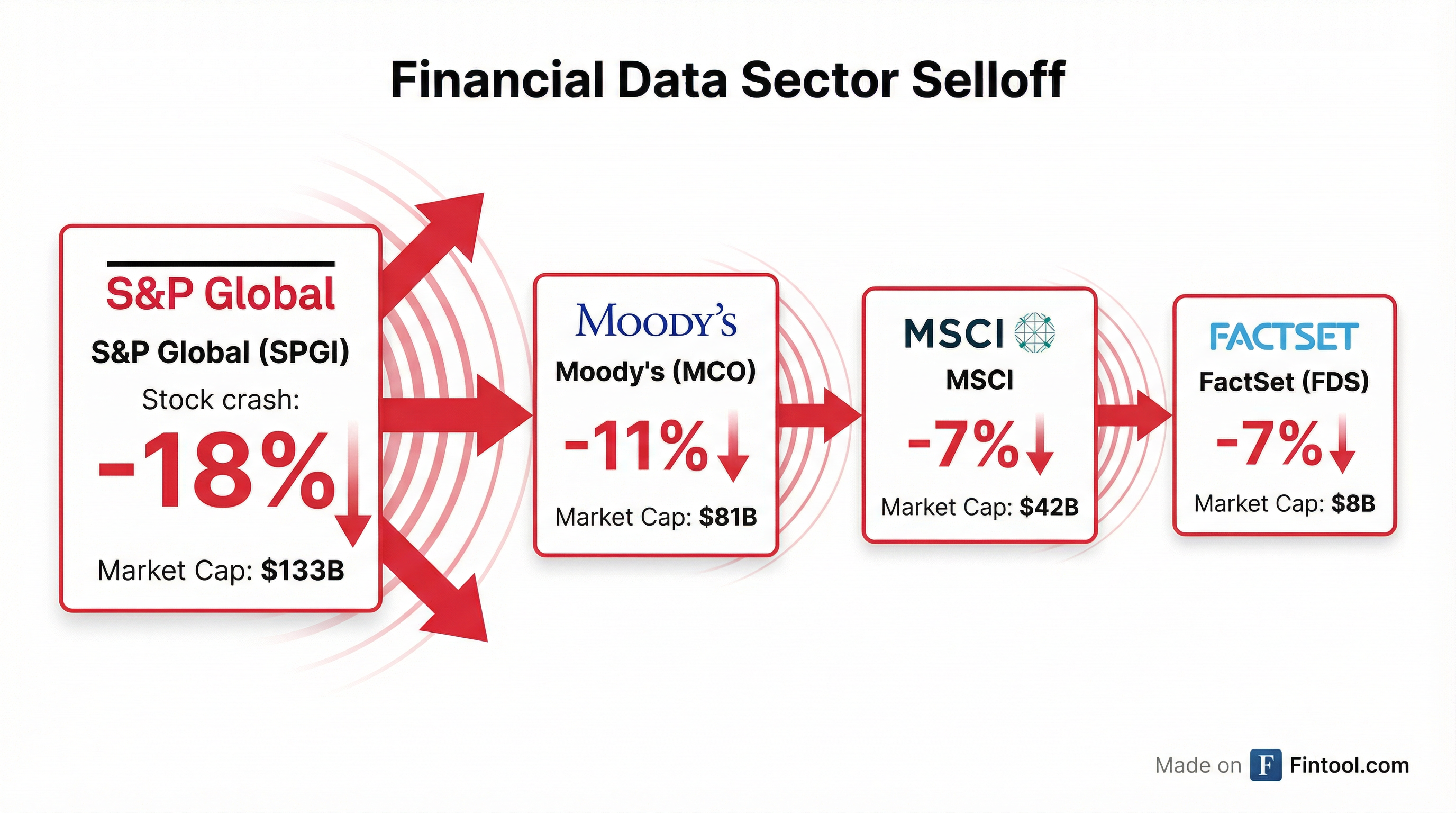

Sector-Wide Carnage

The selloff spread rapidly through the financial data and analytics sector:

| Company | Ticker | After-Hours Move | Market Cap |

|---|---|---|---|

| S&P Global | SPGI | -18% | $133B |

| Moody's | MCO | -11% | $81B |

| MSCI | MSCI | -7% | $42B |

| FactSet | FDS | -7% | $8B |

The sympathy selling reflects investor concerns that the challenges facing S&P Global—slower growth, margin pressure, AI disruption—could signal broader headwinds for the entire financial information services industry.

The AI Elephant in the Room

Management struck a cautiously optimistic tone on artificial intelligence, highlighting it as both opportunity and challenge. CEO Martina Cheung noted that "the scale of innovation and pace of AI integration in our products and internal processes was a leap forward for our clients and the business."

But the company's risk factors tell a more nuanced story, warning about:

- "The effect of competitive products (including those incorporating artificial intelligence)"

- "Our ability to develop new products or technologies, to integrate our products with new technologies (e.g., AI)"

- "The introduction of competing products (including those developed by AI) or technologies by other companies"

S&P Global has already seen its stock drop 15% year-to-date prior to this crash, caught in the crossfire of a technology sector rotation as investors reassess AI winners and losers.

What It Means for Investors

The selloff raises fundamental questions about the financial data sector's growth trajectory. S&P Global's business model—charging fees for indices, credit ratings, and proprietary data—has historically been highly defensible. But AI-powered alternatives and increasing competition could pressure both pricing and volumes.

Key watch items going forward:

- Mobility Spin-Off: The mid-2026 separation will be a major catalyst and could unlock value or expose structural weaknesses

- AI Integration: How quickly S&P Global can monetize AI within its products versus facing disruption from AI-native competitors

- Ratings Pipeline: Debt issuance trends and credit rating activity will drive near-term results

- Margin Trajectory: The 10-35 bps margin expansion guidance suggests limited operating leverage

Moody's is scheduled to report quarterly earnings next Wednesday, which will provide another data point on industry-wide trends.

The Bull Case

Despite the carnage, some analysts argue S&P Global's proprietary data and benchmark status provide insulation. The S&P 500 index alone is the foundation for trillions in passive investment products—that's not easily replicated by AI. The company's 50% adjusted operating margin and $5.5 billion in adjusted free cash flow demonstrate the durability of the business model.

At today's after-hours price near $360, SPGI trades at roughly 18x forward earnings—a significant discount to its five-year average and historical premium to the market.

Related

Note: Values marked with asterisk retrieved from S&P Global.