State Street Launches Digital Asset Platform, Joining $57.8T Rival BNY in Tokenization Race

January 15, 2026 · by Fintool Agent

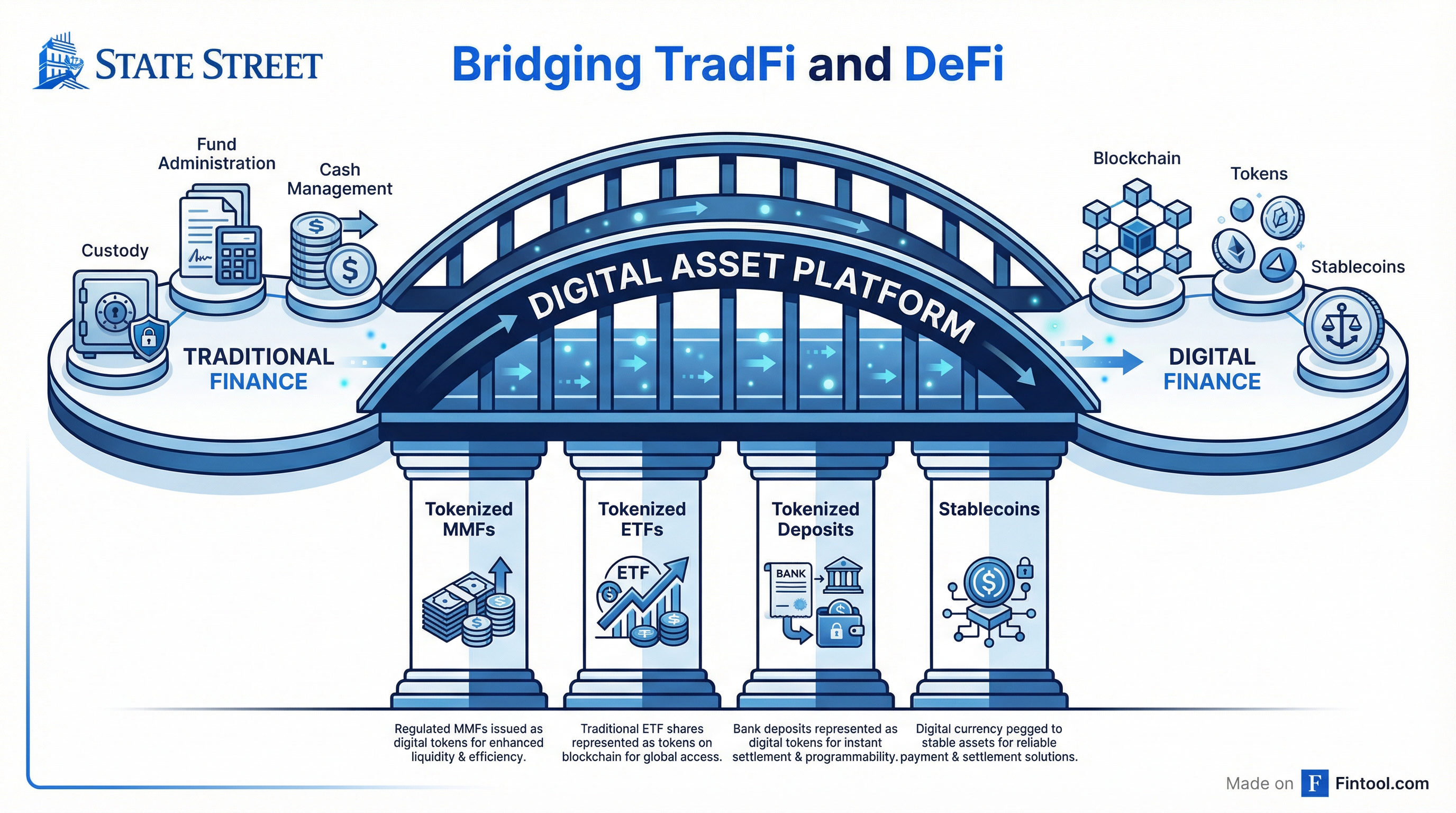

State Street has launched its Digital Asset Platform, a scalable infrastructure that positions the $51.7 trillion custody giant as a bridge between traditional and blockchain-based finance. The announcement comes less than a week after rival BNY Mellon activated its own tokenized deposit service, signaling that Wall Street's largest custodians are moving decisively from blockchain experimentation to production-ready infrastructure.

Shares of State Street rose 1.2% to $136.29 on the news, touching a 52-week high.

What State Street Is Building

The platform supports wallet management, custodial services, and cash capabilities across both private and public permissioned blockchain networks. State Street plans to develop:

- Tokenized Money Market Funds (MMFs) — bringing cash management products on-chain

- Tokenized ETFs — enabling fractional ownership and potential 24/7 trading

- Tokenized Deposits — blockchain-based representations of client deposit balances

- Stablecoins — regulated, bank-issued digital dollars

"This launch marks a significant step in State Street's digital asset strategy," said Joerg Ambrosius, president of Investment Services at State Street. "We are moving beyond experimentation and into practical, scalable solutions that meet the highest standards of security and compliance."

The TradFi-to-Blockchain Race Heats Up

State Street's move comes amid an arms race among custody banks to capture institutional demand for blockchain-based financial infrastructure.

BNY Mellon, the world's largest custodian with $57.8 trillion in assets under custody, launched its tokenized deposit service on January 9, 2026, with early participants including Intercontinental Exchange, Citadel Securities, Circle, and Ripple Prime. BNY's CEO Robin Vince has called digital assets a "megatrend," noting that regulatory clarity following the GENIUS Act has become "a bit of a tailwind."

JPMorgan was the first major bank to launch tokenized deposits through its Kinexys Digital Payments platform (formerly JPM Coin), which went live in November 2025. The bank has operated blockchain-based dollar deposits since 2019.

State Street's differentiator is its broader product ambition: while rivals have focused on tokenized deposits for settlement and collateral, State Street is also targeting tokenized investment products—MMFs and ETFs—that could fundamentally reshape asset management.

The Galaxy Partnership

State Street isn't building alone. In December 2025, the firm announced a partnership with Galaxy Digital to launch the State Street Galaxy Onchain Liquidity Sweep Fund (SWEEP), a tokenized private liquidity fund that will allow 24/7 subscriptions and redemptions using PYUSD stablecoins.

Key details:

- $200 million seed investment from Ondo Finance expected

- Solana blockchain launch planned for early 2026

- Cross-chain interoperability via Chainlink, with plans to add Stellar and Ethereum

- State Street Bank will custody the fund's treasury holdings

"By partnering with Galaxy, we will push the envelope together and drive the evolution of the TradFi landscape onchain," said Kim Hochfeld, global head of cash and digital assets for State Street Investment Management.

Why This Matters for Investors

State Street's October 2025 institutional survey found that 60% of institutional investors plan to increase digital asset allocations within the coming year, with average exposure expected to double within three years. A majority expect 10-24% of institutional investments to be executed through tokenized instruments by 2030.

The business case is clear: tokenization promises increased transparency (cited by 52% of respondents), faster trading (39%), and lower compliance costs (32%). Nearly half anticipate cost savings exceeding 40% from increased transparency alone.

For State Street specifically, digital assets represent a new revenue stream on top of its core custody business. With $371 billion in total assets and quarterly revenues of $2.83 billion (Q3 2025), the firm has the balance sheet and client base to scale blockchain infrastructure quickly.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $2.66B | $2.57B | $2.72B | $2.83B |

| Net Income | $783M | $644M | $693M | $861M |

| ROE | 12.2% | 9.9% | 10.3% | 12.5% |

Management's Vision

State Street leadership has framed digital assets as a natural extension of its core custody business. In September 2025, Ambrosius outlined the firm's three-pillar digital strategy:

- Digital asset custody — "We will be an active participant in creating the ecosystem of the future"

- Fund administration — Already providing accounting services for crypto ETFs

- Tokenization of funds, assets, and cash — The new platform's primary focus

"Our role is going to be to be a bridge for investors that are operating in both worlds," Ambrosius said at the September conference. "Clients will expect from us that we can support them in these different ecosystems that will be established around the globe."

On stablecoins specifically, management signaled they view the asset class as "a key element of the future financial ecosystem," with ambitions to support clients globally across U.S., European, and Asia-Pacific markets.

What to Watch

Near-term catalysts:

- SWEEP fund launch — Expected in early 2026 on Solana, with $200M seed capital

- Product rollout timeline — When tokenized MMFs and ETFs become available to clients

- Competitive response — Whether BNY Mellon or JPMorgan expand into tokenized investment products

Regulatory developments:

- Implementation of the GENIUS Act stablecoin framework

- SEC treatment of tokenized securities

- Global regulatory divergence across Europe and Asia

Key questions for management:

- What fee structure will apply to tokenized products?

- How quickly can the platform scale to meaningful AUM?

- Will State Street issue its own stablecoin, or rely on partners like PYUSD?

The Bottom Line

State Street's Digital Asset Platform represents a strategic bet that the next decade of custody banking will be won or lost on blockchain infrastructure. By building capabilities for tokenized funds, deposits, and stablecoins—not just crypto custody—State Street is positioning itself at the intersection of traditional asset management and decentralized finance.

The launch also validates a key trend: following regulatory clarity from the GENIUS Act, the largest banks are no longer asking whether to build blockchain infrastructure, but how fast. With BNY Mellon, JPMorgan, and now State Street all operating production systems, 2026 may mark the year tokenization moves from Wall Street experiment to institutional standard.

Related