Target Stock Jumps as Activist Toms Capital Takes Aim at Struggling Retailer

December 26, 2025 · by Fintool Agent

Target shares surged as much as 7% on Thursday after the Financial Times reported that activist hedge fund Toms Capital Investment Management has built a significant stake in the retailer following a brutal sales slump that has erased nearly a third of the stock's value this year.

The stock touched an intraday high of $103.03 before settling around $98, still up about 1.5% on the day. The exact size of Toms Capital's stake remains undisclosed, but the move puts Target in the crosshairs of one of the most successful activist investors of recent years.

The Numbers Tell the Story

Target's struggles are stark. The stock has plummeted 64% from its pandemic-era high of $268.98, when locked-down consumers transformed the retailer into a one-stop destination for essentials, apparel, and home goods. Year-to-date, Target has lost 29% of its value while rival Walmart has gained 24%.

The operational picture is equally challenging. Target has now posted 12 consecutive quarters of negative or negligible comparable sales growth. In its most recent quarter, comp sales declined 2.7%, with particular weakness in discretionary categories like home and apparel.

| Metric | Q3 2024 | Q3 2025 | Q3 2026 | YoY Change |

|---|---|---|---|---|

| Revenue ($B) | $25.0 | $25.7 | $25.3 | -1.5% |

| Comp Sales | -4.9% | -4.9% | -2.7% | Improving |

| EBIT Margin | 5.5% | 4.7% | 4.6% | -90bps |

| EPS | $2.10 | $1.85 | $1.51 | -28% |

Toms Capital: The Activist With a Winning Streak

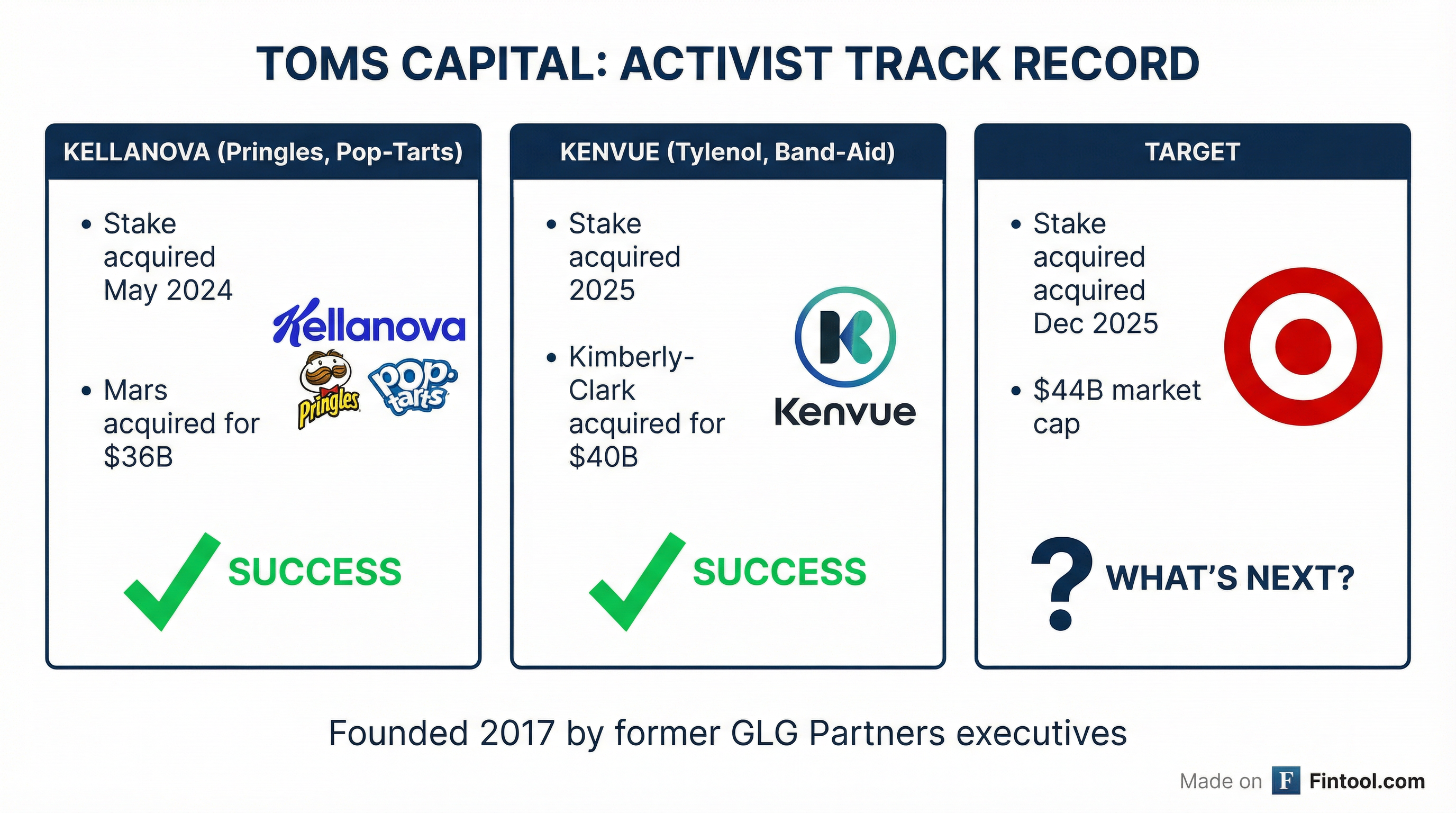

What makes this stake particularly noteworthy is Toms Capital's remarkable track record. Founded in 2017 by former GLG Partners executives, the hedge fund has been involved in several high-profile activist campaigns that have ended in major M&A transactions:

Kellanova: Toms Capital took a stake in the Pringles and Pop-Tarts maker in May 2024 and engaged with management on improving shareholder returns. Three months later, Mars announced it would acquire Kellanova for $36 billion—one of the largest food deals ever.

Kenvue: The fund built a position in the Johnson & Johnson spinoff and pushed for a full sale or asset separation. Kimberly-Clark subsequently acquired Kenvue for approximately $40 billion.

U.S. Steel: Toms Capital also holds shares in U.S. Steel, where Nippon Steel's $14.1 billion takeover bid remains pending regulatory approval.

A Company in Transition

Toms Capital's arrival coincides with a leadership transition at Target. CEO Brian Cornell, who steered the company through its pandemic-era boom, announced his departure on the most recent earnings call after 11 years at the helm.

"This is my final earnings call as Target CEO," Cornell said in November. "Our business has not been performing up to its potential over the last few years, and I am singularly focused on supporting Michael and the entire leadership team as they make changes."

Incoming COO Michael Fiddelke acknowledged the challenges directly: "We're far from satisfied with our current results, and we won't be satisfied until we're operating at our full potential."

The company recently eliminated approximately 1,800 headquarters positions—about 8% of its corporate footprint—in what Fiddelke characterized as a move to "work with greater agility" rather than simply cut costs.

The Bull Case for Activist Intervention

Target presents a classic activist playbook opportunity:

Depressed valuation: At a $44 billion market cap, Target trades at roughly 10x forward earnings compared to Walmart's 26x and Costco's 50x. The stock is near multi-year lows while the broader retail sector has recovered.

Real estate value: Target operates approximately 1,960 stores across the U.S., many in prime suburban locations. The company has been investing heavily in remodels and new larger-format stores.

Strong brands and loyalty: Target Circle is one of the nation's largest retail loyalty programs, and the company's same-day delivery service powered by Target Circle 360 grew more than 35% in Q3.

Margin recovery potential: The company has essentially eliminated its pandemic-era inventory shrink problem, which management expects will contribute 80-90 basis points of gross margin favorability for the full year.

$5 billion CapEx plan: Target is ramping capital spending by 25% next year, focusing on store remodels, technology, and new stores.

What Could Toms Capital Push For?

While neither Target nor Toms Capital has commented publicly, the activist's prior campaigns offer clues to potential strategies:

-

Full sale exploration: Given Toms Capital's success in facilitating sales of Kellanova and Kenvue, the fund may push Target to explore strategic alternatives. Potential acquirers could include private equity firms, international retailers, or Amazon—which has been quietly building its physical retail presence.

-

Asset monetization: Target's real estate portfolio, its Roundel advertising business (which saw mid-teens growth in Q3), and its Target Circle data could all be monetized or separated.

-

Operational improvements: The activist may push for accelerated cost cuts, faster inventory optimization, or changes to the company's promotional strategy.

-

Capital return enhancement: With the stock depressed, an aggressive buyback program could be attractive. Target repurchased only $150 million of shares in Q3, exercising what management called "caution" given environmental uncertainty.

What to Watch

March 2026 Investor Day: Target has scheduled a financial community meeting in Minneapolis for March 3, 2026, where management will unveil more details on its turnaround strategy. This event could become a flashpoint if Toms Capital seeks to present alternative views.

13-D filing: If Toms Capital's stake exceeds 5%, the fund will be required to file a Schedule 13-D with the SEC, revealing its position size and intentions. This filing could come at any time.

Q4 earnings: Target's holiday quarter results, expected in early March, will be crucial. The company has guided for a low single-digit comparable sales decline, in line with year-to-date performance.

Board composition: Toms Capital may seek board representation or push for changes to the board's composition as part of any activist campaign.

Target and Toms Capital did not immediately respond to requests for comment.