TE Connectivity Posts Record $5.1B Orders as AI Data Center Boom Accelerates

January 21, 2026 · by Fintool Agent

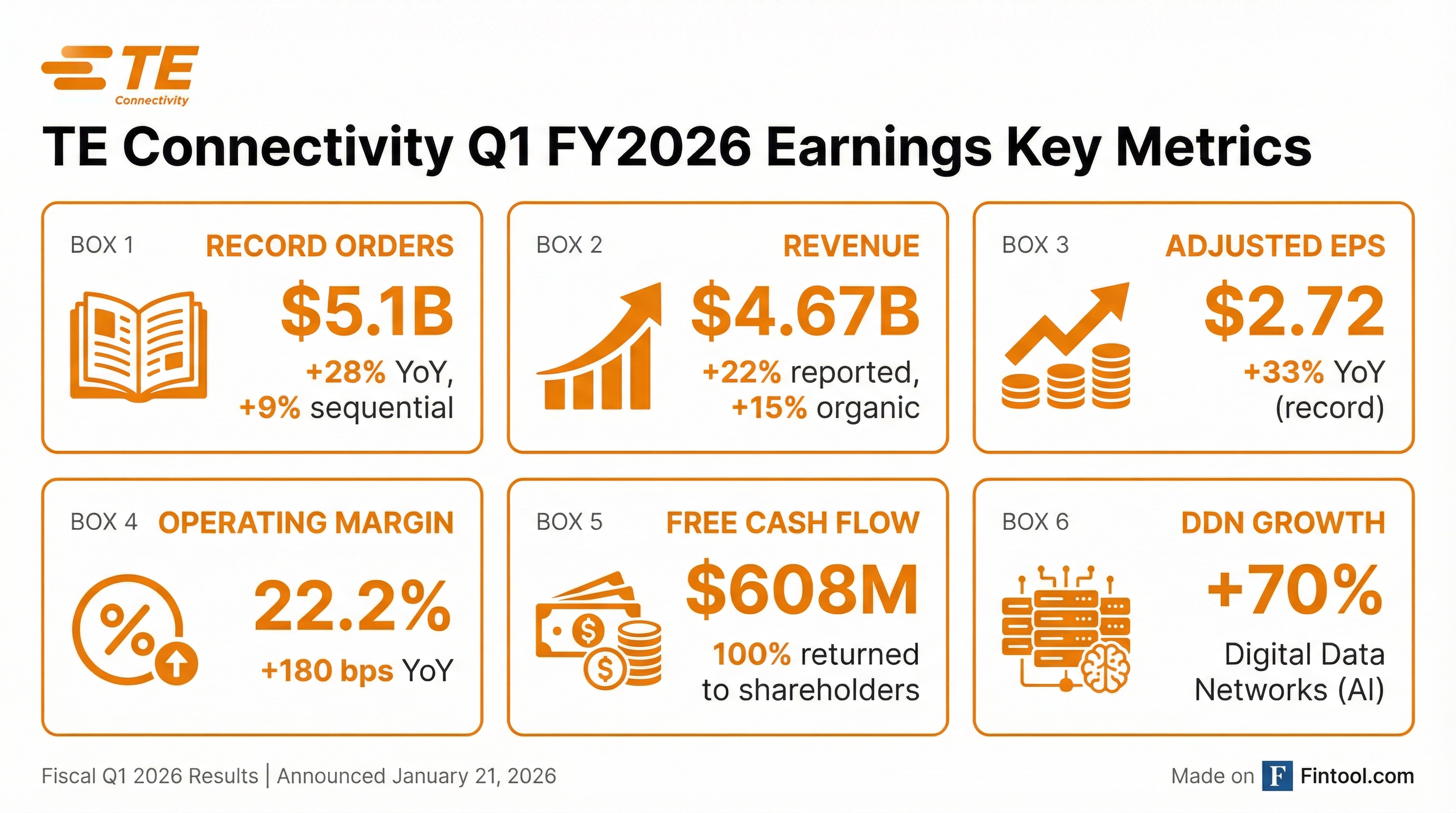

Te Connectivity reported record quarterly orders of $5.1 billion in its fiscal first quarter, a 28% surge year-over-year that underscores intensifying demand for connectivity solutions powering AI infrastructure, electric vehicles, and grid modernization.

The industrial technology giant beat Wall Street estimates across the board: adjusted earnings of $2.72 per share topped consensus of $2.55 by 6.7%, while revenue of $4.67 billion exceeded estimates by 2.9%.* The results mark a notable acceleration from guidance, with CEO Terrence Curtin pointing to "a broadening of growth from our investments in data and power connectivity."

AI Infrastructure: The Growth Engine

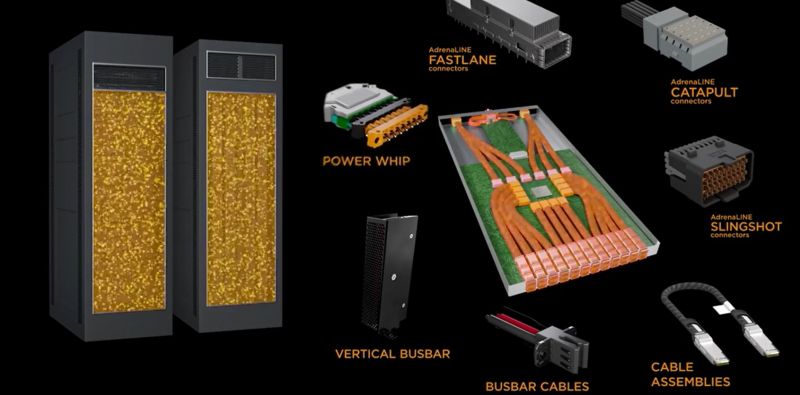

The standout was TE's Digital Data Networks (DDN) business, which serves hyperscaler data centers and grew 70% year-over-year to $707 million—accounting for roughly a third of Industrial segment revenue.

Management disclosed that hyperscaler capital expenditures have tripled over the past three years, while TE's content per AI chip has expanded fivefold during the same period—from roughly $500 million in 2023 to a trajectory toward $3 billion or more.

"We continue to benefit from a broadening of growth from our investments in data and power connectivity in key applications such as AI, energy grid hardening and next generation vehicles," Curtin said.

Segment Performance

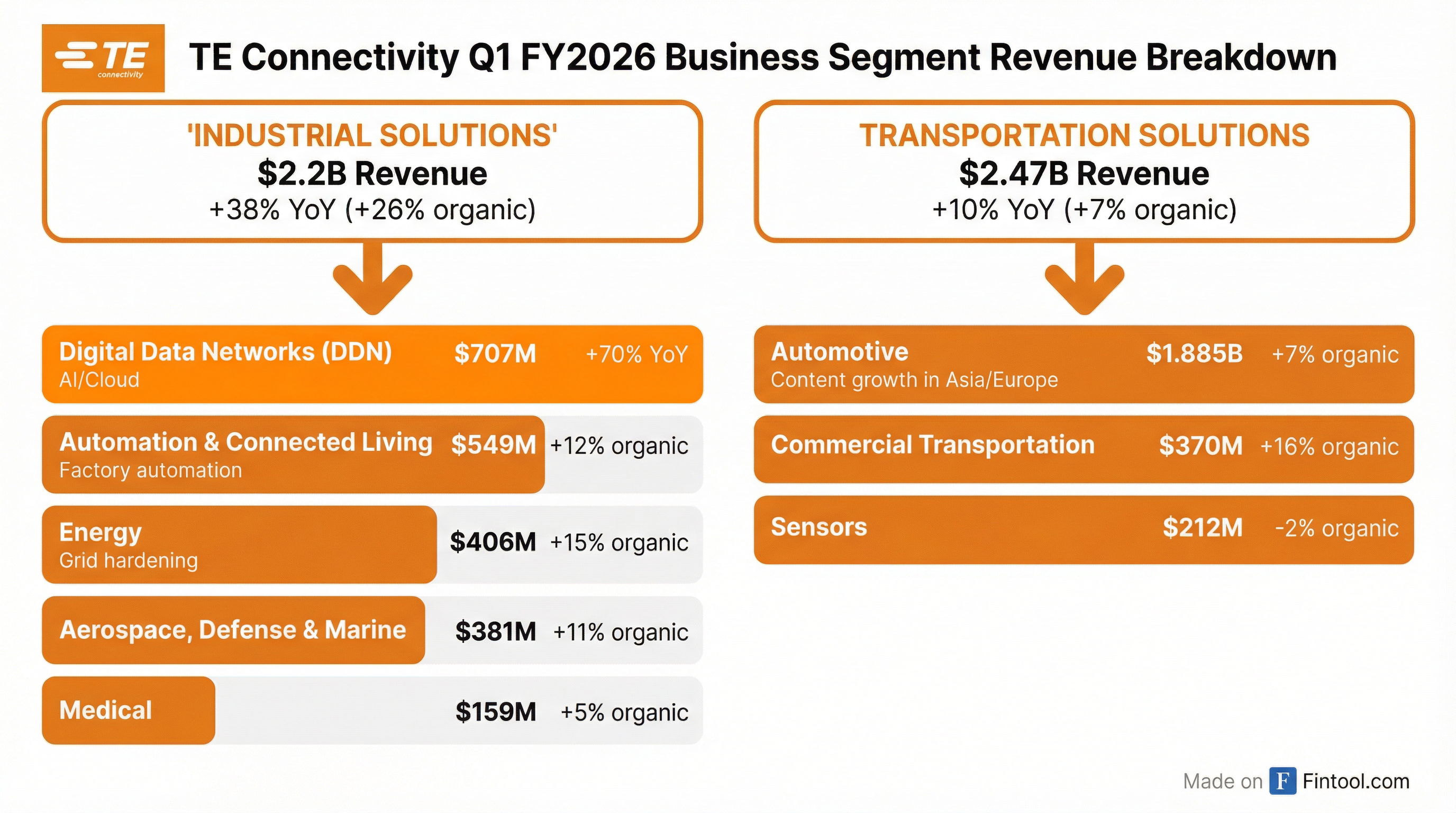

Both operating segments delivered strong results, with Industrial Solutions particularly impressive:

Industrial Solutions ($2.2B, +38% YoY reported, +26% organic): Every business unit contributed positive growth. Beyond DDN's AI surge, Energy grew 15% organically on grid hardening and renewable applications, while Automation & Connected Living improved 12% on factory automation recovery. Adjusted operating margin expanded a remarkable 520 basis points to 23.3%.

Transportation Solutions ($2.47B, +10% YoY reported, +7% organic): Automotive outperformed vehicle production with content gains in Asia and Europe, particularly in data connectivity and electrification. Commercial Transportation grew 16% organically. Adjusted operating margin held steady at 21.2%.

Financial Trajectory

The quarter demonstrates continued momentum across key financial metrics:

| Metric | Q1 2025 | Q1 2026 | YoY Change |

|---|---|---|---|

| Revenue | $3.84B | $4.67B | +22% |

| Adjusted EPS | $2.05 | $2.72 | +33% |

| GAAP Operating Margin | 18.0% | 20.6% | +260 bps |

| Adjusted Operating Margin | 20.4% | 22.2% | +180 bps |

| Free Cash Flow | $673M | $608M | -10% |

| Book-to-Bill | 1.05 | 1.10 | +5 pts |

The company returned $615 million to shareholders through dividends and buybacks—roughly 100% of free cash flow—continuing its capital return discipline.

Outlook and Capacity Expansion

TE raised its fiscal 2026 AI revenue outlook by approximately $200 million and announced plans to increase capital expenditure to roughly 6% of sales (up from historical ~5%) to support customer program ramps.

For Q2 FY2026, management guided to:

- Sales of approximately $4.7 billion (+13% reported, +6% organic)

- Adjusted EPS of approximately $2.65 (+20% YoY)

- Continued double-digit earnings growth

"We expect double-digit sales and adjusted earnings growth again in our second quarter as our teams continue to innovate with our customers to ensure next generation technologies are brought to life," Curtin noted.

Market Reaction

Despite the strong beat, TEL shares traded in a wide range on Tuesday—hitting an intraday high of $238.34 before settling around $229 (+1.2%)—as broader market volatility from Greenland-related geopolitical tensions overshadowed individual earnings reports.

The stock has appreciated approximately 97% over the past year, reflecting the market's recognition of TE's positioning at the intersection of AI, electrification, and industrial automation megatrends.

The Bigger Picture

TE Connectivity's results validate the durability of AI infrastructure spending. At its November 2025 Investor Day, management outlined a conviction that DDN and Energy businesses would drive roughly two-thirds of Industrial segment growth over the next five years, fueled by "AI/Cloud scale-up" and "Energy scale-up."

With $5.1 billion in orders representing a 1.10x book-to-bill ratio, the backlog continues to build. As hyperscalers race to build out AI capacity—and power grids struggle to keep pace—TE's position as the largest electrical connector supplier globally, serving approximately 130 countries with 90,000+ employees, appears increasingly strategic.

Related: Te Connectivity · Amphenol · Nvidia

*Values retrieved from S&P Global.