Texas Instruments Adds Data Center Segment After 70% Growth, Guides Above Consensus as Analog Chip Recovery Takes Hold

January 27, 2026 · by Fintool Agent

Texas Instruments delivered what analysts are calling a pivotal earnings report Tuesday, adding data center as a standalone end market for the first time after 70% year-over-year growth in Q4 and guiding Q1 above consensus expectations—the first above-seasonal first quarter guidance in roughly 15 years.

TXN shares surged approximately 9% in after-hours trading to around $196, extending year-to-date gains to nearly 11%. The move signals a potential inflection point for the broader analog semiconductor industry, which has endured a brutal two-year inventory correction.

"With the inventory correction that has plagued the industry during the last two years essentially complete, we believe the company is well positioned to see acceleration of growth as we move throughout 2026," Stifel analyst Tore Svanberg said.

Data Center Emerges as Third Growth Pillar

The headline move: TI is now breaking out data center as a separate end market, joining industrial, automotive, personal electronics, and communications equipment. It's a structural recognition that AI demand has grown too large to bury in other segments.

"To better reflect the growth opportunities we see for our analog and embedded products, we reorganized our end markets to include data center, which includes sectors related to data center compute, data center networking, and rack power and thermal management," CEO Haviv Ilan said on the earnings call.

The numbers tell the story of the segment's rapid rise:

| Metric | Q4 2025 | FY 2025 |

|---|---|---|

| Data Center Revenue | $450M | $1.5B |

| YoY Growth | 70% | 64% |

| % of Total Revenue | 9% | 9% |

Unlike Nvidia, which dominates with GPUs for AI training and inference, TI plays a supporting but critical role. Its analog chips handle power management, signal conversion, and thermal control—functions that become more important as data centers scale.

"Most of our business is based on the analog side. Between power and signal chain, I would say it's maybe a little bit more power, but both are very strong," Ilan explained. "If you look at the rack and you open it up, there are thousands of different parts, and many of them are analog and embedded parts."

Q1 Guidance: First Above-Seasonal in 15 Years

TI's Q1 guidance came in notably above Street expectations:

| Metric | Q1 2026 Guidance | Consensus | Beat |

|---|---|---|---|

| Revenue | $4.32B-$4.68B | $4.42B | +$80M at midpoint |

| EPS | $1.22-$1.48 | $1.26 | +$0.09 at midpoint |

When asked what's driving the strength, Ilan pointed to two factors: industrial recovery and data center growth.

"Industrial is now up close to 20% year-over-year, but remember, it still has a lot of room to go when you think about the previous peaks—about 25% from where we were in 2022," Ilan said.

On pricing: "The answer is no. It's not pricing related. We're just seeing growing orders."

CFO Rafael Lizardi added color on the order book: "We did see revenue linearity through the quarter improve. Month one to month two to month three, we did see it continue to build. Same with backlog. And our turns business—when a customer comes in and wants an order shipped right away—we continue to see that run at higher levels."

Q4 Results: Beating on Profitability

Fourth quarter results came in roughly in-line on revenue but beat on profitability:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $4.42B | $4.01B | +10% |

| Gross Margin | 56% | 58% | -200 bps |

| Operating Profit | $1.5B | $1.4B | +7% |

| EPS | $1.27 | $1.31* | -3% |

Revenue by end market showed the diversification of growth drivers:

| End Market | Q4 2025 YoY | FY 2025 Revenue | % of Total |

|---|---|---|---|

| Industrial | +18% | $5.8B | 33% |

| Automotive | +upper single digits | $5.8B | 33% |

| Data Center | +70% | $1.5B | 9% |

| Personal Electronics | -upper teens | $3.7B | 21% |

| Communications | -low single digits | $0.5B | 3% |

"Industrial, automotive, and data center combined made up about 75% of TI's revenue in 2025, up from about 43% in 2013," Ilan noted—a decade-long transformation toward higher-margin, stickier end markets.

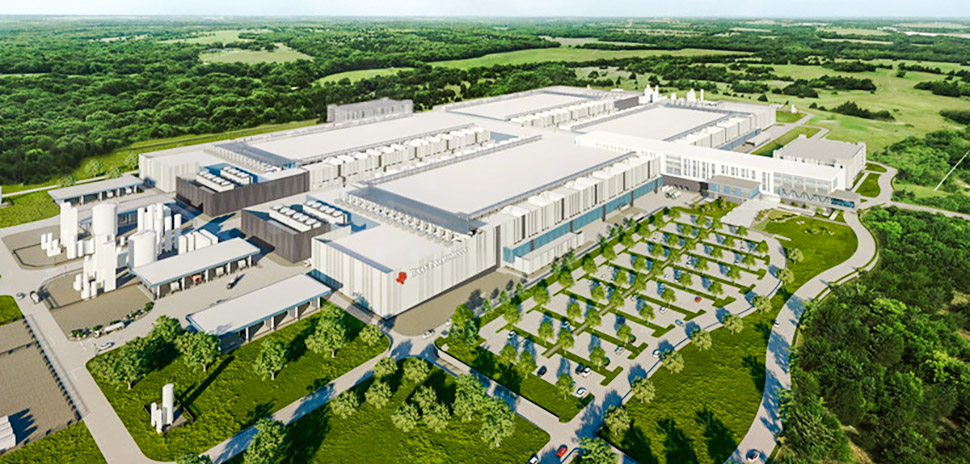

Sherman Fab: Ahead of Schedule

TI's $30 billion Sherman, Texas manufacturing complex—the cornerstone of its long-term capacity strategy—is ramping ahead of plan.

"We are very pleased about the execution in Sherman. It's actually ramped ahead of schedule, high yields. We also see with the new equipment that we have, really, the factory is more capable than we originally hoped," Ilan said.

The facility uses TI's advanced BCD (Bipolar-CMOS-DMOS) process technology—critical for power management chips destined for data centers. New products sampling from Sherman target the V-core voltage regulator socket, one of the largest opportunities in AI accelerators.

"TI is building the technology in Sherman, Texas. This is where our BCD process is serving us very well. That product is sampling, and we expect our opportunity in data center to further expand in the coming years," Ilan said.

Capital allocation guidance for 2026:

- CapEx: $2B-$3B (down from $4.6B in 2025 as the build cycle winds down)

- Depreciation: $2.2B-$2.4B

- CHIPS Act direct funding: Up to $1.6B expected across milestones

- Investment Tax Credit: Now 35% on qualifying 2026 CapEx

The Bigger Picture: End of the Analog Winter

TI's results carry implications beyond one company. The analog semiconductor industry has been mired in an inventory correction since mid-2022, when pandemic-era overstocking gave way to destocking across nearly every end market.

Free cash flow tells the story of recovery: TI generated $2.9B in 2025, up 96% from 2024, as the combination of revenue recovery and declining CapEx begins to flow through.

"We are at a point where all this capacity we've put in place and the inventory that we've positioned is going to serve us well," Ilan said. "End equipments are being redesigned with more semis every day. It will continue to be the case in the future."

For investors watching the analog space—including Analog Devices, On Semiconductor, and Microchip Technology—TI's results suggest the worst may be over.

What to Watch

-

Data center sustainability: Can TI maintain 50%+ growth as the segment becomes more material? Management expects continued momentum "as long as CapEx continues to be invested in data centers."

-

Industrial trajectory: Q1 guidance assumes continued recovery, but Ilan cautioned the market "has been jittery in the last 12 months."

-

Pricing discipline: TI expects low single-digit price declines again in 2026, even as some competitors raise prices. "If anything changes with pricing, TI will respond. But right now, that's our assumption."

-

February capital management call: TI will provide more detail on capacity plans and capital allocation on February 24.

Related Companies: Texas Instruments · Nvidia · Analog Devices · On Semiconductor · Microchip Technology