Titan International CEO Says Agentic AI Is 'A Good Fit' for Mid-Cap Manufacturers

February 5, 2026 · by Fintool Agent

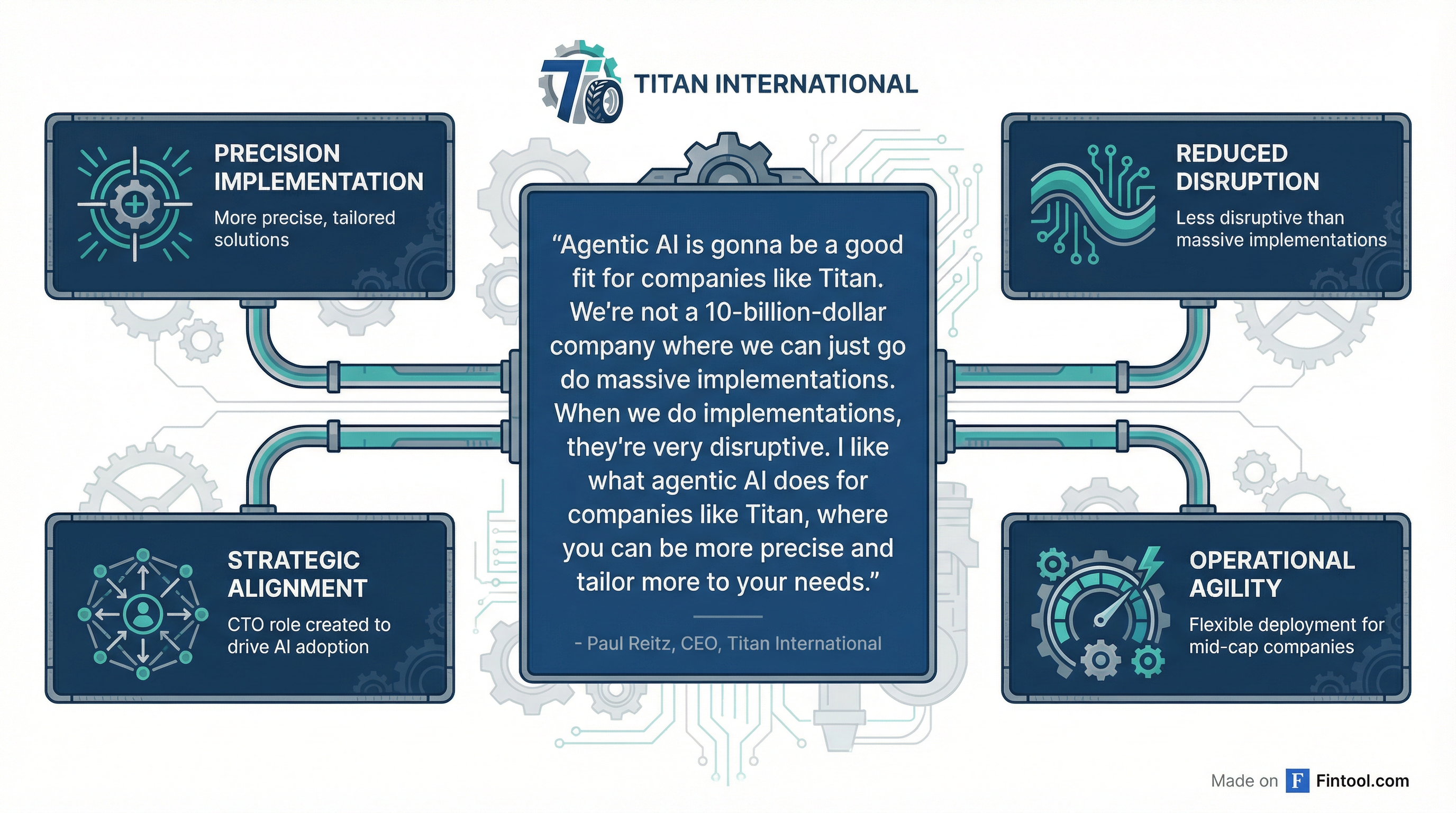

Titan International CEO Paul Reitz made headlines at the Noble Capital Markets Emerging Growth Virtual Equity Conference today, telling investors that "agentic AI is gonna be a good fit for companies like Titan" as the off-highway tire and wheel manufacturer positions itself for technology-driven transformation amid an extended agricultural equipment downturn.

The comments came during a fireside chat with Noble Capital's Joe Gomes, where Reitz explained why the $690 million market cap company recently created a Chief Transformation Officer role specifically to accelerate AI adoption—a strategic bet that smaller manufacturers can implement AI more effectively than their larger peers.

"We're not a 10-billion-dollar company where we can just go do massive implementations," Reitz said. "When we do implementations, they're very disruptive. I like what agentic AI does for companies like Titan, where you can be more precise and tailor more to your needs."

Leadership Reshuffled for AI Push

The agentic AI strategy is already reshaping Titan's C-suite. In December 2025, the company announced that longtime CFO David Martin would transition to a newly created Senior Vice President & Chief Transformation Officer role, overseeing IT alignment, AI adoption, human capital, and risk management initiatives.

Tony Eheli, previously Chief Accounting Officer, was promoted to CFO, while Jim Pach moved from Corporate Controller to CAO—all internal promotions that Reitz highlighted as evidence of the company's bench strength.

"It's a great opportunity for Titan. When you have the strong team and you're able to make a change like that, that's not the norm," Reitz told conference attendees. "You would typically have to go outside the company, especially if you're looking for a CTO, looking for a CFO. But at Titan, we've built a great team."

The message to investors: Martin's seven years repositioning Titan's financial foundation now frees him to lead the company's technology transformation, while Eheli—with experience from Danaher and PwC—takes the financial reins.

Why Agentic AI for a Tire Manufacturer?

Reitz's embrace of agentic AI—autonomous AI systems that can execute multi-step tasks with minimal human oversight—reflects a growing recognition among mid-cap industrials that traditional enterprise software implementations often prove too costly and disruptive for companies of their scale.

For Titan, which produces wheels, tires, and undercarriage products across 20+ manufacturing locations globally for agricultural, construction, and consumer equipment, the AI opportunity spans operations, supply chain, and customer service. The company's "one-stop shop" strategy—servicing everything from lawn mowers to the largest agricultural combines—creates a complex product portfolio that could benefit from AI-driven optimization.

"We're shifting how we approach technology. You can read about it, you can talk about it, but if you don't have the resources to execute, then you're just dreaming," Reitz said. "We're really putting David into a role where he's gonna be focused on how we drive AI innovation."

Stock Near 52-Week Highs Despite Ag Downturn

Despite an extended agricultural equipment downturn that has pressured sales at John Deere and CNH Industrial, Titan's stock has rallied to near 52-week highs:

The stock closed at $10.79 on February 5, up 1.3% on the day and trading 82% above its 52-week low of $5.93. At $10.94, shares touched a new 52-week high earlier in the session.

| Metric | Value |

|---|---|

| Current Price | $10.79 |

| 52-Week High | $10.94 |

| 52-Week Low | $5.93 |

| Market Cap | $690M |

| 50-Day Avg | $8.49 |

| 200-Day Avg | $8.33 |

Data as of February 5, 2026

Investors appear to be crediting Titan's tariff positioning—the company has won three International Trade Commission cases against unfair import practices—and its balance sheet discipline through the cycle.

Navigating the Agricultural Equipment Trough

Reitz acknowledged the challenging backdrop in large agricultural equipment, where Deere has projected 2026 as "the bottom of the large ag cycle" and CNH Industrial has cut production to avoid inventory gluts.

"Boy, ag has been a wild ride," Reitz told the conference. "It's been this inventory balancing issue... I think inventories are getting more balanced, and so we've seen some customers come to us throughout 2025 and put in drop-in orders because they need to get inventory balanced again."

The CEO highlighted relative bright spots:

- Small ag performing better with continued improvement expected through 2026

- Brazil had a strong 2025 and is holding up heading into 2026

- Construction showing positive signs in Brazil, Australia, and the U.S.

- Consumer holding up with new product innovation driving demand

For large ag—Titan's most watched segment due to the size of equipment—Reitz said a turnaround depends partly on government action: "The government's gonna have to realize they got to pay attention to farmers... I like what Secretary Vilsack's been saying. It's on their radar."

Quarterly Financial Snapshot

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $390.2 | $482.2 | $532.2 | $448.0 | $383.6 | $490.7 | $460.8 | $466.5 |

| EBITDA ($M)* | $31.3 | $43.6 | $38.0 | $15.8 | $(7.6) | $28.1 | $27.2 | $27.0 |

| EBITDA Margin* | 8.0% | 9.0% | 7.1% | 3.5% | (2.0%) | 5.7% | 5.9% | 5.8% |

| Net Income ($M) | $(2.6) | $9.2 | $2.1 | $(18.2) | $1.3 | $(0.6) | $(4.5) | $(2.3) |

*Values retrieved from S&P Global

Tariffs: 'Emotional Net Benefit,' Awaiting Stability

Reitz offered candid commentary on tariffs, acknowledging that while Titan has historically benefited from trade protections—having won three ITC cases proving unfair imports were harming the company—the current implementation has created challenges.

"The emotional net benefit is there... at least they're recognizing what we already knew, that the world is not a fair place," Reitz said. "The challenge is on the financial side—we've all seen tariffs are horribly messy. The execution or the implementation of them, drawing them on a whiteboard, then erasing them, then changing them... that's not good for any company."

He noted that some competitors have received government assistance to "outwait" the tariff uncertainty, while Titan has had to work through pre-tariff inventory shipped into the U.S. market.

"I think what we look forward to getting the financial benefit from tariffs is gonna be when the world stabilizes around what the tariff policy is," Reitz added. "We can't keep having uncertainty around tariffs. We got to get a policy and stick to it."

Capital Allocation: Discipline Through the Cycle

With large ag expected to remain challenged through at least the first half of 2026, Titan is maintaining tight balance sheet discipline. The company ended Q3 2025 with $205 million in cash and $709 million in total debt.

"We know the first half of the year with large ag is still continuing to be in a tough place, and so we gotta be very disciplined with our balance sheet," Reitz said. "Small cap companies going through the couple years of a downturn like we have with our primary segment in ag, to still have a strong balance sheet is a sign of strength for Titan."

Priorities remain focused on:

- Safety, environmental, and maintenance capital

- Continued investment in product development and innovation

- Balance sheet discipline and debt reduction

- Being positioned for M&A opportunities

What to Watch

The Noble Capital conference provided a clear roadmap for monitoring Titan's transformation:

- AI implementation milestones: With Martin now focused full-time on transformation, investors should watch for specific AI deployments in operations, manufacturing efficiency, and customer service

- Tariff policy stabilization: Titan's financial benefit from trade protection depends on consistent, predictable policy

- Large ag inflection: The company sees production upticks before equipment sales—early indicator of cycle turning

- LSW adoption: Titan's proprietary low sidewall tire technology, which Reitz said improves yields by 30%+ at turns, continues expanding into mid-sized farms

For a company navigating an extended industry downturn, Titan's bet on agentic AI represents an unconventional path to operational efficiency—one that its CEO argues plays to mid-cap manufacturers' strengths rather than exposing their resource constraints.

Related

Conference: Noble Capital Markets Emerging Growth Virtual Equity Conference, February 5, 2026. Fireside chat conducted by Joe Gomes, Managing Director and Senior Analyst, Noble Capital.