TPG Rise Climate Acquires Sabre Industries in $3.5B Deal, Betting on AI-Driven Power Demand

February 6, 2026 · by Fintool Agent

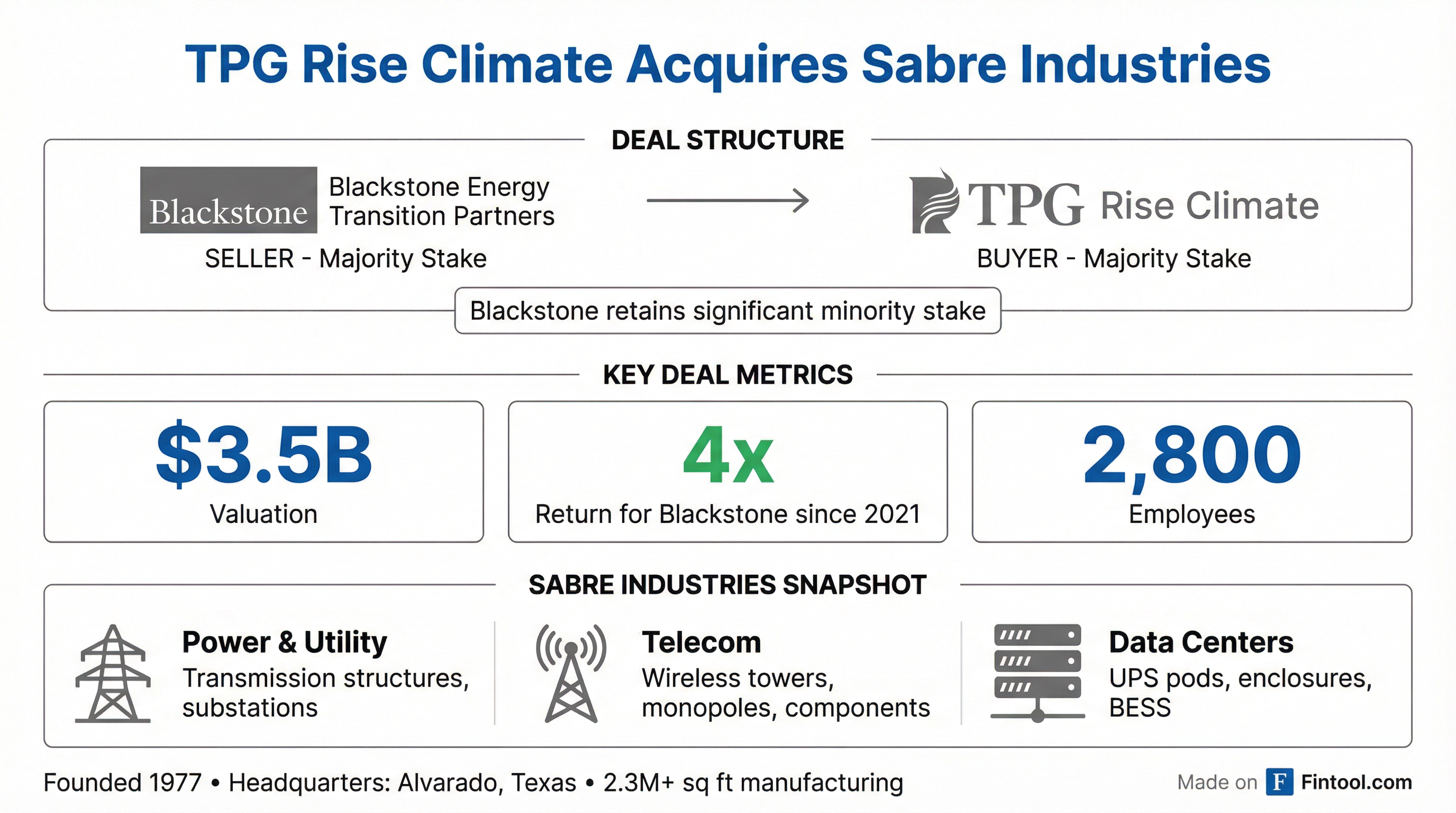

TPG Inc. is making its largest climate infrastructure bet yet, acquiring a majority stake in Sabre Industries for approximately $3.5 billion from Blackstone Inc. . The deal values the Texas-based power infrastructure manufacturer at roughly four times what Blackstone paid in 2021 —a return that underscores the explosive demand for grid modernization as AI data centers strain America's aging electrical infrastructure.

Blackstone will retain a significant minority stake in the company, continuing its partnership with Sabre as the business scales to meet surging demand from utilities, hyperscalers, and telecom operators .

The Power Behind the AI Boom

Sabre Industries sits at a critical nexus of three converging mega-trends: AI-driven data center expansion, grid modernization, and the reshoring of American manufacturing. Founded in 1977 and headquartered in Alvarado, Texas, the company designs, engineers, and manufactures transmission and distribution structures, wireless towers, integrated electrical enclosures, and data center infrastructure through 2.3 million square feet of purpose-built manufacturing space .

The timing is deliberate. U.S. power demand is rising at the fastest pace in decades, driven by the convergence of AI data center expansion, industrial electrification, and reshoring . Data center demand for power is projected to grow threefold by 2030, even as interconnection queues lengthen .

According to a Grid Strategies Report cited in recent earnings calls, U.S. electricity usage could increase by 5-6% annually over the next five years—compared to sub-1% growth over the prior two decades—with data centers accounting for more than half of that growth . Meeting this demand could require the U.S. power sector to build new generation and transmission capacity at more than six times the pace of recent years .

Strategic Rationale: Climate Meets Compute

TPG is acquiring Sabre through TPG Rise Climate, its dedicated climate investing platform. The move aligns with TPG's broader strategy of investing in companies that enable the energy transition while benefiting from secular growth tailwinds.

"TPG Rise Climate's expertise in grid modernization, power equipment, electrification solutions, and data centers, along with their understanding of the needs facing the businesses we serve, makes them the right partner to support the continued scaling and manufacturing enhancements across all aspects of our business," said Timothy Rossetti, CEO and President of Sabre Industries .

Sabre's utility business—its largest segment—supports the modernization and reliability of America's electrical grid. But its integrated enclosures are increasingly deployed for large-scale data center projects, positioning the company at the intersection of climate infrastructure and AI compute buildout .

| Business Segment | Products & Solutions |

|---|---|

| Power & Utility | Transmission structures, substations, light duty structures, coatings |

| Telecom | Self-supporting towers, monopoles, guyed structures, small cell solutions |

| Building Systems | UPS pods, integrated equipment skids, battery storage (BESS), electrical houses |

A 4x Return for Blackstone

For Blackstone, the transaction marks a successful exit from a 2021 investment that capitalized on the early stages of the grid modernization wave. The $3.5 billion valuation represents approximately a 4x multiple on Blackstone's original investment .

Blackstone Energy Transition Partners has committed over $27 billion of equity globally across the energy sector, focusing on control-oriented investments in businesses that deliver reliable, affordable, and cleaner energy .

Blackstone's decision to retain a minority stake signals continued conviction in Sabre's growth trajectory as demand for power infrastructure accelerates.

Market Reaction

TPG shares rose 1.5% to $54.11 on Friday following the announcement, while Blackstone gained 0.5% to $127.50. TPG has traded between $37.52 and $70.38 over the past year, with shares currently sitting below their 50-day moving average of $62.95.

| Metric | TPG Inc. | Blackstone Inc. |

|---|---|---|

| Market Cap | $20.8B | $153.1B |

| FY 2025 Revenue | $2.4B* | $10.0B |

| FY 2025 Net Income | $185M | $3.0B |

| Total Assets | $13.5B | $47.7B |

*Values retrieved from S&P Global

The Bigger Picture: Grid Constraints Define the AI Race

The Sabre acquisition reflects a broader recognition across capital markets that power infrastructure—not just chips—will determine who wins the AI race. Hyperscalers are increasingly making leasing decisions based on who can secure and deliver power capacity on a predictable schedule .

Baker Hughes projects global power demand will double to approximately 60,000 terawatt-hours by 2040, with data center power demand increasing at a 12% CAGR through 2040 as AI workloads scale . The next wave of demand is projected to run at load factors close to 96%—compared to the system-wide average of 60%—creating unprecedented strain on transmission infrastructure .

This dynamic has attracted capital from across the private equity landscape. The Sabre deal follows a surge of infrastructure transactions as firms position for multi-decade tailwinds in electrification, grid hardening, and distributed power.

What to Watch

- Integration timeline: TPG has not disclosed specific synergy targets or operational changes planned for Sabre

- Capacity expansion: Whether Sabre will expand beyond its current 2.3 million sq ft manufacturing footprint to meet demand

- Data center share: How quickly Sabre's building systems segment—which serves hyperscalers—grows relative to its legacy utility and telecom businesses

- IPO potential: Whether TPG positions Sabre for a public listing once scale and margins reach optimal levels

Related Companies: TPG Inc. | Blackstone Inc.