Earnings summaries and quarterly performance for TPG.

Executive leadership at TPG.

Jon Winkelried

Chief Executive Officer

Anilu Vazquez-Ubarri

Chief Operating Officer

Jack Weingart

Chief Financial Officer

James Coulter

Executive Chair

Jennifer Chu

Chief Legal Officer and General Counsel

Joann Harris

Chief Compliance Officer

Todd Sisitsky

President

Board of directors at TPG.

David Trujillo

Director

Deborah Messemer

Independent Director

Ganen Sarvananthan

Director

Gunther Bright

Independent Director

Jeffrey Rhodes

Director

Kathy Elsesser

Independent Director

Kelvin Davis

Director

Mary Cranston

Independent Director

Nehal Raj

Director

Research analysts who have asked questions during TPG earnings calls.

Glenn Schorr

Evercore ISI

6 questions for TPG

Michael Cyprys

Morgan Stanley

6 questions for TPG

Brian Bedell

Deutsche Bank

5 questions for TPG

Alexander Blostein

Goldman Sachs

4 questions for TPG

Craig Siegenthaler

Bank of America

4 questions for TPG

Kenneth Worthington

JPMorgan Chase & Co.

4 questions for TPG

Arnaud Giblat

BNP Paribas

3 questions for TPG

Brennan Hawken

UBS Group AG

3 questions for TPG

Michael Brown

Wells Fargo Securities

3 questions for TPG

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for TPG

Ben Budish

Barclays PLC

2 questions for TPG

Ken Worthington

JPMorgan

2 questions for TPG

Kyle Voigt

Keefe, Bruyette & Woods

2 questions for TPG

Mike Brown

UBS

2 questions for TPG

Brian McKenna

Citizens JMP Securities

1 question for TPG

Dan Fannon

Jefferies & Company Inc.

1 question for TPG

Daniel Fannon

Jefferies Financial Group Inc.

1 question for TPG

Steven Chubak

Wolfe Research

1 question for TPG

William Katz

TD Cowen

1 question for TPG

Recent press releases and 8-K filings for TPG.

- TPG Operating Group II, L.P., an indirect subsidiary of TPG Inc., completed an offering of $500,000,000 aggregate principal amount of 4.875% Senior Notes due 2031 on February 26, 2026.

- The Notes bear an annual interest rate of 4.875%, with semi-annual payments commencing November 15, 2026, and will mature on May 15, 2031.

- These notes are unsecured and unsubordinated obligations of the Issuer, fully and unconditionally guaranteed by TPG Inc. and its other indirect subsidiaries.

- The offering generated gross proceeds of $499,570,000 from an issue price of 99.914% of the principal amount.

- The expected credit ratings for the notes are Moody's: A3, S&P: BBB+, and Fitch: A-.

- Verallia reported 2025 revenue of €3,331 million, a -3.6% decrease compared to 2024, with adjusted EBITDA reaching €692 million and a 20.8% margin.

- Free cash flow for 2025 doubled to €166 million from €83 million in 2024, while the net debt ratio increased to 2.7x adjusted EBITDA as of December 2025, up from 2.1x in December 2024.

- The company's Board of Directors decided to propose a €1.00 per share dividend for the 2025 financial year, with an option for shareholders to receive it in cash or new shares.

- For 2026, Verallia anticipates an adjusted EBITDA of around €700 million and a free cash flow of approximately €220 million.

- Verallia is considering adapting its industrial footprint in Europe, including the closure of a site in Germany, the shutdown of a furnace in France, and the shutdown of a furnace in the United Kingdom in parallel with the restart of a more efficient one nearby.

- TPG Operating Group II, L.P., an indirect subsidiary of TPG, priced a registered public offering of $500,000,000 aggregate principal amount of 4.875% senior notes due 2031.

- The notes will bear interest at a rate of 4.875% per year, with semi-annual payments beginning on November 15, 2026.

- The offering is expected to close on February 26, 2026, and the net proceeds will be used to pay down outstanding debt under its revolving credit facility and for general corporate purposes.

- TPG Inc. announced that its indirect subsidiary, TPG Operating Group II, L.P., intends to offer senior notes due 2031 in a registered public offering.

- The net proceeds from this offering are planned to pay down outstanding debt under its revolving credit facility and for general corporate purposes.

- Wells Fargo Securities, LLC, BofA Securities, Inc., and Morgan Stanley & Co. LLC are acting as joint book-running managers for the offering.

- TPG Inc. and Jackson Financial Inc. have closed a long-term strategic investment management partnership.

- Under the agreement, TPG will manage a minimum commitment of $12 billion of Assets Under Management (AUM) for Jackson, with economic incentives aligned to a long-term target of $20 billion, under a 10-year initial term.

- TPG made a $500 million minority investment in Jackson, acquiring 4,715,554 shares of Jackson's common stock, which represents an approximate 6.5% common equity stake.

- Additionally, TPG issued 2,279,109 shares of TPG Class A common stock to a wholly owned, indirect subsidiary of Jackson.

- TPG reported a "breakout year" in 2025, raising $51 billion in capital, a 70% increase from the prior year, and growing Fee Related Earnings (FRE) to approximately $950 million.

- The firm is strategically diversifying its Asset Under Management (AUM), with private equity now representing about 50% of total AUM, down from 80% four years ago, and aims to raise over $50 billion in 2026 with an expected FRE margin of 47%.

- TPG is expanding its private wealth channel with TPOP, which has raised approximately $1.5 billion by the end of January since its launch in June last year, and is growing its insurance business through a strategic partnership with Jackson Financial for a long-term investment management agreement starting at $12 billion.

- The credit business, significantly bolstered by the Angelo Gordon acquisition, raised $20 billion in 2025 and is evolving with new initiatives in investment-grade asset-backed finance and TPG Advantage Direct Lending.

- TPG reported a "breakout year" in 2025, with $51 billion in capital raised (a 70% increase from $30 billion in 2024), $50 billion deployed, FRR growing to $2.1 billion, and FRE reaching $950 million.

- For 2026, TPG targets over $50 billion in fundraising and expects its FRE margin to expand to about 47% from 45% in 2025.

- The firm is diversifying its growth beyond private equity, with AUM in private equity now 50% (down from 80% at IPO), and significant expansion in credit (raised $20 billion in 2025) and real estate (at least four funds in market for 2026).

- Key strategic initiatives include a $12 billion (potentially $20 billion) insurance partnership with Jackson Financial and the successful launch of the private wealth product TPOP, which raised $1.5 billion by January 2026.

- TPG reported a "breakout year" in 2025, raising approximately $51 billion in capital, a 70% increase from the prior year's $30 billion, and deploying over $50 billion.

- The company anticipates another robust fundraising year in 2026, expecting to raise in excess of $50 billion, and projects its FRE margin to expand to about 47% from 45% in 2025.

- TPG is diversifying its AUM, with private equity now representing about 50% compared to 80% at its 2022 IPO, and plans to launch at least four different real estate funds in 2026.

- The firm launched TPOP in June 2025, a private wealth product that had raised about $1.5 billion by January 2026, and established a strategic insurance partnership with Jackson Financial, starting with a $12 billion investment management agreement.

- TPG reported a strong 2025, raising $51 billion and deploying $52 billion, pushing its assets under management (AUM) to figures between $286 billion and more than $300 billion.

- The firm has approximately $72 billion in dry powder and plans to accelerate investments in 2026, targeting opportunities from market dislocation, including the technology sector.

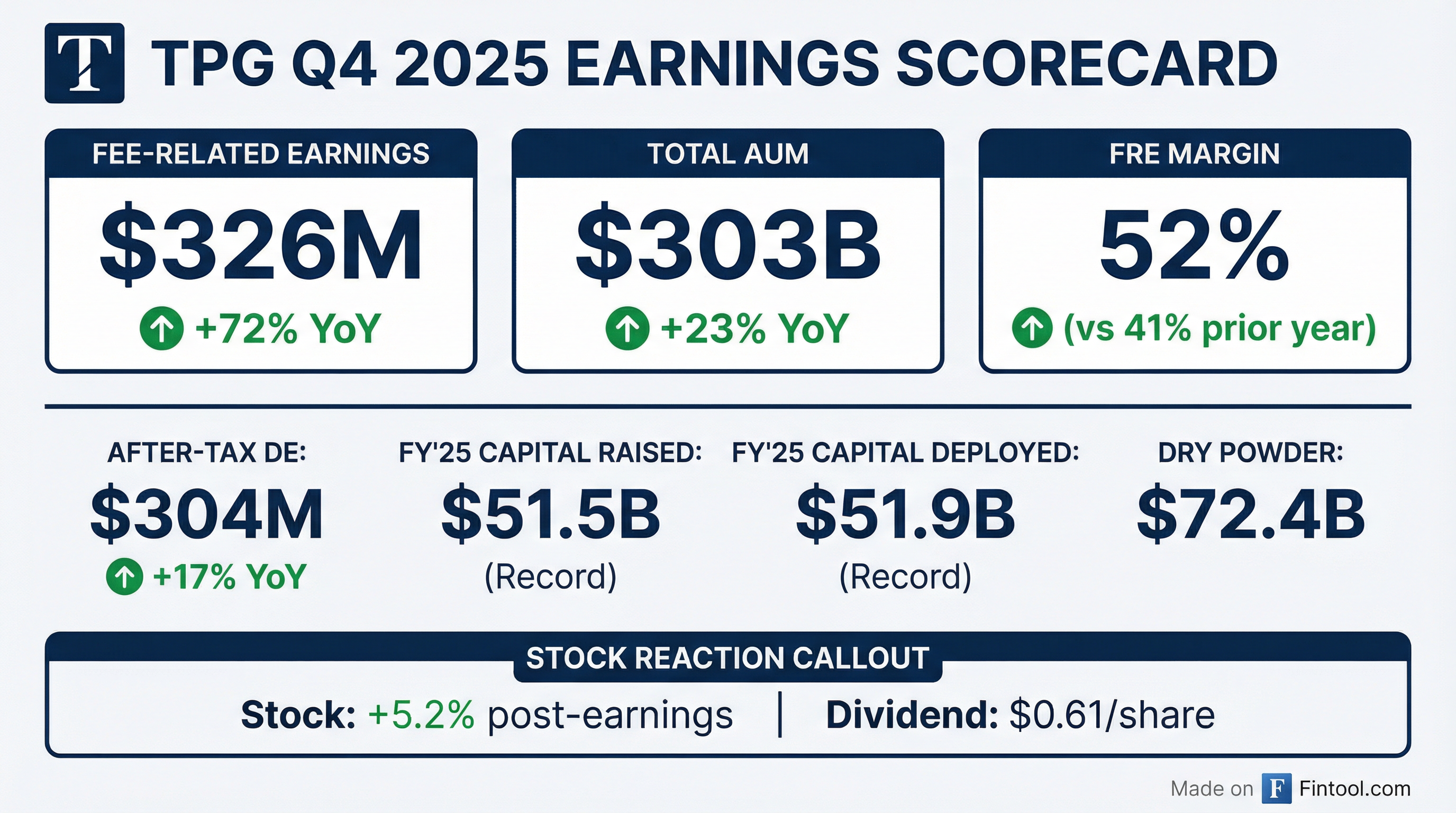

- In Q4, asset-management income jumped sharply to $282 million (compared to $11 million in Q4 2024), fee-related revenue rose 36% year-over-year, and firm-wide AUM grew about 23%.

- TPG's credit platform expanded to about $93 billion by year-end 2025, attracted over $20 billion of new capital, and generated investment returns above 11% for the year.

- TPG declared a quarterly dividend with a record date of February 19, 2026, and a payable date of March 5, 2026.

- TPG reported Net income attributable to TPG Inc. of $77 million for Q4 2025, a significant increase from $13 million in Q4 2024.

- For the full year 2025, the company raised over $51 billion and deployed $52 billion, driving total Assets Under Management (AUM) to over $300 billion.

- Fee-Related Revenues (FRR) for Q4 2025 increased 36% to $628 million compared to Q4 2024, with Fee-Related Earnings (FRE) of $326 million and After-Tax Distributable Earnings (After-tax DE) of $304 million.

- TPG declared a quarterly dividend of $0.61 per share of Class A common stock for Q4 2025, payable on March 5, 2026.

- The company concluded Q4 2025 with $72.4 billion in available capital for deployment.

Fintool News

In-depth analysis and coverage of TPG.

Quarterly earnings call transcripts for TPG.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more