Trump Raises Tariffs on South Korea to 25%, Hammering Auto Stocks

January 26, 2026 · by Fintool Agent

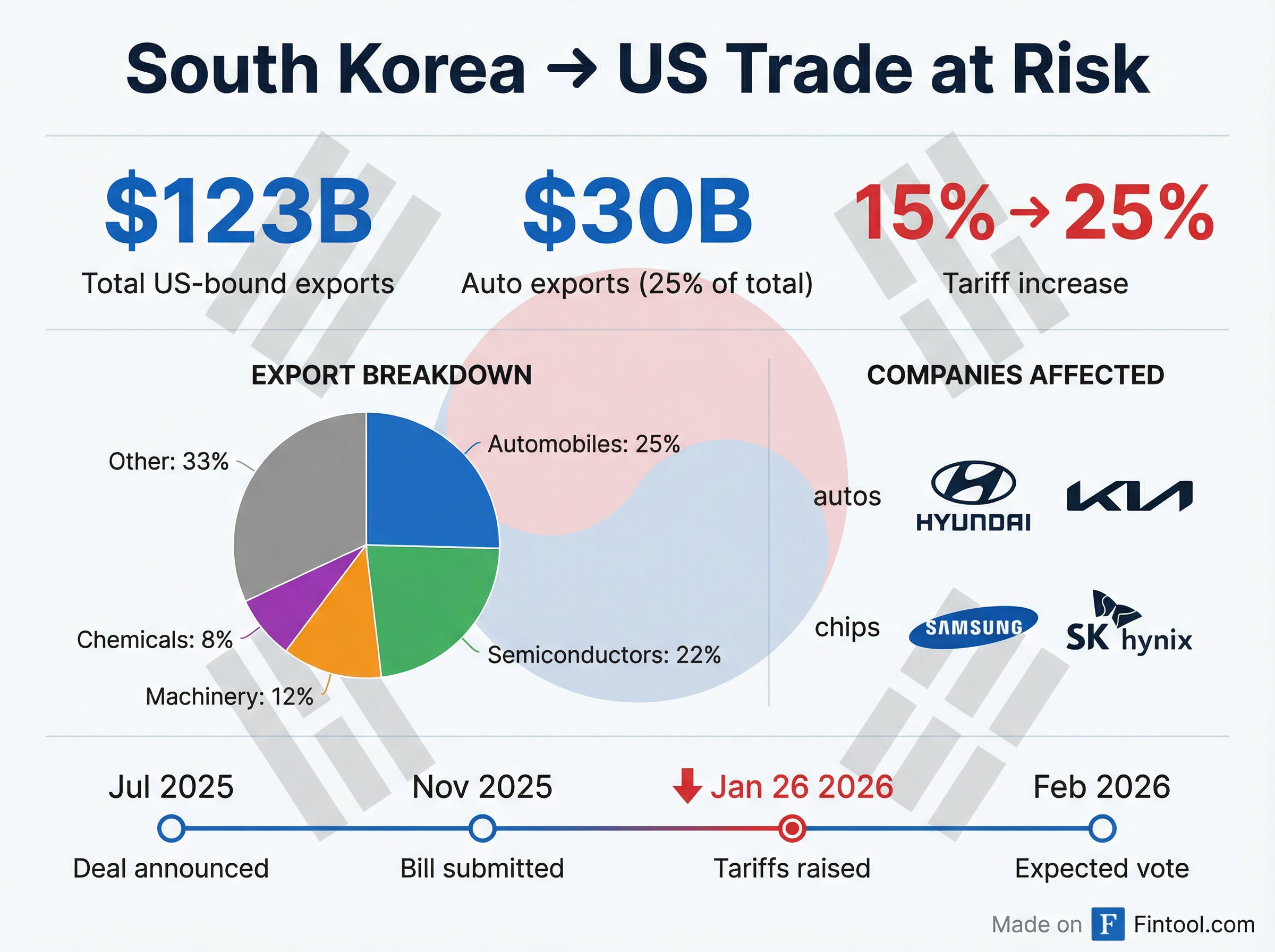

President Trump announced via Truth Social that he is raising tariffs on South Korean imports from 15% to 25%, citing Seoul's failure to ratify last year's trade agreement. The unexpected move sent Korean markets tumbling—with Hyundai falling 3.5% and Kia dropping 4.8%—and puts approximately $30 billion in annual auto exports at risk.

South Korea said it received no official notification of the tariff increase and announced that Industry Minister Kim Jung-kwan would travel to Washington immediately to meet Commerce Secretary Howard Lutnick.

What Triggered the Tariff Hike

The tariff increase stems from a procedural dispute over a trade agreement reached in July 2025. Under that deal, the US lowered tariffs on Korean autos and auto parts from 25% to 15%—putting them on par with Japanese competitors—in exchange for South Korea's commitment to invest $350 billion in US strategic sectors.

The agreement was submitted to South Korea's National Assembly on November 26, 2025, and is currently under review. Korean media reports indicate the bill is likely to pass in February, when the next parliamentary session begins.

Trump, however, grew impatient with the timeline.

"Because the Korean Legislature hasn't enacted our Historic Trade Agreement, which is their prerogative, I am hereby increasing South Korean TARIFFS on Autos, Lumber, Pharma, and all other Reciprocal TARIFFS, from 15% to 25%," Trump wrote on Truth Social.

No executive order has been issued yet, leaving the implementation timeline unclear.

Who Gets Hurt

Korean Automakers

South Korea's auto sector faces the most immediate pain. The country exported $30.2 billion in vehicles to the US in 2025—accounting for 25% of all Korean exports to America—though this was already down 13.2% from 2024 amid earlier trade uncertainty.

Hyundai Motor and affiliate Kia, the dominant Korean automakers, would be hit hardest given their significant US export volumes. Both stocks fell sharply in early trading Tuesday in Seoul.

General Motors

Among US automakers, General Motors has the most at stake. The company operates a substantial manufacturing presence in South Korea, producing approximately 500,000 vehicles annually—most of which are exported to the United States.

GM had already flagged Korea as a material tariff exposure. On its Q2 2025 earnings call, CFO Paul Jacobson disclosed that of the company's estimated $4-5 billion in annual tariff impact, roughly $2 billion stems from Korean operations.

CEO Mary Barra defended the Korean operations but acknowledged uncertainty about their future:

"The operation in Korea... is a very efficient operation that we're very proud of. But we've got to evaluate when we have some certainty with what the tariff will be. So I'm not gonna speculate right now until we know where the agreement between Korea and the United States lands."

GM has taken short-term mitigation steps, including shifting some production to US facilities, and announced a $4 billion investment in domestic manufacturing capacity that would bring the company to producing over 2 million vehicles in the US.

Importantly, Barra noted that vehicles produced in Korea remain "contribution margin positive" and "in high demand"—suggesting the company won't walk away from the operation easily.

Market Reaction

The benchmark KOSPI index fell 0.7% in early Tuesday trading in Seoul, while the Korean won weakened 0.5% against the dollar.

US automaker stocks showed muted reaction on Monday, with GM down 0.3% and Ford down 0.8%—though both were trading before Trump's late-day announcement.

| Metric | GM | Ford |

|---|---|---|

| Market Cap | $74.1B | $52.6B |

| Stock Price | $79.43 | $13.45 |

| Change (Jan 26) | -0.31% | -0.85% |

*Values retrieved from S&P Global.

Broader Trade Context

The Korea tariff threat is the latest in a series of aggressive trade moves by the Trump administration in January 2026:

- Saturday: Trump threatened Canada with 100% tariffs if it pursued a trade deal with China

- Earlier this month: Trump threatened 25% tariffs on eight countries, including the UK, over opposition to US plans regarding Greenland—later walking back the threat

- Ongoing: Tariff frameworks with the European Union remain on pause

The pattern suggests Trump is using tariff threats as negotiating leverage, with actual implementation often delayed or reversed. The Supreme Court is also currently reviewing a landmark case that could constrain presidential tariff authority.

What to Watch

Immediate: Industry Minister Kim Jung-kwan's meetings with Commerce Secretary Lutnick, scheduled for January 28-31. Any signals of compromise could ease tensions.

February: South Korea's National Assembly is expected to vote on ratifying the trade agreement. Passage could render the tariff hike moot if Trump views it as compliance.

Q4 Earnings: Both GM and Ford report earnings this week. Analysts will be listening closely for updated tariff guidance and any changes to Korean operations strategy.

Supreme Court: The ongoing tariff case could fundamentally alter the president's ability to unilaterally raise tariffs, potentially affecting the enforceability of this announcement.