Ubisoft's €1 Billion Reset: 6 Games Killed, Prince of Persia Remake Dead

January 21, 2026 · by Fintool Agent

Ubisoft is taking a €1 billion operating loss to radically restructure itself into five autonomous "Creative Houses," killing six games—including the repeatedly delayed Prince of Persia: The Sands of Time remake—and closing studios in what CEO Yves Guillemot called a necessary move "to build a more focused, efficient and sustainable organization."

Shares rose approximately 8% on the news to €6.77 as investors welcomed the decisive action, though the stock remains down over 90% from its October 2018 all-time high of €24.29.

The Numbers

| Metric | Previous Guidance | New Guidance |

|---|---|---|

| FY26 Net Bookings | €1.9 billion | €1.5 billion |

| FY26 Operating Income | Breakeven | €1 billion loss |

| Cash Reserves (end FY26) | — | €1.25-1.35 billion |

| Net Debt (end FY26) | — | €150-250 million |

| Free Cash Flow | — | Negative €400-500 million |

The €650 million hit from game cancellations and project delays accounts for the bulk of the swing from breakeven to a €1 billion operating loss.

Ubisoft has withdrawn its FY26-27 guidance entirely and will outline new medium-term projections in May 2026.

Six Games Dead, Seven Delayed

The restructuring kills six projects outright:

- Prince of Persia: The Sands of Time remake — announced in 2020, repeatedly delayed, now canceled

- Three unannounced new IPs — including what the company called "innovative" projects

- One mobile title

- One additional unannounced game

Seven additional games received development time extensions "to ensure enhanced quality benchmarks," including an unannounced title originally planned for FY26 that has slipped to FY27.

The Prince of Persia cancellation ends a troubled development that saw the project bounce between studios, miss multiple release windows, and become a symbol of Ubisoft's production difficulties. First announced for a January 2021 release, the remake was delayed four times before today's cancellation.

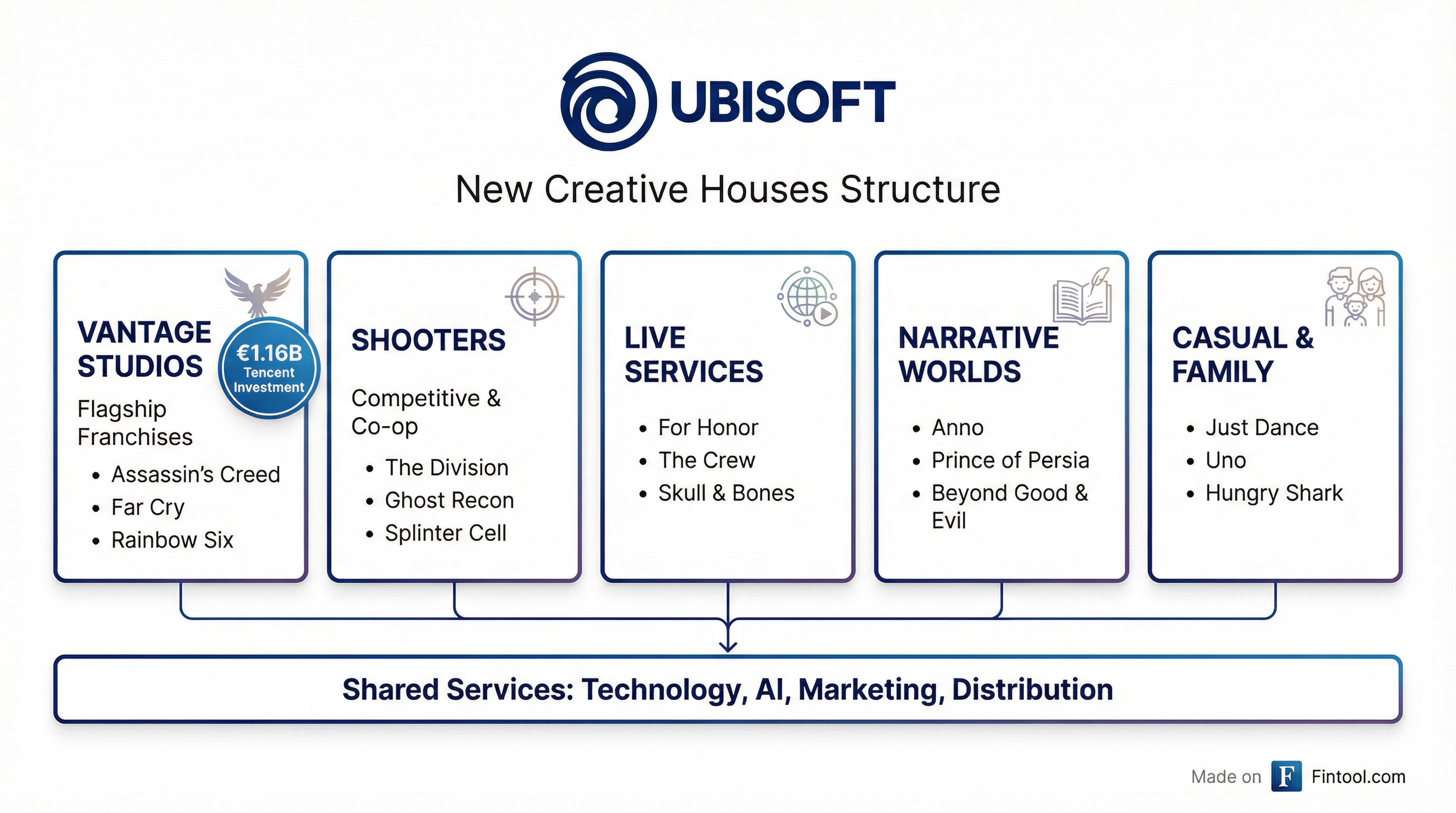

The Five Creative Houses

Ubisoft is replacing its studio-based structure with five genre-focused business units, each responsible for its own P&L:

Creative House 1: Vantage Studios

- Franchises: Assassin's Creed, Far Cry, Rainbow Six

- Backed by Tencent's €1.16 billion investment (completed November 2025)

- Goal: Turn flagship franchises into "annual billionaire brands"

- Valuation: €3.8 billion (pre-investment, including debt)

Creative House 2: Shooters

- Franchises: The Division, Ghost Recon, Splinter Cell

- Focus: Competitive and cooperative shooter experiences

Creative House 3: Live Services

- Franchises: For Honor, The Crew, Riders Republic, Brawlhalla, Skull & Bones

- Focus: Operating "a roster of select, sharp Live experiences"

Creative House 4: Narrative Worlds

- Franchises: Anno, Might & Magic, Rayman, Prince of Persia, Beyond Good & Evil

- Focus: Immersive fantasy worlds and narrative-driven universes

Creative House 5: Casual & Family

- Franchises: Just Dance, Idle Miner Tycoon, Hungry Shark, Uno, Hasbro titles

- Focus: Reclaiming position in casual gaming

Each Creative House will have separate management teams with compensation tied to player engagement and value creation metrics, marking a shift from Ubisoft's historically centralized approach.

The Tencent Lifeline

The restructuring wouldn't be possible without Tencent's €1.16 billion investment in Vantage Studios, completed in November 2025. That deal:

- Valued Vantage Studios at €3.8 billion (pre-investment, with debt)

- Gave Tencent a 26.32% stake in the subsidiary

- Eliminated Ubisoft's net debt position

- Provided cash to fund the restructuring

The Chinese gaming giant retains no voting rights and Vantage remains fully controlled by Ubisoft, but the capital injection fundamentally changed the company's options for restructuring.

Studio Closures and Cost Cuts

Ubisoft confirmed the closure of at least two studios:

- Ubisoft Stockholm — closed

- Ubisoft Halifax — closed last week

Additional studio closures and restructurings are expected. The company is also mandating a return to full-time in-office work.

Cost Savings Targets:

| Initiative | Amount | Timeline |

|---|---|---|

| Original cost reduction | €100 million | Achieved March 2026 (one year early) |

| New additional savings | €200 million | Over next two years |

The €200 million target will be achieved through studio closures, headcount reductions, and operational efficiencies. Ubisoft will also "continue to consider potential asset sales."

Why Now?

CEO Yves Guillemot's letter to employees framed the restructuring as a response to structural industry shifts:

"The AAA industry has become persistently more selective and competitive with rising development costs and greater challenges in creating brands. On the other hand, exceptional AAA games, when successful, have more financial potential than ever."

The company pointed to three industry dynamics:

- Market selectivity — Players concentrate spending on fewer, higher-quality titles

- Cost escalation — AAA development budgets continue rising

- Brand creation difficulty — New franchises face steep odds against established IP

Ubisoft's response is to double down on its strongest franchises (via Vantage Studios) while operating smaller, more agile units for other genres.

The AI Bet

Notably, Ubisoft is accelerating investments in "player-facing Generative AI" as part of the restructuring. While details were sparse, the company signaled AI will play a larger role in both game development and player-facing features.

This follows industry-wide moves by Electronic Arts, Activision Blizzard, and others to integrate generative AI into development pipelines—a trend that has drawn criticism from game developers and unions concerned about job displacement.

What to Watch

May 2026 — New medium-term guidance and financial targets Early April 2026 — Creative Houses structure goes live FY27 — Delayed games scheduled for release Ongoing — Additional studio closure and headcount announcements

The restructuring represents Ubisoft's most dramatic strategic shift since going public. Whether the five Creative Houses model can deliver the "exceptional game quality" Guillemot promises—while cutting costs 20%+—will determine if this reset marks a turnaround or the beginning of a longer decline.

Related Companies: Tencent+2.25%, Electronic Arts+1.05%, Take-two Interactive+1.22%