Earnings summaries and quarterly performance for TAKE TWO INTERACTIVE SOFTWARE.

Executive leadership at TAKE TWO INTERACTIVE SOFTWARE.

Board of directors at TAKE TWO INTERACTIVE SOFTWARE.

Ellen Siminoff

Director

J Moses

Director

LaVerne Srinivasan

Lead Independent Director

Michael Dornemann

Director

Michael Sheresky

Director

Paul Viera

Director

Roland Hernandez

Director

Susan Tolson

Director

William “Bing” Gordon

Director

Research analysts who have asked questions during TAKE TWO INTERACTIVE SOFTWARE earnings calls.

Andrew Marok

Raymond James Financial

8 questions for TTWO

Christopher Schoell

UBS

8 questions for TTWO

Douglas Creutz

TD Cowen

8 questions for TTWO

Eric Handler

Roth Capital Partners, LLC

8 questions for TTWO

Colin Sebastian

Baird

6 questions for TTWO

Martin Yang

Oppenheimer & Co. Inc.

6 questions for TTWO

Ed Alter

Jefferies

5 questions for TTWO

Alec Brondolo

Wells Fargo

4 questions for TTWO

Matthew Cost

Morgan Stanley

4 questions for TTWO

Michael Hickey

The Benchmark Company, LLC

4 questions for TTWO

Mike Hickey

The Benchmark Company LLC

4 questions for TTWO

Brian Pitz

BMO Capital Markets

3 questions for TTWO

Clay Griffin

MoffettNathanson LLC

3 questions for TTWO

Jason Bazinet

Citigroup

3 questions for TTWO

Omar Dessouky

Bank of America

3 questions for TTWO

Clayton Griffin

MoffettNathanson

2 questions for TTWO

Cory Carpenter

JPMorgan Chase & Co.

2 questions for TTWO

Drew Crum

B. Riley Securities

2 questions for TTWO

Eric Sheridan

Goldman Sachs

2 questions for TTWO

James Heaney

Jefferies

2 questions for TTWO

Arthur Chu

Bank of America

1 question for TTWO

Benjamin Soff

Deutsche Bank

1 question for TTWO

Recent press releases and 8-K filings for TTWO.

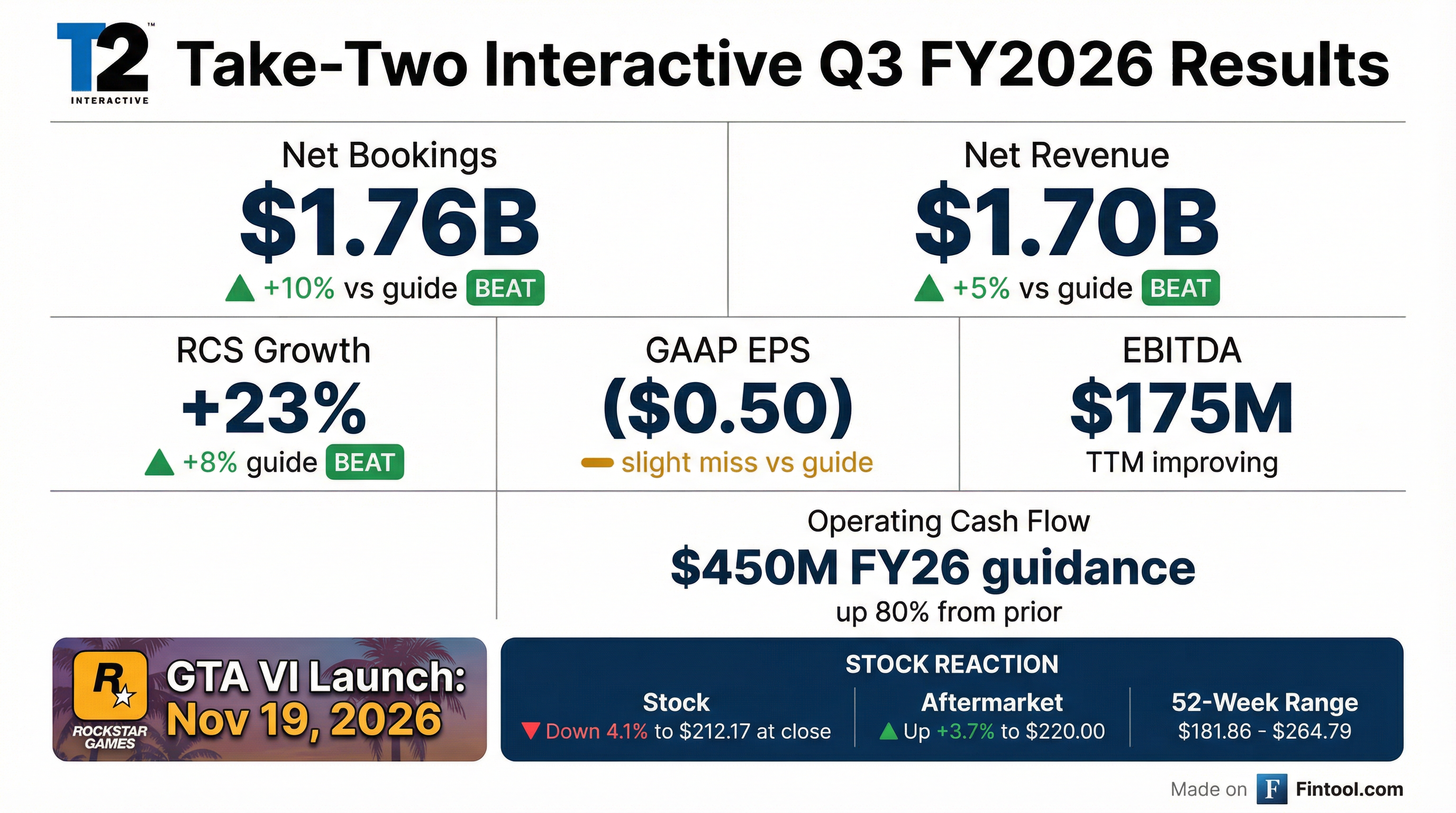

- GAAP Net Revenue of $1,699 M in Q3 FY2026; GAAP Net Loss of $(93 M) and EPS of $(0.50).

- Net Bookings reached $1,757 M, above guidance of $1,550–1,600 M, with Recurrent Consumer Spending up 23% YoY.

- Revised FY2026 guidance: GAAP Net Revenue $6,550–6,600 M, Net Bookings $6,650–6,700 M, and GAAP EPS $(2.00)–(1.84).

- Q4 FY2026 outlook: GAAP Net Revenue $1,573–1,623 M, Net Bookings $1,510–1,560 M, and RCS growth 7% YoY.

- Q3 net bookings $1.76 billion, ahead of guidance; GAAP net revenue $1.7 billion (+25% yoy), cost of revenue $754 million, operating expenses $984 million, and recurrent consumer spending +23% (76% of bookings).

- Raised FY 2026 net bookings guidance to $6.65 – $6.7 billion (18% growth); GAAP net revenue $6.55 – $6.6 billion, cost of revenue $2.78 – $2.8 billion, operating expenses $3.96 – $3.97 billion, and operating cash flow ~$450 million.

- Q4 2026 guidance: net bookings $1.51 – $1.56 billion vs $1.58 billion prior year; GAAP net revenue $1.57 – $1.62 billion, cost of revenue $675 – $692 million, operating expenses $973 – $983 million, and recurrent consumer spending +7%.

- Franchise highlights: mobile net bookings +19% with Toon Blast +43%, Match Factory +17%, Empires & Puzzles +11%, Words With Friends +6%; NBA 2K26 sold ~8 million units with RCS +30%; GTA Online RCS +27%.

- Financial results: Q3 net bookings of $1.76 billion (above guidance) and GAAP net revenue of $1.7 billion, up 25% YoY.

- Raised full-year FY26 net bookings outlook to $6.65–$6.7 billion (18% growth) and operating cash flow forecast to $450 million.

- Outperformance driven by core franchises: NBA 2K net bookings +30%, GTA Online +27%, and mobile segment growth of +19% YoY.

- Q4 guidance: net bookings $1.51–$1.56 billion, GAAP net revenue $1.57–$1.62 billion; upcoming releases include Civilization VII (Apple Arcade), PGA TOUR 2K25 (Switch 2), and WWE 2K26.

- Delivered third-quarter net bookings of $1.76 billion (versus guidance $1.55–1.6 billion) and GAAP net revenue up 25% to $1.7 billion

- Raised full-year fiscal 2026 net bookings outlook to $6.65–6.7 billion (+18% at midpoint), GAAP net revenue to $6.55–6.6 billion, and operating cash flow to ~$450 million

- Recurrent consumer spending grew 23%, comprising 76% of net bookings; NBA 2K RCS +30%, Grand Theft Auto Online +27%, mobile +19%

- Key franchise milestones: NBA 2K sold ~8 million units YTD, GTA V lifetime sales >225 million units, mobile titles Toon Blast +43% and Match Factory +17% Y/Y

- Q3 Net Bookings grew 28% to $1.76 billion, above guidance range.

- GAAP net revenue rose to $1.70 billion, up from $1.36 billion year-over-year.

- GAAP net loss narrowed to $92.9 million (-$0.50/share) vs $125.2 million (-$0.71/share) in the prior-year quarter.

- Fiscal 2026 Net Bookings outlook raised to $6.65–6.70 billion, reflecting strong momentum.

- Net Bookings grew 28% year-over-year to $1.76 billion in Q3 FY2026, with recurrent consumer spending comprising 76% of total bookings.

- GAAP net revenue rose to $1.70 billion (+25% YoY) while GAAP net loss narrowed to $92.9 million ($0.50 per share) from $125.2 million ($0.71) a year earlier.

- The company raised its FY2026 Net Bookings outlook to $6.65–6.70 billion, and projects record FY2027 bookings following the launch of Grand Theft Auto VI.

- GTA VI release pushed to November 19, 2026, triggering a ~10% intraday share drop.

- Q2 beat estimates with adjusted EPS of $1.46 and revenue of $1.96 billion.

- FY26 guidance lifted to $3.05–$3.30 adj EPS (from $2.60–$2.85) and $6.4–$6.5 billion net bookings (from $6.05–$6.15 billion).

- Q3 outlook calls for a loss of $0.49–$0.35 per share and revenue of $1.57–$1.62 billion, above consensus of ~$1.50 billion.

- Take-Two postponed Grand Theft Auto VI to November 19, 2026, marking its second delay to ensure the game meets expected polish standards.

- Approximately 30–40 staff were fired in the UK and Canada amid union-busting and leak allegations, prompting protests at Rockstar North’s Edinburgh office.

- In its Q2 report, Take-Two highlighted strong uptake for NBA 2K26 and a favorable reception for Borderlands 4.

- Grand Theft Auto V has sold about 220 million units, while GTA Online membership grew by over 20% year-over-year.

- Delivered Q2 net bookings of $1.96 B, surpassing guidance of $1.7–1.75 B, and raised FY 2026 net bookings outlook to $6.4–6.5 B.

- Recurrent consumer spending grew 20%, accounting for 73% of net bookings; driven by NBA 2K (+45%) and mobile titles, while GTA Online declined.

- GAAP net revenue was $1.77 B (+31%), cost of revenue $793 M (+27%), and operating expenses $1.1 B (+5%).

- FY 2026 guidance updated: GAAP net revenue $6.38–6.48 B, cost of revenue $2.66–2.69 B, and total operating expenses $3.98–4.00 B.

- Grand Theft Auto VI launch moved to November 19, 2026, with no change to GTA Online support cadence.

- Net bookings of $1.96 billion in Q2, the best second quarter on record, and raised fiscal 2026 net bookings guidance to $6.4–6.5 billion.

- Grand Theft Auto VI release delayed to November 19, 2026; GTA V has sold 220 million units and GTA Plus subscriptions grew 20% YoY.

- Mobile segment saw strong growth: Toon Blast net bookings +26% YoY, Match Factory +20%, Rollic achieved record net bookings with 3.8 billion lifetime downloads, and CSR reached $1 billion in lifetime in-game spending.

Quarterly earnings call transcripts for TAKE TWO INTERACTIVE SOFTWARE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more