Earnings summaries and quarterly performance for ELECTRONIC ARTS.

Executive leadership at ELECTRONIC ARTS.

Board of directors at ELECTRONIC ARTS.

Research analysts who have asked questions during ELECTRONIC ARTS earnings calls.

Andrew Marok

Raymond James Financial

4 questions for EA

Douglas Creutz

TD Cowen

4 questions for EA

Christopher Schoell

UBS

3 questions for EA

Eric Handler

Roth Capital Partners, LLC

3 questions for EA

Colin Sebastian

Baird

2 questions for EA

Eric Sheridan

Goldman Sachs

2 questions for EA

James Heaney

Jefferies

2 questions for EA

Clayton Griffin

MoffettNathanson

1 question for EA

Cory Carpenter

JPMorgan Chase & Co.

1 question for EA

Matthew Cost

Morgan Stanley

1 question for EA

Michael Hickey

The Benchmark Company, LLC

1 question for EA

Mike Hickey

The Benchmark Company LLC

1 question for EA

Recent press releases and 8-K filings for EA.

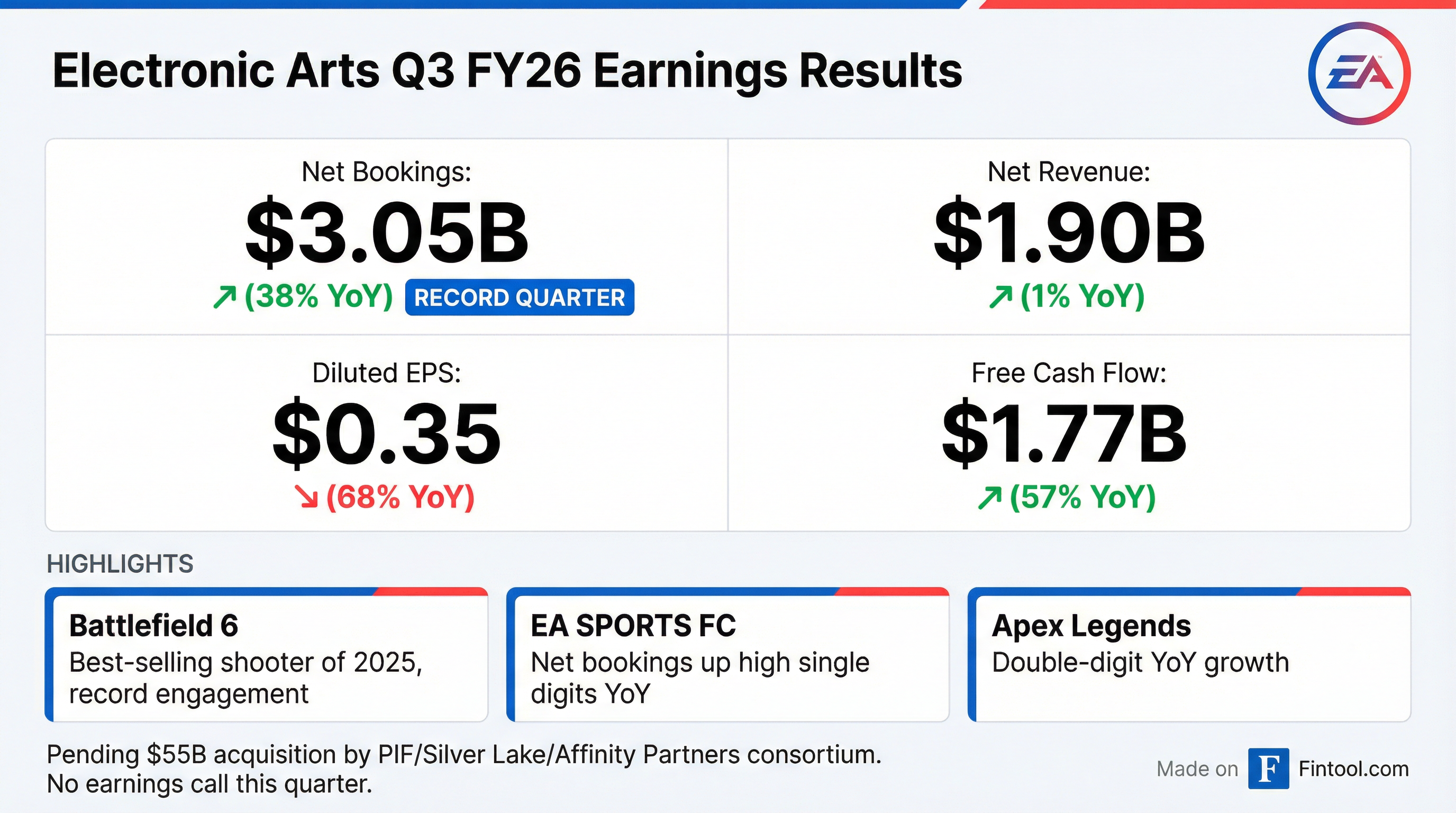

- Record Q3 net bookings of roughly $3.05 billion, up ~37–38% year-over-year and beating estimates by about $130 million, driven by EA SPORTS FC, Ultimate Team, Apex Legends and FC Mobile.

- GAAP revenue of $1.901 billion and EPS of $0.35, both below prior-year levels.

- Declared a $0.19 quarterly dividend, payable on March 18.

- No conference call due to a pending investor consortium acquisition, limiting management commentary on the outlook.

- Operating margin averaged around 17.11%, down from a past peak near 27.84%, highlighting ongoing margin pressure.

- Q1 FY26 net bookings were $1.298 B, up 3% YoY (cc); TTM net bookings reached $7.4 B, up 4% YoY, with live services representing 72% of total TTM net bookings.

- Q1 FY26 net revenue was $1,671 M, GAAP EPS $0.79, and operating cash flow $17 M, resulting in free cash flow of $(55) M.

- EA SPORTS™ F1® 25 delivered strong YoY net bookings growth, and FC Mobile achieved a record quarter for net bookings.

- FY26 guidance issued for net bookings of $7.6 B–$8.0 B, net revenue of $7.1 B–$7.5 B, and GAAP EPS of $3.09–$3.79.

- Net bookings of $3.046 billion in Q3 FY26, up 38% year-over-year.

- Net revenue of $1.901 billion and operating cash flow of $1.826 billion for the quarter ($2.522 billion TTM).

- Battlefield 6 was the best-selling shooter of 2025, driving record bookings; EA SPORTS FC and Apex Legends also posted strong net bookings growth.

- Declared a $0.19 per share quarterly dividend, payable March 18, 2026.

- Record quarterly net bookings of $3.046 billion, up 38% year-over-year, driven by the landmark launch of Battlefield 6.

- Net revenue of $1.901 billion (+1% YoY) and net income of $88 million (EPS $0.35) for the quarter.

- Declared a $0.19 per share quarterly cash dividend, payable March 18, 2026.

- Operating cash flow of $1.826 billion; no earnings call held due to the pending $55 billion acquisition by an investor consortium expected to close in Q1 FY27.

- Shareholders approved a $55 billion take-private by a consortium led by Saudi Arabia’s Public Investment Fund at $210 per share, with PIF to end up with about 93.4% ownership.

- The transaction, the largest going-private deal in the video-game industry’s history, still requires government and regulatory clearance and is targeted to close in Q1 2027.

- EA reported $1.883 billion in revenue and $1.11 in adjusted EPS for Q3 2025, missing elevated expectations and limiting near-term upside.

- The deal has drawn mixed reactions, with proponents citing fresh growth capital and critics raising ethical and influence concerns over major Saudi ownership.

- Record date for voting was November 19, 2025; shareholders of record as of that date could vote electronically or by proxy.

- A quorum was reached with 203,451,107 shares (over 81% of outstanding) present in person or by proxy.

- Stockholders approved all three proposals, including the merger agreement, advisory vote on named executive officer compensation, and authority to adjourn for additional proxies if needed.

- Final voting results will be filed with the SEC on a Form 8-K.

- Electronic Arts held its special meeting on Dec 22, 2025, with a record date of Nov 19, 2025, and proxy materials distributed on Nov 20, 2025.

- A quorum was met with 203,451,107 shares (over 81%) of outstanding stock present or by proxy.

- The Board recommended approval of three proposals: the Merger Agreement with Oak-Eagle AcquireCo/MergerCo, an advisory vote on executive compensation related to the merger, and authority to adjourn for additional proxies if needed.

- All three proposals were approved by the requisite vote and the meeting was adjourned.

- At EA's Special Meeting on December 22, 2025, a quorum was established with 81% of outstanding shares present or represented (record date November 19, 2025).

- Proposal 1: Adoption of the Merger Agreement dated September 28, 2025, among EA, Oak Eagle Acquire Co., and Oak Eagle Merger Co.; Board recommended FOR; approved.

- Proposal 2: Advisory approval of compensation payable to Named Executive Officers in connection with the merger; Board recommended FOR; approved.

- Proposal 3: Approval to adjourn the meeting to solicit additional proxies if necessary; Board recommended FOR; approved.

- All results will be filed on Form 8-K; the meeting adjourned at 2:03 PM.

- Consortium-led $55 billion leveraged buyout will take Electronic Arts private, with Saudi Arabia’s PIF owning 93.4%, Silver Lake 5.5%, and Affinity Partners 1.1%.

- The transaction, the largest leveraged buyout in history, is pending regulatory and shareholder approval and is expected to close next year.

- EA’s revenues have stagnated over the past three fiscal years, underscoring pressure within the video game sector.

- Suspended trading and delayed release of H1 fiscal 2025-26 results to curb speculation; report due before markets open on November 21, 2025.

- CFO Frederick Duguet cited the need for extra time to finalize the semester’s closing and review strategic options.

- Delay has fueled acquisition speculation by Tencent, which holds a stake in Ubisoft and recently formed Vantage Studios, acquiring key franchise rights.

- Ongoing cost-cutting measures since 2023 include studio closures and over 3,000 layoffs as shares have fallen nearly 50% this year amid industry headwinds.

Fintool News

In-depth analysis and coverage of ELECTRONIC ARTS.

EA Posts Record $3 Billion Quarter on Battlefield 6 Dominance—Its Last Report as a Public Company

Ubisoft Crashes 33% in Record Plunge as Prince of Persia Axed, Studios Shuttered

EA Shareholders Greenlight $55 Billion Saudi Takeover in Largest LBO Ever

Quarterly earnings call transcripts for ELECTRONIC ARTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more