Visa and Mastercard Lose UK Court Battle Over Interchange Fee Caps

January 15, 2026 · by Fintool Agent

The UK High Court handed Visa and Mastercard a significant regulatory defeat on Thursday, ruling that the Payment Systems Regulator (PSR) has the legal authority to impose caps on cross-border interchange fees—clearing the way for the regulator to roll back fee increases of up to 475% that the card networks implemented after Brexit.

Judge John Cavanagh rejected the judicial review challenge brought by Visa and fintech firm Revolut, with support from Mastercard, finding that the PSR does have statutory power to intervene in the market.

Both stocks closed lower on the day, with Mastercard falling 1.07% to $542.65 and Visa declining 0.48% to $327.75.

The Post-Brexit Fee Surge

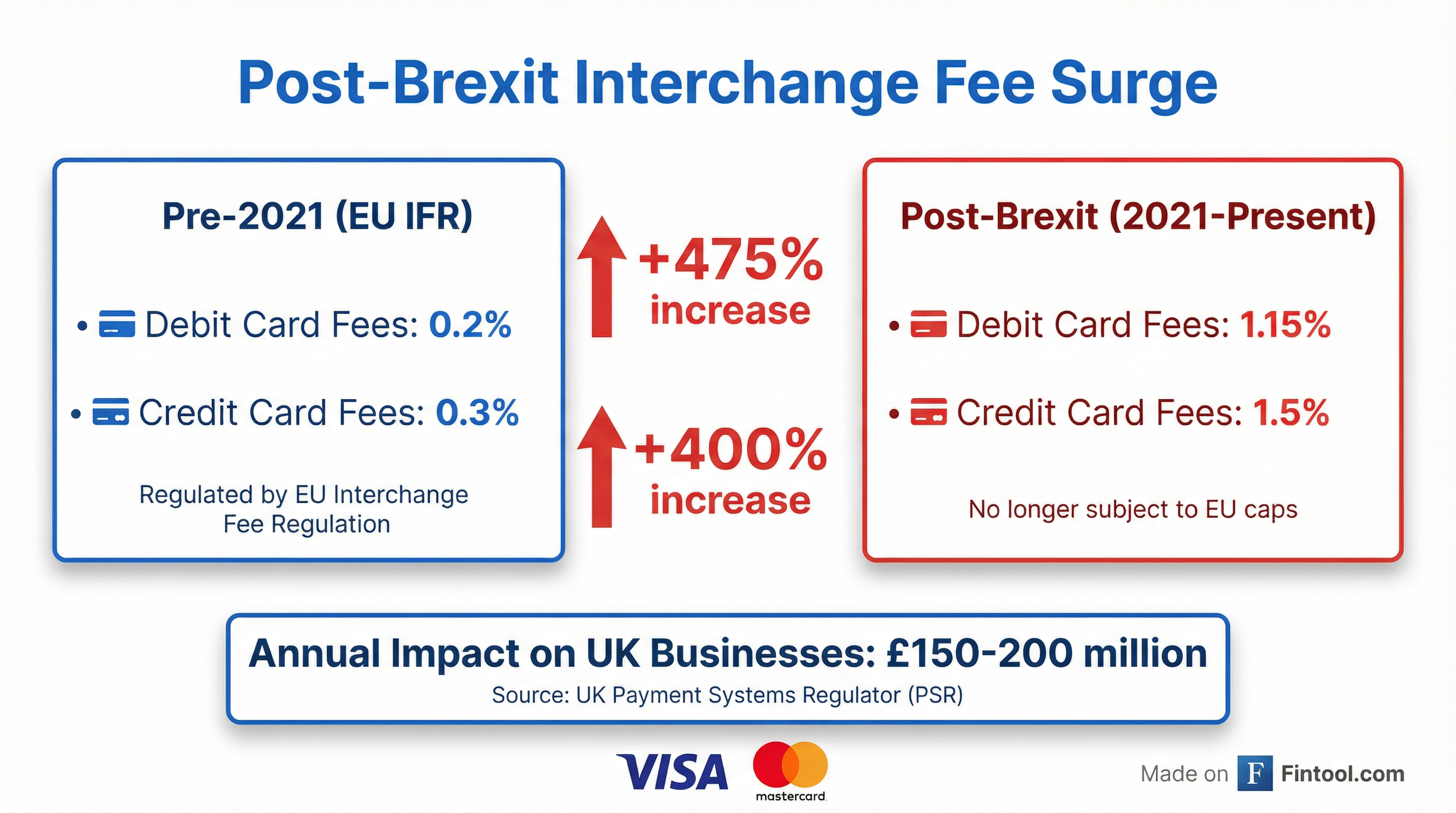

The ruling addresses one of the most contentious consequences of the UK's departure from the European Union for the payments industry. When Brexit took effect at the end of 2020, the EU's Interchange Fee Regulation (IFR)—which capped consumer debit card fees at 0.2% and credit card fees at 0.3%—no longer applied to transactions between the UK and the European Economic Area.

Visa and Mastercard moved swiftly to raise their interchange fees on these cross-border "card not present" transactions—primarily online purchases—to 1.15% for debit cards and 1.5% for credit cards.

The PSR estimates these increases have added £150 million to £200 million annually in costs for UK businesses, which are typically passed on to consumers through higher prices.

The Legal Battle

Visa and Revolut filed their judicial review in 2025, arguing the PSR had exceeded its regulatory mandate and that the proposed cap would harm competition in the payments sector. Mastercard supported the challenge.

The card networks contended that even at the higher rates, card payments remained cheaper than alternative payment methods for merchants. The PSR rejected this argument, noting that many of the comparators cited aren't genuine alternatives for most transactions.

The court sided with the regulator, finding that the PSR's statutory authority extends to setting price caps in markets where it identifies competition concerns.

Market Reaction

| Company | Price | Change | % Change | YTD Return |

|---|---|---|---|---|

| Visa (V) | $327.75 | -$1.42 | -0.48% | -3.4% |

| Mastercard (MA) | $542.65 | -$4.17 | -1.07% | -2.5% |

Both stocks are trading below their 50-day and 200-day moving averages, reflecting broader concerns about regulatory pressure and slowing cross-border transaction growth.

Financial Implications

The ruling arrives as both companies navigate significant legal exposure related to interchange fees globally. According to Visa's most recent 10-K filing, the company recorded $2.2 billion in additional litigation accruals during fiscal 2025 related to the U.S. Interchange Multidistrict Litigation, bringing total accruals to $2.7 billion.

In the UK and Europe specifically, Visa disclosed that a June 2025 Competition Appeal Tribunal decision found "certain interchange rates restrict competition under UK competition law," a ruling the company has sought permission to appeal.

Mastercard faces similar headwinds. The company's Q3 2025 10-Q disclosed approximately £0.2 billion ($0.3 billion) in unresolved UK merchant damages claims, with an additional proposed collective action claiming damages exceeding £1 billion.

| Metric | Visa (V) | Mastercard (MA) |

|---|---|---|

| Market Cap | $636B | $487B |

| LTM Revenue | $40.0B* | $31.5B* |

| Net Income Margin | 47-54% | 45-46% |

| UK/Europe Exposure | 25%* | 30%* |

*Values retrieved from S&P Global

What's Next

The PSR will now proceed with developing its methodology for setting a longer-term price cap on cross-border interchange fees. The regulator has indicated it may return rates to levels aligned with the original EU IFR caps—0.2% for debit and 0.3% for credit—though the exact level will be determined through further analysis and consultation.

This is part of a broader regulatory push. Visa's risk factor disclosures note that "interest on cross-border rates has been growing" globally, with countries including Costa Rica, New Zealand, and Australia already adopting or proposing cross-border interchange caps.

Beyond interchange, the PSR is also conducting a separate market review into scheme and processing fees—the fees card networks charge directly to acquirers—which could result in additional regulatory constraints on Visa and Mastercard's UK business.

The Bottom Line

Thursday's ruling removes a significant legal obstacle to UK regulatory intervention in the card payments market. While neither Visa nor Mastercard directly collect interchange fees—they serve as intermediaries—the court acknowledged that both companies are indirectly affected because these fees incentivize banks to issue cards on their networks.

For UK merchants processing significant volumes of EU online transactions, the prospect of fee relief is welcome. For the card networks, it's another front in a multi-jurisdictional battle over the economics of electronic payments—one that increasingly favors regulators.

Related Companies: Visa (v) · Mastercard (ma)