Universal Corporation Rescinds CFO Offer 8 Days After Announcement

January 29, 2026 · by Fintool Agent

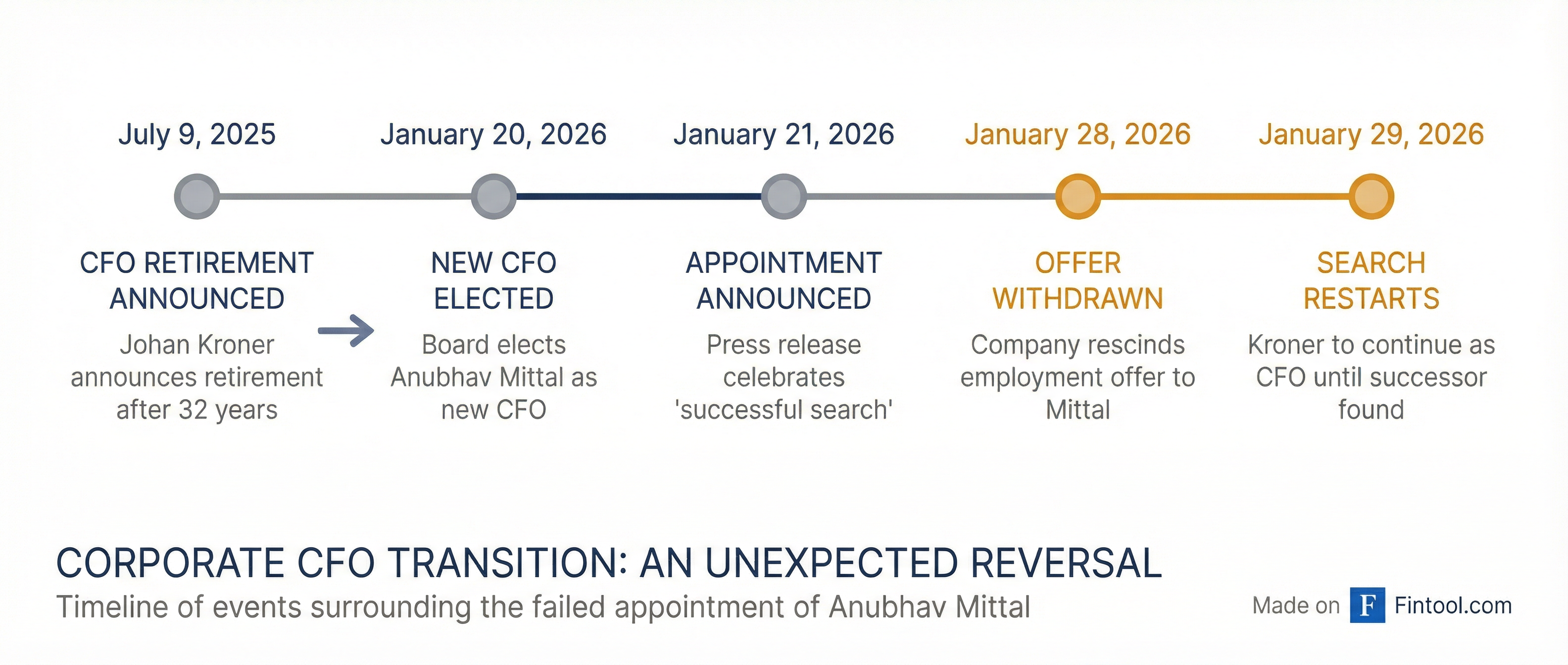

Universal Corporation withdrew its offer of employment to incoming CFO Anubhav Mittal on January 28—just eight days after celebrating his appointment as the "successful culmination" of a six-month executive search.

The terse 8-K filing offers no explanation. It simply states that current CFO Johan C. Kroner "will continue to serve" until a successor is found and that Universal "anticipates electing a successor in the near term."

A Search That Seemed Settled

The original announcement on January 21 painted a picture of careful planning.

Kroner had announced his retirement last July after 32 years with the Richmond-based tobacco leaf merchant, including seven years as CFO. Universal engaged a global executive search firm and spent six months vetting candidates before selecting Mittal from Archer Daniels Midland.

The credentials looked ideal: 20 years of finance experience, CFO of ADM Nutrition (an $8 billion business), Harvard MBA, M&A leadership at Kellogg.

"Anubhav joins Universal as a proven finance executive and global business leader with a strong track record of strategic execution and value creation," CEO Preston Wigner said in the original press release.

Mittal himself called it "an exciting time for the Company" and said he looked forward to "deliver meaningful value for our shareholders."

The Compensation Package That Never Was

The January 21 filing disclosed detailed terms for Mittal's employment:

| Component | Value |

|---|---|

| Base Salary | $650,000 |

| Target Bonus | $500,000 |

| Annual LTI Target | $850,000 |

| One-Time RSU Grant | $2,000,000 |

| Signing Bonus | $600,000 |

The signing bonus included a clawback provision requiring full repayment if Mittal voluntarily resigned or was terminated for cause within 24 months. That clause never had a chance to take effect.

What Could Have Gone Wrong?

Neither the company nor Mittal has issued a statement explaining the reversal. The 8-K states only that Universal—not Mittal—withdrew the offer, suggesting this wasn't a case of the candidate backing out.

Possible explanations range from issues discovered during pre-employment screening to contractual complications with ADM, where Mittal was still employed. Industry watchers note that executive offers are sometimes rescinded when background checks reveal inconsistencies or when non-compete agreements prove more restrictive than anticipated.

The timing is particularly awkward. Universal is scheduled to report Q3 fiscal 2026 earnings on February 11—less than two weeks away—with Kroner now staying on as CFO rather than transitioning to an advisory role as planned.

What Happens Now

Universal says it expects to name a successor "in the near term," suggesting the company may turn to runner-up candidates from its recent search rather than starting over.

Kroner's original retirement date of July 1, 2026, was already contingent on a smooth transition. With the search now reset, his timeline becomes uncertain. The company had awarded him a special $600,000 retention bonus in RSUs specifically to ensure continuity through the transition period.

Market Reaction

UVV shares closed at $55.80 on January 29, up 0.7% on the day and roughly flat from the $55.03 close on January 21 when the original appointment was announced. The muted response reflects either market indifference to the small-cap tobacco supplier or investors not yet processing the news filed after hours.

| Date | Event | UVV Close | Change |

|---|---|---|---|

| Jan 20, 2026 | Board elects Mittal | $54.44 | - |

| Jan 21, 2026 | Announcement released | $55.03 | +1.1% |

| Jan 28, 2026 | Offer withdrawn | $55.36 | +0.6% |

| Jan 29, 2026 | 8-K filed | $55.80 | +0.7% |

Universal trades at roughly 12x trailing earnings and offers a 6% dividend yield—metrics that attract income investors more than growth-focused managers who might scrutinize executive bench strength more closely.

The Bigger Picture

For a $1.4 billion company operating in the declining tobacco leaf supply chain, stable financial leadership matters. Universal has been diversifying into plant-based ingredients and specialty products, a transformation that requires disciplined capital allocation—exactly what Mittal's M&A and corporate development experience was supposed to bring.

Instead, the company enters its fiscal Q3 earnings call with its 32-year veteran CFO back in the chair and an unexplained breakdown in its succession process.

Related