Earnings summaries and quarterly performance for UNIVERSAL CORP /VA/.

Executive leadership at UNIVERSAL CORP /VA/.

Preston Wigner

Chairman, President and Chief Executive Officer

Airton Hentschke

Senior Vice President and Chief Operating Officer

Catherine Claiborne

Vice President, General Counsel and Secretary

Johan Kroner

Senior Vice President and Chief Financial Officer

Patrick O'Keefe

Senior Vice President, Universal Global Ventures, Inc.

Board of directors at UNIVERSAL CORP /VA/.

Arthur Schick Jr

Director

Diana Cantor

Director

Fotini Manolios

Director

Gregory Trojan

Director

Jacqueline Williams

Director

Lennart Freeman

Director

Robert Sledd

Director

Thomas Johnson

Lead Independent Director

Thomas Tullidge Jr

Director

Research analysts who have asked questions during UNIVERSAL CORP /VA/ earnings calls.

Recent press releases and 8-K filings for UVV.

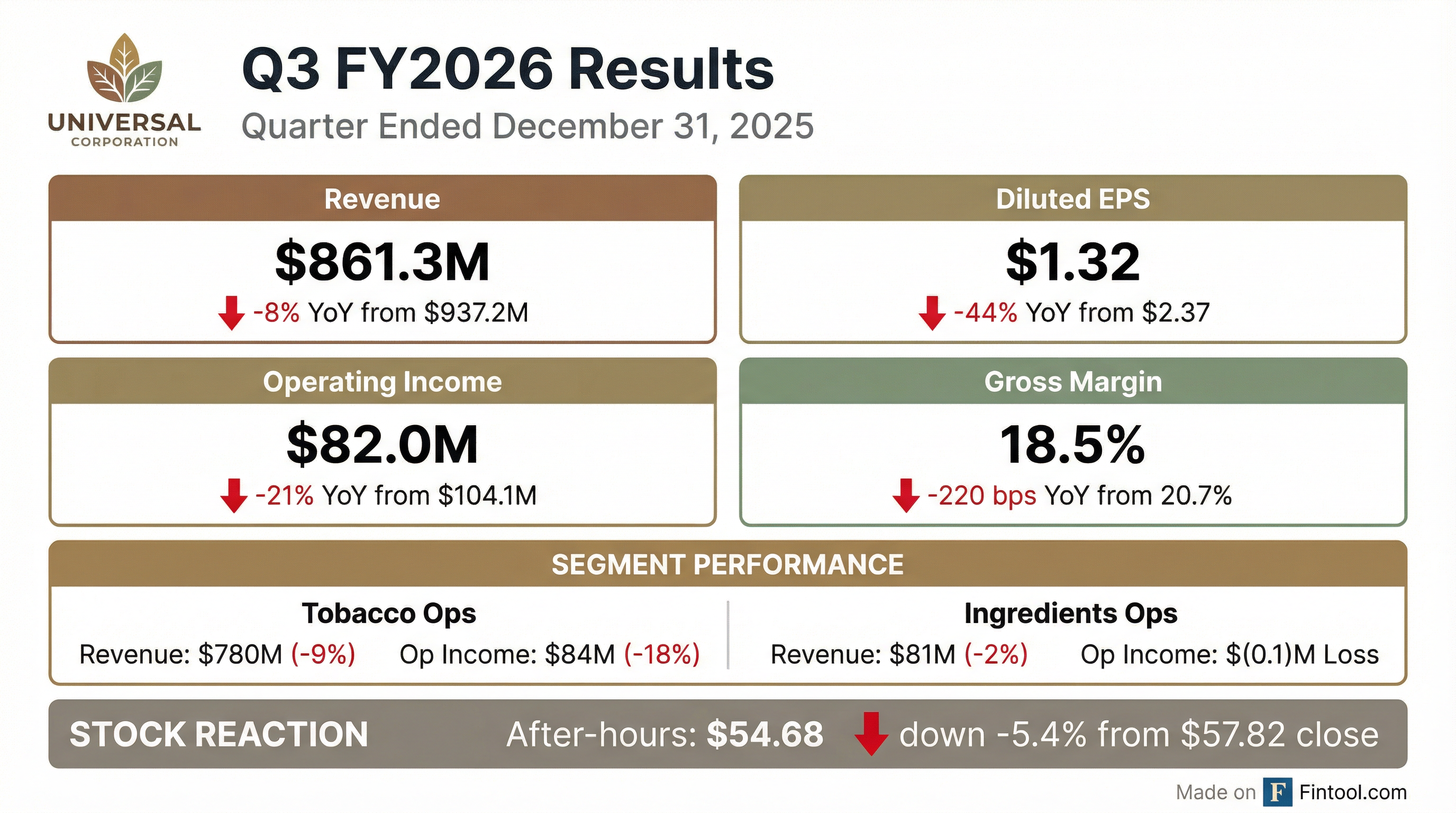

- Universal Corporation reported consolidated revenue of $861.3 million for the third quarter of fiscal year 2026, a decrease from $937.2 million in the prior year quarter, with net income at $33.2 million compared to $59.6 million.

- The tobacco operations segment delivered solid results in Q3 2026, though revenue was down compared to a robust prior year quarter, as the market transitions into an oversupply environment.

- The ingredients operations segment experienced compressed margins due to higher fixed costs from significant investments, market headwinds in the consumer packaged goods sector, and more pronounced tariff impacts.

- The company refinanced and upsized its corporate credit facility, enhancing liquidity and financial flexibility, and announced Steven S. Diel as the new CFO, effective April 1st.

- Universal Corporation reported Q3 fiscal year 2026 consolidated revenue of $861.3 million, operating income of $82 million, and net income of $33.2 million, reflecting declines from the prior year's third quarter.

- The Ingredients operations segment recorded a segment operating loss of $0.1 million in Q3 2026, attributed to higher fixed costs from investments, market headwinds in the consumer packaged goods sector, and increased tariff impacts.

- The Tobacco operations segment posted $779.9 million in revenue and $84 million in operating income for Q3 2026, a solid performance despite being lower than the strong prior year quarter as the market shifts to oversupply.

- The company enhanced its financial flexibility by refinancing and upsizing its corporate credit facility, with net debt at $995 million and liquidity availability totaling $917 million as of December 31, 2025.

- Steven S. Diel was appointed as the new Chief Financial Officer, effective April 1st.

- Consolidated revenue for the third quarter of fiscal year 2026 was $861.3 million, with net income at $33.2 million, down from $937.2 million and $59.6 million respectively in the prior year.

- The Tobacco Operations segment delivered $779.9 million in Q3 revenue and $84 million in operating income, while the Ingredients Operations segment reported $81.3 million in Q3 revenue but incurred an operating loss of $0.1 million due to higher fixed costs, market headwinds, and tariff impacts.

- Universal Corporation refinanced and upsized its corporate credit facility, enhancing liquidity and financial flexibility, and announced the appointment of Steven S. Diel as the new Chief Financial Officer, effective April 1st.

- Universal Corporation reported Q3 2026 consolidated sales and other operating revenue of $861.3 million, an 8% decrease, and diluted earnings per share of $1.32, a 44% decrease, compared to the prior year. For the nine months ended December 31, 2025, consolidated sales and other operating revenue were $2,209.2 million, down 2%, and diluted earnings per share were $3.02, down 11%.

- Steven S. Diel has been appointed Senior Vice President and Chief Financial Officer, effective April 1, 2026, succeeding Johan C. Kroner who will remain as an advisor until July 1, 2026.

- The company refinanced and upsized its revolving credit facility by $250 million in December 2025, extending its maturity to December 2030, with approximately $595 million available as of December 31, 2025. Total debt decreased by $77 million to $1,078.8 million at December 31, 2025, compared to December 31, 2024, while net debt (non-GAAP) increased by $51 million to $995.3 million over the same period.

- For the nine months ended December 31, 2025, Tobacco operations sales decreased by 3% to $1,944.1 million and operating income decreased by 5% to $185.0 million. Ingredients operations revenue increased by 7% to $265.2 million but operating income decreased by 82% to $1.4 million.

- Universal Corporation reported Q3 FY2026 sales of $861.3 million, an 8% decrease, and diluted earnings per share of $1.32, a 44% decrease, compared to the prior year. For the nine months ended December 31, 2025, sales were $2,209.2 million, down 2%, and diluted EPS was $3.02, down 11%.

- Tobacco operations sales declined by 9% in Q3 and 3% for the nine months, primarily due to lower sales volumes, despite firm customer demand for most tobacco styles.

- Ingredients operations sales decreased by 2% in Q3 but grew 7% for the nine months, facing market headwinds, softer customer demand, and higher fixed costs.

- The company refinanced and upsized its revolving credit facility in December 2025, extending maturity to December 2030, and reported total debt down $77 million at December 31, 2025, compared to December 31, 2024.

- Universal Corporation (UVV) is a global business-to-business agri-products company and the world's leading leaf tobacco supplier, which has recently expanded into a new Universal Ingredients segment for food and beverage markets.

- The company's three-pillar corporate strategy aims to maximize and optimize its tobacco business, grow the ingredients business both organically and through acquisitions, and strengthen the company for the future.

- Financially, Universal Corporation has shown strong performance, with Adjusted EBITDA and free cash flow increasing over the last five fiscal years, including a 9% CAGR for Adjusted EBITDA.

- The company prioritizes shareholder returns, having achieved its 55th consecutive annual dividend increase, and maintains a fiscally conservative approach to debt, with levels around 2.5 times Adjusted EBITDA.

- Universal Corporation (UVV) is a global business-to-business agri-products company, recognized as the world's leading leaf tobacco supplier, and is pursuing a three-pillar corporate strategy to maximize its tobacco business, grow its ingredients business, and strengthen the company for the future.

- The company has established a new segment, Universal Ingredients, through acquisitions since 2018, which processes fruit, vegetables, botanical extracts, and flavors for the food and beverage markets, including a recent $30-plus million expansion in its extracts and flavor capabilities.

- UVV has demonstrated strong financial performance, with Adjusted EBITDA and free cash flow increasing over the last five fiscal years, and has achieved 55 consecutive annual increases to its dividend.

- Universal Corporation (UVV) is a global business-to-business agri-products company with two main segments: leaf tobacco supply and a newer food ingredients business.

- The company's strategy focuses on maximizing its leading tobacco business, growing the Universal Ingredients segment organically and through acquisitions, and strengthening the overall company.

- The Universal Ingredients segment, established since 2018, processes fruit, dehydrated vegetables, and botanical extracts/flavors, with recent investments including a $30+ million expansion for extraction, blending, and aseptic packaging capabilities.

- Financially, Universal Corporation has achieved increased Adjusted EBITDA and free cash flow over the last five fiscal years, with Adjusted EBITDA growing at a 9% CAGR during this period.

- The company has also maintained a strong commitment to shareholders, marking its 55th consecutive annual increase to its dividend.

- Universal Corporation entered into a new unsecured Credit Agreement on December 9, 2025, with JPMorgan Chase Bank, N.A. serving as the Administrative Agent.

- The Credit Agreement provides for a five-year term loan A-1 facility of $275,000,000, a seven-year term loan A-2 facility of $345,000,000, and a five-year revolving loan facility of $780,000,000.

- The revolving credit facility includes availability of up to $25,000,000 for letters of credit and up to $20,000,000 for short-term swingline borrowings.

- The Company has the option to request up to two one-year extensions for the maturity dates of the loans and may increase the aggregate amount of the Revolving Credit Facility and/or obtain incremental term loans up to $300,000,000.

- Commitments under the Revolving Credit Facility are subject to a facility fee ranging from 0.25% to 0.40%, depending on the Company’s ratio of consolidated total indebtedness to consolidated EBITDA.

- Consolidated revenue for the first half of fiscal year 2026 increased by $40 million to $1.3 billion, with operating income rising $16 million to $101 million.

- For the second quarter of fiscal year 2026, consolidated revenue grew by $43 million to $754 million, but operating income decreased by $1 million to $68 million.

- The Tobacco Operations segment reported a $29 million revenue increase on a 3% rise in sales volumes in Q2 2026, though operating income declined by $12 million due to unfavorable foreign currency, higher inventory write-downs, and a less favorable product mix.

- The Ingredients Operations segment achieved higher revenues on increased sales volumes in Q2 2026, but operating income was lower due to challenges in the consumer packaged goods industry, tariff uncertainty, and higher fixed costs from an expanded facility.

- Net debt decreased by $52 million as of September 30 compared to the prior year, and the company maintains $340 million available under its revolving credit facility. Uncommitted tobacco inventory stands at 13%, within the target range, despite an anticipated market shift to oversupply by year-end.

Fintool News

In-depth analysis and coverage of UNIVERSAL CORP /VA/.

Quarterly earnings call transcripts for UNIVERSAL CORP /VA/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more