xAI Burned $7.8 Billion in Nine Months on Just $107 Million Revenue

January 8, 2026 · by Fintool Agent

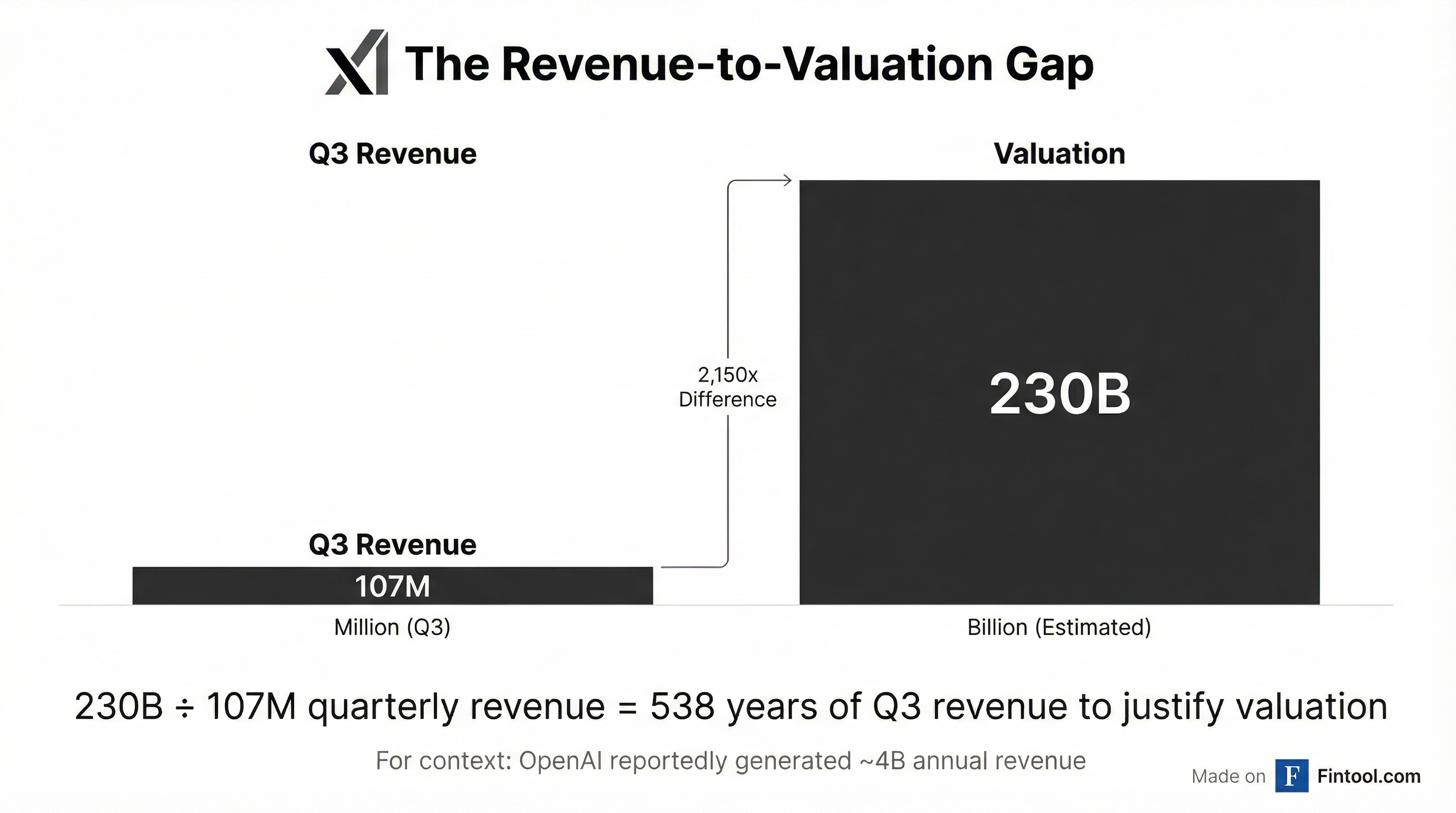

Elon Musk's artificial intelligence company xAI reported a net loss of $1.46 billion for the September quarter, widening from $1 billion in the first quarter, according to internal documents reviewed by Bloomberg. The disclosure provides the first detailed look at the financial reality behind a company valued at $230 billion — one burning through cash at roughly $1 billion per month while generating just $107 million in quarterly revenue.

The Numbers Behind the Hype

xAI's financial profile reveals the staggering capital requirements of competing at AI's frontier:

| Metric | Q1 2025 | Q3 2025 | Change |

|---|---|---|---|

| Net Loss | $1.0B | $1.46B | +46% |

| Revenue | $54M* | $107M | +98% |

| Cash Burn Rate | $850M/mo | $1B/mo | +18% |

*Q1 revenue estimated from sequential doubling

The company burned through $7.8 billion in cash during the first nine months of 2025, primarily on data center infrastructure, talent acquisition, and software development.

While revenue nearly doubled sequentially to $107 million in Q3 — likely driven by Grok API access and enterprise deployments — the gap between spending and income remains vast. At Q3's annualized revenue run rate of ~$428 million, xAI would need 537 years to generate enough revenue to justify its current $230 billion valuation.

Where the Money Goes: The Colossus Buildout

The cash hemorrhage is funding the most ambitious AI infrastructure project ever attempted. xAI's Memphis-based Colossus data center complex is expanding to 2 gigawatts of compute capacity — enough to power roughly 1.5 million homes — across three facilities:

- Colossus 1: Operational since mid-2025 with ~100,000 Nvidia+7.87% GPUs

- Colossus 2: Under construction, targeting ~550,000 GPUs

- MACROHARDRR: Newly acquired warehouse being converted to data center

The company has committed approximately $18 billion to acquire 555,000 NVIDIA GPUs, making it one of the largest single customers for AI chips globally. On-site natural gas turbines bypass traditional utility constraints, enabling xAI to compress what typically takes 4 years of buildout into weeks.

Just-In-Time Financing

The financial disclosure comes just two days after xAI announced closing a $20 billion Series E funding round — exceeding its $15 billion target as investors including Nvidia+7.87%, Cisco+2.99%, Fidelity, and the Qatar Investment Authority piled in.

The timing appears strategic. At a $1 billion monthly burn rate, xAI would exhaust its previous capital within quarters without fresh injections. The $20 billion provides approximately 20 months of runway at current spending levels — assuming no further acceleration.

Total funding raised by xAI now exceeds $42 billion, according to PitchBook. The company's private market valuation of $230 billion places it third among AI labs, behind Anthropic-2.53% ($350 billion) and OpenAI (~$500 billion).

| Company | Valuation | Total Funding |

|---|---|---|

| OpenAI | $500B | $50B+ |

| Anthropic | $350B | $16B |

| xAI | $230B | $42B |

The Tesla-Optimus Connection

Bloomberg's report revealed xAI plans to use its AI models to power Tesla's Optimus humanoid robots — a strategic convergence that could justify the premium valuation.

Musk has positioned Tesla+3.50% as a robotics company, with Optimus potentially generating more value than the automotive business. If xAI's Grok models become the intelligence layer for millions of Optimus units, the company's revenue trajectory could shift dramatically.

However, Optimus remains in early production stages. The path from AI chatbot to embodied robotics involves solving numerous technical challenges that competitors haven't yet cracked.

Response from xAI

When contacted by Reuters for comment on the financial disclosures, xAI responded with: "Legacy Media Lies."

The dismissive response is consistent with Musk's combative stance toward traditional media, though it leaves the substance of Bloomberg's reporting uncontested.

What to Watch

Near-term catalysts:

- Grok 5 release: Expected in early 2026, with Musk claiming a 10% chance of achieving artificial general intelligence

- Colossus 2 completion: Target of 550,000 GPUs operational

- Tesla earnings: Any commentary on Optimus-xAI integration

Key risks:

- Regulatory scrutiny: xAI's Grok has faced probes in Europe, India, and Malaysia over harmful content generation

- Talent retention: Competing with OpenAI and Anthropic for top researchers

- Infrastructure delays: Supply chain constraints on NVIDIA GPUs

- Sustainability: $1B+/month burn rate requires continuous capital raises

The financials reveal xAI as a company making an extraordinary bet — that massive infrastructure investment will create an insurmountable moat in AI. Whether that bet pays off depends on whether Grok can close the gap with GPT and Claude, and whether the Tesla synergies materialize.

For now, investors are paying $230 billion for a company generating $107 million per quarter. The AI arms race has never been more expensive to enter — or to win.