Earnings summaries and quarterly performance for ALICO.

Executive leadership at ALICO.

Board of directors at ALICO.

Research analysts who have asked questions during ALICO earnings calls.

BR

Brandon Rogers

Roth Capital Partners, LLC

3 questions for ALCO

Also covers: LOOP

Brandon B. Rogers

ROTH Capital Partners

2 questions for ALCO

Also covers: SKYX

GV

George Vasashamo

Freedom Broadcast

2 questions for ALCO

Gerry Sweeney

Roth Capital Partners, LLC

2 questions for ALCO

Also covers: AZZ, BOOM, CECO +8 more

Recent press releases and 8-K filings for ALCO.

Alico Reports Improved Q1 2026 Results and Provides FY 2026 Guidance

ALCO

Earnings

Guidance Update

New Projects/Investments

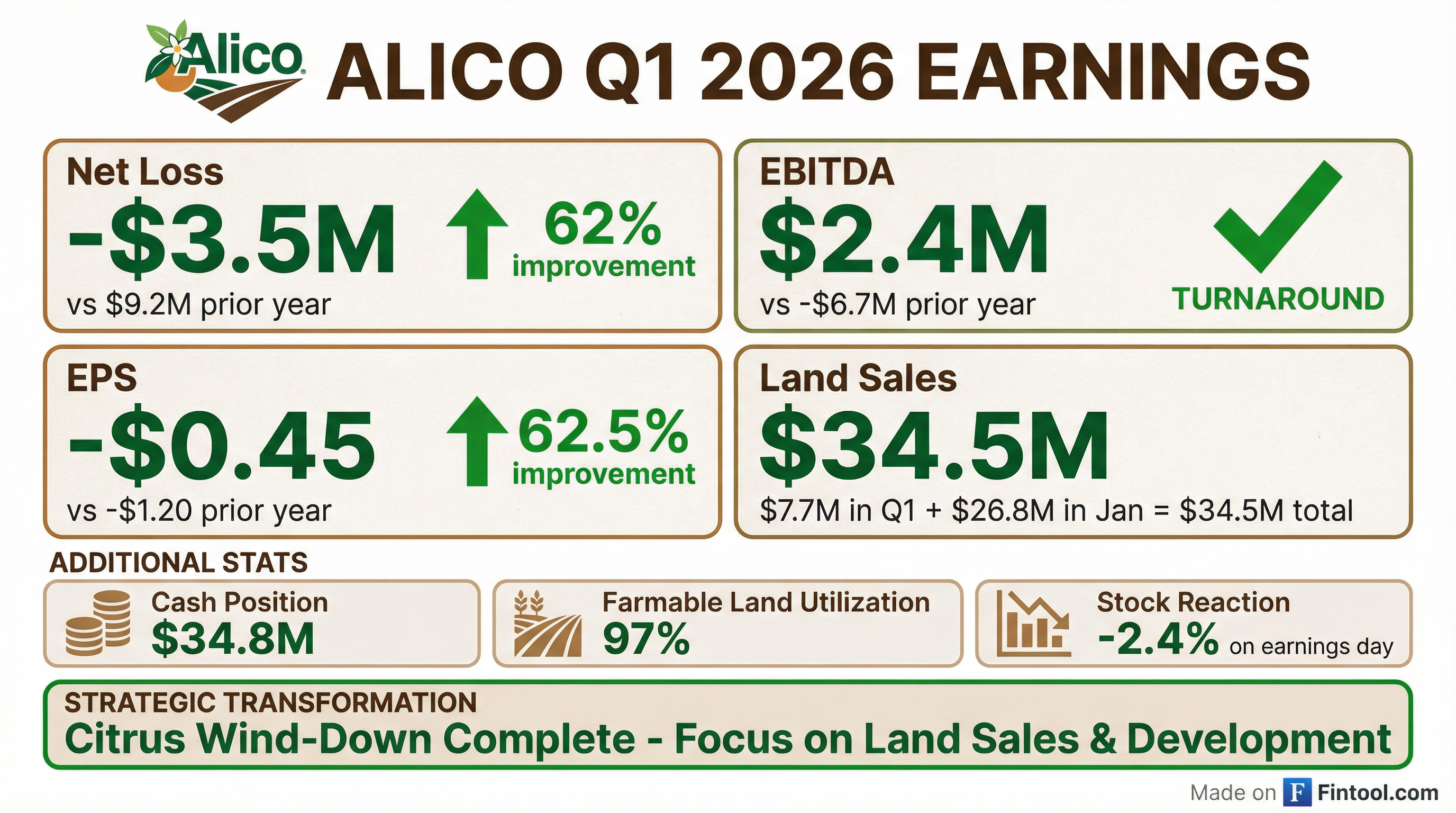

- Alico reported a net loss improvement to $3.5 million and achieved positive EBITDA of $2.4 million in Q1 2026, significantly better than the prior year's net loss of $9.2 million and negative EBITDA of $6.7 million.

- The company generated $7.7 million in land sales during Q1 2026 and an additional $26.8 million from a citrus grove sale after quarter end, contributing to a strong balance sheet with $34.8 million in cash and $50.7 million in net debt as of December 31, 2025.

- For fiscal year 2026, Alico expects to deliver adjusted EBITDA of approximately $14 million and anticipates reducing net debt to approximately $35 million by year-end.

- Alico has achieved 97% utilization of its farmable agricultural acreage and is advancing its real estate development projects, with Corkscrew Grove Villages on track for an anticipated 2026 decision from Collier County.

Feb 5, 2026, 1:30 PM

Alico Reports Improved Q1 2026 Financials and Provides FY 2026 Guidance

ALCO

Earnings

Guidance Update

New Projects/Investments

- Alico reported an improved net loss of $3.5 million and achieved positive EBITDA of $2.4 million in Q1 2026, a significant improvement from the prior year's net loss of $9.2 million and negative EBITDA of $6.7 million. Total revenue for the quarter was $1.9 million, reflecting the substantial conclusion of its citrus business.

- The company's land monetization strategy yielded $7.7 million in land sales during Q1 2026, contributing to $34.5 million in total land sales through January 2026. This bolstered the balance sheet, resulting in $34.8 million in cash and $50.7 million in net debt at quarter-end.

- Alico's strategic focus includes 97% utilization of its farmable agricultural acreage and advancing four near-term real estate development projects, which are collectively valued between $335 million and $380 million. The Corkscrew Grove Villages project is on track for a 2026 decision by Collier County.

- For fiscal year 2026, Alico anticipates Adjusted EBITDA of approximately $14 million, expects to end the year with around $50 million in cash, and projects reducing net debt to approximately $35 million.

Feb 5, 2026, 1:30 PM

Alico Reports Improved Q1 2026 Net Loss and Positive EBITDA, Advances Land Monetization Strategy

ALCO

Earnings

Guidance Update

New Projects/Investments

- Alico reported a net loss of $3.5 million or $0.45 per diluted share for Q1 2026, a significant improvement from a $9.2 million loss in the prior year, and achieved positive EBITDA of $2.4 million compared to -$6.7 million in the prior year period. Total revenue for the quarter was $1.9 million, primarily reflecting the substantial conclusion of its citrus business.

- The company generated $7.7 million in land sales during Q1 2026, with total land sales year-to-date through January 2026 reaching $34.5 million, including a $26.8 million sale of approximately 2,950 acres after quarter end.

- Alico maintains a strong balance sheet with $34.8 million in cash and $50.7 million in net debt at quarter end. The company anticipates ending fiscal year 2026 with approximately $50 million in cash and reducing net debt to approximately $35 million.

- Strategic initiatives are progressing, with 97% utilization of its farmable agricultural acreage. The four near-term real estate development projects, including Corkscrew Grove Villages, are estimated to have a present value between $335 million and $380 million, with a final decision for Corkscrew Grove Villages anticipated in 2026. For fiscal year 2026, Alico expects to deliver adjusted EBITDA of approximately $14 million.

Feb 5, 2026, 1:30 PM

Alico, Inc. Announces First Quarter Ended December 31, 2025 Financial Results

ALCO

Earnings

Guidance Update

New Projects/Investments

- Alico reported a net loss of $3.5 million and positive EBITDA of $2.4 million for the first quarter ended December 31, 2025, an improvement from a net loss of $9.2 million and negative EBITDA of $6.7 million in the prior year period.

- The company completed $7.7 million in land sales during Q1 2026, with total land sales reaching $34.5 million year-to-date through January 2026, as it executes its strategic shift away from citrus operations.

- As of December 31, 2025, Alico's balance sheet shows $34.8 million in cash and a 14.39 to 1 current ratio.

- For fiscal year 2026, the company anticipates approximately $14 million in Adjusted EBITDA, with an expected cash balance of approximately $50 million and net debt of approximately $35 million by year-end.

- The entitlement decision for the Corkscrew Grove Villages development is expected in 2026, with potential construction beginning in 2028 or 2029 if approvals are granted.

Feb 4, 2026, 9:05 PM

Alico, Inc. Announces Q1 2026 Financial Results and Strategic Progress

ALCO

Earnings

Guidance Update

New Projects/Investments

- Alico, Inc. reported a net loss of $3.5 million and positive EBITDA of $2.4 million for the first quarter ended December 31, 2025, an improvement from a net loss of $9.2 million and negative EBITDA of $6.7 million in the prior year period.

- The company completed $7.7 million in land sales during Q1 2026, contributing to $34.5 million in total land sales year-to-date through January 2026, and achieved 97% utilization of its farmable acreage.

- As of December 31, 2025, Alico held $34.8 million in cash and had $50.7 million in net debt. The entitlement decision for the Corkscrew Grove Villages development is anticipated in 2026.

- For fiscal year 2026, Alico expects to achieve Adjusted EBITDA of approximately $14 million, with year-end cash of approximately $50 million and net debt of approximately $35 million.

Feb 4, 2026, 9:03 PM

Alico Completes Land Sale and Achieves High Agricultural Utilization

ALCO

Share Buyback

New Projects/Investments

- Alico, Inc. completed a large grove sale of approximately 2,950 acres for $26.8 million in gross proceeds.

- Including previously announced transactions, the company has completed $34.6 million in land monetization transactions in fiscal year 2026.

- Alico has achieved 97% utilization of its approximately 32,500 farmable agricultural acreage through new lease agreements.

- These actions represent the successful continuation of Alico's strategic transformation, which began in fiscal year 2025, to become a diversified land company.

- As of September 30, 2025, Alico reported a net debt position of $47.4 million and authorized a share buyback program of up to $50 million in April 2025.

Jan 15, 2026, 1:30 PM

Alico outlines real estate transformation strategy and project milestones

ALCO

New Projects/Investments

Share Buyback

Dividends

- Alico is undergoing a strategic transformation from citrus production to a real estate-focused land company, driven by the unprofitability of its former core business.

- The company owns over 50,000 acres in Florida, with 25% (approximately 12,000 acres) designated for residential and commercial development, and the remaining 75% leased for agricultural use.

- Key real estate projects, such as the Corkscrew Grove Village Project, are advancing through the entitlement process, with county-level approval expected by end of April 2026.

- Alico has a $50 million share buyback program authorized until the end of 2028 and has reduced net debt to $48 million as of September (FY 2025), down from over $200 million a decade ago.

- The estimated present value of Alico's assets is between $650 million and $750 million, significantly exceeding its current market capitalization of approximately $280 million.

Jan 13, 2026, 4:00 PM

Alico Details Real Estate Transformation and Asset Monetization Strategy

ALCO

New Projects/Investments

Share Buyback

Revenue Acceleration/Inflection

- Alico is undergoing a significant transformation, shifting from its historical citrus production business due to unsustainable economics to focus on real estate development and land leasing.

- The company owns over 50,000 acres in Florida, with approximately 25% (12,000 acres) earmarked for residential or commercial development and the remaining 75% (40,000 acres) for agricultural leasing.

- A key development project, the Corkscrew Grove Village Project in Collier County, plans for 9,000 houses and is progressing through county, state, and federal approval processes, with county approval anticipated by the end of April 2026.

- The estimated present value of Alico's assets is between $650 million and $750 million, significantly higher than its current market capitalization of approximately $280 million.

- Alico is actively managing its balance sheet, reducing net debt to $48 million (as of September FY 2025), and has a $50 million share buyback program approved until the end of 2028.

Jan 13, 2026, 4:00 PM

Alico outlines real estate transformation strategy and development milestones

ALCO

New Projects/Investments

Share Buyback

Revenue Acceleration/Inflection

- Alico is undergoing a significant transformation, shifting from a citrus producer to focusing on real estate development and land leasing.

- The company owns over 50,000 acres of land in Florida, with approximately 25% (around 12,000 acres) earmarked for residential or commercial development and the remaining 75% for agricultural leasing.

- A major development, the Corkscrew Grove Village Project in Collier County, plans for 9,000 houses and is progressing through entitlement approvals, with county-level approval anticipated by the end of April 2026.

- Alico's stock was up 40% last year (FY 2025), and the company sold $23-$24 million in land assets in FY 2025, with $34 million of assets held for sale as of November (for September balance). The company also has a $50 million share buyback program approved until the end of 2028.

Jan 13, 2026, 4:00 PM

Alico Reports Q4 and Full Fiscal Year 2025 Results, Highlights Strategic Transformation

ALCO

Earnings

Guidance Update

New Projects/Investments

- Alico successfully completed its strategic pivot from a traditional citrus producer to a diversified land company in fiscal year 2025, concluding its final major citrus harvest and de-risking its business model.

- For fiscal year 2025, the company exceeded its adjusted EBITDA guidance, achieving $22.5 million (target $20 million), and generated $23.8 million in land sales, surpassing its $20 million guidance.

- Alico significantly strengthened its balance sheet, ending fiscal year 2025 with $38.1 million in cash and reducing net debt to $47.4 million, providing financial flexibility to fund operations through fiscal year 2027.

- The company's four near-term real estate development projects, totaling 5,500 acres, are estimated to have a present value of between $335 million and $380 million to be realized within the next five years, with a final decision for Corkscrew Grove Villages expected in 2026.

- Management's NPV analysis values Alico's 49,000-acre land portfolio between $650 million and $750 million, significantly above its current market capitalization of approximately $240 million, and the company remains committed to shareholder returns through dividends and an authorized $50 million buyback program.

Nov 25, 2025, 1:30 PM

Quarterly earnings call transcripts for ALICO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more