Earnings summaries and quarterly performance for AMBC.

Executive leadership at AMBC.

Claude LeBlanc

Detailed

President and Chief Executive Officer

CEO

DM

Daniel McGinnis

Detailed

Senior Managing Director, Chief Operating Officer

DB

David Barranco

Detailed

Senior Managing Director

DT

David Trick

Detailed

Executive Vice President, Chief Financial Officer and Treasurer

RE

Robert Eisman

Detailed

Senior Managing Director, Chief Accounting Officer and Controller

SS

Sharon Smith

Detailed

Executive Vice President, Group Chief Operating Officer

SK

Stephen Ksenak

Detailed

Senior Managing Director and General Counsel

Board of directors at AMBC.

Research analysts who have asked questions during AMBC earnings calls.

Recent press releases and 8-K filings for AMBC.

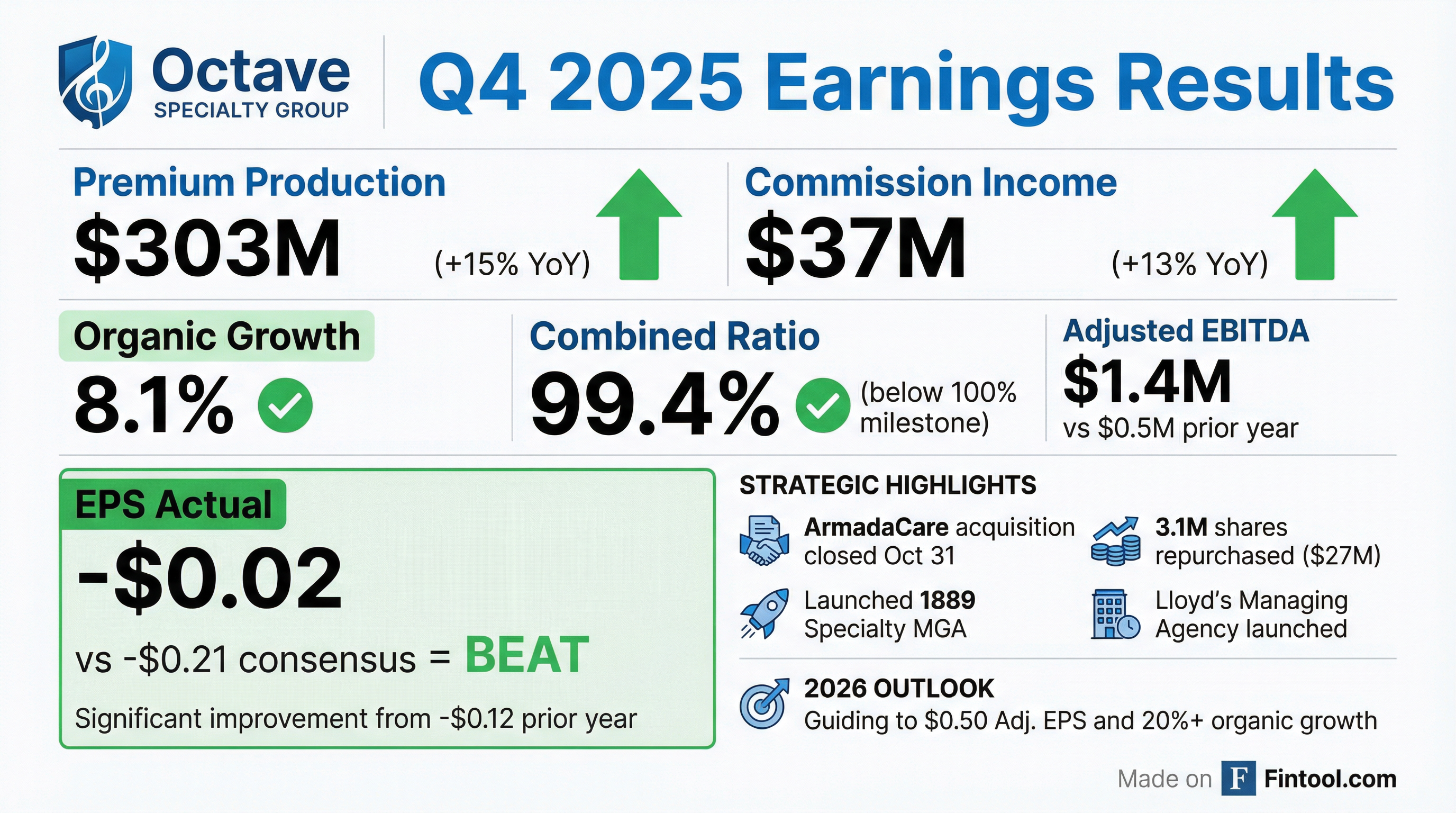

Octave Specialty Group Reports Strong Q4 2025 Performance and Issues 2026 Guidance

AMBC

Earnings

Guidance Update

Share Buyback

- Octave Specialty Group reported a 15% year-over-year increase in premium production to $303 million and a 13% rise in commission income to $37 million for Q4 2025.

- The company completed the strategic acquisition of ArmadaCare on October 31, expanding its Accident & Health offerings, and launched 1889 Specialty, a new professional lines MGA.

- In October, Octave repurchased 3.1 million shares totaling $27 million, representing approximately 6.7% of shares outstanding.

- For 2026, the company provided guidance including 20%+ organic growth for Insurance Distribution with Adjusted EBITDA of ~$40 million, and Consolidated Adjusted Net Income of ~$0.50/share.

4 days ago

Octave Specialty Group (formerly Ambac Financial Group) Announces Q3 2025 Results and Rebranding

AMBC

Earnings

M&A

Share Buyback

- Ambac Financial Group has rebranded as Octave Specialty Group, marking its transition to a pure-play specialty P&C insurance business.

- For Q3 2025, the company reported a net loss from continuing operations of $32 million, or $0.67 per diluted share, and an adjusted EBITDA loss of $3 million.

- The insurance distribution segment's revenue increased 80% to $43 million compared to Q3 2024, driven by 40% organic growth. Adjusted EBITDA for this segment grew 183% to $6 million.

- Strategic initiatives included the sale of its legacy financial guarantee business for $420 million, the acquisition of RemadaCare, and the repurchase of 3.1 million shares. Corporate expense reductions are expected to decrease run-rate adjusted corporate expenses by over $10 million.

- Octave Specialty Group maintains an aspirational $80 million EBITDA goal for 2028 and targets approximately $30 million in adjusted corporate expenses for 2026.

Nov 11, 2025, 1:30 PM

Ambac Reports Q3 2025 Results, Announces Strategic Transactions and Share Repurchase

AMBC

Earnings

M&A

Share Buyback

- Ambac completed the sale of its Legacy Financial Guarantee business for $420 million in cash on September 29, 2025, and acquired ArmadaCare for $250 million in cash and new debt on October 31, 2025.

- The company repurchased 3,142,554 shares in October 2025, representing 6.5% of basic weighted average shares outstanding, and launched 1889 Specialty, a new MGA, in October 2025.

- For Q3 2025, Ambac reported a consolidated net loss to shareholders from continuing operations of $(31.7) million and a consolidated adjusted net loss to shareholders from continuing operations of $(10.0) million.

- Total premium production increased 32% to $343 million in Q3 2025, driven by a 69% rise in insurance distribution premiums produced to $245 million.

Nov 11, 2025, 1:30 PM

Ambac Financial Group, Inc. Rebrands to Octave Specialty Group, Inc.

AMBC

Delisting/Listing Issues

New Projects/Investments

M&A

- Ambac Financial Group, Inc. has rebranded to Octave Specialty Group, Inc., with the name change becoming effective on November 10, 2025, at 4:15 pm ET.

- The company will begin trading under its new ticker symbol "NYSE: OSG" on November 20, 2025.

- This rebrand signifies the company's transformation into a leading specialty insurance platform, focusing on building and acquiring high-performing managing general agency (MGA) businesses.

- As part of the rebrand, its acquisition division, Cirrata Group, is now Octave Partners, and its incubation division, Beat Capital Partners, is now Octave Ventures.

Nov 10, 2025, 10:20 PM

Ambac Financial Group Announces Third Quarter 2025 Results

AMBC

Earnings

Share Buyback

M&A

- Ambac Financial Group reported a net loss attributable to shareholders of $(112.62) million for the third quarter of 2025, resulting in a diluted net loss per share of $(2.35). Total revenues from continuing operations were $66.61 million, marking a 5% decrease from the prior-year period.

- The Insurance Distribution segment demonstrated strong performance, with total revenue increasing 80% to $43.22 million and organic revenue growth reaching 40.0% for the quarter. This segment's Adjusted EBITDA to shareholders grew 183% to $5.99 million.

- Conversely, the Specialty P&C Insurance segment saw gross premiums written decrease 16% to $97.19 million and net premiums written fall 46% to $17.78 million. The segment recorded a net loss to shareholders of $(0.05) million and a Combined Ratio of 112.9%.

- Subsequent to September 30, 2025, Ambac repurchased 3.1 million shares of its common stock at an average price of $8.48, which accounted for 6.7% of shares outstanding.

- The company completed the sale of its legacy financial guarantee business in late September, now focusing exclusively on the growth and profitability of its specialty P&C businesses, including the integration of ArmadaCare.

Nov 10, 2025, 9:13 PM

Ambac Reports Third Quarter 2025 Results with Net Loss and Strategic Focus Shift

AMBC

Earnings

Share Buyback

M&A

- Ambac reported a net loss attributable to shareholders of $(112.6) million for the third quarter of 2025, with total revenues from continuing operations decreasing 5% to $67 million compared to the prior-year period.

- The Insurance Distribution segment demonstrated strong performance, with total revenue growing 80% to $43 million and organic revenue growth of 40.0% for the quarter.

- The Specialty P&C Insurance (Everspan) segment saw gross premiums written decline 16% to $97 million and net premiums written decrease 46% to $18 million, contributing to a net loss to shareholders of $0.1 million and a combined ratio of 112.9%.

- Subsequent to the quarter, Ambac repurchased 3.1 million shares in October at an average price of $8.48, representing 6.7% of shares outstanding.

- The company has completed the sale of its legacy financial guarantee business, shifting its sole focus to the growth and profitability of its specialty P&C businesses.

Nov 10, 2025, 9:05 PM

Ambac Financial Group Completes ArmadaCare Acquisition

AMBC

M&A

New Projects/Investments

- Ambac Financial Group, Inc. completed its acquisition of ArmadaCare, a leading supplemental health insurance program manager, from SiriusPoint Ltd. on November 3, 2025.

- ArmadaCare will continue to operate as a wholly owned subsidiary of Ambac, retaining its brand and existing management team.

- Ambac's President and CEO, Claude LeBlanc, stated that the acquisition strengthens Ambac's financial profile, diversifies its distribution platform, and offers complementary capabilities to its existing accident and health businesses.

Nov 3, 2025, 1:38 PM

Ambac Subsidiary Beat Capital Partners Launches 1889 Specialty Insurance Services

AMBC

Product Launch

New Projects/Investments

Management Change

- Ambac Financial Group's subsidiary, Beat Capital Partners, has launched 1889 Specialty Insurance Services.

- 1889 Specialty will offer management liability and professional lines insurance to small and medium-sized financial institutions, asset managers, insurance companies, and insurance agents and brokers.

- The new entity is led by Blair Bartlett, who has more than 20 years of financial lines experience and was previously Vice President of Financial Institutions at Crum & Forster.

- Products are written on an excess and surplus (E&S) basis and distributed primarily through wholesale channels, backed by A+ rated capacity.

Oct 16, 2025, 12:30 PM

Ambac Financial Group Announces Acquisition of ArmadaCare

AMBC

M&A

New Projects/Investments

- Ambac Financial Group has signed an agreement to acquire 100% interest in ArmadaCare, a specialty MGA operating in the Accident & Health (A&H) market, with the acquisition expected to close in Q4 2025.

- The purchase price for ArmadaCare is $250 million, representing a 13.8x LTM 6/30/2025 EBITDA multiple.

- The acquisition will be financed through a combination of cash and newly issued debt, including a new $100 million Term Loan A and a $20 million Revolving Credit Facility.

- ArmadaCare reported $148 million in Annualized Premium in Force (APIF) and $18 million in EBITDA for LTM Q2'25, with an EBITDA Margin of 45%.

- The transaction is anticipated to bolster Ambac's margins and be accretive to its earnings in 2026, strategically diversifying its insurance distribution business in a non-correlated market.

Sep 30, 2025, 12:30 PM

Ambac Financial Group Completes Legacy Business Sale and Announces ArmadaCare Acquisition

AMBC

M&A

Share Buyback

New Projects/Investments

- Ambac Financial Group successfully closed the sale of its legacy business, Ambac Assurance Corporation (AAC), for $420 million, completing its transition into a pure-play specialty insurance platform.

- The company signed an agreement to acquire ArmadaCare, a specialty A&H platform, for $250 million, financed by $120 million in new facilities. ArmadaCare generated $18 million in EBITDA on $40 million gross revenue for the trailing 12 months ended June 30, 2025, and the acquisition is expected to be accretive to EBITDA immediately and to earnings in 2026.

- As part of its capital management plan, Ambac repaid $150 million of outstanding debt, repurchased a $62 million co-investment, and will reinitiate its share repurchase program with $35 million remaining authorization. The company aims to achieve $80+ million of adjusted EBITDA for common shareholders by 2028.

- The company implemented a new target operating model, streamlining its leadership team, reducing executive compensation expenses, and plans a company rebrand in the fourth quarter.

Sep 30, 2025, 12:30 PM

Quarterly earnings call transcripts for AMBC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more