Earnings summaries and quarterly performance for AMERICAN SUPERCONDUCTOR CORP /DE/.

Executive leadership at AMERICAN SUPERCONDUCTOR CORP /DE/.

Board of directors at AMERICAN SUPERCONDUCTOR CORP /DE/.

Research analysts who have asked questions during AMERICAN SUPERCONDUCTOR CORP /DE/ earnings calls.

CR

Colin Rusch

Oppenheimer & Co. Inc.

10 questions for AMSC

Also covers: AEVA, ALB, AMPX +25 more

Eric Stine

Craig-Hallum Capital Group LLC

10 questions for AMSC

Also covers: ALTO, AMRC, ASPN +19 more

JC

Justin Clare

Roth MKM

10 questions for AMSC

Also covers: AMPS, ATKR, BWEN +11 more

TM

Tim Moore

EF Hutton

7 questions for AMSC

Also covers: AMPS, ARQ, BE +12 more

Recent press releases and 8-K filings for AMSC.

AMSC Reports Strong Q3 FY2025 Results, Exceeds Revenue Guidance, and Provides Optimistic Q4 Outlook

AMSC

Earnings

Guidance Update

M&A

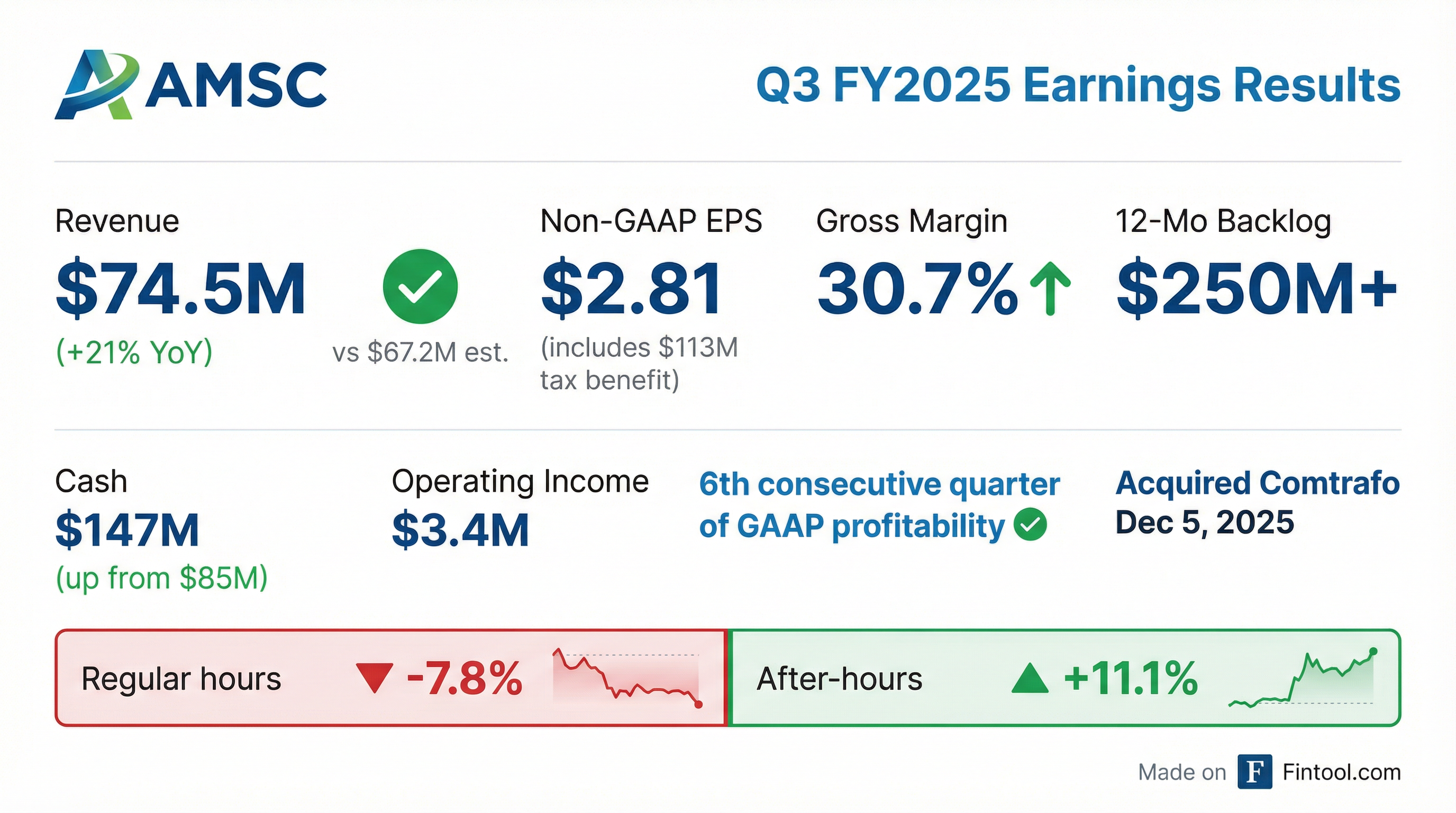

- AMSC reported Q3 fiscal year 2025 revenue of $74.5 million, a 20% increase year-over-year, exceeding guidance and including $4.6 million from the Comtrafo acquisition.

- The company achieved $117.8 million in GAAP net income and $123.5 million in non-GAAP net income, significantly driven by a $113.1 million tax benefit from the release of a valuation allowance on deferred tax assets. Excluding this benefit, net income was $4.7 million and non-GAAP net income was $10.5 million.

- AMSC ended the quarter with $147.1 million in cash after the $88.3 million cash acquisition of Comtrafo and generated $3.2 million in operating cash flow.

- The 12-month backlog exceeded $250 million, and the company provided Q4 fiscal year 2025 revenue guidance to exceed $80 million, with net income expected to exceed $3 million and non-GAAP net income to exceed $8 million.

- The business is diversified, with significant contributions from traditional energy, renewables, military, and utility markets, and a new data center project contributed 5% of revenue.

Feb 5, 2026, 3:00 PM

AMSC Reports Strong Q3 FY2025 Results, Exceeding Guidance and Announcing Significant Tax Benefit

AMSC

Earnings

Guidance Update

M&A

- AMSC reported Q3 fiscal year 2025 revenue of $74.5 million, exceeding guidance and marking over 20% year-over-year growth, with total revenue for the past nine months nearly matching the entire previous fiscal year.

- The company achieved its sixth consecutive quarter of profitability and tenth consecutive quarter of non-GAAP profitability, with gross margins topping 30% for the third sequential quarter.

- Net income for the quarter was $117.8 million or $2.68 per share, significantly boosted by a $113.1 million tax benefit from the release of a valuation allowance on deferred tax assets.

- The acquisition of Comtrafo, closed on December 5, 2025, contributed $4.6 million in revenue for the partial period and is expected to strengthen AMSC's utility position and expand its market reach.

- AMSC ended the quarter with a 12-month backlog of over $250 million and provided strong Q4 fiscal year 2025 revenue guidance to exceed $80 million.

Feb 5, 2026, 3:00 PM

AMSC Reports Strong Q3 FY 2025 Results and Provides Q4 FY 2025 Guidance

AMSC

Earnings

Guidance Update

M&A

- AMSC generated revenues of $74.5 million for Q3 FY 2025, exceeding guidance and representing over 20% growth compared to the year-ago quarter, with $4.6 million contributed by the Comtrafo acquisition.

- The company reported net income of $117.8 million or $2.68 per share, and non-GAAP net income of $123.5 million or $2.81 per share for Q3 FY 2025, which included a $113.1 million tax benefit from the release of a valuation allowance on deferred tax assets. Excluding this benefit, net income was $4.7 million or $0.11 per share.

- For Q4 FY 2025, AMSC expects revenues to exceed $80 million, net income to exceed $3 million or $0.07 per share, and non-GAAP net income to exceed $8 million or $0.17 per share.

- The Grid business unit accounted for 85% of total revenues, growing 21% year-over-year, while the Wind business unit grew 25%. The company ended the quarter with $147.1 million in cash after the $88.3 million cash consideration for the Comtrafo acquisition and reported a 12-month backlog of over $250 million.

- AMSC delivered on a data center project, which represented about 5% of revenue in the quarter, and sees opportunities in both data center construction and supporting utilities with data center-related challenges.

Feb 5, 2026, 3:00 PM

AMSC Reports Strong Q3 FY2025 Results and Positive Q4 FY2025 Outlook

AMSC

Earnings

Guidance Update

M&A

- AMSC reported revenues of $74.5 million for the third quarter of fiscal year 2025, an increase from $61.4 million in the same period of fiscal 2024, driven by organic growth and the acquisition of Comtrafo.

- Net income for Q3 FY2025 was $117.8 million, or $2.68 per share, compared to $2.5 million, or $0.07 per share, in Q3 FY2024, primarily due to a $113.1 million tax benefit.

- Non-GAAP net income for the quarter was $123.5 million, or $2.81 per share, up from $6.0 million, or $0.16 per share, in the prior year.

- The company ended the quarter with $147.1 million in cash, cash equivalents, and restricted cash as of December 31, 2025.

- For the fourth quarter ending March 31, 2026, AMSC expects revenues to exceed $80.0 million, net income to exceed $3.0 million (or $0.07 per share), and non-GAAP net income to exceed $8.0 million (or $0.17 per share).

Feb 4, 2026, 9:07 PM

AMSC Reports Q3 FY2025 Financial Results and Provides Q4 FY2025 Outlook

AMSC

Earnings

Guidance Update

Revenue Acceleration/Inflection

- AMSC reported revenue of $74.5 million for the third quarter of fiscal 2025, an increase of over 20% year-over-year, and achieved a gross margin greater than 30%.

- Net income for the quarter was $117.8 million, or $2.68 per share, significantly boosted by a $113.1 million tax benefit related to the release of a valuation allowance on a deferred tax asset.

- The company concluded the quarter with $147.1 million in cash, cash equivalents, and restricted cash and a 12-month backlog of over $250 million.

- For the fourth quarter ending March 31, 2026, AMSC expects revenues to exceed $80.0 million and net income to exceed $3.0 million, or $0.07 per share.

Feb 4, 2026, 9:05 PM

AMSC Acquires Comtrafo

AMSC

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- American Superconductor Corporation (AMSC) announced the acquisition of Comtrafo Industria de Transformadores Elétricos S.A., a 30-year-old family-owned Brazilian manufacturer of large power and distribution transformers.

- The acquisition cost is approximately $55 million in cash and $78 million in stock, with an additional $29 million paid for over 100 acres of land for manufacturing expansion.

- Comtrafo is expected to generate approximately $55 million in revenue for calendar year 2025, with operating margins regularly exceeding 20%.

- The acquisition is anticipated to be immediately accretive in the quarter ending March 2026.

- Comtrafo has a total backlog of about $85 million, with approximately $55 million in 12-month backlog.

Dec 11, 2025, 2:00 PM

AMSC Acquires Contrafo Industria de Transformadores Eléctricos S.A.

AMSC

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- American Superconductor Corporation (AMSC) announced the acquisition of Contrafo Industria de Transformadores Eléctricos S.A. (Contrafo), a Brazilian manufacturer of large power and distribution transformers.

- The acquisition cost approximately $55 million in cash and $78 million in stock for the business, with an additional $29 million for over 100 acres of land.

- Contrafo is expected to generate $55 million in revenue for calendar year 2025, with operating margins regularly exceeding 20%, and has a total backlog of $85 million.

- The acquisition is anticipated to be immediately accretive next quarter and expands AMSC's product offerings and market reach into the $1.5 billion annually Brazilian transformer market. An earn-out structure is in place if Contrafo more than doubles its business, correlating to doubling revenue in three years or sooner.

Dec 11, 2025, 2:00 PM

AMSC acquires Brazilian transformer manufacturer Comtrafo

AMSC

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- AMSC announced the acquisition of Comtrafo Indústria de Transformadores Elétricos S.A., a Brazilian manufacturer of large power and distribution transformers for utility and industrial customers.

- Comtrafo is expected to generate $55 million in revenue for calendar year 2025, with gross margins comparable to AMSC's and operating margins regularly exceeding 20%.

- The acquisition cost is approximately $55 million in cash and $78 million in stock for the business, plus an additional $29 million for over 100 acres of land for manufacturing expansion.

- The deal is expected to be immediately accretive next quarter and accelerates AMSC's plans by at least one year.

- This acquisition expands AMSC's product portfolio to include transformers up to 250 MVA for the transmission grid and establishes a significant presence in the $1.5 billion annual Brazilian transformer market, which is part of a broader Latin American market expected to triple by the mid-2030s.

Dec 11, 2025, 2:00 PM

American Superconductor Corporation Enters Stock Exchange Agreement for Comtrafo Acquisition

AMSC

M&A

New Projects/Investments

- American Superconductor Corporation (AMSC), through its wholly-owned subsidiary AMSC Brazil, entered into a Stock Exchange Agreement dated December 5, 2025, to acquire Comtrafo, a Brazilian manufacturer of large power and distribution transformers.

- Comtrafo reported approximately $50 million in revenue for calendar year 2024, with gross margins of 30% and operating margins of about 20%.

- The agreement includes potential earnout payments to the Stockholders, contingent on Comtrafo's Adjusted EBITDA performance over three periods, with a maximum aggregate payment of BRL$382,500,000.

- Comtrafo has a total backlog of approximately $85 million, with about $55 million expected within 12 months.

Dec 10, 2025, 9:04 PM

AMSC Reports Strong Q2 FY2025 Results and Provides Q3 FY2025 Guidance

AMSC

Earnings

Guidance Update

New Projects/Investments

- AMSC reported revenues of $65.9 million for the second quarter of fiscal year 2025, representing a 20% increase compared to the year-ago quarter and marking the third consecutive quarter at this higher revenue level. The Grid business unit's revenues increased by 16%, while the Wind business unit's revenues increased by 53% over the same period.

- The company achieved its fifth consecutive quarter of profitability and ninth consecutive quarter of non-GAAP profitability, with a gross margin of 31% for Q2 FY2025. Non-GAAP net income was $8.9 million, or $0.20 per share, and the company ended the quarter with $218.8 million in cash, cash equivalents, and restricted cash.

- For the third quarter of fiscal year 2025, AMSC expects revenues to be in the range of $65-$70 million, with non-GAAP net income exceeding $6 million, or $0.14 per share. The company also highlighted a 12-month backlog of well over $200 million and anticipates acceleration in military and data center opportunities.

Nov 6, 2025, 3:00 PM

Quarterly earnings call transcripts for AMERICAN SUPERCONDUCTOR CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more