Earnings summaries and quarterly performance for Aon.

Executive leadership at Aon.

Gregory C. Case

Chief Executive Officer and President

Darren Zeidel

Executive Vice President, General Counsel and Company Secretary

David DeBrunner

Senior Vice President, Global Controller and Chief Accounting Officer

Edmund Reese

Executive Vice President and Chief Financial Officer

Lisa Stevens

Executive Vice President and Chief Administrative Officer

Mindy Simon

Chief Operating Officer

Board of directors at Aon.

Admiral James G. Stavridis

Director

Adriana Karaboutis

Director

Byron O. Spruell

Director

Cheryl A. Francis

Director

Gloria Santona

Director

Jeffrey C. Campbell

Director

Jin-Yong Cai

Director

Jo Ann Jenkins

Director

Jose Antonio Álvarez

Director

Lester B. Knight

Chair of the Board

Richard C. Notebaert

Director

Sarah E. Smith

Director

Research analysts who have asked questions during Aon earnings calls.

David Motemaden

Evercore ISI

7 questions for AON

Elyse Greenspan

Wells Fargo

7 questions for AON

Andrew Kligerman

TD Cowen

5 questions for AON

Robert Cox

The Goldman Sachs Group, Inc.

4 questions for AON

Jamminder Bhullar

JPMorgan Chase & Co.

3 questions for AON

Meyer Shields

Keefe, Bruyette & Woods

3 questions for AON

Bob Huang

Morgan Stanley

2 questions for AON

Charlie Lederer

BMO

2 questions for AON

Jimmy Bhullar

JPMorgan Chase & Co.

2 questions for AON

Matthew Heimermann

Citi

2 questions for AON

Michael Zaremski

BMO Capital Markets

2 questions for AON

Alex Scott

Barclays PLC

1 question for AON

Cave Montazeri

Deutsche Bank

1 question for AON

Dean Criscitiello

Keefe, Bruyette & Woods

1 question for AON

Grace Carter

BofA Securities

1 question for AON

Jon Paul Newsome

Piper Sandler & Co.

1 question for AON

Recent press releases and 8-K filings for AON.

- Aon and KNIAZHA VIG secured a $25M reinsurance facility with the U.S. International Development Finance Corporation to underwrite war-risk insurance for SMEs and private individuals in Ukraine.

- The facility, effective Feb. 1, 2026, provides up to $100M in coverage on war-risk insurance policies.

- This collaboration builds on Aon’s efforts that have mobilized over $490M in public and private capital to support Ukraine’s economy and reconstruction.

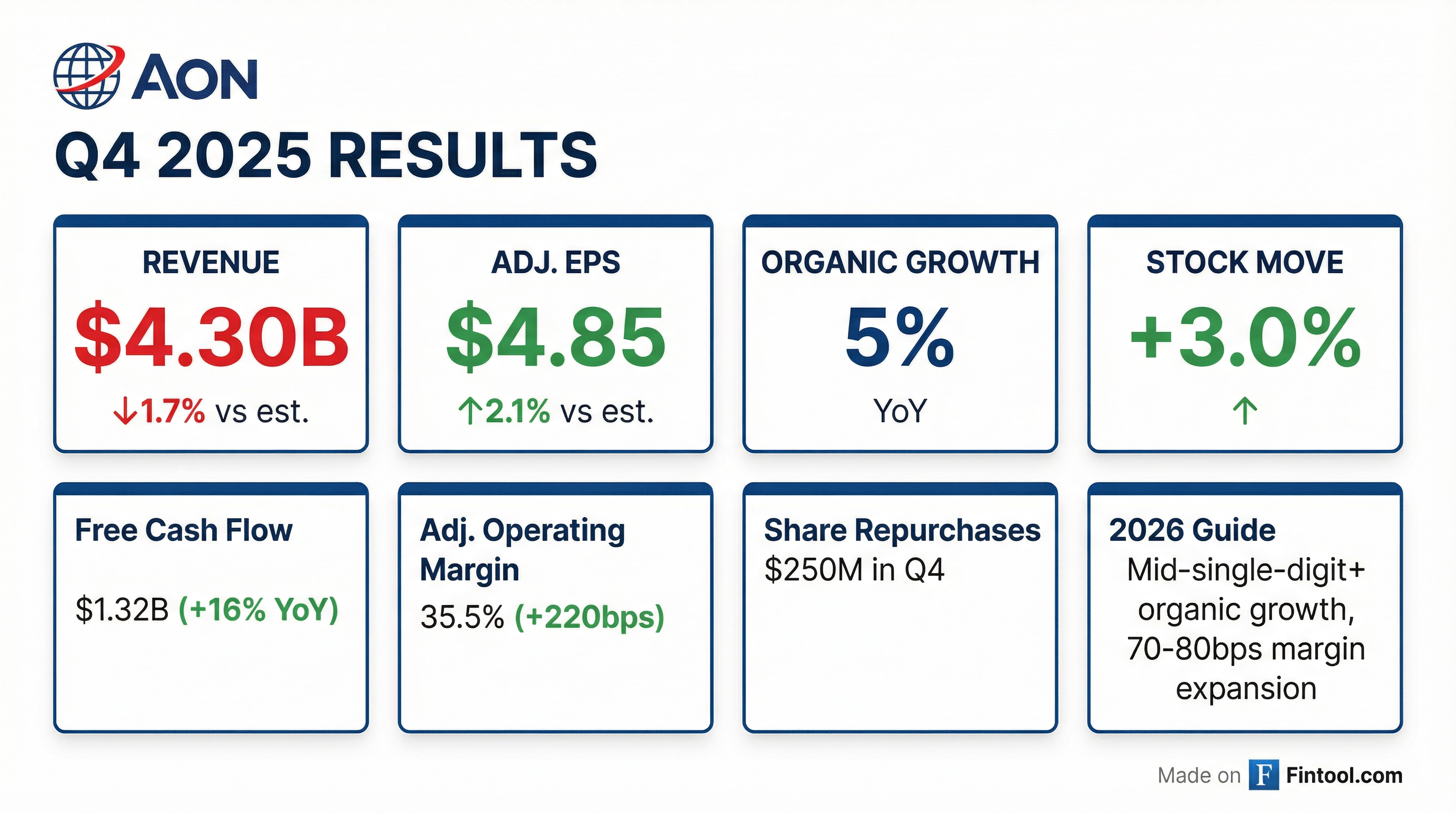

- Q4 adjusted operating income rose 11% to $1.5 billion, with margins expanding 220 bps to 35.5% (FY 2025 margin 32.4%, +90 bps).

- Generated $1.3 billion in Q4 free cash flow; full-year free cash flow was $3.2 billion (+14%), debt paid down ~$1.9 billion lowering leverage to 2.9×, and returned $1.6 billion to shareholders (including $1 billion in buybacks).

- 2026 guidance targets mid-single-digit organic revenue growth, 70–80 bps of margin expansion, double-digit free cash flow growth to $4.3 billion, and at least $1 billion in share repurchases.

- Q4 total revenue of $4.3 B, up 4% Y/Y; organic revenue growth of 5% in Q4 and 6% for FY 2025.

- Adjusted operating income of $1.525 B with margin expansion of 220 bps to 35.5%; adjusted EPS of $4.85, up 10% Y/Y.

- Free cash flow of $1.323 B, up 16% Y/Y; returned $160 M in dividends and $250 M in share repurchases in Q4.

- 2026 guidance targets mid-single-digit organic revenue growth, 70–80 bps of margin expansion, strong EPS growth, and double-digit free cash flow growth.

- Aon delivered FY2025 organic revenue growth of 6%, total revenue of $17 billion (+9%), adjusted operating margin of 32.4% (+90 bps), adjusted EPS of $17.07 (+9%), and free cash flow growth of 14%.

- In Q4 2025, organic revenue rose 5%, total revenue reached $4.3 billion (+4%), adjusted operating margin expanded to 35.5% (+220 bps), adjusted EPS was $4.85 (+10%), and free cash flow grew 16%.

- Aon ended 2025 with $7 billion of available capital for 2026, plans at least $1 billion in share repurchases, and will pursue high-return M&A while maintaining investment and dividend discipline.

- For 2026, the company targets mid-single-digit or greater organic revenue growth, 70–80 bps of adjusted operating margin expansion, strong EPS growth, and double-digit free cash flow, with $4.3 billion expected free cash flow generation.

- Full-year 2025: organic revenue growth of 6%, total revenue of $17 billion, adjusted operating margin of 32.4% (+90 bps), adjusted EPS of $17.07 (+9%), and free cash flow of $3.2 billion (+14%).

- Q4 2025: organic revenue growth of 5%, revenue of $4.3 billion (+4%), adjusted operating margin of 35.5% (+220 bps), adjusted EPS of $4.85 (+10%), and free cash flow of $1.3 billion (+16%).

- Executing on Aon United and the 3×3 plan, with strategic innovation in Alternative Business Services (ABS), data center lifecycle insurance (DCLP), and AI-powered risk solutions, driving client wins and middle-market expansion.

- 2026 guidance: mid-single-digit organic revenue growth, 70–80 bps of adjusted operating margin expansion, strong adjusted EPS growth, and double-digit free cash flow growth; plans at least $1 billion in share repurchases and retains $7 billion of available capital.

- Aon delivered $4.3 billion revenue (+4% YoY) in Q4 and $17.2 billion (+9% YoY) for FY 2025, with organic revenue growth of 5% in Q4 and 6% for the year.

- Q4 diluted EPS of $7.82 (+138%) and adjusted EPS of $4.85 (+10%), and full-year diluted EPS of $17.02 (+36%) and adjusted EPS of $17.07 (+9%).

- Strong cash generation: Q4 free cash flow of $1.323 billion (+16%), full-year $3.218 billion (+14%), and $1.9 billion of debt repaid in 2025, achieving the leverage objective in Q4.

- For 2026, Aon expects mid-single-digit organic revenue growth, 70–80 bps of adjusted operating margin expansion, strong adjusted EPS growth, and double-digit free cash flow growth.

- Aon’s fourth-quarter revenue rose 4% to $4.3 billion, driven by 5% organic growth, while full-year revenue increased 9% to $17.2 billion with 6% organic growth.

- Diluted EPS in Q4 was $7.82, up 138%, and adjusted EPS was $4.85, up 10%; for the full year, diluted EPS was $17.02, up 36%, and adjusted EPS was $17.07, up 9%.

- Free cash flow reached $1.32 billion in Q4 (+16%) and $3.22 billion for the year (+14%); the company paid down $1.9 billion of debt and met its leverage target in Q4.

- Aon introduced 2026 guidance calling for mid-single-digit organic revenue growth, 70–80 bps of adjusted operating margin expansion, strong adjusted EPS growth and double-digit free cash flow growth.

- The company repurchased 2.7 million shares for $1 billion in 2025 (including 0.7 million shares for $250 million in Q4) and has $1.3 billion of repurchase authorization remaining.

- Aon’s 2026 Climate and Catastrophe Insight report finds that severe convective storms (SCS) have overtaken tropical cyclones as the costliest insured peril of the 21st century, generating $61 billion in insured losses in 2025—the third-highest SCS toll on record.

- Global economic losses from natural disasters in 2025 amounted to $260 billion (the lowest since 2015), while insured losses remained elevated at $127 billion, marking the sixth consecutive year above the $100 billion threshold.

- Insurers covered 49% of global economic losses in 2025, leaving a protection gap of 51%, the smallest on record.

- California wildfires (Palisades and Eaton Fires) were the costliest ever, causing $58 billion in economic losses and $41 billion in insured losses.

- Aon Global Limited will redeem in full and delist its 2.875% Senior Notes due 2026 from the NYSE on February 14, 2026, at a redemption price of 100% plus accrued interest.

- The redemption will retire all notes issued on May 14, 2014, under the Indenture dated May 24, 2013 (as amended April 1, 2020).

- The aggregate redemption price is €510,869,863 (approximately €1,021.74 per €1,000 principal), payable upon surrender of the notes.

- The Bank of New York Mellon (London Branch) will act as paying agent; final interest will be paid as part of the redemption price.

- Aon has expanded its Data Center Lifecycle Insurance Program (DCLP) by $1 billion, raising total capacity to $2.5 billion to meet growing risk complexity in cloud, AI and digital infrastructure projects.

- The program unifies construction, cyber, cargo and operational risks into a single, coordinated solution, streamlining capacity for Construction All Risks, Delay in Start-Up and Operational Property Damage/Business Interruption.

- Key coverages include up to $400 million for cyber and tech E&O, $100 million in third-party liability (ex-U.S.), and $500 million in project cargo insurance, supported by integrated risk engineering and analytics.

Quarterly earnings call transcripts for Aon.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more