Earnings summaries and quarterly performance for Covista.

Executive leadership at Covista.

Stephen W. Beard

Chief Executive Officer

Douglas G. Beck

Senior Vice President, General Counsel, Corporate Secretary and Institutional Support Services

Michael Betz

President, Walden University and Chief Digital Officer

Robert J. Phelan

Senior Vice President, Chief Financial Officer

Scott Liles

President, Medical and Veterinary

Board of directors at Covista.

Betty Vandenbosch

Director

Donna J. Hrinak

Director

Georgette Kiser

Director

Kenneth J. Phelan

Director

Liam Krehbiel

Director

Lisa W. Wardell

Director

Michael W. Malafronte

Lead Independent Director

Sharon L. O'Keefe

Director

William W. Burke

Director

Research analysts who have asked questions during Covista earnings calls.

Jeffrey Silber

BMO Capital Markets

5 questions for ATGE

Jack Slevin

Jefferies Financial Group Inc.

4 questions for ATGE

Steven Pawlak

Baird

4 questions for ATGE

Alexander Paris

Barrington Research Associates, Inc.

3 questions for ATGE

Recent press releases and 8-K filings for ATGE.

- Covista, rebranded on February 5th, is strategically pivoting to dominate healthcare education with its new "Purpose at Scale" strategy, building on the successful "Growth with Purpose" initiative that exceeded investor targets.

- The company has demonstrated strong financial performance, with enrollments growing from approximately 78,000 to over 97,000 and revenue from $1.4 billion to over $1.9 billion. EBITDA margins improved by 200 basis points from fiscal 2023 to 2025, with an additional 100 basis points expected in fiscal 2026, reaching at least 26.7%. EPS grew from $4.21 in fiscal 2023 to approaching $8 per share in fiscal 2026.

- Under "Purpose at Scale," Covista projects a 7%-10% revenue CAGR and a 10%-14% adjusted EPS CAGR over the next several years, targeting over 120,000 students by fiscal 2029. Specific revenue growth is guided at 6%-8% for fiscal 2027, 7%-10% for fiscal 2028, and 8%-11% for fiscal 2029, aiming for $2.35 billion-$2.53 billion in fiscal 2029. EPS growth is projected at 9%-13% in fiscal 2027, 10%-14% in fiscal 2028, and 12%-16% in fiscal 2029, reaching $10.60-$11.80 by fiscal 2029.

- Key investments include opening 10-15 new Chamberlain campuses by fiscal 2029, with four already underway, and these are incorporated into the earnings guidance. The capital allocation strategy prioritizes self-funded innovation, value-driven share repurchases, debt management, and accretive M&A.

- Covista reaffirmed its FY26 guidance, projecting revenue between $1,900 million and $1,940 million (YoY growth +6% to +8.5%) and adjusted EPS between $7.80 and $8.00 (YoY growth +17% to +20%).

- The company demonstrated a strong track record of financial performance, with revenue growing from $1,451 million in FY '23 to $1,788 million in FY '25, and Adjusted EBITDA increasing from $343 million to $460 million over the same period, alongside expanding Adjusted EBITDA margins.

- Covista set ambitious long-term targets for FY 2027-2029, aiming for a Revenue CAGR of +7% to +10% and an Adjusted EPS CAGR of +10% to +14%, with FY 2029 target ranges of $2,350 million to $2,530 million for revenue and $10.60 to $11.80 for Adjusted EPS.

- Strategic growth drivers include leveraging AI for student experience and operations, accelerating new program development, and expanding capacity, targeting over 120,000 total enrollees by FY29.

- Covista, formerly ATGE, rebranded on February 5th and introduced its "Purpose at Scale" strategy, building on the successful "Growth with Purpose" initiative.

- Under the previous strategy, the company grew enrollments from approximately 78,000 to over 97,000 and revenue from $1.4 billion to over $1.9 billion. EBITDA margins improved by 200 basis points from fiscal 2023 to 2025, with an additional 100 basis points projected for fiscal 2026, reaching at least 26.7%.

- The new "Purpose at Scale" strategy targets a 7%-10% revenue CAGR and a 10%-14% adjusted EPS CAGR over the next several years, aiming to enroll over 120,000 students by fiscal 2029.

- Specific financial targets for fiscal 2029 include revenue between $2.35 billion and $2.53 billion and EPS between $10.60 and $11.80. The company also plans to open 10-15 new Chamberlain campuses by fiscal 2029.

- Covista maintains a balanced capital allocation philosophy, including self-funding innovation, value-driven share repurchases, debt management, and potential accretive M&A.

- Covista, which rebranded on February 5th, introduced its new "Purpose at Scale" strategy, building on the successful "Growth with Purpose" which exceeded investor targets.

- The company reaffirmed its fiscal 2026 guidance and set long-term targets for fiscal years 2027-2029, projecting a 7%-10% revenue CAGR and 10%-14% adjusted EPS CAGR.

- Covista aims to enroll over 120,000 students by fiscal 2029 and anticipates 125-250 basis points of margin expansion over the next three years.

- Capital allocation priorities include self-funding innovation, value-driven share repurchases (supported by a $750 million authorization), debt management, and accretive M&A.

- Key growth initiatives include expanding Chamberlain with 10-15 new campuses by fiscal 2029 and continued strong enrollment and margin growth at Walden University.

- Covista introduced Purpose at Scale, its new three-year growth strategy for fiscal years 2027 through 2029, focusing on addressing America's healthcare workforce shortage.

- The company announced long-term financial targets for FY27-FY29, projecting revenue growth of 6-8% (FY27), 7-10% (FY28), and 8-11% (FY29), and adjusted earnings per share growth of 9-13% (FY27), 10-14% (FY28), and 12-16% (FY29).

- Covista reaffirmed its fiscal year 2026 guidance, expecting revenue between $1,900 million and $1,940 million and adjusted earnings per share between $7.80 and $8.00.

- Effective at market open on February 24, 2026, the company's stock began trading under the new ticker symbol CVSA on the NYSE.

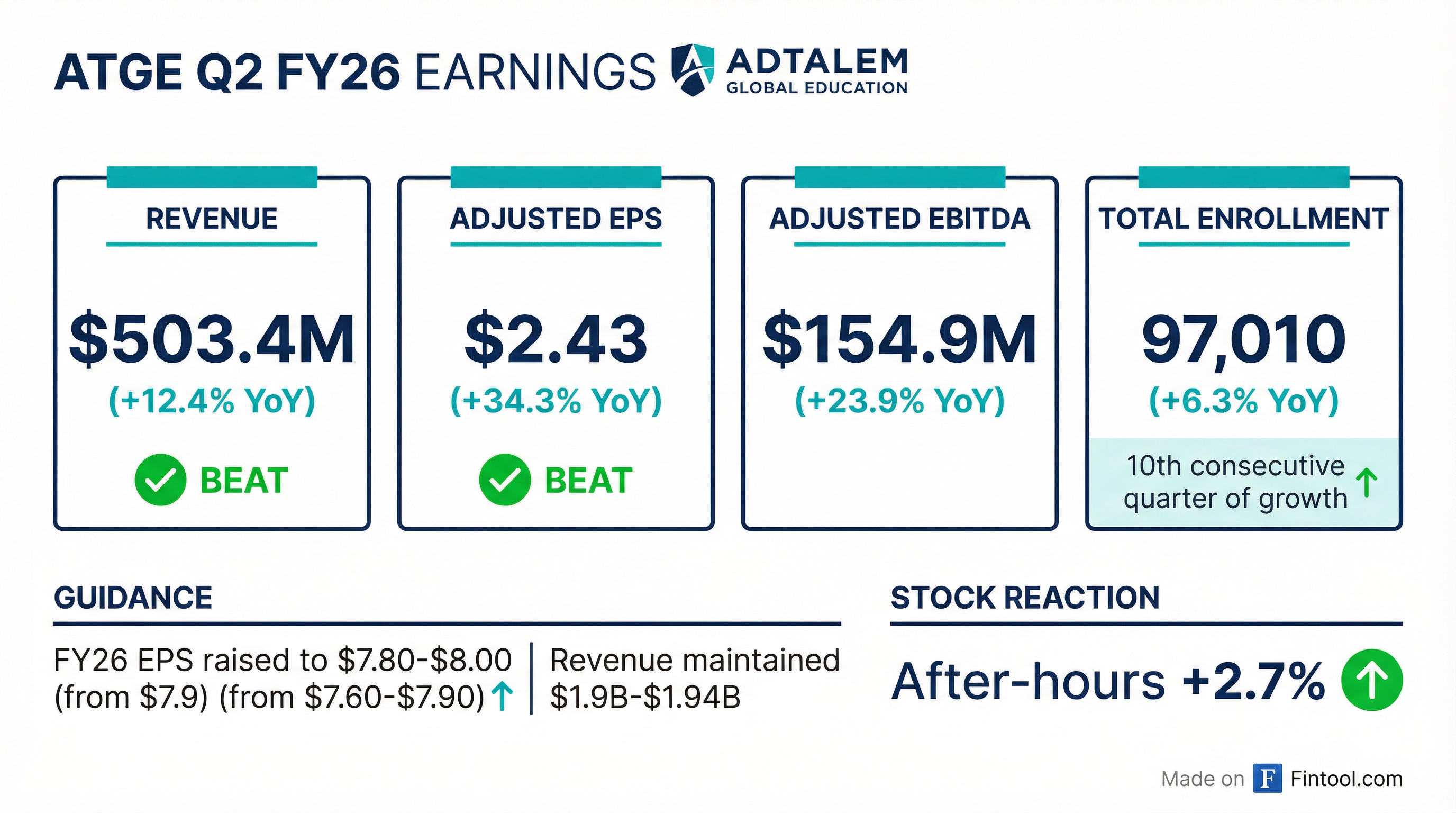

- Adtalem Global Education affirmed its FY2026 revenue guidance of $1.9 billion to $1.94 billion and raised its adjusted FY2026 EPS guidance to roughly $7.80–$8.00 from a prior range of $7.60–$7.90. This updated EPS guidance implies roughly 17%–20% year-over-year growth.

- The company reported Q2 revenue of $503.385 million, surpassing expectations, and achieved its tenth consecutive quarter of enrollment growth with a 6.3% increase to about 97,000 students.

- Adtalem returned $165 million to shareholders and showcased a strong financial profile, including a 19.6% operating margin, a 13.8% net margin, and a 17.67% return on equity (ROE).

- Adtalem Global Education reported strong Q2 FY 2026 results, with revenue increasing 12% to $503 million and adjusted earnings per share rising 34% to $2.43.

- The company raised its full-year adjusted EPS guidance for FY 2026 to a range of $7.80-$8.00, representing 17%-20% growth, while maintaining its revenue guidance of $1.9 billion-$1.94 billion.

- Total enrollment grew 6% to 97,000 students, marking the 10th consecutive quarter of enrollment growth, with Walden achieving record total enrollment of 52,400 students.

- $165 million was deployed to share repurchases in Q2, with approximately $728 million remaining on the current authorization as of December 31st.

- Adtalem Global Education reported Q2 FY26 revenue of $503.4 million, an increase of 12.4% year-over-year, with adjusted EPS of $2.43, up 34.3% year-over-year, and an adjusted EBITDA margin of 30.8%, a 290 basis point improvement.

- Total enrollment grew 6.3% year-over-year in Q2 FY26, marking the tenth straight quarter of total enrollment growth, primarily driven by the Walden and Medical & Veterinary segments.

- The company raised its FY26 adjusted EPS guidance range to $7.80 – $8.00, representing 17% to 20% year-over-year growth.

- Adtalem completed a $150 million share repurchase authorization and announced a new $750 million program, returning $165 million to shareholders through repurchases in Q2, and repaid $50 million of outstanding Term Loan B.

- Adtalem Global Education reported strong Q2 FY2026 results, with revenue growing 12% to $503 million and adjusted earnings per share increasing 34% to $2.43 compared to the prior year.

- The company raised its full-year adjusted EPS guidance to a range of $7.80-$8.00, representing 17%-20% growth. Full-year revenue guidance was maintained at 6%-8.5% growth.

- Total enrollment grew over 6% to 97,000 students, marking the 10th consecutive quarter of enrollment growth. Walden achieved record total enrollment of 52,400 students, up 13%.

- Adtalem deployed $165 million to share repurchases in Q2, with approximately $728 million remaining on its current authorization as of December 31st.

- While Chamberlain's total enrollment declined 1% in Q2, application volumes for both pre-licensure and post-licensure nursing programs are up double digits, which is expected to translate into future enrollment growth.

- Adtalem Global Education reported Q2 2026 revenue of $503.4 million, an increase of 12.4% year-over-year, and adjusted earnings per share of $2.43, up 34.3% compared to the prior year.

- The company achieved its 10th consecutive quarter of enrollment growth, with total enrollment increasing over 6% to 97,000 students. Walden recorded record total enrollments of 52,400 students, up 13%, while Chamberlain's total enrollment declined by 1%.

- Adtalem raised its full-year fiscal year 2026 adjusted EPS guidance from the previous range of $7.60-$7.90 to a new range of $7.80-$8.00, representing 17%-20% growth. Full-year revenue guidance was maintained at $1.9 billion - $1.94 billion, or 6%-8.5% growth year-over-year.

- During Q2 2026, the company deployed $165 million to share repurchases, with approximately $728 million remaining on its current authorization as of December 31st.

Fintool News

In-depth analysis and coverage of Covista.

Quarterly earnings call transcripts for Covista.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more