Earnings summaries and quarterly performance for AVANOS MEDICAL.

Executive leadership at AVANOS MEDICAL.

David Pacitti

Chief Executive Officer

Kerr W. Holbrook

Senior Vice President and Chief Commercial Officer

Mojirade A. James

Senior Vice President, General Counsel and Secretary

Scott Galovan

Senior Vice President, Chief Financial Officer

Sigfrido Delgado

Senior Vice President, Operations

Board of directors at AVANOS MEDICAL.

Research analysts who have asked questions during AVANOS MEDICAL earnings calls.

Daniel Stauder

Citizen JMP

3 questions for AVNS

Danny Stauder

Citizens JMP

2 questions for AVNS

Anton Gvozdikov

Stifel

1 question for AVNS

Danis

Citizens CM

1 question for AVNS

Frederick Wise

Stifel

1 question for AVNS

Kristen Stewart

CL King & Associates

1 question for AVNS

Recent press releases and 8-K filings for AVNS.

- Avanos Medical, Inc. announced its intention to nominate James L. Cunniff and William P. Burke as independent directors for election to its Board of Directors at the 2026 Annual Meeting of Stockholders.

- This decision follows a cooperation agreement with Bradley L. Radoff and one of his affiliates, which includes the nomination of Mr. Cunniff and another independent director (Mr. Burke).

- As part of the agreement, Bradley L. Radoff has withdrawn his previous director nomination and the Radoff Parties have committed to certain standstill restrictions and voting commitments until the 2027 Annual Meeting.

- Mr. Cunniff, President and CEO of Electromed, Inc., and Mr. Burke, former EVP and CFO of Haemonetics Corporation, are expected to bring significant operating, finance, and accounting experience to the Board.

- Avanos Medical reported full year 2025 net sales of $701 million and adjusted diluted earnings per share of $0.94, exceeding revised guidance, with Q4 2025 net sales at $181 million and adjusted diluted EPS at $0.29.

- The company provided 2026 guidance projecting net sales of $700 million to $720 million and adjusted diluted earnings per share of $0.90 to $1.10, driven by anticipated around 5% consolidated organic growth.

- Strategic segments delivered strong organic growth in 2025, with Specialty Nutrition Systems growing over 8% and Pain Management & Recovery up 2.3%. The company is also executing a China exit strategy for syringe manufacturing by June 2026, expecting full-year 2026 tariff P&L costs of approximately $30 million, a $12 million increase from 2025.

- Key portfolio actions included the divestiture of its hyaluronic acid business, exiting the Game Ready rental business, and the acquisition of Nexus Medical, with the IV therapy business exit scheduled for Q1 2026.

- AVNS reported FY 2025 revenue of $701 million and adjusted diluted earnings per share of $0.94, exceeding revised estimates.

- The company achieved 6% organic growth in strategic segments, with the Specialty Nutrition Systems segment growing 8.2% organically in FY 2025.

- Strategic actions included the acquisition of Nexus Medical and the divestiture of the Hyaluronic Acid product line, alongside plans to exit the IV therapy business.

- Operational initiatives are expected to deliver $15-$20 million in incremental annualized savings by the end of 2026.

- For 2026, AVNS estimates adjusted diluted earnings per share to be between $0.90 and $1.10.

- Avanos Medical reported full year 2025 net sales of $701 million and adjusted diluted earnings per share of $0.94, exceeding its revised guidance. For Q4 2025, net sales were approximately $181 million with adjusted diluted EPS of $0.29.

- The company issued 2026 guidance, projecting net sales between $700 million and $720 million and adjusted diluted earnings per share of $0.90 to $1.10.

- Avanos expects approximately $30 million in tariff P&L costs for 2026, an increase of $12 million from 2025, but is confident in its plan to be fully exited from China for its syringe portfolio by June 2026.

- Key strategic actions in 2025 included the divestiture of the hyaluronic acid business, exiting the Game Ready rental business, and the acquisition of Nexus Medical.

- Avanos Medical reported full-year 2025 net sales of $701 million and adjusted diluted earnings per share of $0.94, exceeding the revised guidance ranges.

- The company's strategic segments demonstrated strong organic growth in 2025, with Specialty Nutrition Systems (SNS) growing over 8% and Pain Management & Recovery (PMNR) up 2.3%.

- For 2026, Avanos forecasts net sales in the range of $700 million to $720 million and adjusted diluted earnings per share of $0.90 to $1.10, anticipating approximately $30 million in tariff P&L costs.

- Strategic initiatives include successful tariff mitigation efforts, with plans to exit all China syringe manufacturing by June 2026, and portfolio shaping through the acquisition of Nexus Medical and divestitures of the hyaluronic acid and IV therapy businesses.

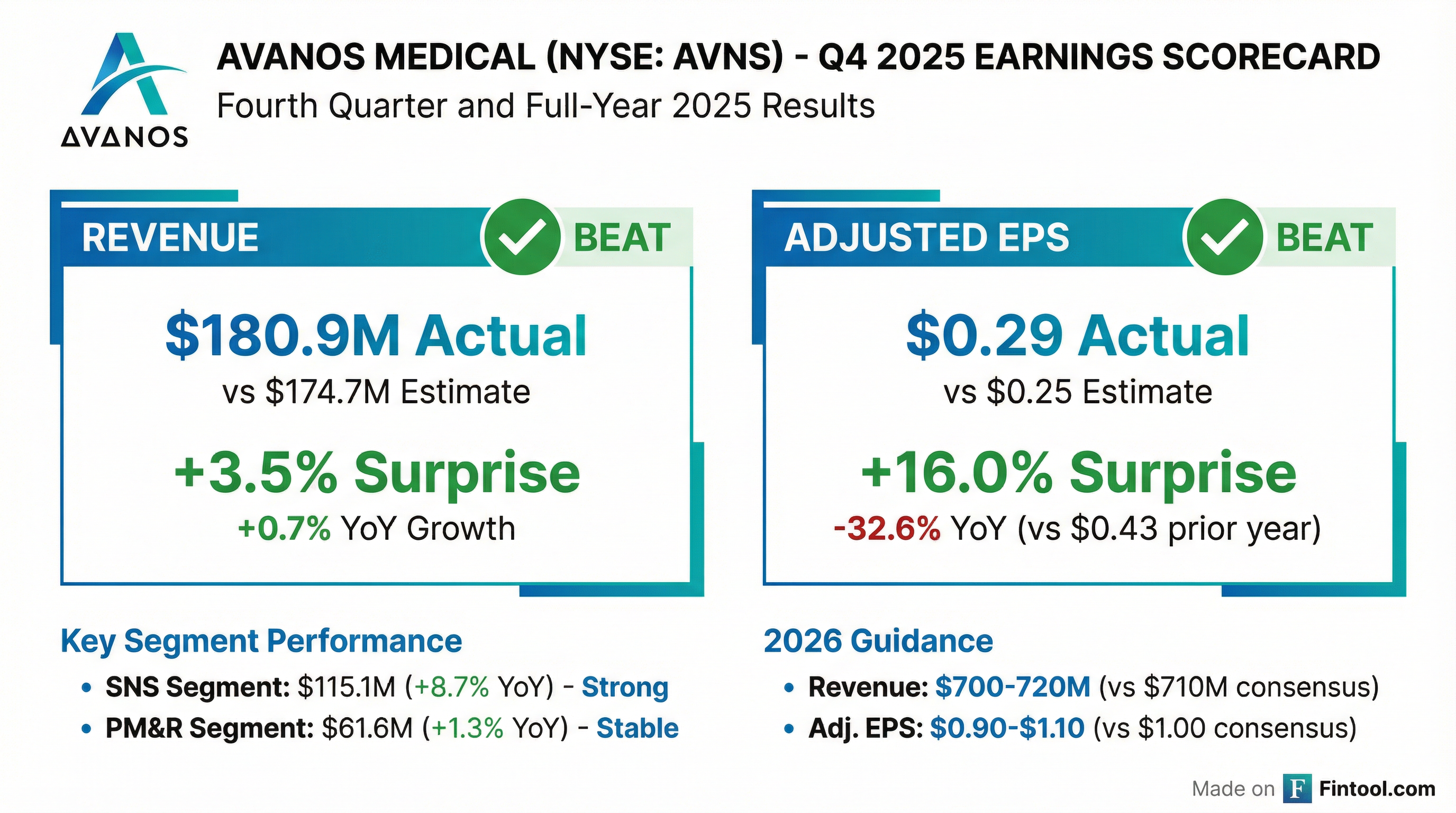

- Avanos reported Q4 2025 adjusted EPS of $0.29 and revenue of $180.9 million, exceeding Street estimates and marking its third EPS beat in the last four quarters.

- The company projects revenue of $700–$720 million by 2026, attributing cost benefits to exiting China, tariff-mitigation, and expanded transformation initiatives.

- Despite top-line momentum, Avanos faces profitability challenges with negative net margins and EPS, and a low Altman Z-Score of -0.13, indicating financial distress risk.

- Avanos shares have rallied approximately 35.6% year-to-date, significantly outperforming the S&P 500, while insiders have been net sellers and institutional ownership changes have been mixed.

- Avanos Medical, Inc. exceeded full-year revenue and achieved the top end of full-year earnings-per-share guidance for 2025, delivering 6% organic growth in strategic segments.

- For the fourth quarter of 2025, net sales were $180.9 million and adjusted diluted earnings per share were $0.29.

- For the full-year 2025, net sales increased 1.9% to $701.2 million and adjusted diluted earnings per share were $0.94. Full-year adjusted EBITDA totaled $86.8 million and free cash flow was $43.1 million.

- The company's net debt as of December 31, 2025, was $10.7 million, compared to $27.0 million in the prior year.

- Avanos Medical, Inc. provided 2026 adjusted diluted earnings per share guidance of $0.90 to $1.10.

- Avanos Medical reported full-year 2025 net sales of $701.2 million and adjusted diluted earnings per share of $0.94, exceeding full-year revenue and achieving the top end of EPS guidance.

- For the fourth quarter of 2025, total net sales were $180.9 million and adjusted diluted earnings per share was $0.29.

- The company delivered 6% organic growth in strategic segments for the full year and expects transformation initiatives to provide $15 to $20 million of incremental annualized savings by the end of 2026.

- Avanos Medical provided its 2026 outlook, projecting net sales between $700 million and $720 million and adjusted diluted earnings per share between $0.90 and $1.10.

- The Centers for Medicare and Medicaid Services (CMS) released the 2026 Medicare Hospital Outpatient Prospective Payment System (OPPS) and Medicare Ambulatory Surgical Center (ASC) Payment System Final Rule, expanding qualifying products under the Non-Opioids Prevent Addiction in the Nation (NOPAIN) Act. This act requires separate Medicare payment for qualifying non-opioid drugs and devices from January 1, 2025, through December 31, 2027.

- Avanos Medical's ON-Q elastomeric infusion pump and ambIT electronic infusion pump will continue to receive separate payment under the NOPAIN Act, having been originally qualified in January 2025.

- The Game Ready GRPro 2.1 cryo-pneumatic compression pain management system has been confirmed by CMS to meet qualifying requirements for separate payment under the NOPAIN Act, effective January 1, 2026.

- CMS has established payment limitations for these systems when medically necessary and used with a covered surgical procedure: $2,008.72 for the ON-Q infusion system, $2,008.72 for the ambIT infusion system, and $1,997.16 for the Game Ready GRPro 2.1 system.

- Avanos Medical (AVNS) reaffirmed its full-year sales guidance of $690-$700 million and adjusted EPS of $0.85-$0.95, expecting to finish at the higher end of sales guidance.

- The company aims to become a $1 billion business by 2030, driven by accelerating growth in its Specialty Nutrition Systems and Pain Management and Recovery segments, synergistic M&A, and operational efficiency.

- Strategic initiatives include realizing $15-$20 million in cost savings by 2026 and mitigating tariff impacts by exiting China by mid-2026.

- Avanos' M&A strategy, exemplified by the Nexus acquisition in September 2025 which generated $5 million in revenue over four months, focuses on acquiring at least one deal annually worth $20 million or more to support revenue growth.

Quarterly earnings call transcripts for AVANOS MEDICAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more