Earnings summaries and quarterly performance for BANK OF THE JAMES FINANCIAL GROUP.

Executive leadership at BANK OF THE JAMES FINANCIAL GROUP.

Board of directors at BANK OF THE JAMES FINANCIAL GROUP.

AP

Augustus Petticolas Jr.

Detailed

Director

DD

Douglas Dalton III

Detailed

Director

JA

John Alford Jr.

Detailed

Director

JD

Julie Doyle

Detailed

Director

LA

Lewis Addison

Detailed

Director

LL

Lydia Langley

Detailed

Director

PJ

Phillip Jamerson

Detailed

Director

WF

Watt Foster Jr.

Detailed

Director

WB

William Bryant III

Detailed

Director

Research analysts covering BANK OF THE JAMES FINANCIAL GROUP.

Recent press releases and 8-K filings for BOTJ.

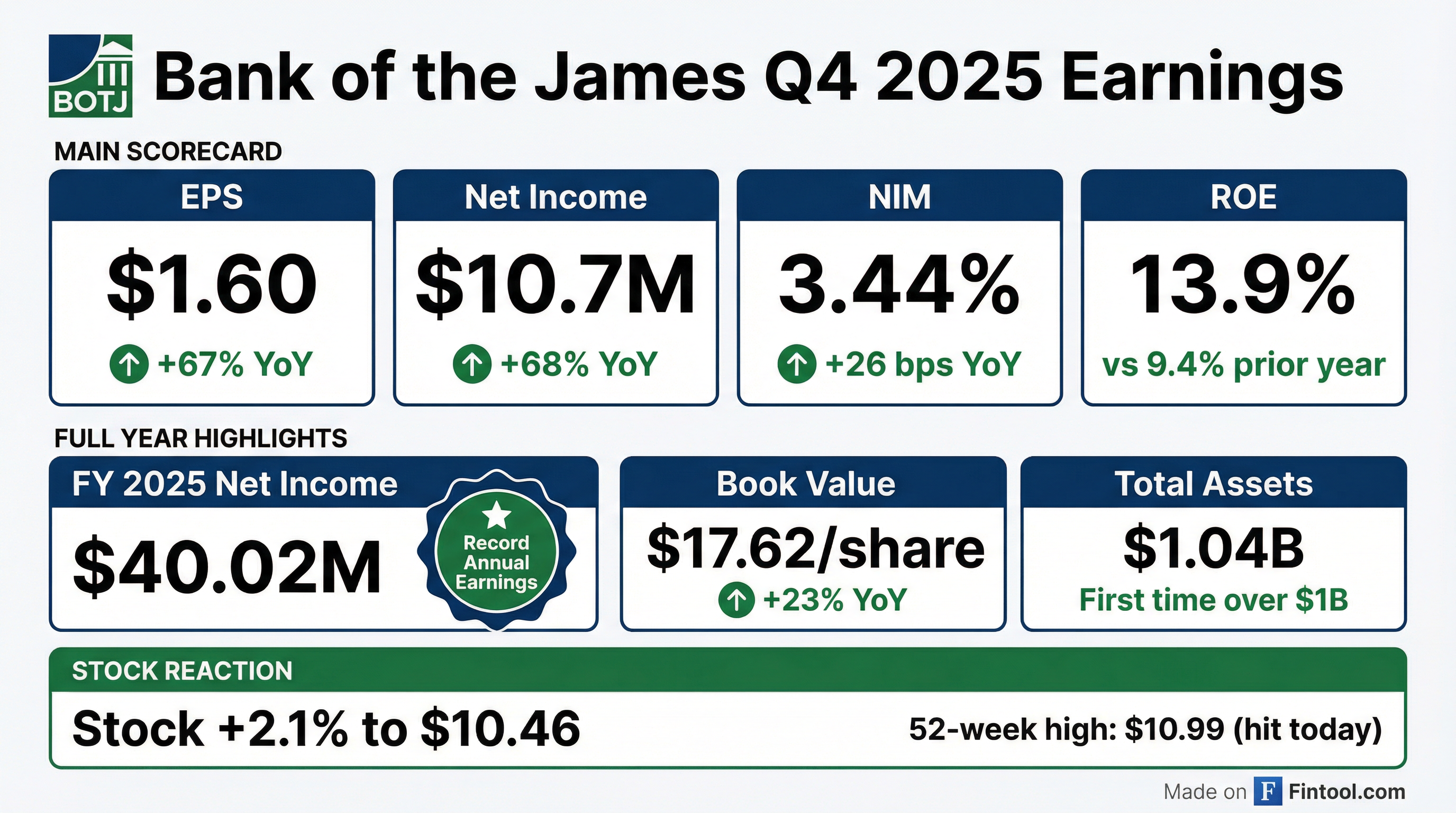

Bank of the James Financial Group Announces Record Full Year 2025 Financial Results

BOTJ

Earnings

Revenue Acceleration/Inflection

- Bank of the James Financial Group, Inc. reported record annual earnings of $9.02 million for the year ended December 31, 2025, a 13.6% increase from $7.94 million in 2024, with earnings per share rising to $1.99 from $1.75.

- Fourth quarter 2025 net income significantly increased to $2.72 million from $1.62 million in the fourth quarter of 2024, with earnings per share of $0.60 compared to $0.36 in the prior year's fourth quarter.

- Total assets grew to $1.04 billion at December 31, 2025, up 6.1% from $979.24 million at December 31, 2024, and total deposits increased by 6.2% to $937.13 million.

- Net interest income for the full year 2025 rose 12.2% to $32.81 million from $29.24 million in 2024, and the net interest margin improved to 3.39% for the full year and 3.44% for the fourth quarter of 2025.

- The efficiency ratio improved to 77.17% for the full year 2025 from 79.11% in 2024, while stockholders' equity increased by 23.4% to $80.05 million, and book value per share rose to $17.62 at December 31, 2025.

2 days ago

Bank of the James Financial Group Announces Record Full Year 2025 Financial Results

BOTJ

Earnings

Revenue Acceleration/Inflection

- Bank of the James Financial Group reported record annual earnings of $9.02 million for the year ended December 31, 2025, marking a 13.6% increase from $7.94 million in 2024, with earnings per share rising to $1.99 from $1.75.

- For the fourth quarter of 2025, net income was $2.72 million, significantly up from $1.62 million in the fourth quarter of 2024, and earnings per share reached $0.60 compared to $0.36 in the prior year quarter.

- The company's balance sheet showed growth, with total assets increasing to $1.04 billion at December 31, 2025, a 6.1% rise from the previous year, and total deposits growing by 6.2% to $937.13 million.

- Profitability ratios improved, as the net interest margin reached 3.44% in Q4 2025 (up from 3.18% in Q4 2024) and the efficiency ratio improved to 70.81% in Q4 2025 (from 82.62% in Q4 2024).

- Stockholders' equity increased by 23.4% to $80.05 million at December 31, 2025, contributing to a rise in book value per share to $17.62 from $14.28.

2 days ago

Bank of the James Announces Q3 2025 Financial Results

BOTJ

Earnings

Revenue Acceleration/Inflection

- Bank of the James reported record quarterly earnings for the third quarter of 2025, with earnings per share of $0.61.

- Net interest income increased by 10.5% to $8.30 million in Q3 2025, and the net interest margin expanded to 3.44%.

- Interest expense decreased in Q3 2025, partly due to the extinguishment of approximately $10 million in capital notes in the second quarter of 2025.

- Loans, net of allowance for credit losses, grew to $653.29 million at September 30, 2025, and total assets reached $1.02 billion.

- The company maintained strong asset quality, with a nonperforming loans to total loans ratio of 0.29% at September 30, 2025.

Oct 30, 2025, 8:32 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more