Earnings summaries and quarterly performance for Perspective Therapeutics.

Executive leadership at Perspective Therapeutics.

Board of directors at Perspective Therapeutics.

Research analysts who have asked questions during Perspective Therapeutics earnings calls.

Recent press releases and 8-K filings for CATX.

Perspective Therapeutics Presents Positive Interim Data for Neuroendocrine Tumor Trial

CATX

- Perspective Therapeutics presented updated interim data from its Phase 1/2a trial of [212Pb]VMT-α-NET in neuroendocrine tumors at the 2026 ASCO Gastrointestinal Cancers Symposium, with a December 10, 2025, data cutoff.

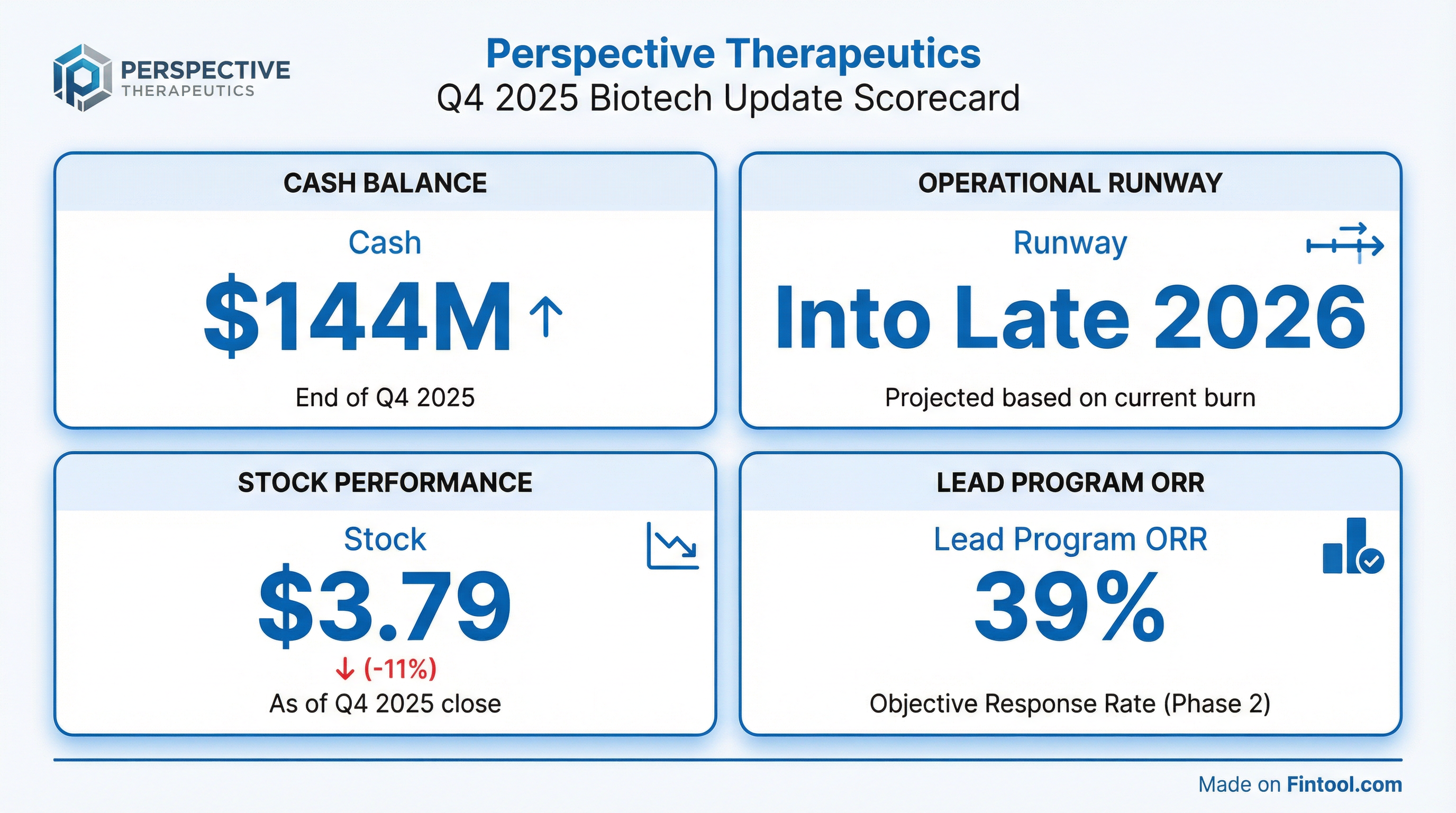

- In Cohort 2 (5.0 mCi), 39% of 23 evaluable patients achieved objective response per RECIST v1.1, and 76% of 25 total evaluable patients remained progression-free and alive.

- Safety data across 56 patients showed no dose-limiting toxicities, no treatment-related discontinuations, and no clinically significant myelosuppression.

- Regulatory engagement is planned for 2026 to advance the program toward a registrational trial.

Feb 17, 2026, 4:17 PM

Perspective Therapeutics Prices Underwritten Offering

CATX

New Projects/Investments

- Perspective Therapeutics, Inc. (CATX) announced the pricing of an underwritten offering of common stock and pre-funded warrants on February 2, 2026. The offering closed on February 3, 2026.

- The offering included 39,576,088 shares of common stock priced at $3.79 per share and pre-funded warrants to purchase 6,598,046 shares of common stock priced at $3.789 per pre-funded warrant.

- The aggregate gross proceeds from this offering are expected to be approximately $175 million. The net proceeds will be used to advance clinical development of product candidates, invest in manufacturing facilities, and for working capital and other general corporate purposes.

Feb 3, 2026, 9:07 PM

Perspective Therapeutics Provides Update on Clinical Programs, Manufacturing, and Financial Position

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics (CATX) is advancing three clinical programs in radiopharmaceuticals: VMT-α-NET for neuroendocrine tumors, a melanoma program, and PSV359 for advanced solid tumors.

- The VMT-α-NET program has demonstrated promising initial Phase 1 data, including a 39% overall response rate and 78% progression-free survival with over one year follow-up, alongside a compelling safety profile. The FDA has granted fast-track designation and encouraged its development as a front-line therapy alternative.

- The company has secured end-to-end manufacturing and is building a network of facilities across the US (New Jersey, Iowa, Chicago, Houston, LA) to support commercial scalability and ensure a reliable supply chain for its short-shelf-life therapies.

- Perspective Therapeutics reported $174 million in cash from its last quarterly filing, which is projected to last until the end of the year. Data updates for the VMT-α-NET and melanoma programs are expected in mid-2026, with FAP-alpha program updates later in the year.

Jan 14, 2026, 10:15 PM

Perspective Therapeutics provides clinical and manufacturing updates at J.P. Morgan Healthcare Conference

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics (CATX) is advancing three clinical programs, including VMT-α-NET for neuroendocrine tumors, a melanoma program, and PSV359 for advanced solid tumors.

- The VMT-α-NET program has received fast-track designation and shown promising initial Phase 1 data, including a 39-44% overall response rate and 78-81% progression-free survival, with a favorable safety profile, leading to consideration for a registrational trial.

- The company's proprietary platform utilizes the lead-212 isotope for targeted alpha therapy and its imaging twin, lead-203, for patient selection, designed to optimize biodistribution and reduce off-target toxicity.

- Perspective Therapeutics has secured end-to-end manufacturing capabilities and is expanding a network of facilities to support commercial scalability and ensure timely delivery of its radiopharmaceutical therapies.

- The company anticipates providing more data updates across its clinical programs throughout 2026 and the current year.

Jan 14, 2026, 10:15 PM

Perspective Therapeutics (CATX) discusses radiopharmaceutical pipeline and manufacturing capabilities

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics (CATX) is advancing its radiopharmaceutical pipeline, leveraging a proprietary chemical chelator and Lead-212 alpha emitter for targeted cancer treatment, with Lead-203 used for patient selection and imaging.

- The company has three clinical programs: VMT-α-NET for neuroendocrine tumors, a melanoma program targeting MC1R, and a PSV359 program for advanced solid tumors targeting FAP-alpha. The VMT-α-NET program has demonstrated a compelling safety profile with no DLTs or discontinuations due to adverse events.

- Perspective Therapeutics has established end-to-end manufacturing capabilities, including the ability to stockpile the parent isotope Thorium-228, which supports a scalable supply chain for its radiopharmaceuticals.

- The company reported a strong financial position with $174 million in cash from its last quarterly filing, expected to fund operations until the end of the year.

- Upcoming data catalysts include mid-2026 updates for the VMT-α-NET and melanoma programs, with updates for the FAP-alpha program expected later in the year.

Jan 14, 2026, 10:15 PM

Perspective Therapeutics Announces Business Updates and Strategic Priorities

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics, Inc. announced business updates and strategic priorities, including a presentation at the 44th Annual J.P. Morgan Healthcare Conference on January 14, 2026.

- For its lead program, VMT-α-NET, updated interim data as of December 10, 2025, showed it was well-tolerated in 56 patients and demonstrated durable disease control and deepening of tumor response in neuroendocrine tumors, with 76% (19 of 25 patients) without progression and remaining alive.

- The company expects clinical updates in mid to late 2026 for VMT01 (melanoma) and PSV359 (FAP across solid tumors), and is expanding its manufacturing capabilities to support future growth.

Jan 12, 2026, 1:20 PM

Perspective Therapeutics Provides Updates on Radiopharmaceutical Pipeline and Financial Outlook

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics' lead program, VMT-α-NET, for SSTR2 positive tumors, demonstrated a 44% overall response rate (ORR) in GAP-NET patients compared to Lutathera's 13% ORR, with a stronger safety profile. Additional data from higher dose cohorts is expected next year.

- The company is also advancing VMED 01, 02 for metastatic melanoma (targeting MC1R) and a FAP-targeting program for solid tumors, with data from both expected next year.

- Perspective Therapeutics has a cash balance of $172 million on its balance sheet, with a historical quarterly burn of approximately $20 million, extending its cash runway until the end of 2026.

- The company is expanding its manufacturing capabilities with operational sites in Iowa and New Jersey, and new facilities under development in Chicago, Houston, and Los Angeles, alongside a secured strategic thorium stockpile for several years.

Dec 2, 2025, 6:00 PM

Perspective Therapeutics (CATX) Provides Update on Clinical Programs, Financials, and Manufacturing

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics (CATX) reported a cash runway extending until the end of 2026, with $172 million on its balance sheet from its last filing and a historical burn rate of approximately $20 million per quarter.

- The company's lead program, VMT-α-NET, for SSTR2 positive neuroendocrine tumors, demonstrated a 44% Overall Response Rate (ORR) in GAP-NETs, compared to Lutathera's 13% ORR, with an "incredibly safe" profile showing no long-term renal toxicity or dysphagia. The company is discussing a registrational trial with the FDA, with the 5 mCi dose considered suitable.

- Perspective Therapeutics is also advancing its VMED 01, 02 program for MC1R-positive metastatic melanoma and a FAP program for solid tumors, with data from both programs expected next year.

- The company has operational manufacturing sites in Iowa and New Jersey, and is developing additional facilities in Chicago, Houston, and L.A. to scale up production and handle various isotopes.

Dec 2, 2025, 6:00 PM

Perspective Therapeutics Discusses Radiopharmaceutical Pipeline and Financial Outlook

CATX

New Projects/Investments

Guidance Update

- Perspective Therapeutics highlighted its VMT-α-NET program, an alpha-emitter radiopharmaceutical for SSTR2 positive neuroendocrine tumors, reporting a 44% overall response rate (ORR) in a like-for-like comparison at ESMO, significantly higher than Lutathera's 13% ORR, with a favorable safety profile.

- The company is developing other radiopharmaceutical programs, including VMED 01, 02 for metastatic melanoma (targeting MC1R) and a FAP program for solid tumors, with data expected next year for both.

- Perspective Therapeutics reported a cash runway extending until the end of 2026, with $172 million on the balance sheet and a historical burn rate of approximately $20 million per quarter.

- The company is expanding its manufacturing capabilities with operational sites in Iowa and New Jersey, and new facilities under development in Chicago, Houston, and Los Angeles, supported by a strategic thorium stockpile.

Dec 2, 2025, 6:00 PM

Perspective Therapeutics, Inc. Announces Q3 2025 Results and Business Highlights

CATX

Earnings

New Projects/Investments

Guidance Update

- Perspective Therapeutics, Inc. reported a net loss of $26.0 million, or $0.35 per basic and diluted share, for the three months ended September 30, 2025.

- As of September 30, 2025, the company held approximately $174 million in cash, cash equivalents, and short-term investments, which is expected to fund current planned clinical milestones and operational investments into late 2026.

- The company provided an update on its [212Pb]VMT-α-NET Phase 1/2a study, noting that eight patients have been enrolled into Cohort 3 (6.0 mCi) within three months of its opening.

Nov 10, 2025, 9:20 PM

Quarterly earnings call transcripts for Perspective Therapeutics.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more