Earnings summaries and quarterly performance for CHAIN BRIDGE BANCORP.

Executive leadership at CHAIN BRIDGE BANCORP.

John J. Brough, II

Detailed

Chief Executive Officer

CEO

DM

David M. Evinger

Detailed

President, Chief Risk Officer, and Corporate Secretary

JR

James R. Pollock

Detailed

Senior Vice President, Corporate Development Officer

JR

Joanna R. Williamson

Detailed

Executive Vice President and Chief Financial Officer

PG

Peter G. Fitzgerald

Detailed

Chairman of the Board

Board of directors at CHAIN BRIDGE BANCORP.

AJ

Andrew J. Fitzgerald

Detailed

Director

BT

Benita Thompson-Byas

Detailed

Director

JM

Joseph M. Fitzgerald

Detailed

Director

LB

Leigh-Alexandra Basha

Detailed

Director

MM

Mark Martinelli

Detailed

Director

MJ

Michael J. Conover

Detailed

Director

ML

Michelle L. Korsmo

Detailed

Director

PW

Paul W. Leavitt

Detailed

Director

TG

Thomas G. Fitzgerald, Jr.

Detailed

Director

YF

Yonesy F. Núñez

Detailed

Director

Research analysts covering CHAIN BRIDGE BANCORP.

Recent press releases and 8-K filings for CBNA.

Chain Bridge Bancorp, Inc. Reports Q4 and Full Year 2025 Financial Results

CBNA

Earnings

Revenue Acceleration/Inflection

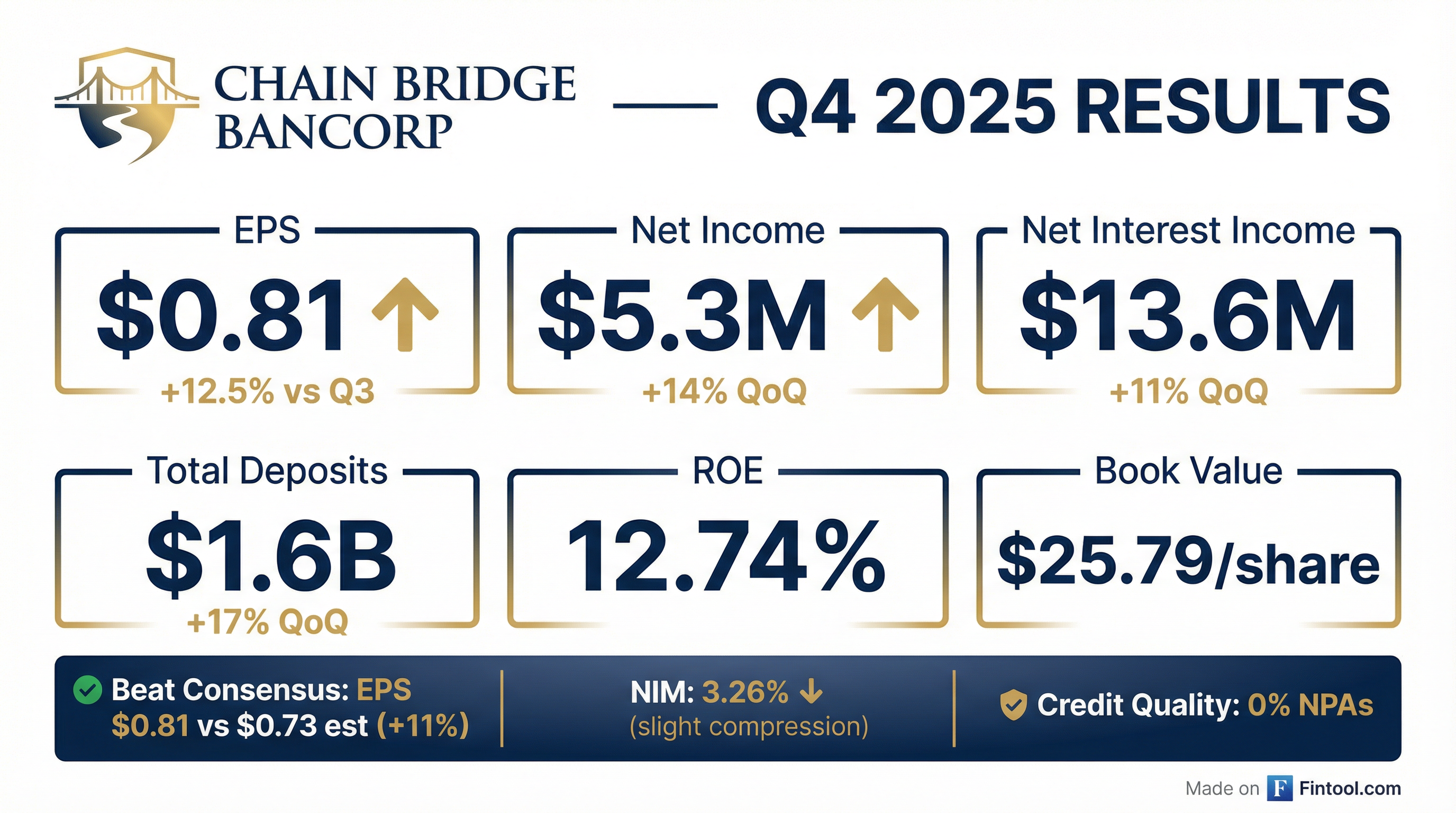

- Chain Bridge Bancorp, Inc. reported net income of $5.3 million and earnings per share of $0.81 for the fourth quarter of 2025, an increase from $4.7 million and $0.72 in the third quarter of 2025, and $3.7 million and $0.59 in the fourth quarter of 2024.

- For the full year ended December 31, 2025, the company reported net income of $20.2 million and earnings per share of $3.08, compared to $20.9 million and $4.17 for the same period in 2024.

- Total assets grew to $1.8 billion at December 31, 2025, up from $1.4 billion at December 31, 2024, with total deposits reaching $1.6 billion at December 31, 2025, compared to $1.2 billion at December 31, 2024.

- Net interest income for the fourth quarter of 2025 was $13.6 million, compared to $11.4 million in the fourth quarter of 2024, though the net interest margin decreased to 3.26% from 3.46% over the same period.

- The Trust & Wealth Department's total assets under administration (AUA) significantly increased to $610.7 million at December 31, 2025, from $330.3 million at December 31, 2024.

Jan 28, 2026, 9:18 PM

Chain Bridge Bancorp, Inc. Reports Q3 2025 Financial Results and Key Ratios

CBNA

Earnings

- Chain Bridge Bancorp, Inc. reported net income of $14,893 thousand and earnings per share of $2.27 for the nine months ended September 30, 2025.

- As of September 30, 2025, the company's total assets were $1,534,355 thousand, with total deposits of $1,364,540 thousand and total stockholders' equity of $163,096 thousand.

- The company maintained strong capital ratios, with a Tier 1 risk-based capital ratio of 44.43% and a total risk-based regulatory capital ratio of 45.56% as of September 30, 2025.

- The liquidity ratio stood at 89.54% and the loan-to-deposit ratio was 20.82% as of September 30, 2025.

- On October 3, 2024, the company reclassified and converted each outstanding share of its existing common stock into 170 shares of Class B Common Stock.

Nov 5, 2025, 9:16 PM

Chain Bridge Bancorp, Inc. Reports Third Quarter 2025 Financial Results

CBNA

Earnings

- Chain Bridge Bancorp, Inc. reported net income of $4.7 million and Earnings Per Share of $0.72 for the third quarter of 2025, compared to $7.5 million and $1.64 respectively for the third quarter of 2024. For the nine months ended September 30, 2025, net income was $14.9 million and EPS was $2.27, down from $17.2 million and $3.77 for the same period in 2024.

- As of September 30, 2025, the company's total assets were $1.5 billion and total deposits were $1.4 billion. It maintained a Tier 1 leverage ratio of 11.34%, a Tier 1 risk-based capital ratio of 44.43%, and a total risk-based capital ratio of 45.56%. Book value per share stood at $24.86.

- The year-over-year decline in net income for the nine months ended September 30, 2025, was primarily driven by a $5.0 million reduction in noninterest income (due to changes in One-Way Sell® deposit activity and increased use of reciprocal ICS® deposits) and a $2.9 million increase in noninterest expenses (related to operational growth and public company costs), partially offset by a $4.9 million increase in net interest income.

Oct 28, 2025, 9:06 PM

Chain Bridge Bancorp, Inc. Details Q2 2025 Performance and Recent Milestones

CBNA

Earnings

- Chain Bridge Bancorp, Inc. reported net income of $10.191 million and earnings per share of $1.55 for the six months ended June 30, 2025, achieving a return on average equity of 13.61%.

- As of June 30, 2025, the company maintained strong financial health with total assets of $1.445 billion, a liquidity ratio of 88.21%, and a Tier 1 risk-based capital ratio of 43.48%.

- The company completed its IPO in October 2024, issuing 1,992,897 shares at $22.00 per share and generating approximately $36.5 million in net proceeds. As of June 30, 2025, Chain Bridge Bancorp, Inc. was added to the Russell 3000® Index.

- Chain Bridge Bancorp, Inc. operates with a dual-class share structure, where Class B Common Stock (3,410,321 shares outstanding) holds 10 votes per share and collectively represents a majority of the voting power. A significant portion of its deposit base comes from political organizations, which are subject to seasonal variations tied to federal election cycles.

Sep 2, 2025, 9:35 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more