Earnings summaries and quarterly performance for Consensus Cloud Solutions.

Executive leadership at Consensus Cloud Solutions.

Board of directors at Consensus Cloud Solutions.

Research analysts who have asked questions during Consensus Cloud Solutions earnings calls.

David Larsen

BTIG

4 questions for CCSI

Jenny Shen

TD Cowen

4 questions for CCSI

Gene Mannheimer

Freedom Capital Markets

3 questions for CCSI

Isaac Saulson

Oppenheimer & Co. Inc.

2 questions for CCSI

Isaac Sellhausen

Oppenheimer & Co. Inc.

1 question for CCSI

Mark Zhang

Citigroup

1 question for CCSI

Matthew Sandschafer

Mesirow Financial

1 question for CCSI

Recent press releases and 8-K filings for CCSI.

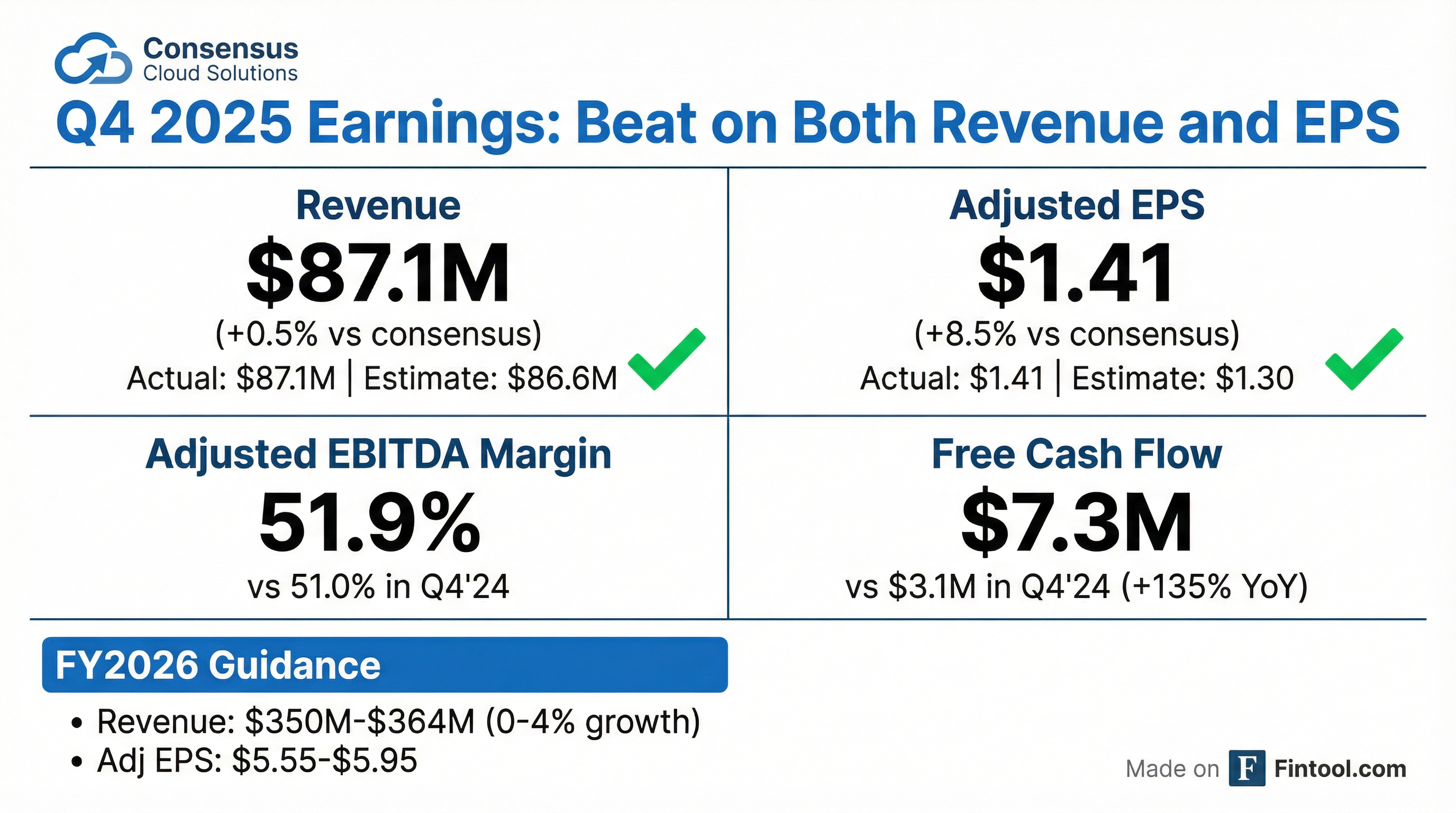

- Consensus Cloud Solutions reported Q4 2025 revenue of $87.1 million, Adjusted EBITDA of $45.2 million, and Adjusted EPS of $1.41. For the full year 2025, revenue was $350 million, Adjusted EBITDA was $187 million, and Adjusted EPS was $5.62.

- The company achieved record revenue for the quarter and year, with Corporate revenue growing +7.3% year-over-year in Q4 2025 and now representing 64% of total revenue. SoHo revenue was down 11% to $30.3 million but performed ahead of expectations.

- In 2025, the company retired ~$36 million in debt and repurchased 1 million shares for ~$23 million. The year-end 2025 total debt balance was $562 million, with a total debt to EBITDA ratio of 3.0x.

- For full-year 2026, Consensus Cloud Solutions provided guidance with a midpoint of $357.0 million in revenue, $187.5 million in Adjusted EBITDA, and $5.75 in Adjusted EPS. Total revenue growth is projected to be 0% to 4%, with Corporate revenue growth of 7.2% to 11.2% and SoHo revenue decline of -12.3% to -8.3%.

- Consensus Cloud Solutions reported Q4 2025 revenue of $87.1 million and full-year 2025 revenue of $349.7 million, which was essentially flat year-over-year.

- The company achieved record free cash flow of $106 million in 2025, a 20% increase from 2024, and reported $186.9 million in Adjusted EBITDA for the full year.

- Debt was reduced to $562 million by year-end 2025, meeting the target leverage of 3x gross debt to Adjusted EBITDA, and management plans to be more aggressive with its share repurchase program in 2026.

- The Corporate channel's revenue grew 7.3% year-over-year in Q4 2025 and 6.5% for the full year, representing 64% of total revenue in 2025 and projected to reach 68% in 2026, while the SOHO channel undergoes a deliberate decline.

- For full-year 2026, Consensus Cloud Solutions forecasts revenue between $350 million and $364 million (midpoint $357 million) and Adjusted EPS between $5.55 and $5.95 (midpoint $5.75).

- Consensus Cloud Solutions reported Q4 2025 revenue of $87.1 million and full-year 2025 revenue of $349.7 million, with adjusted EPS of $1.41 for Q4 2025 and $5.62 for the full year.

- For full-year 2026, the company provided revenue guidance between $350 million and $364 million (midpoint $357 million) and adjusted EPS guidance between $5.55 and $5.95 (midpoint $5.75).

- The corporate channel revenue grew 7.3% year-over-year to $56.8 million in Q4 2025, representing 64% of total revenue in 2025 and projected to reach 68% in 2026. The company anticipates multimillion-dollar revenue from eFax Clarity and approximately $9 million from the VA contract in 2026.

- The company generated $106 million in free cash flow in 2025 and repurchased 1 million shares for $23 million during the year, with a strong bias towards future equity repurchases.

- CFO Jim Malone will retire at the end of Q1 2026, and Adam Varon will succeed him as CFO, effective April 1st.

- Consensus Cloud Solutions reported strong Q4 and full year 2025 results, with full year revenue of $349.7 million and a record $106 million in free cash flow, representing a 20% increase from 2024. The company also reduced its debt to $562 million by year-end 2025, achieving its initial target of 3x total debt to Adjusted EBITDA.

- The company announced a CFO transition, with Jim Malone retiring at the end of Q1 2026. Adam Varon, current SVP of finance, will succeed him as CFO effective April 1st, and Karel Krulich will become Chief Accounting Officer.

- Consensus Cloud Solutions provided 2026 full year guidance, projecting revenue between $350 million and $364 million (midpoint $357 million), Adjusted EBITDA between $182 million and $193 million (midpoint $187.5 million), and Adjusted EPS between $5.55 and $5.95 (midpoint $5.75).

- The business continues its strategic shift towards corporate revenue, which grew 7.3% year-over-year in Q4 2025 to $56.8 million and is projected to reach 68% of total revenue in 2026, up from 64% in 2025. The company also plans to be more aggressive in its share repurchase program in 2026, given the free cash flow yield on its stock.

- Consensus Cloud Solutions, Inc. reported Q4 2025 revenues of $87.1 million, a 0.1% increase year-over-year, with diluted earnings per share increasing 15.2% to $1.06. For the full year 2025, revenues were $349.7 million, a 0.2% decrease from 2024, while Adjusted earnings per diluted share increased 3.1% to $5.62.

- The company generated record net cash provided by operating activities and free cash flow in 2025, with free cash flow increasing 19.9% to $105.9 million for the full year.

- CCSI successfully refinanced and retired $234.1 million of 6% Notes due October 2026 and repurchased approximately 1 million shares of its common stock during 2025.

- For Q1 2026, the company expects revenues between $85.4 million and $89.4 million, and for the full year 2026, revenues are projected to be between $350.0 million and $364.0 million.

- Consensus Cloud Solutions, Inc. (CCSI) reported Q4 2025 revenues of $87.1 million, a slight increase from Q4 2024, primarily driven by a 7.3% growth in its Corporate business, and full-year 2025 revenues of $349.7 million.

- For Q4 2025, net income increased by 13% to $20.5 million and diluted EPS rose by 15.2% to $1.06; for the full year 2025, net income was $84.5 million and diluted EPS was $4.35.

- The company generated record net cash provided by operating activities and free cash flow in 2025, which facilitated a $36 million debt reduction and the repurchase of approximately 1 million shares of company stock.

- CCSI also released its Q1 2026 and Full Year 2026 guidance.

- Consensus Cloud Solutions (CCSI) reported Q3 2025 revenue of $87.8 million and adjusted EBITDA of $46.4 million (52.8% margin), with adjusted EPS of $1.38.

- The corporate channel revenue grew 6.1% year-over-year to $56.3 million, driven by record usage and net adds from eFax Protect, and the VA contract also achieved record usage and revenue.

- Free cash flow was $44.4 million, a 32% increase from Q3 2024, and the company expects full-year 2025 free cash flow to exceed $95 million.

- The company significantly reduced its debt, retiring $200 million of 6% notes and planning to retire the remaining $34 million, reducing total indebtedness to $569 million at a lower interest rate of 5.65%.

- For Q4 2025, guidance projects revenues between $84.9 million and $88.9 million (midpoint $86.9 million) and adjusted EPS between $1.27 and $1.37 (midpoint $1.32).

- Consolidated revenue for Q3 2025 was $87.8 million, flat year-over-year, with Adjusted EBITDA at $46.4 million (52.8% margin) and Adjusted EPS at $1.38, both flat year-over-year.

- The Corporate business segment reported Q3 2025 revenue of $56.3 million, a 6.1% increase from Q3 2024, driven by a 102% revenue retention rate and a total customer count of 65,000.

- The SoHo business segment's Q3 2025 revenue was $31.5 million, showing a slowing rate of decline compared to the previous year.

- Free cash flow for Q3 2025 increased by 32% year-over-year to $44.4 million.

- CCSI provided Q4 2025 guidance, projecting revenue between $84.9 million and $88.9 million, Adjusted EBITDA between $43.1 million and $46.0 million, and Adjusted EPS between $1.27 and $1.37. The company also repurchased 121K shares for ~$2.7M and is retiring $234M of 6.0% Notes.

- Consensus Cloud Solutions reported Q3 2025 revenues of $87.8 million, consistent with Q3 2024, with Corporate business revenue increasing 6.1% and SoHo business revenue decreasing 9.2%.

- Net income for Q3 2025 increased to $22.1 million (from $21.1 million in Q3 2024) and diluted earnings per share rose to $1.15 (from $1.09).

- Adjusted EBITDA for Q3 2025 was $46.4 million (down from $46.9 million in Q3 2024), while free cash flow increased significantly to $44.4 million from $33.6 million in Q3 2024.

- After the quarter-end, the company retired $200 million of 6% Notes due October 2026 using a new credit facility and expects to retire the remaining $34 million before year-end.

- The company provided Q4 2025 guidance, projecting revenues between $84.9 million and $88.9 million, Adjusted EBITDA between $43.1 million and $46.0 million, and Adjusted earnings per diluted share between $1.27 and $1.37.

- Consensus Cloud Solutions reported Q3 2025 revenues of $87.8 million, consistent with the prior year, with net income increasing to $22.1 million and diluted earnings per share rising 5.5% to $1.15 compared to Q3 2024.

- The company demonstrated strong cash generation, with net cash provided by operating activities increasing to $51.6 million and free cash flow rising to $44.4 million in Q3 2025.

- Corporate channel revenue grew 6.1% compared to Q3 2024, offsetting a 9.2% decrease in the SoHo business, consistent with the company's strategic initiative.

- For Q4 2025, Consensus Cloud Solutions provided guidance for revenue between $84.9 million and $88.9 million and Adjusted earnings per diluted share between $1.27 and $1.37.

- The company ended Q3 2025 with $97.6 million in cash and cash equivalents and continued its capital allocation efforts, including $2.6 million in common stock repurchases during the quarter.

Fintool News

In-depth analysis and coverage of Consensus Cloud Solutions.

Quarterly earnings call transcripts for Consensus Cloud Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more